444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Armenia Stock Market serves as a critical component of the country’s financial infrastructure, providing a platform for investors to buy, sell, and trade securities issued by local companies. The market plays a vital role in capital formation, facilitating investment opportunities, and fostering economic growth and development in Armenia.

Meaning: The Armenia Stock Market refers to the organized exchange where securities such as stocks, bonds, and derivatives are bought and sold by investors. It serves as a primary mechanism for companies to raise capital by issuing shares to the public and allows investors to participate in the financial markets, diversify their portfolios, and generate returns through trading activities.

Executive Summary: The Armenia Stock Market has experienced steady growth and development in recent years, supported by regulatory reforms, technological advancements, and increasing investor participation. While the market is relatively small compared to global counterparts, it offers opportunities for domestic and international investors to access Armenian equities, debt instruments, and other financial products.

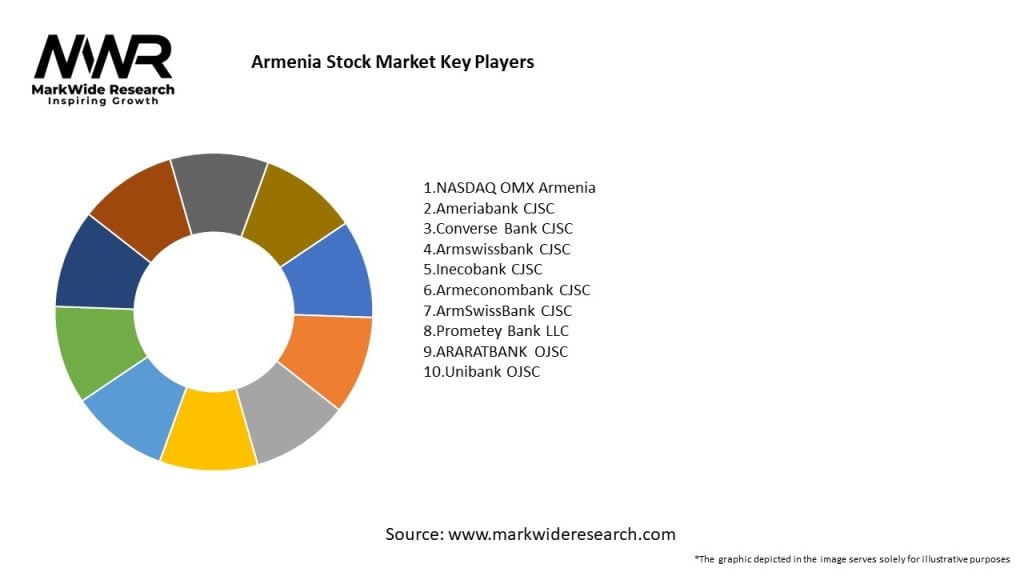

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Armenia Stock Market operates within a dynamic environment shaped by economic trends, regulatory changes, technological advancements, and investor behavior. Market dynamics, including market sentiment, investor sentiment, and macroeconomic factors, influence market performance, trading activity, and investment decisions, requiring market participants to adapt and respond to changing market conditions.

Regional Analysis: The Armenia Stock Market exhibits regional variations in market structure, investor preferences, and regulatory frameworks across different regions and cities. Key regions such as Yerevan, Gyumri, and Vanadzor represent major financial centers with active stock exchange activity, brokerage services, and investor participation. Regional analysis enables market stakeholders to understand local market dynamics, investor profiles, and investment opportunities, facilitating targeted market strategies and expansion plans.

Competitive Landscape:

Leading Companies in the Armenia Stock Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

