444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The factoring services market in India is witnessing significant growth, fueled by the country’s burgeoning economy, expanding SME sector, and evolving financial landscape. Factoring services play a crucial role in providing liquidity to businesses by facilitating the conversion of accounts receivable into cash. With increasing awareness and adoption of factoring solutions among businesses, the Indian factoring services market is poised for robust expansion.

Meaning

Factoring services involve the purchase of accounts receivable from businesses by a financial institution (factor) at a discounted rate. This allows businesses to access immediate cash flow, thereby improving liquidity and enabling them to meet working capital requirements. In India, factoring services cater to the diverse financing needs of businesses across various sectors, contributing to economic growth and development.

Executive Summary

The factoring services market in India is experiencing rapid growth, driven by factors such as favorable government initiatives, technological advancements, and increasing demand from SMEs. With factors offering tailored solutions to meet the unique financing needs of businesses, the market presents lucrative opportunities for both factors and businesses seeking working capital solutions.

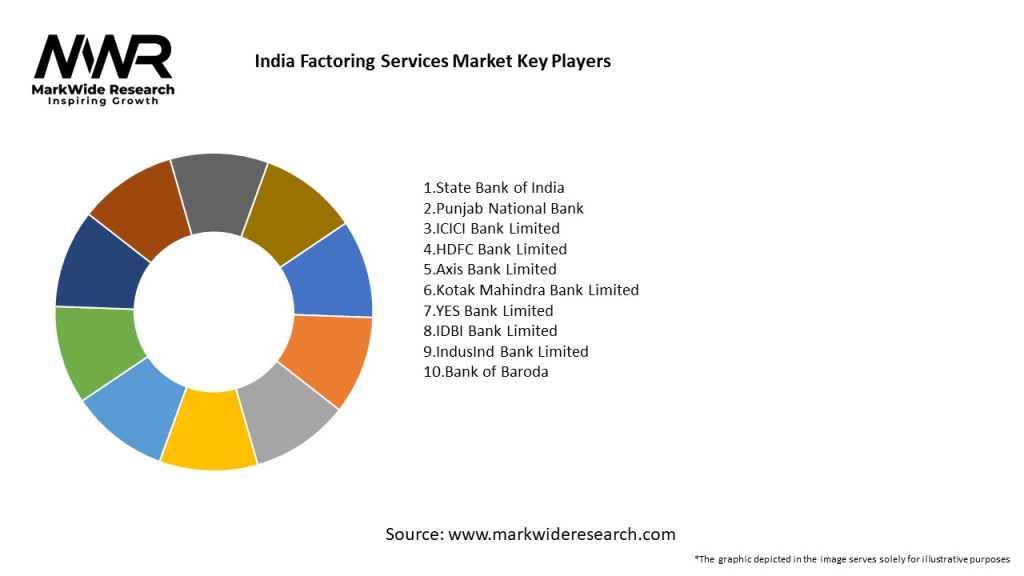

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The factoring services market in India operates within a dynamic environment influenced by factors such as economic conditions, regulatory changes, technological advancements, and market competition. Adapting to these dynamics is essential for factors to capitalize on opportunities, mitigate risks, and maintain competitiveness in the market.

Regional Analysis

The Indian factoring services market exhibits regional variations influenced by factors such as economic development, industrialization, and business demographics. While metropolitan cities like Mumbai, Delhi, and Bangalore serve as key hubs for factoring activities, emerging Tier II and Tier III cities are witnessing increasing demand for factoring services, driven by growing SME presence and business activities.

Competitive Landscape

Leading Companies in India Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Indian factoring services market can be segmented based on factors such as:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has posed challenges to the factoring services market in India, leading to disruptions in business operations, supply chain delays, and liquidity constraints. However, factors have played a critical role in supporting businesses by providing working capital solutions, credit risk management, and financial stability during these challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The factoring services market in India is poised for robust growth, driven by factors such as government support, technological innovation, and increasing demand from SMEs. Despite challenges such as regulatory complexities and competition from traditional financing options, the market presents significant opportunities for factors to expand their market presence, innovate their service offerings, and address evolving market needs.

Conclusion

The factoring services market in India plays a pivotal role in providing working capital solutions, supporting business growth, and enhancing financial stability. With increasing government support, technological advancements, and market demand, factors are well-positioned to capitalize on opportunities and drive market expansion. By addressing challenges, embracing innovation, and fostering collaborations, the Indian factoring services market can continue to thrive and contribute to the growth and development of the economy.

What is Factoring Services?

Factoring services involve the financial transaction where a business sells its accounts receivable to a third party, known as a factor, at a discount. This allows businesses to improve cash flow, manage credit risk, and focus on growth without waiting for customer payments.

What are the key players in the India Factoring Services Market?

Key players in the India Factoring Services Market include companies like SBI Factors and Commercial Services Pvt. Ltd., Maanaveeya Development and Finance Pvt. Ltd., and Reliance Commercial Finance Ltd., among others.

What are the growth factors driving the India Factoring Services Market?

The growth of the India Factoring Services Market is driven by increasing demand for working capital, the rise of small and medium enterprises (SMEs), and the need for efficient cash flow management. Additionally, the growing awareness of factoring as a financing option is contributing to market expansion.

What challenges does the India Factoring Services Market face?

The India Factoring Services Market faces challenges such as regulatory hurdles, lack of awareness among businesses about factoring benefits, and competition from traditional financing options. These factors can hinder the growth and adoption of factoring services.

What opportunities exist in the India Factoring Services Market?

Opportunities in the India Factoring Services Market include the potential for digital transformation in service delivery, the expansion of factoring services to underserved sectors, and the increasing trend of international trade financing. These factors can enhance service offerings and attract new clients.

What trends are shaping the India Factoring Services Market?

Trends shaping the India Factoring Services Market include the adoption of technology for better service efficiency, the rise of online factoring platforms, and a growing focus on customer-centric solutions. These trends are helping to modernize the industry and improve accessibility for businesses.

India Factoring Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Recourse Factoring, Non-Recourse Factoring, Invoice Discounting, Supply Chain Financing |

| Client Type | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

| Industry Vertical | Manufacturing, Retail, Construction, Logistics |

| Transaction Size | Small Scale, Medium Scale, Large Scale, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in India Factoring Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at