444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom Forex Cards Market represents a crucial segment within the broader financial services industry, offering individuals and businesses convenient and efficient solutions for managing foreign currency transactions and international travel expenses. Forex cards, also known as travel cards or currency cards, provide users with the flexibility to make purchases, withdraw cash, and conduct transactions in multiple currencies while avoiding the complexities and costs associated with traditional currency exchange methods.

Meaning

Forex cards are prepaid payment cards that allow users to load and store multiple currencies for use during international travel or online transactions. These cards are typically issued by banks, financial institutions, or forex service providers and are equipped with features such as multi-currency support, real-time currency conversion, ATM access, and secure online transactions, making them a convenient and secure alternative to cash and traditional debit or credit cards.

Executive Summary

The United Kingdom Forex Cards Market is experiencing steady growth driven by factors such as increasing international travel, rising cross-border transactions, growing demand for convenient payment solutions, and the expanding adoption of digital banking and financial services. As consumers and businesses seek efficient ways to manage currency exchange rates and transaction costs, forex cards offer a convenient and cost-effective solution for accessing foreign currencies and conducting transactions abroad.

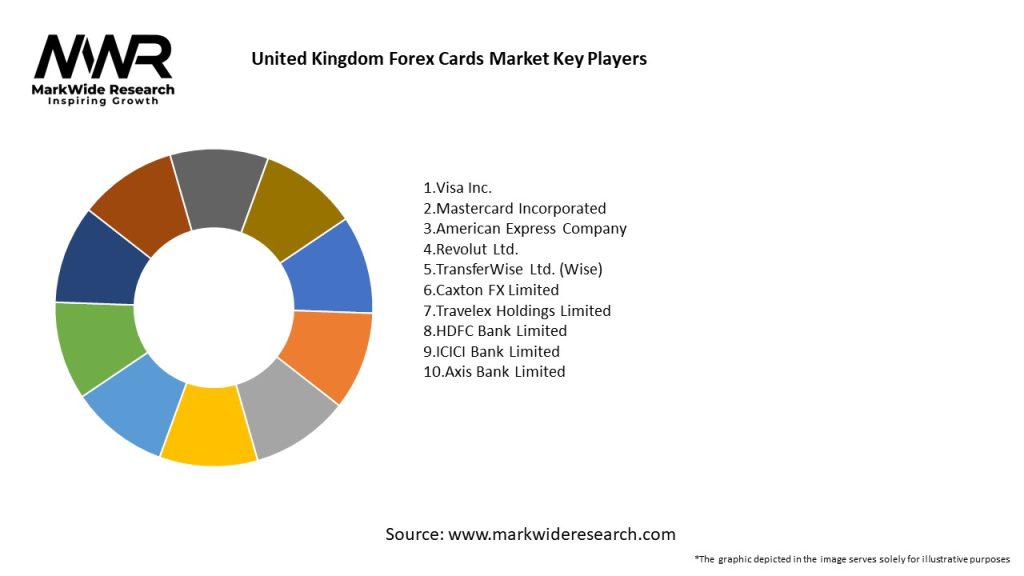

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United Kingdom Forex Cards Market operates within a dynamic and evolving landscape shaped by changing consumer behaviors, technological advancements, regulatory developments, competitive pressures, and macroeconomic trends that influence market dynamics, customer preferences, product offerings, and industry strategies across different segments and market participants.

Regional Analysis

Regional analysis of the United Kingdom Forex Cards Market considers geographical variations, demographic trends, travel patterns, tourism flows, business ties, and cultural influences that impact market demand, usage patterns, regulatory frameworks, and competitive dynamics within the UK, enabling providers to tailor their offerings, distribution channels, and marketing strategies to local market conditions and consumer needs.

Competitive Landscape

Leading Companies in the United Kingdom Forex Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Segmentation of the United Kingdom Forex Cards Market enables providers to target specific customer segments, demographic profiles, travel preferences, spending behaviors, and usage patterns with customized products, features, and value propositions that address unique needs, preferences, and pain points, maximizing market penetration, revenue growth, and competitive advantage in a rapidly evolving and increasingly competitive market landscape.

Category-wise Insights

Category-wise insights into the United Kingdom Forex Cards Market highlight trends, opportunities, and challenges within specific product categories, including multi-currency travel cards, prepaid debit cards, contactless payment solutions, virtual cards, business expense cards, student travel cards, and luxury lifestyle cards tailored to diverse consumer segments, travel purposes, and financial needs in a competitive and dynamic market environment.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the United Kingdom Forex Cards Market can derive several key benefits, including revenue growth, market expansion, brand differentiation, customer loyalty, and competitive advantage through product innovation, market segmentation, channel optimization, and strategic partnerships that create value and drive sustainable business growth in a competitive and dynamic market landscape.

