444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US Ambulatory Surgery Center (ASC) market represents a critical component of the healthcare industry, providing outpatient surgical services in a convenient and cost-effective setting. These facilities offer a wide range of surgical procedures that do not require overnight hospitalization, catering to patients seeking high-quality care, shorter recovery times, and reduced healthcare costs. With their focus on efficiency, safety, and patient satisfaction, ASCs play an increasingly vital role in meeting the growing demand for outpatient surgical services in the United States.

Meaning

Ambulatory Surgery Centers (ASCs) are healthcare facilities that specialize in providing same-day surgical procedures to patients who do not require overnight hospitalization. These centers offer a convenient alternative to traditional hospital-based surgery, providing a wide range of outpatient procedures in a comfortable and patient-friendly environment. ASCs adhere to rigorous quality and safety standards, delivering efficient and cost-effective care while maintaining high levels of patient satisfaction and clinical outcomes.

Executive Summary

The US Ambulatory Surgery Center (ASC) market has experienced significant growth in recent years, driven by factors such as increasing demand for outpatient surgical services, advancements in medical technology, and shifting healthcare delivery models. This market offers numerous opportunities for healthcare providers, investors, and policymakers to improve access to care, enhance patient experiences, and optimize healthcare spending. However, challenges related to reimbursement, regulatory compliance, and market competition must be addressed to sustain growth and innovation in the ASC industry.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US Ambulatory Surgery Center (ASC) market operates in a dynamic healthcare landscape characterized by evolving consumer expectations, technological advancements, regulatory reforms, and market forces. These dynamics shape healthcare delivery models, payment structures, provider-payer relationships, and patient experiences, requiring ASCs to adapt, innovate, and collaborate to thrive in an increasingly competitive and value-driven environment.

Regional Analysis

The US Ambulatory Surgery Center (ASC) market exhibits regional variations in patient demographics, healthcare infrastructure, payer mix, regulatory environments, and market dynamics. While urban areas with dense populations and high demand for healthcare services may support multiple ASCs and specialty centers, rural and underserved regions may face challenges in access, reimbursement, and provider availability, necessitating innovative delivery models and community partnerships.

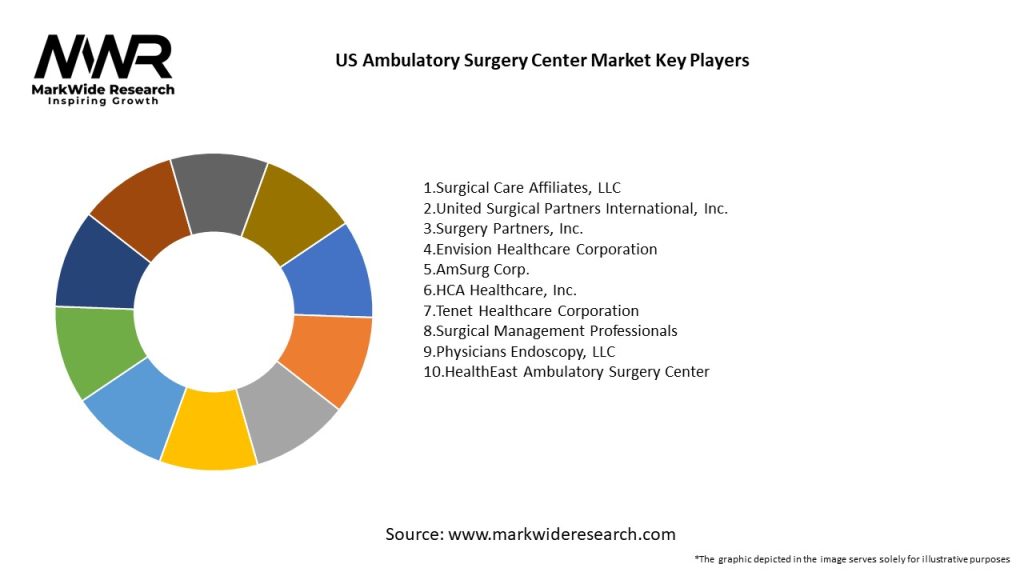

Competitive Landscape

The US Ambulatory Surgery Center (ASC) market is characterized by a competitive landscape with a diverse mix of providers, including independent ASCs, physician-owned practices, hospital-affiliated centers, and corporate chains. Key players differentiate themselves based on factors such as clinical expertise, service excellence, patient satisfaction, pricing transparency, and network integration, while also adapting to market trends, regulatory changes, and competitive pressures to maintain market share and profitability.

Segmentation

The US Ambulatory Surgery Center (ASC) market can be segmented based on various factors, including surgical specialty, procedure complexity, patient demographics, payer mix, and geographic location. Segmentation enables ASCs to target specific patient populations, clinical needs, and market niches, while also optimizing resource allocation, capacity planning, and service delivery to maximize clinical outcomes and financial performance.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The US Ambulatory Surgery Center (ASC) market offers several benefits for industry participants and stakeholders, including patients, physicians, payers, and policymakers. These benefits include increased access to care, reduced healthcare costs, improved patient outcomes, enhanced physician autonomy, and greater efficiency in care delivery, contributing to a more sustainable and patient-centered healthcare system.

SWOT Analysis

A SWOT analysis provides insights into the US Ambulatory Surgery Center (ASC) market’s strengths, weaknesses, opportunities, and threats, enabling stakeholders to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats to achieve strategic objectives and sustainable growth in a dynamic healthcare environment.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the US Ambulatory Surgery Center (ASC) market, leading to disruptions in elective surgeries, changes in patient volumes, financial uncertainties, and operational challenges. However, ASCs have demonstrated resilience, adaptability, and innovation in responding to the pandemic, implementing safety protocols, telehealth solutions, and recovery strategies to ensure continuity of care and restore patient confidence in outpatient surgery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US Ambulatory Surgery Center (ASC) market is poised for continued growth and innovation, fueled by factors such as increasing demand for outpatient surgery, advancements in medical technology, regulatory reforms, and value-based care initiatives. ASCs will play an increasingly vital role in delivering high-quality, cost-effective surgical services, expanding access to care, and driving value-based outcomes in a dynamic and evolving healthcare landscape.

Conclusion

In conclusion, the US Ambulatory Surgery Center (ASC) market represents a dynamic and essential segment of the healthcare industry, providing outpatient surgical services that offer convenience, efficiency, and cost savings for patients, providers, and payers. Despite facing challenges related to reimbursement, regulation, and competition, ASCs continue to thrive by leveraging technological advancements, clinical expertise, and strategic partnerships to deliver exceptional patient care, optimize clinical outcomes, and enhance healthcare value. By embracing innovation, collaboration, and patient-centered care models, ASCs can shape a more sustainable and patient-centered healthcare system for the future.

US Ambulatory Surgery Center Market

| Segmentation Details | Description |

|---|---|

| Service Type | Orthopedic Surgery, Gastroenterology, Pain Management, Ophthalmology |

| End User | Patients, Healthcare Providers, Insurers, Employers |

| Technology | Minimally Invasive, Robotic Surgery, Anesthesia, Imaging Systems |

| Procedure Type | Elective Surgery, Diagnostic Procedures, Therapeutic Procedures, Follow-up Care |

Leading Companies in the US Ambulatory Surgery Center Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at