444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Armenia Banking Market serves as a crucial pillar of the country’s financial system, providing a wide range of financial services to individuals, businesses, and government entities. Banks in Armenia play a vital role in facilitating economic growth, promoting financial inclusion, and supporting the development of various sectors through lending, investment, and wealth management services.

Meaning

The Armenia Banking Market encompasses a network of financial institutions, including commercial banks, credit unions, and microfinance organizations, offering a comprehensive suite of banking products and services such as savings accounts, loans, mortgages, payment services, and investment solutions to meet the diverse financial needs of customers across the country.

Executive Summary

The Armenia Banking Market has experienced significant growth and transformation in recent years, driven by economic reforms, technological advancements, and regulatory developments aimed at enhancing efficiency, stability, and competitiveness within the banking sector. Despite facing challenges such as regulatory compliance, cybersecurity risks, and macroeconomic uncertainties, Armenia’s banking industry remains resilient and dynamic, adapting to evolving market dynamics and customer demands.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Armenia Banking Market operates within a dynamic and evolving ecosystem shaped by technological innovation, regulatory reforms, market competition, and shifting consumer preferences, driving banks to adapt, innovate, and collaborate to address emerging challenges and seize growth opportunities in a rapidly changing environment.

Regional Analysis

Regional analysis of the Armenia Banking Market considers geographical variations, urban-rural divide, and demographic trends that influence banking infrastructure, branch networks, customer demographics, and market dynamics across different regions and provinces of Armenia.

Competitive Landscape

Leading Banks in the Armenia Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

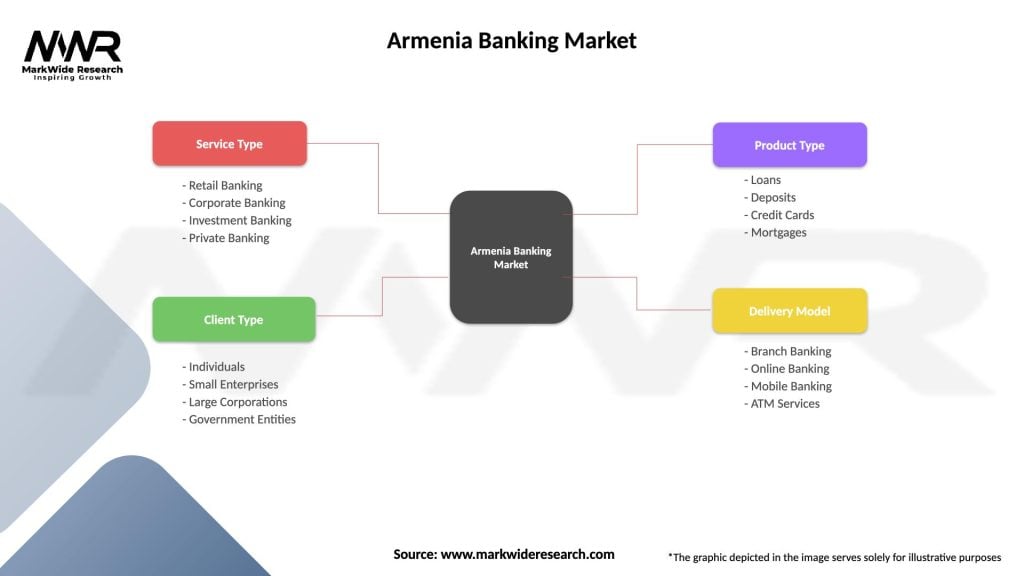

Segmentation

Segmentation of the Armenia Banking Market enables banks to target specific customer segments, industry verticals, and geographic regions with customized banking products, tailored solutions, and personalized services designed to meet the unique needs, preferences, and aspirations of diverse customer demographics and market segments.

Category-wise Insights

Insights into different banking categories, product lines, and service offerings within the Armenia Banking Market provide valuable information for consumers, businesses, and policymakers seeking to understand and navigate the complex landscape of banking products, financial solutions, and wealth management options available in Armenia.

Key Benefits for Industry Participants and Stakeholders

The Armenia Banking Market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Armenia Banking Market highlights:

Market Key Trends

Key trends shaping the Armenia Banking Market include:

Covid-19 Impact

The COVID-19 pandemic has reshaped the Armenia Banking Market by accelerating digital transformation, remote banking, and contactless payment trends while highlighting the importance of resilience, agility, and adaptability in responding to crisis situations and meeting evolving customer needs in a rapidly changing environment.

Key Industry Developments

Key industry developments in the Armenia Banking Market include:

Analyst Suggestions

Analyst suggestions for industry participants in the Armenia Banking Market include:

Future Outlook

The future outlook for the Armenia Banking Market is characterized by opportunities for growth, innovation, and resilience driven by digital transformation, regulatory reforms, market liberalization, and evolving customer preferences that shape the future of banking and finance in Armenia’s dynamic and competitive market landscape.

Conclusion

In conclusion, the Armenia Banking Market represents a vital component of the country’s economy, serving as a catalyst for financial inclusion, economic development, and sustainable growth while navigating challenges such as regulatory compliance, cybersecurity risks, and macroeconomic uncertainties. By embracing digital innovation, customer-centric strategies, and collaborative partnerships, banks in Armenia can position themselves for success, differentiation, and long-term value creation in a rapidly evolving and dynamic market environment.

What is Armenia Banking?

Armenia Banking refers to the financial services and institutions that operate within Armenia, providing services such as savings accounts, loans, and investment opportunities to individuals and businesses.

What are the key players in the Armenia Banking Market?

Key players in the Armenia Banking Market include Ameriabank, Ardshinbank, and VTB Bank Armenia, which offer a range of financial products and services to both retail and corporate clients, among others.

What are the growth factors driving the Armenia Banking Market?

The Armenia Banking Market is driven by factors such as increasing digital banking adoption, a growing middle class, and the expansion of small and medium-sized enterprises (SMEs) seeking financing options.

What challenges does the Armenia Banking Market face?

Challenges in the Armenia Banking Market include regulatory compliance issues, economic fluctuations, and competition from non-bank financial institutions that may offer alternative financial services.

What opportunities exist in the Armenia Banking Market?

Opportunities in the Armenia Banking Market include the potential for fintech innovations, the expansion of mobile banking services, and the increasing demand for personalized banking solutions among consumers.

What trends are shaping the Armenia Banking Market?

Trends in the Armenia Banking Market include the rise of online banking platforms, the integration of artificial intelligence in customer service, and a focus on sustainable finance initiatives to support environmentally friendly projects.

Armenia Banking Market

| Segmentation Details | Description |

|---|---|

| Service Type | Retail Banking, Corporate Banking, Investment Banking, Private Banking |

| Client Type | Individuals, Small Enterprises, Large Corporations, Government Entities |

| Product Type | Loans, Deposits, Credit Cards, Mortgages |

| Delivery Model | Branch Banking, Online Banking, Mobile Banking, ATM Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Banks in the Armenia Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at