444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The South Korea Virtual Cards Market is a dynamic sector within the country’s financial landscape, providing innovative payment solutions to businesses and individuals. Virtual cards, characterized by their digital nature and enhanced security features, have witnessed significant adoption for their convenience in financial transactions.

Meaning:

In South Korea, virtual cards represent digital payment instruments that offer a secure and efficient alternative to traditional payment methods. These cards, devoid of a physical presence, are utilized for online transactions, emphasizing security and seamless user experiences. The concept of virtual cards aligns with the nation’s tech-savvy population and their preference for advanced financial solutions.

Executive Summary:

The executive summary serves as a concise snapshot of the South Korea Virtual Cards Market, encapsulating key trends, major players, and factors influencing market dynamics. It provides stakeholders with a quick overview of the current state of the market.

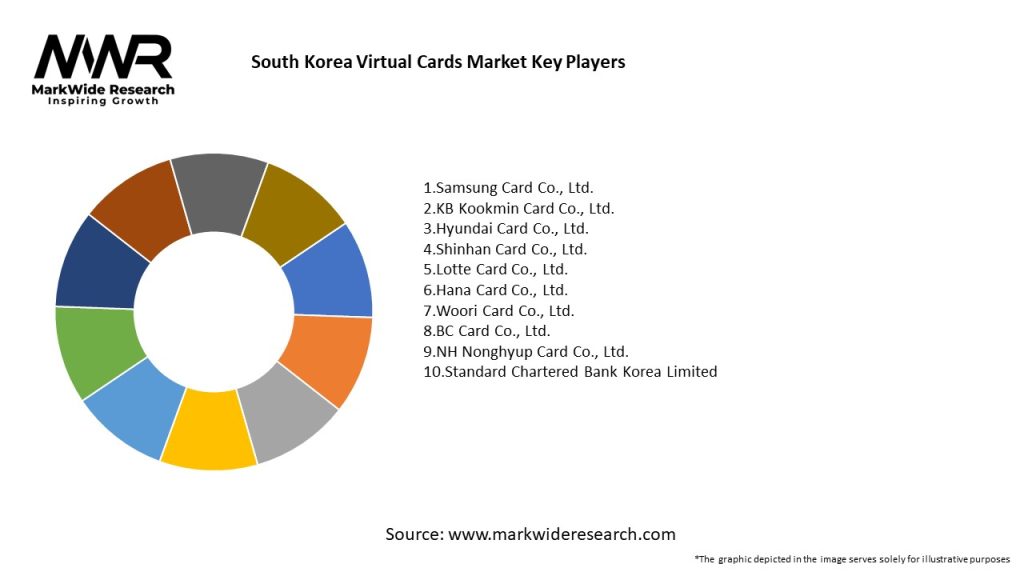

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The South Korea Virtual Cards Market operates within a dynamic environment influenced by economic conditions, technological advancements, regulatory changes, and evolving consumer preferences. Providers must adapt to these dynamics to stay competitive and deliver value to users.

Regional Analysis:

A regional analysis explores variations in the adoption and preferences for virtual cards across different regions in South Korea. This includes considerations for regional economic disparities and cultural influences.

Competitive Landscape:

Leading Companies in the South Korea Virtual Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The market can be segmented based on:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic accelerated the shift towards digital payments in South Korea, influencing the adoption and usage patterns of virtual cards. The increased emphasis on contactless transactions and online shopping further boosted the virtual card market.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the South Korea Virtual Cards Market is optimistic, with sustained growth expected. Continuous technological advancements, changing consumer preferences, and strategic collaborations will shape the market’s trajectory.

Conclusion:

In conclusion, the South Korea Virtual Cards Market represents a thriving sector within the country’s financial landscape. The market’s evolution is driven by a tech-savvy population, fintech innovation, and a growing emphasis on digital payments. Overcoming challenges related to cultural perceptions and regulatory landscapes will be crucial as virtual card providers navigate the dynamic market. With a focus on user education, security, and collaboration, the South Korea Virtual Cards Market is poised for continued success, playing a pivotal role in reshaping financial transactions in the nation.

What is Virtual Cards?

Virtual cards are digital payment cards that allow users to make online transactions without the need for a physical card. They are often used for secure online shopping and can be linked to various payment methods.

What are the key players in the South Korea Virtual Cards Market?

Key players in the South Korea Virtual Cards Market include companies like Toss, Kakao Pay, and Samsung Card, which offer various virtual card solutions for consumers and businesses, among others.

What are the main drivers of growth in the South Korea Virtual Cards Market?

The growth of the South Korea Virtual Cards Market is driven by the increasing adoption of digital payments, the rise in e-commerce activities, and the demand for enhanced security in online transactions.

What challenges does the South Korea Virtual Cards Market face?

Challenges in the South Korea Virtual Cards Market include concerns over cybersecurity, regulatory compliance issues, and competition from traditional banking services that may hinder market penetration.

What opportunities exist in the South Korea Virtual Cards Market?

Opportunities in the South Korea Virtual Cards Market include the potential for partnerships with fintech companies, the expansion of services to include loyalty programs, and the growing trend of contactless payments.

What trends are shaping the South Korea Virtual Cards Market?

Trends in the South Korea Virtual Cards Market include the integration of artificial intelligence for fraud detection, the rise of mobile wallets, and the increasing focus on user-friendly interfaces for better customer experience.

South Korea Virtual Cards Market

| Segmentation Details | Description |

|---|---|

| Product Type | Prepaid Cards, Virtual Debit Cards, Virtual Credit Cards, Corporate Cards |

| End User | Consumers, Small Businesses, Corporates, E-commerce Platforms |

| Technology | Contactless Payments, Mobile Wallets, Blockchain, QR Code Payments |

| Distribution Channel | Online Platforms, Banking Institutions, Fintech Companies, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the South Korea Virtual Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at