444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The online trading platform market in Australia is a dynamic and rapidly growing sector of the financial services industry, providing individuals and institutions with access to domestic and international financial markets. With a strong regulatory framework, technological infrastructure, and a culture of entrepreneurship and innovation, Australia’s online trading platforms have witnessed significant growth, offering a wide range of trading services and investment products.

Meaning

The Australia online trading platform market comprises digital platforms that enable users to buy and sell various financial instruments, including stocks, bonds, derivatives, and currencies. These platforms leverage advanced technology, such as mobile apps and algorithmic trading, to provide users with convenient access to financial markets and empower them to trade and invest according to their preferences and objectives.

Executive Summary

The Australia online trading platform market has experienced rapid expansion driven by factors such as increasing internet penetration, smartphone adoption, and growing investor interest in financial markets. This market presents lucrative opportunities for investors, traders, and platform providers alike, but it also faces challenges related to regulatory compliance, cybersecurity, and market volatility.

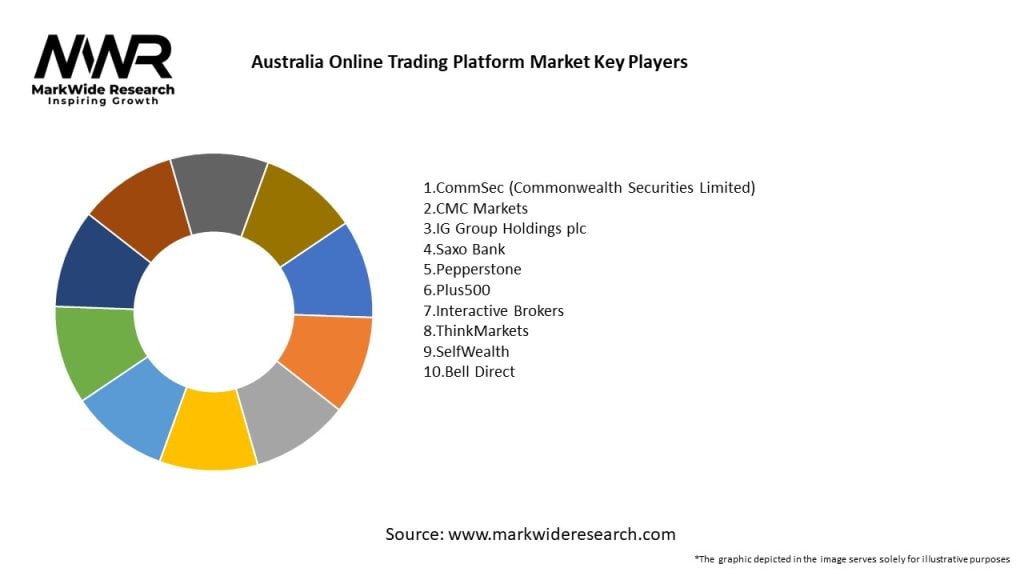

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Australia online trading platform market operates in a dynamic environment shaped by technological innovation, regulatory changes, market trends, and investor behavior. These dynamics influence the competitive landscape and require platform providers to adapt and evolve to meet the evolving needs of users and market conditions.

Regional Analysis

The online trading platform market in Australia exhibits regional variations in terms of user demographics, trading preferences, and regulatory environment. Key regions such as Sydney and Melbourne are hubs for financial activity and innovation, attracting users and businesses alike.

Competitive Landscape

Leading Companies in Australia Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

