444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The corn syrup market in India is a crucial segment within the sweeteners industry, propelled by the country’s thriving food processing sector and the rising demand for cost-effective and versatile sweetening solutions. Corn syrup, derived from corn starch, serves as a fundamental ingredient across a diverse range of food and beverage applications, contributing to flavor enhancement, texture modification, and shelf-life extension.

Meaning

Corn syrup, produced through the enzymatic hydrolysis of corn starch, is a widely utilized sweetening agent in the food and beverage industry in India. Its affordability, functional attributes, and compatibility with various applications make it a preferred choice among food manufacturers seeking reliable sweetening solutions for their products.

Executive Summary

The India corn syrup market has witnessed steady growth attributed to factors such as the expansion of the food processing industry, increasing urbanization, and the burgeoning demand for processed and convenience foods. Despite challenges such as health concerns and regulatory oversight, the market presents opportunities for manufacturers to innovate, diversify product offerings, and cater to evolving consumer preferences.

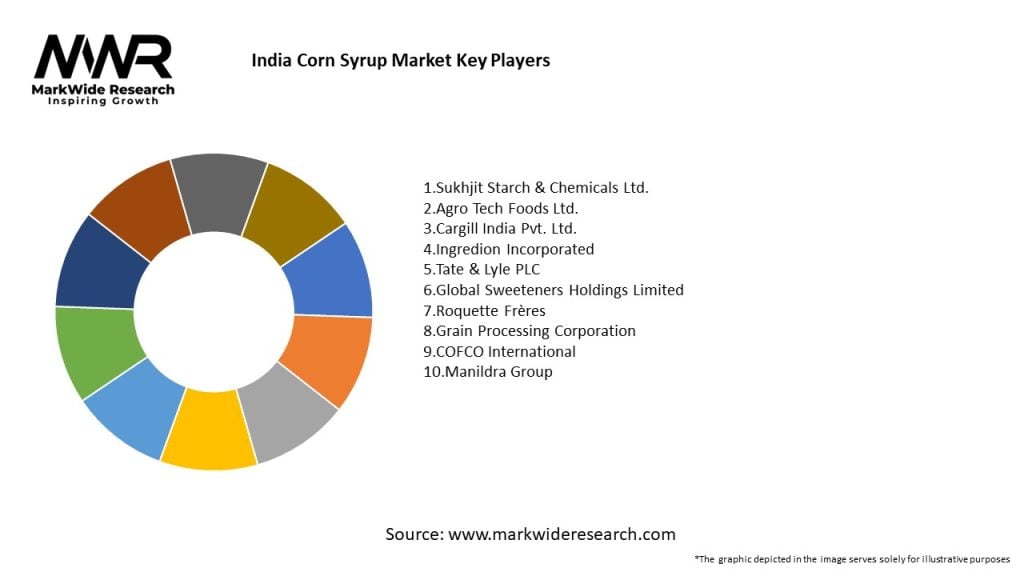

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India corn syrup market operates within a dynamic landscape influenced by factors such as economic conditions, consumer trends, regulatory policies, and technological advancements. These dynamics shape market trends, demand patterns, and business strategies, necessitating adaptation and innovation from industry participants to stay competitive and meet market demands effectively.

Regional Analysis

The corn syrup market in India exhibits regional variations in consumption patterns, market dynamics, and competitive landscapes. Key regions such as North India, South India, East India, West India, and Central India have distinct market characteristics, consumer preferences, and distribution channels, influencing market performance and growth potential.

Competitive Landscape

Leading Companies for India Corn Syrup Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