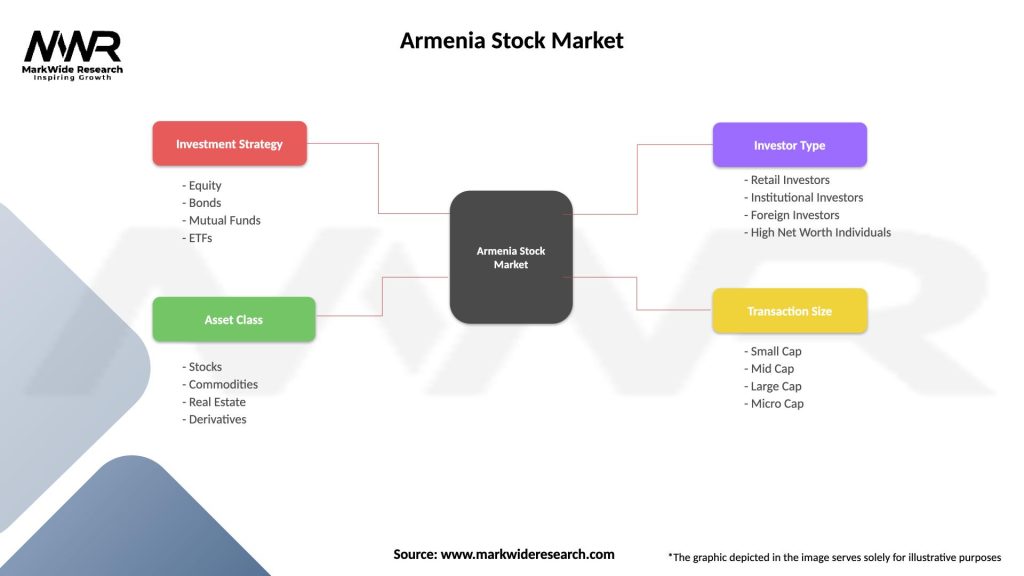

Segmentation: The Armenia Stock Market can be segmented based on various factors such as market capitalization, sectoral classification, trading volume, and investor profile. Segmentation enables market stakeholders to target specific market segments, tailor investment products, and address unique investor needs and preferences, enhancing market efficiency, liquidity, and accessibility.

Category-wise Insights:

Key Benefits for Market Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has had significant implications for the Armenia Stock Market, causing market disruptions, volatility, and investor uncertainty. While the initial phase of the pandemic led to sharp market declines and capital outflows, the market rebounded as fiscal stimulus measures, monetary policy support, and vaccine developments restored investor confidence and market stability. The pandemic accelerated digital transformation, remote trading, and online investor services, reshaping market dynamics and investor behavior.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Armenia Stock Market is poised for continued growth and development, supported by economic recovery, regulatory reforms, and investor confidence. Despite near-term challenges and uncertainties, the market’s long-term outlook remains positive, driven by structural reforms, technological innovation, and market integration. Market stakeholders need to remain vigilant, adaptive, and proactive in addressing emerging risks, seizing opportunities, and advancing market resilience and sustainability.

Conclusion: The Armenia Stock Market serves as a vital pillar of the country’s financial system, facilitating capital formation, investment opportunities, and economic development. Despite its relatively small size, the market plays a crucial role in mobilizing savings, allocating capital, and fostering market efficiency and liquidity. With ongoing regulatory reforms, technological advancements, and market integration efforts, the Armenia Stock Market is well-positioned to capitalize on emerging opportunities, drive sustainable growth, and contribute to Armenia’s long-term economic prosperity.

What is Armenia Stock?

Armenia Stock refers to the financial market where shares of publicly traded companies in Armenia are bought and sold. It serves as a platform for investors to trade equity and debt securities, contributing to the overall economic development of the country.

What are the major players in the Armenia Stock Market?

Key players in the Armenia Stock Market include the Central Bank of Armenia, the Armenian Stock Exchange, and various brokerage firms such as Araratbank and Ameriabank, among others.

What are the growth factors driving the Armenia Stock Market?

The Armenia Stock Market is driven by factors such as increasing foreign investment, economic reforms, and the development of financial instruments. Additionally, the growth of small and medium enterprises is contributing to market expansion.

What challenges does the Armenia Stock Market face?

The Armenia Stock Market faces challenges such as limited liquidity, a small number of listed companies, and regulatory hurdles. These factors can hinder investor confidence and market participation.

What opportunities exist for the Armenia Stock Market in the future?

Opportunities for the Armenia Stock Market include the potential for new listings, increased foreign investment, and the development of new financial products. Additionally, improving market infrastructure could enhance trading efficiency.

What trends are currently shaping the Armenia Stock Market?

Current trends in the Armenia Stock Market include a growing interest in technology-driven trading platforms and increased participation from retail investors. There is also a focus on sustainable investment practices among market participants.

Armenia Stock Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity, Bonds, Mutual Funds, ETFs |

| Asset Class | Stocks, Commodities, Real Estate, Derivatives |

| Investor Type | Retail Investors, Institutional Investors, Foreign Investors, High Net Worth Individuals |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Micro Cap |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Armenia Stock Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at