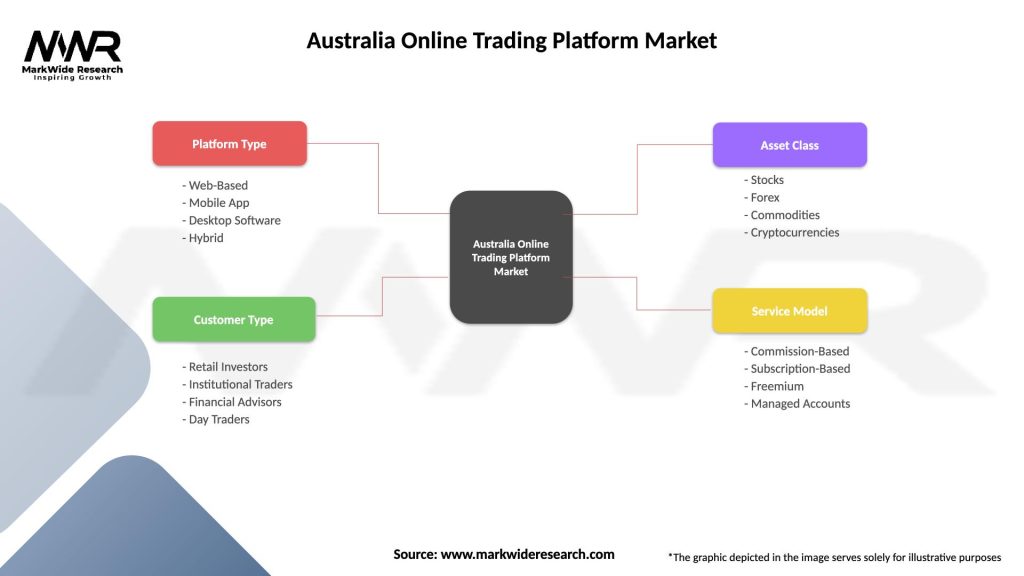

Segmentation

The online trading platform market in Australia can be segmented based on factors such as user demographics, trading preferences, investment objectives, and geographic location. Segmentation enables platform providers to tailor their offerings to specific user segments and enhance user experience.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The online trading platform market in Australia offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT analysis of the Australia online trading platform market highlights the market’s strengths, weaknesses, opportunities, and threats, guiding industry participants in formulating strategic decisions and mitigating risks.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of online trading platforms in Australia, as investors seek alternative ways to invest and manage their finances amid lockdowns and social distancing measures. The pandemic has also highlighted the importance of digitalization and remote access to financial services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the online trading platform market in Australia is optimistic, with continued growth expected driven by factors such as increasing internet penetration, technological innovation, regulatory reforms, and changing investor behavior. However, challenges such as regulatory uncertainty, cybersecurity risks, and market volatility will need to be navigated to realize the market’s full potential.

Conclusion

In conclusion, the online trading platform market in Australia represents a dynamic and rapidly evolving ecosystem, offering investors unprecedented access to financial markets and investment opportunities. With the proliferation of internet and mobile technology, the market is poised for continued growth, presenting significant opportunities for industry participants and stakeholders. By embracing technological innovation, staying abreast of regulatory changes, prioritizing security and user experience, and educating investors, online trading platform providers in Australia can capitalize on the market’s potential and shape the future of finance in the country.

What is Australia Online Trading Platform?

Australia Online Trading Platform refers to digital platforms that facilitate the buying and selling of financial instruments such as stocks, bonds, and currencies through the internet. These platforms provide users with tools for trading, analysis, and portfolio management.

What are the key players in the Australia Online Trading Platform Market?

Key players in the Australia Online Trading Platform Market include companies like CommSec, SelfWealth, and IG Markets, which offer various trading services and tools to investors. These companies compete on features such as user experience, fees, and available trading instruments, among others.

What are the growth factors driving the Australia Online Trading Platform Market?

The Australia Online Trading Platform Market is driven by factors such as increasing internet penetration, a growing interest in personal finance and investment among Australians, and the rise of mobile trading applications. Additionally, the demand for low-cost trading options is also contributing to market growth.

What challenges does the Australia Online Trading Platform Market face?

Challenges in the Australia Online Trading Platform Market include regulatory compliance, cybersecurity threats, and the need for continuous technological advancements. These factors can impact user trust and the overall growth of the market.

What opportunities exist in the Australia Online Trading Platform Market?

Opportunities in the Australia Online Trading Platform Market include the expansion of trading options such as cryptocurrencies and ETFs, as well as the potential for enhanced educational resources for new investors. Additionally, partnerships with fintech companies can lead to innovative trading solutions.

What trends are shaping the Australia Online Trading Platform Market?

Trends in the Australia Online Trading Platform Market include the increasing use of artificial intelligence for trading algorithms, the rise of social trading platforms, and a focus on user-friendly interfaces. These trends are changing how investors interact with trading platforms and make investment decisions.

Australia Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Web-Based, Mobile App, Desktop Software, Hybrid |

| Customer Type | Retail Investors, Institutional Traders, Financial Advisors, Day Traders |

| Asset Class | Stocks, Forex, Commodities, Cryptocurrencies |

| Service Model | Commission-Based, Subscription-Based, Freemium, Managed Accounts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Australia Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at