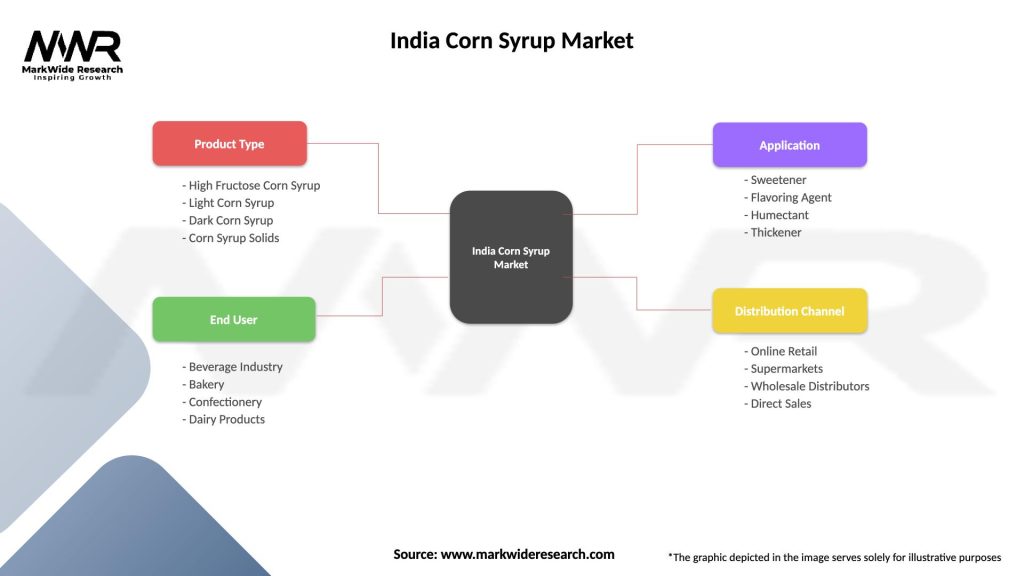

Segmentation

The India corn syrup market can be segmented based on various factors, including:

Segmentation provides insights into market dynamics, consumer preferences, and industry trends, enabling companies to tailor their strategies, product offerings, and marketing initiatives to specific market segments and customer needs effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the India corn syrup market:

Understanding these factors through a SWOT analysis helps companies identify strategic priorities, capitalize on strengths, address weaknesses, exploit opportunities, and mitigate threats to enhance competitiveness and sustain growth in the India corn syrup market.

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the India corn syrup market, influencing consumption patterns, supply chain dynamics, and consumer behavior. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the India corn syrup market is optimistic, with opportunities for growth, innovation, and market expansion driven by factors such as:

Conclusion

The India corn syrup market presents a dynamic and promising landscape characterized by opportunities for growth, innovation, and market expansion. With the increasing demand for convenience foods, the rise in health consciousness among consumers, and the growing emphasis on sustainability, the market is ripe for manufacturers to capitalize on emerging trends and consumer preferences.

To succeed in this competitive market, companies must prioritize consumer education, product innovation, quality assurance, and sustainability initiatives. By focusing on these key areas and aligning their strategies with market trends and regulatory requirements, corn syrup manufacturers can unlock new growth opportunities, strengthen their market presence, and build enduring relationships with consumers in India.

What is Corn Syrup?

Corn syrup is a sweetener made from the starch of corn, primarily used in food and beverage applications. It is commonly utilized in products like candies, baked goods, and soft drinks due to its ability to enhance sweetness and improve texture.

What are the key players in the India Corn Syrup Market?

Key players in the India Corn Syrup Market include companies like Cargill, Archer Daniels Midland Company, and Ingredion, which are known for their production and supply of corn syrup and related products, among others.

What are the growth factors driving the India Corn Syrup Market?

The growth of the India Corn Syrup Market is driven by increasing demand for processed foods and beverages, rising consumer preference for sweeteners, and the expanding confectionery industry. Additionally, the versatility of corn syrup in various applications contributes to its market growth.

What challenges does the India Corn Syrup Market face?

The India Corn Syrup Market faces challenges such as fluctuating corn prices, health concerns related to high sugar consumption, and competition from alternative sweeteners. These factors can impact production costs and consumer preferences.

What opportunities exist in the India Corn Syrup Market?

Opportunities in the India Corn Syrup Market include the potential for product innovation, such as the development of organic corn syrup, and the growing trend of health-conscious consumers seeking lower-calorie sweeteners. Additionally, expanding distribution channels can enhance market reach.

What trends are shaping the India Corn Syrup Market?

Trends shaping the India Corn Syrup Market include the increasing use of corn syrup in the food and beverage industry, the rise of clean label products, and the growing interest in sustainable sourcing practices. These trends reflect changing consumer preferences and industry standards.

India Corn Syrup Market

| Segmentation Details | Description |

|---|---|

| Product Type | High Fructose Corn Syrup, Light Corn Syrup, Dark Corn Syrup, Corn Syrup Solids |

| End User | Beverage Industry, Bakery, Confectionery, Dairy Products |

| Application | Sweetener, Flavoring Agent, Humectant, Thickener |

| Distribution Channel | Online Retail, Supermarkets, Wholesale Distributors, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies for India Corn Syrup Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at