444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Tequila market in France is experiencing a surge in popularity, driven by evolving consumer preferences, a vibrant cocktail culture, and a growing appreciation for premium spirits. Tequila, traditionally associated with Mexico, has carved out a niche in the French market, where discerning consumers value its unique flavors and versatility in cocktails. With a rich culinary tradition and a penchant for quality spirits, France presents lucrative opportunities for Tequila producers to tap into the country’s dynamic beverage landscape.

Meaning

Tequila is a distilled alcoholic beverage made primarily from the blue agave plant, native to Mexico. Produced primarily in the Jalisco region of Mexico, Tequila undergoes a meticulous production process that includes harvesting, cooking, fermentation, distillation, and aging. The spirit is categorized into different types, including blanco (silver), reposado (rested), and añejo (aged), each offering its distinct flavor profile and characteristics.

Executive Summary

The Tequila market in France is witnessing robust growth, fueled by factors such as increasing consumer awareness, expanding distribution channels, and a burgeoning cocktail culture. The market is characterized by a diverse range of Tequila brands, catering to varied consumer preferences and tastes. While traditional Tequila cocktails remain popular, there is a growing trend towards premium Tequila consumption, driven by the demand for authentic and high-quality spirits.

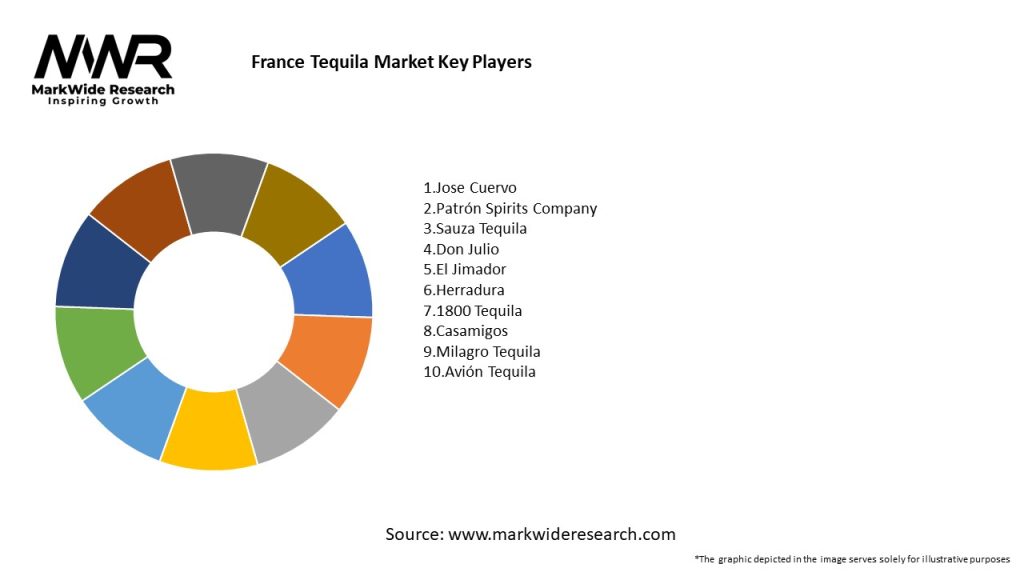

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Tequila market in France operates in a dynamic environment influenced by various factors, including consumer trends, economic conditions, regulatory environment, and competitive landscape. Understanding these dynamics is crucial for producers to navigate the market successfully and capitalize on emerging opportunities.

Regional Analysis

The Tequila market in France exhibits regional variations in consumption patterns, preferences, and distribution channels. Major cities like Paris, Marseille, and Lyon have vibrant bar scenes and a high concentration of cocktail bars and restaurants that drive demand for Tequila. Rural areas and smaller towns may have different consumption habits and preferences, requiring tailored marketing and distribution strategies.

Competitive Landscape

Leading Companies in France Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Tequila market in France can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Tequila market in France:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Tequila market in France is optimistic, with continued growth expected in the post-pandemic era. Premiumization, innovation, health consciousness, and sustainability will be key drivers of growth, as consumers seek high-quality, unique, and environmentally-friendly spirits. Producers that can adapt to evolving consumer preferences, embrace digital innovation, and differentiate themselves through product quality and brand identity will be well-positioned to succeed in the dynamic and competitive French market.

Conclusion

The Tequila market in France presents exciting opportunities for producers, driven by evolving consumer trends, a vibrant cocktail culture, and a growing appreciation for premium spirits. While the market faces challenges such as regulatory complexities and competition from other spirits, there are significant opportunities for growth through premiumization, innovation, and sustainability. By focusing on digital engagement, sustainability initiatives, product innovation, and collaboration, Tequila brands can thrive in the dynamic and competitive French market, delighting consumers and contributing to the continued success of the spirits industry in France.

What is Tequila?

Tequila is a distilled alcoholic beverage made from the blue agave plant, primarily produced in the region surrounding the city of Tequila in Mexico. It is known for its distinct flavor and is often enjoyed in cocktails or sipped neat.

What are the key players in the France Tequila Market?

Key players in the France Tequila Market include brands like Jose Cuervo, Patron, and Don Julio, which are well-known for their premium tequila offerings. These companies compete on quality, branding, and distribution strategies to capture consumer interest, among others.

What are the growth factors driving the France Tequila Market?

The France Tequila Market is driven by increasing consumer interest in premium spirits and the rising popularity of cocktails featuring tequila. Additionally, the trend towards artisanal and craft beverages is encouraging more consumers to explore tequila options.

What challenges does the France Tequila Market face?

Challenges in the France Tequila Market include regulatory hurdles related to alcohol distribution and competition from other spirits like vodka and whiskey. Additionally, consumer education about tequila’s unique qualities remains a barrier to broader acceptance.

What opportunities exist in the France Tequila Market?

Opportunities in the France Tequila Market include the potential for growth in the premium and super-premium segments, as well as the increasing trend of tequila-based cocktails in bars and restaurants. There is also a growing interest in sustainable and organic tequila production.

What trends are shaping the France Tequila Market?

Trends in the France Tequila Market include the rise of flavored tequilas and ready-to-drink cocktails, which appeal to younger consumers. Additionally, there is a growing focus on authenticity and heritage in tequila production, influencing consumer preferences.

France Tequila Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blanco, Reposado, Añejo, Extra Añejo |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Bars |

| Consumer Type | Millennials, Gen Z, Affluent Consumers, Casual Drinkers |

| Packaging Type | Glass Bottles, PET Bottles, Tetra Packs, Cans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in France Tequila Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at