444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview The tequila market in the United Arab Emirates (UAE) is experiencing steady growth, fueled by a combination of factors such as increasing urbanization, rising disposable incomes, and a growing appetite for premium spirits among affluent consumers. Despite being a predominantly Muslim country with cultural sensitivities towards alcohol consumption, the UAE boasts a vibrant hospitality sector and a diverse expatriate population, creating opportunities for tequila brands to establish a presence and cater to a cosmopolitan consumer base.

Meaning Tequila is a distilled alcoholic beverage made primarily from the blue agave plant, originating from Mexico. While traditionally associated with Mexican culture and heritage, tequila has gained popularity worldwide as a symbol of celebration, luxury, and conviviality. In the UAE, tequila is enjoyed by a diverse demographic of consumers, including locals, expatriates, and tourists, who appreciate its unique flavor profiles and versatility in cocktails and social settings.

Executive Summary The UAE tequila market presents lucrative opportunities for domestic and international brands looking to capitalize on the country’s affluent consumer base, thriving nightlife scene, and growing demand for premium spirits. With strategic marketing initiatives, product innovation, and targeted distribution channels, tequila brands can carve out a niche in the competitive UAE alcohol market and establish themselves as preferred choices among discerning consumers.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The UAE tequila market operates within a dynamic and evolving landscape influenced by various factors, including economic trends, regulatory developments, consumer preferences, and cultural dynamics. Tequila brands must navigate these dynamics strategically to capitalize on growth opportunities, mitigate risks, and maintain a competitive edge in the market.

Regional Analysis

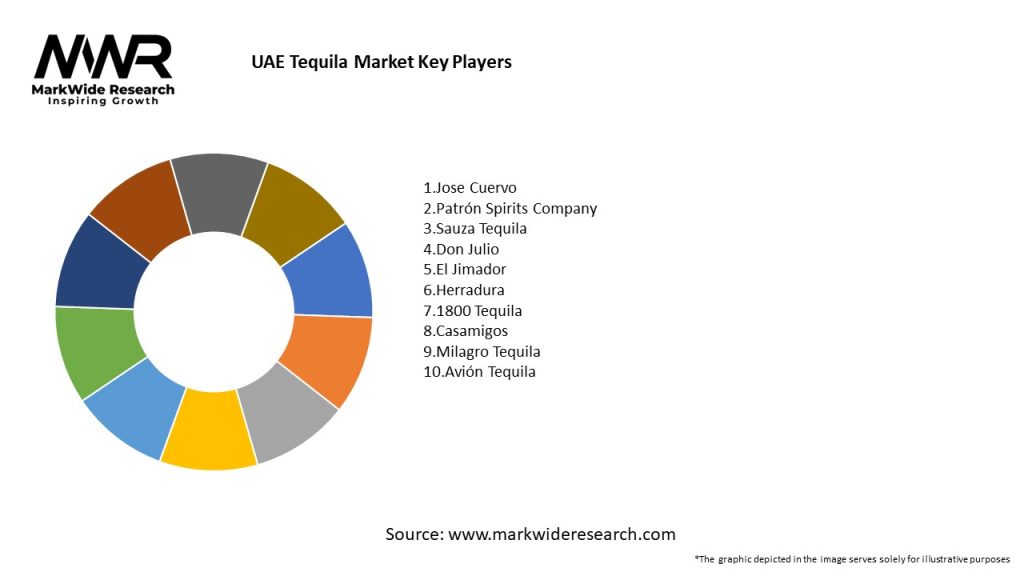

Competitive Landscape The UAE tequila market features a competitive landscape characterized by a mix of domestic, international, and luxury brands vying for market share and consumer attention. Key players in the market include:

Segmentation The UAE tequila market can be segmented based on various factors such as:

Segmentation enables tequila brands to target specific customer segments with tailored product offerings, pricing strategies, and marketing campaigns, thereby maximizing market penetration and revenue potential.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis A SWOT analysis of the UAE tequila market reveals the following:

Understanding these factors through a SWOT analysis helps tequila brands identify strengths, address weaknesses, capitalize on opportunities, and mitigate potential threats to their market success.

Market Key Trends

Covid-19 Impact The Covid-19 pandemic has had a significant impact on the UAE tequila market, influencing consumer behavior, hospitality operations, and distribution channels in the following ways:

Key Industry Developments

Analyst Suggestions

Future Outlook The future outlook for the UAE tequila market is optimistic, with continued growth expected driven by factors such as urbanization, premiumization, and cultural integration. Key trends shaping the future of the market include:

Conclusion The UAE tequila market presents significant opportunities for industry participants and stakeholders to capitalize on changing consumer preferences, rising disposable incomes, and the growing popularity of premium spirits. By leveraging innovation, localization, and digital engagement strategies, tequila brands can position themselves for success in a dynamic and evolving market landscape. With a focus on authenticity, quality, and consumer-centricity, the future of the UAE tequila market is poised for growth, innovation, and cultural relevance in the years to come.

UAE Tequila Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blanco, Reposado, Añejo, Extra Añejo |

| Distribution Channel | Online, Supermarkets, Liquor Stores, Bars |

| Consumer Type | Millennials, Gen Z, Professionals, Tourists |

| Price Tier | Premium, Mid-Range, Budget, Super Premium |

Leading Companies in UAE Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at