444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US specialty injectable generics market is a vital segment within the pharmaceutical industry, catering to the demand for affordable yet high-quality injectable medications. These specialty generics offer therapeutic alternatives to brand-name injectables, providing cost-effective options for patients and healthcare providers. The market’s dynamics are influenced by factors such as patent expirations, regulatory pathways, healthcare policies, and market competition.

Meaning

Specialty injectable generics in the US refer to generic versions of injectable medications used to treat complex and chronic conditions such as cancer, autoimmune diseases, and infectious diseases. These medications are bioequivalent to their brand-name counterparts and undergo rigorous testing to ensure safety, efficacy, and quality. Specialty injectable generics play a crucial role in expanding access to essential treatments, reducing healthcare costs, and improving patient outcomes.

Executive Summary

The US specialty injectable generics market is experiencing steady growth driven by factors such as increasing demand for affordable healthcare, patent expirations of biologic drugs, and regulatory initiatives promoting generic competition. Market players focus on product innovation, manufacturing efficiency, and strategic partnerships to capitalize on emerging opportunities and address market challenges. Despite pricing pressures, regulatory complexities, and competitive threats, the market’s long-term outlook remains positive, supported by sustained demand for specialty injectable generics.

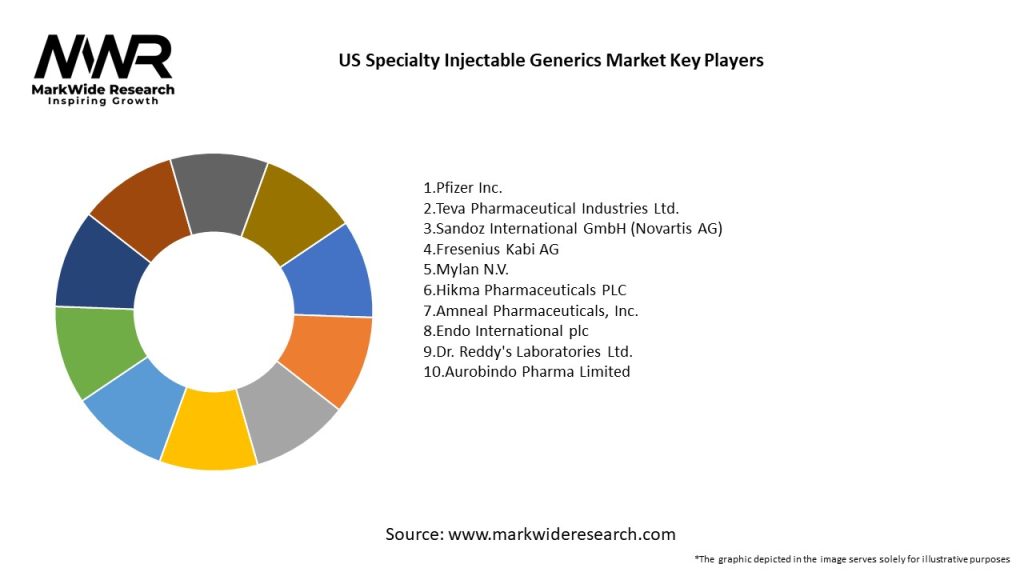

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US specialty injectable generics market operates in a dynamic environment shaped by regulatory changes, competitive dynamics, technological innovations, and healthcare trends. Market dynamics influence product development, market access, pricing strategies, and patient access to affordable therapies, driving industry stakeholders to adapt and innovate in response to evolving market demands.

Regional Analysis

The US specialty injectable generics market exhibits regional variations influenced by factors such as population demographics, healthcare infrastructure, reimbursement policies, and market competition. Regional analysis enables market players to identify geographic opportunities, tailor market strategies, and optimize resource allocation to maximize market penetration and profitability.

Competitive Landscape

Leading Companies in the US Specialty Injectable Generics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The US specialty injectable generics market can be segmented based on various factors such as therapeutic area, drug class, distribution channel, and end-user. Segmentation enables market players to identify target segments, customize marketing strategies, and address specific customer needs, driving market growth and profitability.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The US specialty injectable generics market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats facing the US specialty injectable generics market:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has both positive and negative impacts on the US specialty injectable generics market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The US specialty injectable generics market is poised for continued growth and innovation, driven by factors such as biosimilar adoption, therapeutic innovation, regulatory initiatives, and market competition. Despite challenges such as regulatory hurdles, pricing pressures, and competitive threats, the market’s long-term outlook remains positive, supported by sustained demand for affordable and effective specialty injectable therapies across therapeutic areas.

Conclusion

The US specialty injectable generics market plays a vital role in expanding patient access to essential therapies, reducing healthcare costs, and driving therapeutic innovation. Despite challenges such as regulatory complexities, pricing pressures, and competitive threats, the market offers significant opportunities for manufacturers, healthcare providers, and patients to collaborate, innovate, and succeed in the dynamic and evolving landscape of specialty injectable generics. By investing in biosimilar development, patient-centric solutions, regulatory compliance, and strategic partnerships, industry stakeholders can navigate market challenges, capitalize on emerging opportunities, and contribute to the advancement of patient care and public health in the United States.

What is Specialty Injectable Generics?

Specialty Injectable Generics refer to a category of generic medications that are administered via injection and are used to treat complex or chronic conditions. These generics often include biologics and other specialized formulations that require specific handling and administration protocols.

What are the key players in the US Specialty Injectable Generics Market?

Key players in the US Specialty Injectable Generics Market include companies like Sandoz, Teva Pharmaceuticals, and Mylan, which are known for their extensive portfolios of injectable generics. These companies compete on factors such as product quality, regulatory compliance, and market access, among others.

What are the growth factors driving the US Specialty Injectable Generics Market?

The US Specialty Injectable Generics Market is driven by factors such as the increasing prevalence of chronic diseases, the rising demand for cost-effective treatment options, and advancements in drug formulation technologies. Additionally, the push for biosimilars is contributing to market growth.

What challenges does the US Specialty Injectable Generics Market face?

Challenges in the US Specialty Injectable Generics Market include stringent regulatory requirements, high development costs, and competition from branded specialty drugs. These factors can hinder the entry of new players and affect pricing strategies.

What opportunities exist in the US Specialty Injectable Generics Market?

Opportunities in the US Specialty Injectable Generics Market include the potential for developing biosimilars, expanding into underserved therapeutic areas, and leveraging technological advancements in drug delivery systems. These factors can enhance market penetration and patient access.

What trends are shaping the US Specialty Injectable Generics Market?

Trends in the US Specialty Injectable Generics Market include the increasing focus on personalized medicine, the rise of telehealth services for patient management, and the growing importance of sustainability in pharmaceutical manufacturing. These trends are influencing how companies approach product development and market strategies.

US Specialty Injectable Generics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biologics, Biosimilars, Small Molecules, Peptides |

| Therapy Area | Oncology, Autoimmune Disorders, Infectious Diseases, Pain Management |

| End User | Hospitals, Clinics, Home Healthcare, Specialty Pharmacies |

| Delivery Mode | Intravenous, Subcutaneous, Intramuscular, Intra-articular |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Specialty Injectable Generics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at