444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The alcohol e-commerce market in India has experienced remarkable growth in recent years, driven by factors such as increasing internet penetration, changing consumer preferences, and the emergence of online shopping platforms. With a large and diverse population, coupled with a rising demand for premium and imported alcoholic beverages, India presents significant opportunities for businesses to establish a strong online presence and cater to the evolving needs of consumers in the alcohol sector.

Meaning

The India alcohol e-commerce market refers to the online retailing of alcoholic beverages, including beer, wine, spirits, and other alcoholic drinks, through various digital channels such as e-commerce platforms, mobile applications, and specialty online retailers. This market segment is characterized by its dynamic nature, influenced by factors such as technological advancements, regulatory frameworks, and cultural nuances shaping the online retail landscape in India.

Executive Summary

This executive summary provides a concise overview of the India alcohol e-commerce market, highlighting key trends, drivers, restraints, opportunities, and challenges. It aims to offer valuable insights to industry stakeholders, including alcohol producers, distributors, retailers, and policymakers, to navigate the evolving landscape of online alcohol retailing in India.

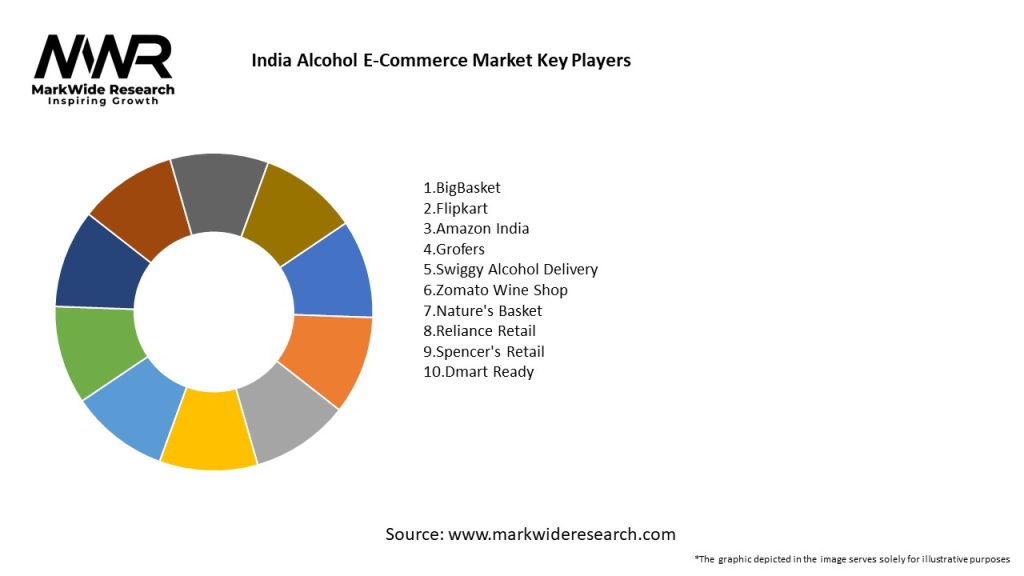

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India alcohol e-commerce market is characterized by dynamic and evolving dynamics, influenced by technological innovation, regulatory developments, changing consumer behavior, and competitive forces. These dynamics shape market trends, strategic decisions, and business models, impacting the growth and sustainability of online alcohol retailing in India.

Regional Analysis

Competitive Landscape

Leading Companies for India Alcohol E-Commerce Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India alcohol e-commerce market can be segmented based on various factors such as product type, distribution channel, consumer demographics, and geographic region. Common segmentation criteria include:

Each segment presents unique opportunities and challenges for market players, requiring tailored strategies and offerings to effectively target and engage diverse consumer segments in the India alcohol e-commerce market.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the digital transformation of the India alcohol e-commerce market, as consumers increasingly turn to online channels to purchase alcoholic beverages while adhering to social distancing measures and movement restrictions. E-commerce platforms, retailers, and logistics providers have adapted their strategies and operations to meet surging demand, ensure product availability, and enhance safety protocols in response to the pandemic.

Key Industry Developments

Analyst Suggestions

Industry analysts recommend that market players focus on [mention specific recommendations], including [mention key strategies or initiatives], to capitalize on emerging opportunities and address key market challenges in the India alcohol e-commerce market. Additionally, they suggest that businesses stay abreast of [mention specific trends or developments] and adapt their strategies accordingly to maintain competitiveness and sustainability in the market.

Future Outlook

The future outlook for the India alcohol e-commerce market is optimistic, with continued growth expected in the coming years. Key drivers such as [mention key drivers] and [mention key drivers] are expected to fuel market expansion, while technological innovation, regulatory reforms, and shifting consumer preferences will shape the evolution of online alcohol retailing in India. By embracing digitalization, innovation, and strategic collaboration, businesses can navigate the dynamic landscape of the India alcohol e-commerce market and unlock new opportunities for growth and success.

Conclusion

In conclusion, the India alcohol e-commerce market offers significant opportunities for industry participants and stakeholders to capitalize on the growing demand for alcoholic beverages in a digitally connected and increasingly affluent consumer market. Despite regulatory challenges, logistical complexities, and competitive pressures, businesses can leverage digitalization, data-driven insights, and consumer engagement strategies to thrive in the dynamic and evolving landscape of online alcohol retailing in India. By prioritizing innovation, sustainability, and customer-centricity, companies can position themselves for long-term success and leadership in this fast-growing market segment.

What is Alcohol E-Commerce?

Alcohol E-Commerce refers to the online sale and distribution of alcoholic beverages, including beer, wine, and spirits, through digital platforms. This sector has gained significant traction due to changing consumer preferences and the convenience of online shopping.

What are the key players in the India Alcohol E-Commerce Market?

Key players in the India Alcohol E-Commerce Market include companies like Sula Vineyards, United Breweries, and Pernod Ricard, which are known for their extensive product offerings and strong market presence. These companies leverage online platforms to reach a broader audience, among others.

What are the growth factors driving the India Alcohol E-Commerce Market?

The growth of the India Alcohol E-Commerce Market is driven by factors such as increasing smartphone penetration, a rise in disposable incomes, and changing consumer behaviors favoring online shopping. Additionally, the convenience of home delivery services has further fueled this trend.

What challenges does the India Alcohol E-Commerce Market face?

The India Alcohol E-Commerce Market faces challenges such as regulatory restrictions on alcohol sales, varying state laws, and logistical issues related to delivery. These factors can complicate operations and limit market expansion.

What opportunities exist in the India Alcohol E-Commerce Market?

Opportunities in the India Alcohol E-Commerce Market include the potential for growth in premium and craft alcohol segments, as well as the expansion of subscription-based models. Additionally, partnerships with local breweries and distilleries can enhance product offerings.

What trends are shaping the India Alcohol E-Commerce Market?

Trends shaping the India Alcohol E-Commerce Market include the rise of personalized shopping experiences, increased focus on sustainability in packaging, and the integration of technology for better customer engagement. These trends reflect evolving consumer preferences and market dynamics.

India Alcohol E-Commerce Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beer, Wine, Spirits, Ready-to-Drink |

| Customer Type | Retail Consumers, Corporate Clients, Event Planners, Restaurants |

| Delivery Model | Home Delivery, Click and Collect, Subscription Service, On-Demand |

| Payment Method | Credit Card, Digital Wallet, Cash on Delivery, Bank Transfer |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies for India Alcohol E-Commerce Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at