444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The factoring services market in Australia serves as a critical component of the country’s financial ecosystem, providing businesses with essential working capital solutions to manage cash flow, mitigate credit risk, and support growth initiatives. With a diverse economy and a strong SME sector, Australia’s factoring market plays a significant role in facilitating trade finance activities and supporting businesses across various industries.

Meaning

Factoring services in Australia involve the purchase of accounts receivable by financial institutions (factors) at a discounted rate, enabling businesses to convert their outstanding invoices into immediate cash flow. This allows businesses to address short-term financing needs, optimize working capital, and access liquidity without taking on additional debt. Factoring services in Australia are designed to enhance financial stability, support business expansion, and improve cash flow management for companies of all sizes.

Executive Summary

The factoring services market in Australia is characterized by steady growth, driven by factors such as increasing demand from SMEs, technological advancements, and the country’s robust trade activities. With factors offering a range of flexible financing solutions tailored to the diverse needs of businesses, the Australian factoring market presents significant opportunities for both factors and businesses seeking working capital solutions.

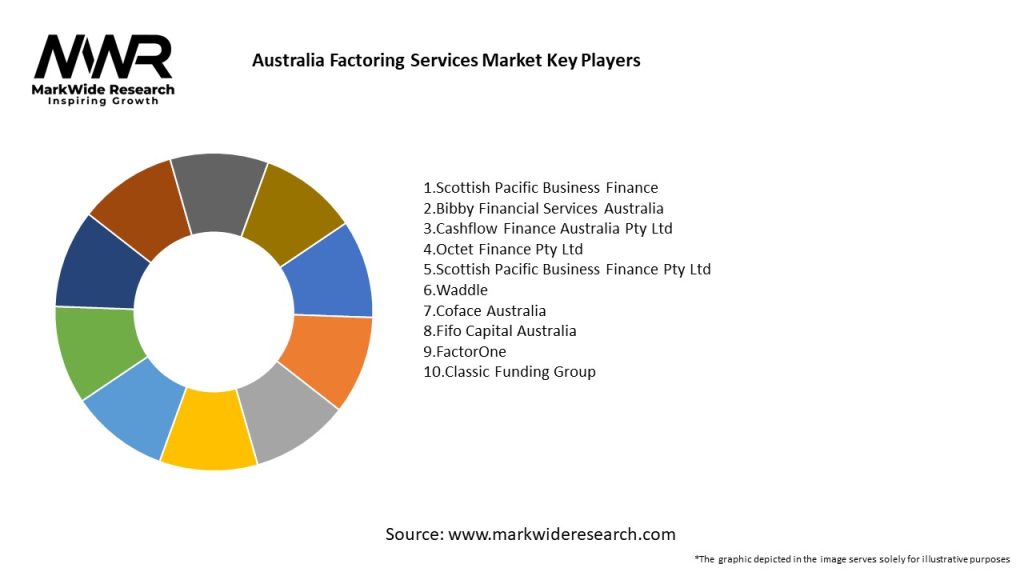

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The factoring services market in Australia operates within a dynamic environment influenced by factors such as economic conditions, regulatory reforms, technological advancements, and market competition. Adapting to these dynamics is essential for factors to capitalize on opportunities, mitigate risks, and maintain competitiveness in the market.

Regional Analysis

The factoring services market in Australia exhibits regional variations influenced by factors such as business demographics, industrial concentration, and economic development. While urban centers such as Sydney, Melbourne, and Brisbane serve as key hubs for financial activities, regional disparities in SME presence and industry clusters influence market dynamics across different states and territories.