SWOT Analysis

A SWOT analysis of the United Kingdom Forex Cards Market provides insights into the market’s strengths, weaknesses, opportunities, and threats, enabling industry participants to identify strategic priorities, address potential risks, leverage competitive advantages, and capitalize on emerging opportunities that drive sustainable growth and competitive success in the marketplace.

Market Key Trends

Key trends shaping the United Kingdom Forex Cards Market include innovations in product features, payment technologies, security standards, regulatory compliance, customer engagement, digital integration, cross-border partnerships, and personalized experiences that reflect evolving consumer preferences, lifestyle trends, and financial needs in a competitive and dynamic market environment.

Covid-19 Impact

The Covid-19 pandemic has accelerated trends and transformations in the United Kingdom Forex Cards Market, including increased demand for digital payments, contactless transactions, online banking, remote account management, and virtual customer service channels that cater to changing consumer behaviors, safety concerns, and economic uncertainties in response to social distancing measures, travel restrictions, and lockdown regulations.

Key Industry Developments

Key industry developments in the United Kingdom Forex Cards Market include product innovations, strategic partnerships, regulatory reforms, market expansions, customer acquisitions, technology investments, consumer education initiatives, and corporate social responsibility programs that drive brand awareness, customer engagement, and market growth in a competitive and dynamic business environment.

Analyst Suggestions

Analyst suggestions for industry participants in the United Kingdom Forex Cards Market include:

Future Outlook

The future outlook for the United Kingdom Forex Cards Market is characterized by opportunities for innovation, growth, and disruption driven by changing consumer behaviors, technological advancements, regulatory reforms, competitive pressures, and macroeconomic trends that shape market dynamics, industry strategies, and customer experiences in a post-pandemic world.

Conclusion

In conclusion, the United Kingdom Forex Cards Market represents a dynamic and evolving segment within the financial services industry, offering individuals and businesses convenient, secure, and cost-effective solutions for managing foreign currency transactions, international travel expenses, and cross-border payments in an increasingly interconnected and digitized global economy. By embracing innovation, collaboration, and customer-centricity, forex card providers can navigate challenges, seize opportunities, and foster sustainable growth, resilience, and leadership in a competitive and dynamic market landscape.

What is Forex Cards?

Forex cards, also known as travel cards or prepaid currency cards, are financial instruments that allow travelers to load multiple currencies onto a single card for use abroad. They provide a convenient way to manage foreign exchange and avoid high transaction fees associated with credit cards.

What are the key players in the United Kingdom Forex Cards Market?

Key players in the United Kingdom Forex Cards Market include companies like Travelex, Revolut, and Wise, which offer various forex card options tailored for travelers. These companies compete on features such as exchange rates, fees, and customer service, among others.

What are the growth factors driving the United Kingdom Forex Cards Market?

The growth of the United Kingdom Forex Cards Market is driven by increasing international travel, the rising demand for cost-effective currency exchange solutions, and the convenience of digital banking. Additionally, the expansion of e-commerce and online travel bookings contributes to the market’s growth.

What challenges does the United Kingdom Forex Cards Market face?

The United Kingdom Forex Cards Market faces challenges such as fluctuating exchange rates, regulatory changes affecting cross-border transactions, and competition from alternative payment methods like mobile wallets. These factors can impact consumer trust and market stability.

What opportunities exist in the United Kingdom Forex Cards Market?

Opportunities in the United Kingdom Forex Cards Market include the development of innovative features such as contactless payments and integration with mobile apps. Additionally, targeting niche markets like expatriates and frequent travelers can enhance market penetration.

What trends are shaping the United Kingdom Forex Cards Market?

Trends shaping the United Kingdom Forex Cards Market include the increasing adoption of digital wallets, the demand for multi-currency cards, and enhanced security features like biometric authentication. These trends reflect changing consumer preferences towards more flexible and secure payment options.

United Kingdom Forex Cards Market

| Segmentation Details | Description |

|---|---|

| Card Type | Prepaid Cards, Virtual Cards, Reloadable Cards, Multi-Currency Cards |

| Distribution Channel | Online, Retail Stores, Banks, Travel Agencies |

| End User | Travelers, Students, Expatriates, Business Professionals |

| Currency Type | USD, EUR, AUD, JPY |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Forex Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at