444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market serves as a vital component of the country’s retail sector, catering to the needs of homeowners, DIY enthusiasts, and professionals seeking tools, materials, and supplies for home renovation and improvement projects. This market encompasses a wide range of products and services, including hardware, power tools, building materials, paints, home décor, and garden supplies. With the UK’s strong tradition of DIY culture and homeownership, the DIY home improvement retailing market plays a significant role in meeting consumer demand for affordable and accessible solutions for enhancing their living spaces.

Meaning

The United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market involves the sale of products and services tailored to homeowners and DIY enthusiasts looking to undertake home renovation, repair, and improvement projects independently. DIY retailers offer a comprehensive range of tools, materials, and supplies, along with expert advice and guidance, to empower customers to tackle projects ranging from small repairs to major renovations. This market caters to diverse consumer needs and preferences, providing accessible and affordable solutions for enhancing living spaces.

Executive Summary

The United Kingdom DIY Home Improvement Retailing Market has experienced steady growth driven by factors such as increasing homeownership rates, renovation trends, and DIY culture. While presenting opportunities for retailers to expand their product offerings and customer base, the market also faces challenges related to online competition, changing consumer behavior, and economic uncertainties. Understanding key market dynamics and emerging trends is essential for retailers to develop effective strategies and maintain competitiveness in the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United Kingdom DIY Home Improvement Retailing Market operates within a dynamic environment influenced by factors such as economic conditions, consumer behavior, technological advancements, and regulatory changes. Understanding market dynamics is essential for retailers to adapt strategies, innovate product offerings, and meet evolving customer needs effectively.

The UK DIY home improvement retailing market is driven by consumer behavior that is increasingly inclined towards enhancing personal spaces in a cost-effective manner. The rise of e-commerce platforms and online marketplaces has reshaped how consumers access DIY products, providing a vast selection of goods alongside detailed reviews and how-to guides. Brick-and-mortar stores, on the other hand, continue to thrive by offering hands-on experiences, knowledgeable staff, and in-store workshops that cater to the growing demand for DIY skills.

Regional Analysis

Competitive Landscape

Leading Companies in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

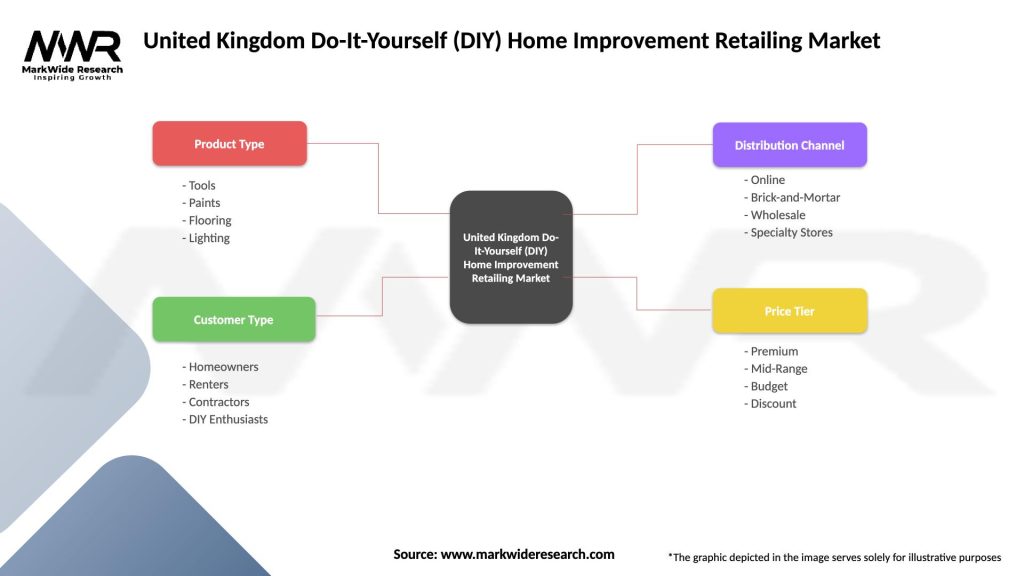

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the DIY home improvement market in the UK. As people spent more time at home, there was a noticeable increase in demand for home improvement products. Many consumers took the opportunity to renovate their living spaces, resulting in a surge in sales for DIY products, particularly paints, garden supplies, and hardware tools. E-commerce also saw rapid growth as lockdowns pushed more consumers to purchase products online. Although there were challenges in supply chains and store closures, the DIY sector emerged as one of the few industries to experience growth during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United Kingdom’s DIY home improvement retailing market is set to grow steadily over the next several years, driven by sustained interest in home improvement projects, advancements in smart home technologies, and the increasing focus on sustainability. As the market becomes more digitalized, e-commerce is expected to play a pivotal role in driving growth. Retailers that innovate and adapt to changing consumer preferences will be well-positioned to thrive in this evolving market.

Conclusion

The United Kingdom DIY Home Improvement Retailing Market serves as a vital component of the country’s retail sector, meeting the diverse needs of homeowners, DIY enthusiasts, and professionals seeking tools, materials, and supplies for home renovation and improvement projects. With opportunities for innovation, omnichannel retailing, and market expansion, DIY retailers can navigate challenges and capitalize on emerging trends to drive sustainable growth and contribute to the success of the UK’s retail industry. By understanding key market dynamics, embracing digitalization, and focusing on customer-centric strategies, retailers can position themselves for success in the dynamic and evolving DIY home improvement retail landscape.

What is Do-It-Yourself (DIY) Home Improvement Retailing?

Do-It-Yourself (DIY) Home Improvement Retailing refers to the sector where consumers purchase materials and tools to undertake home improvement projects independently. This includes activities such as renovation, decoration, and maintenance of residential properties.

What are the key players in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market?

Key players in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market include B&Q, Homebase, and Wickes, among others. These companies offer a wide range of products from tools to building materials and home decor.

What are the growth factors driving the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market?

The growth of the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market is driven by increasing consumer interest in home improvement projects, the rise of online shopping, and a growing trend towards sustainable living. Additionally, the COVID-19 pandemic has led to more people investing time and resources into their homes.

What challenges does the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market face?

Challenges in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market include supply chain disruptions, fluctuating material costs, and competition from online retailers. These factors can impact product availability and pricing strategies.

What opportunities exist in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market?

Opportunities in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market include the expansion of e-commerce platforms, the introduction of innovative products, and the increasing popularity of home improvement shows. These trends can attract new customers and enhance sales.

What trends are shaping the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market?

Trends shaping the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market include a focus on eco-friendly products, the rise of smart home technology, and the popularity of DIY workshops. These trends reflect changing consumer preferences towards sustainability and technology integration.

United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tools, Paints, Flooring, Lighting |

| Customer Type | Homeowners, Renters, Contractors, DIY Enthusiasts |

| Distribution Channel | Online, Brick-and-Mortar, Wholesale, Specialty Stores |

| Price Tier | Premium, Mid-Range, Budget, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United Kingdom Do-It-Yourself (DIY) Home Improvement Retailing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at