Competitive Landscape

Leading Companies in Australia Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

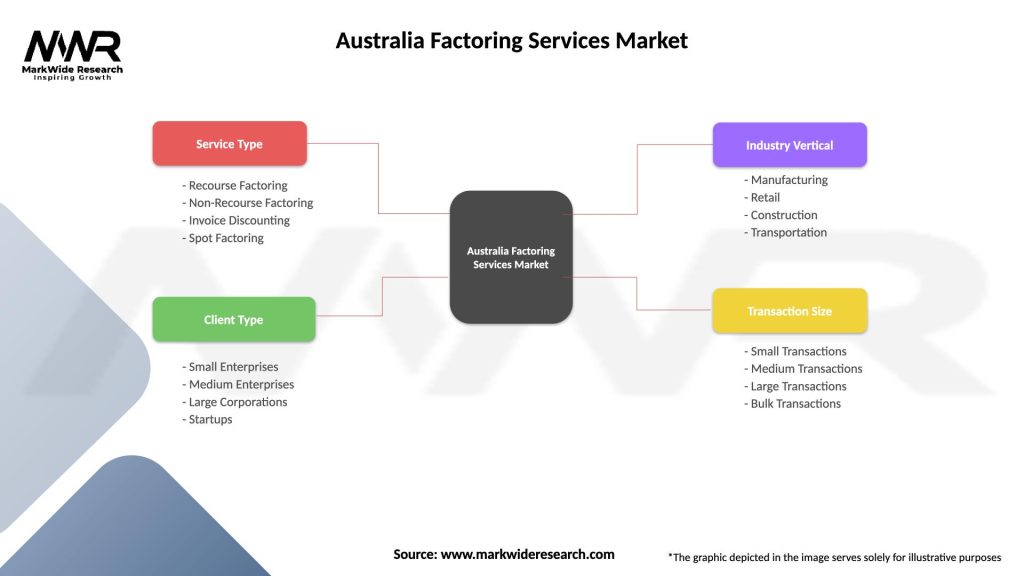

The Australian factoring services market can be segmented based on factors such as:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has posed challenges to the factoring services market in Australia, leading to disruptions in business operations, supply chain delays, and liquidity constraints. However, factors have played a critical role in supporting businesses by providing working capital solutions, credit risk management, and financial stability during these challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The factoring services market in Australia is poised for steady growth, driven by factors such as SME expansion, technological innovation, and government support for trade finance initiatives. Despite challenges such as regulatory complexities and competition from traditional financing options, the market presents significant opportunities for factors to expand market presence, innovate service offerings, and address evolving market needs.

Conclusion

The factoring services market in Australia plays a vital role in supporting business growth, enhancing liquidity, and facilitating trade finance activities. With increasing demand from SMEs, technological advancements, and government initiatives supporting SME growth, the market presents promising opportunities for factors to expand market presence, innovate service offerings, and contribute to economic development. By addressing challenges, embracing innovation, and fostering collaborations, factors can position themselves for success in the dynamic Australian factoring services market.

What is Factoring Services?

Factoring services involve the sale of accounts receivable to a third party, known as a factor, to improve cash flow. This financial solution is commonly used by businesses to manage their working capital and reduce the risk of bad debts.

What are the key players in the Australia Factoring Services Market?

Key players in the Australia Factoring Services Market include companies like Scottish Pacific, Prospa, and eCapital, which provide various factoring solutions tailored to different industries, among others.

What are the growth factors driving the Australia Factoring Services Market?

The growth of the Australia Factoring Services Market is driven by increasing demand for cash flow management solutions, the rise of small and medium-sized enterprises, and the need for businesses to mitigate credit risk.

What challenges does the Australia Factoring Services Market face?

Challenges in the Australia Factoring Services Market include the potential for high fees associated with factoring, the risk of dependency on external financing, and competition from alternative financing options.

What opportunities exist in the Australia Factoring Services Market?

Opportunities in the Australia Factoring Services Market include the expansion of digital factoring platforms, increased awareness of factoring benefits among businesses, and the potential for tailored services for niche industries.

What trends are shaping the Australia Factoring Services Market?

Trends in the Australia Factoring Services Market include the adoption of technology-driven solutions, such as online platforms for faster transactions, and a growing focus on customer service and flexibility in factoring agreements.

Australia Factoring Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Recourse Factoring, Non-Recourse Factoring, Invoice Discounting, Spot Factoring |

| Client Type | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

| Industry Vertical | Manufacturing, Retail, Construction, Transportation |

| Transaction Size | Small Transactions, Medium Transactions, Large Transactions, Bulk Transactions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Australia Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at