444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The undersea warfare systems market in Japan encompasses a wide range of naval assets and technologies dedicated to submarine operations, anti-submarine warfare (ASW), and maritime surveillance. Japan’s strategic maritime interests, including territorial defense, protection of sea lanes, and regional stability, drive investments in advanced undersea warfare capabilities.

Meaning

Undersea warfare systems in Japan refer to a comprehensive suite of naval assets and technologies designed for underwater operations, including submarines, ASW vessels, maritime patrol aircraft, sonar systems, and torpedoes. These systems play a critical role in safeguarding Japan’s maritime sovereignty, ensuring maritime security, and countering potential threats in the Indo-Pacific region.

Executive Summary

The Japan undersea warfare systems market is characterized by technological innovation, strategic partnerships, and regional cooperation to address evolving maritime security challenges. Investments in indigenous defense capabilities, international collaborations, and maritime domain awareness initiatives position Japan as a key player in the global undersea warfare domain. Understanding key market insights, technological trends, and strategic imperatives is essential for stakeholders navigating this dynamic landscape.

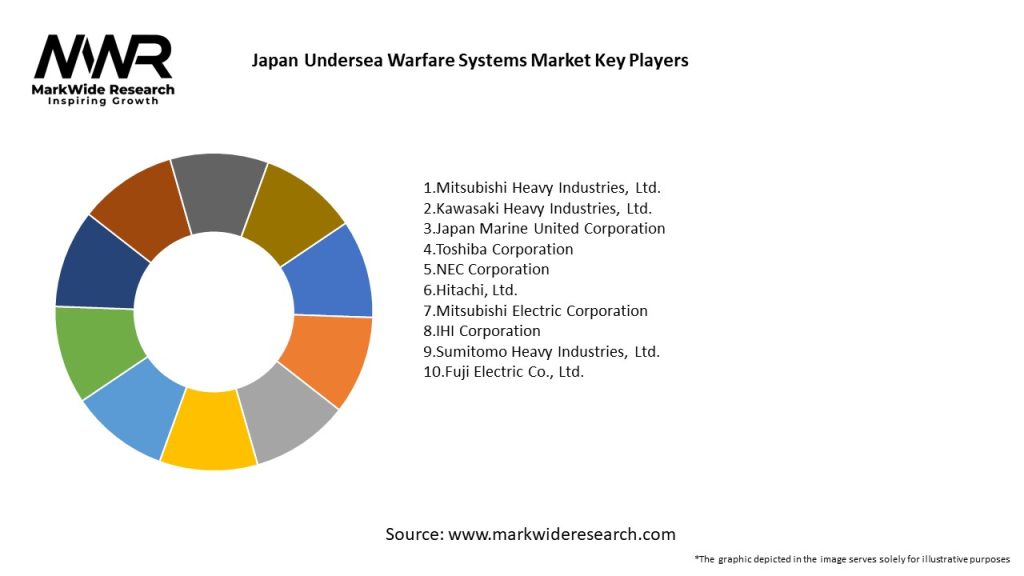

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Japan undersea warfare systems market operates within a dynamic environment shaped by geopolitical rivalries, regional security challenges, and technological advancements. Adapting to these dynamics requires strategic foresight, innovation, and collaboration to maintain Japan’s maritime superiority and defense-industrial resilience.

Regional Analysis

The undersea warfare systems market in Japan extends across its maritime territories, including the East China Sea, Sea of Japan, and Western Pacific Ocean. Each region presents unique operational challenges and opportunities for submarine operations, ASW patrols, and maritime security missions.

Competitive Landscape

Leading Companies in Japan Undersea Warfare Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Japan undersea warfare systems market can be segmented based on various factors, including platform type (submarines, ASW vessels), technology (sonar systems, torpedoes), and end-user (navy, coast guard, maritime law enforcement). Segmentation provides a nuanced understanding of market dynamics and customer requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Japan undersea warfare systems market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Understanding these factors through a SWOT analysis enables stakeholders to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats in the Japan undersea warfare systems market.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has affected Japan’s defense industry, including the undersea warfare systems market, with disruptions in production, supply chains, and international cooperation. However, Japan’s strategic imperatives and defense modernization efforts remain unchanged, driving continued investments in undersea warfare capabilities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Japan undersea warfare systems market is poised for continued growth, driven by strategic imperatives, defense modernization efforts, and export opportunities. Strategic investments in submarine platforms, ASW technologies, and maritime surveillance systems will shape the future trajectory of Japan’s maritime security and defense-industrial resilience.

Conclusion

The Japan undersea warfare systems market plays a critical role in safeguarding Japan’s maritime sovereignty, ensuring maritime security, and countering potential threats in the Indo-Pacific region. By investing in indigenous defense capabilities, promoting export opportunities, and fostering technological innovation, Japan aims to maintain its position as a leading maritime power in the global undersea warfare domain. By addressing key challenges, leveraging emerging opportunities, and adapting to evolving geopolitical dynamics, Japan’s defense industry will continue to shape the future of undersea warfare.

What is Undersea Warfare Systems?

Undersea Warfare Systems refer to the technologies and strategies used to detect, track, and neutralize underwater threats, including submarines and mines. These systems encompass a range of equipment such as sonar, unmanned underwater vehicles, and torpedoes.

What are the key players in the Japan Undersea Warfare Systems Market?

Key players in the Japan Undersea Warfare Systems Market include Mitsubishi Heavy Industries, Kawasaki Heavy Industries, and Japan Radio Company. These companies are involved in the development and production of advanced undersea warfare technologies, among others.

What are the growth factors driving the Japan Undersea Warfare Systems Market?

The Japan Undersea Warfare Systems Market is driven by increasing maritime security concerns, advancements in underwater technology, and the need for enhanced naval capabilities. The rising tensions in regional waters also contribute to the demand for sophisticated undersea systems.

What challenges does the Japan Undersea Warfare Systems Market face?

Challenges in the Japan Undersea Warfare Systems Market include high development costs, technological complexities, and regulatory hurdles. Additionally, the rapid pace of technological change can make it difficult for companies to keep up with innovations.

What opportunities exist in the Japan Undersea Warfare Systems Market?

Opportunities in the Japan Undersea Warfare Systems Market include the development of autonomous underwater vehicles and enhanced sonar systems. The increasing focus on maritime domain awareness also presents avenues for growth in this sector.

What trends are shaping the Japan Undersea Warfare Systems Market?

Trends in the Japan Undersea Warfare Systems Market include the integration of artificial intelligence in underwater systems, the rise of hybrid warfare strategies, and increased collaboration between defense contractors and government agencies. These trends are reshaping how undersea warfare is approached.

Japan Undersea Warfare Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Submarines, Torpedoes, Sonar Systems, Underwater Drones |

| Technology | Acoustic Sensors, Autonomous Navigation, Communication Systems, Surveillance Technology |

| End User | Military, Defense Contractors, Research Institutions, Government Agencies |

| Application | Surveillance, Reconnaissance, Anti-Submarine Warfare, Mine Countermeasures |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Japan Undersea Warfare Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at