444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South Korean automotive automatic tire inflation system (ATIS) market is witnessing significant growth, driven by advancements in automotive technology, increasing demand for commercial vehicles, and a focus on improving road safety and efficiency. ATIS, also known as tire pressure monitoring systems (TPMS), plays a crucial role in maintaining optimal tire pressure, enhancing vehicle performance, and reducing fuel consumption. With South Korea’s thriving automotive industry and emphasis on innovation, the ATIS market presents lucrative opportunities for industry players and stakeholders.

Meaning

Automotive automatic tire inflation systems (ATIS) are advanced safety features integrated into vehicles to monitor and regulate tire pressure automatically. These systems use sensors to detect changes in tire pressure and inflate or deflate tires as needed to maintain optimal pressure levels. By ensuring proper tire inflation, ATIS improves vehicle handling, stability, and fuel efficiency, while reducing the risk of tire blowouts and accidents. In South Korea, ATIS technology is gaining traction among commercial vehicle operators, fleet managers, and consumers seeking enhanced safety and performance in their vehicles.

Executive Summary

The South Korean automotive ATIS market is experiencing robust growth, fueled by increasing awareness of the importance of tire maintenance, stringent safety regulations, and advancements in sensor technology. Key market players are investing in research and development to enhance product features, reliability, and compatibility with various vehicle models. The market offers significant growth opportunities for manufacturers, suppliers, and service providers catering to the automotive sector. However, challenges such as pricing pressures, regulatory compliance, and competition from alternative technologies pose considerations for industry participants.

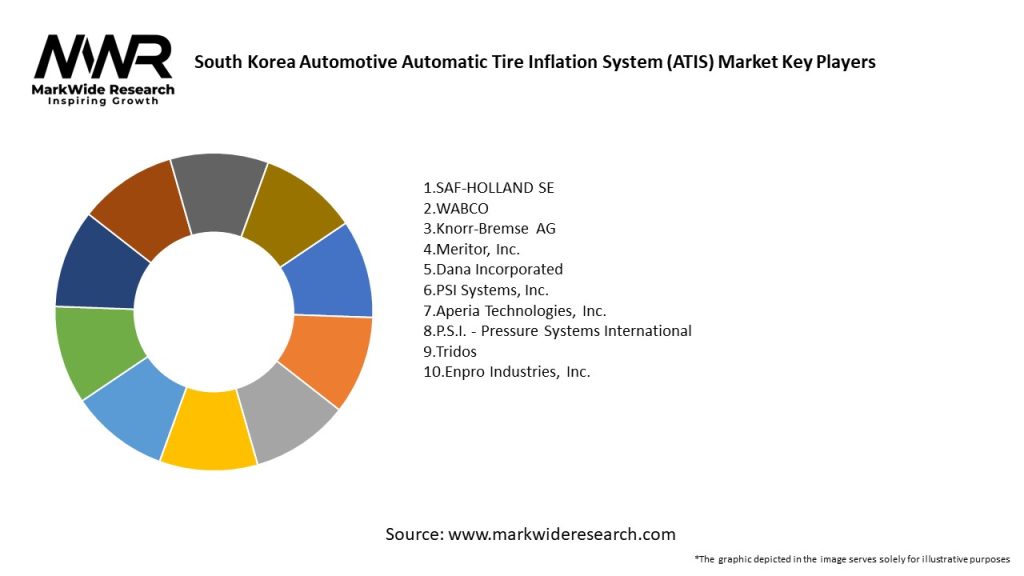

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The South Korean automotive ATIS market operates in a dynamic environment shaped by technological innovation, regulatory changes, consumer preferences, and industry trends. Understanding market dynamics is essential for stakeholders to adapt strategies, capitalize on opportunities, and navigate challenges effectively. Key dynamics driving market growth include:

Regional Analysis

The South Korean automotive ATIS market exhibits regional variations influenced by factors such as urbanization, transportation infrastructure, economic development, and regulatory frameworks. Key regions driving market demand include:

Competitive Landscape

Leading Companies South Korea Automotive Automatic Tire Inflation System (ATIS) Market :

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The South Korean automotive ATIS market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the South Korean automotive ATIS market. While the initial disruption in vehicle production and supply chain operations affected market demand and investments in automotive technology, the subsequent recovery and rebound in vehicle sales and aftermarket activities have accelerated the adoption of ATIS solutions. The pandemic has also highlighted the importance of vehicle safety and maintenance, driving consumer awareness and demand for TPMS technology to enhance vehicle performance and reliability in challenging operating environments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The South Korean automotive ATIS market is poised for continued growth and innovation, driven by technological advancements, regulatory mandates, and consumer demand for safety and efficiency features in vehicles. Key trends shaping the market’s future outlook include the integration of ATIS with connected vehicle platforms, advancements in sensor technology, predictive maintenance solutions, and energy harvesting systems. Industry players that embrace these trends, prioritize innovation, and collaborate with ecosystem partners will gain a competitive edge and capitalize on the expanding market opportunities in South Korea’s automotive ATIS sector.

Conclusion

The South Korean automotive automatic tire inflation system (ATIS) market presents significant growth prospects, driven by factors such as increasing vehicle safety regulations, rising demand for commercial vehicles, and advancements in sensor technology. Industry participants and stakeholders stand to benefit from the market’s growth trajectory by focusing on product innovation, expanding market reach, educating consumers, and ensuring compliance with regulatory standards. By embracing technological advancements, fostering industry collaboration, and addressing evolving market dynamics, South Korea’s automotive ATIS market is poised for sustained growth and innovation in the years to come, contributing to enhanced vehicle safety, efficiency, and sustainability on the nation’s roads.

What is Automotive Automatic Tire Inflation System (ATIS)?

Automotive Automatic Tire Inflation System (ATIS) refers to a technology designed to automatically maintain optimal tire pressure in vehicles. This system enhances safety, improves fuel efficiency, and extends tire life by ensuring that tires are always inflated to the recommended levels.

What are the key players in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market?

Key players in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market include companies like Continental AG, Schrader Electronics, and Pirelli, which are known for their innovations in tire technology and inflation systems, among others.

What are the growth factors driving the South Korea Automotive Automatic Tire Inflation System (ATIS) Market?

The growth of the South Korea Automotive Automatic Tire Inflation System (ATIS) Market is driven by increasing vehicle safety regulations, rising awareness of tire maintenance, and advancements in automotive technology that promote efficiency and performance.

What challenges does the South Korea Automotive Automatic Tire Inflation System (ATIS) Market face?

Challenges in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market include high installation costs, limited consumer awareness, and potential technical issues related to system reliability and maintenance.

What opportunities exist in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market?

Opportunities in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market include the growing demand for electric vehicles, which often require advanced tire management systems, and the potential for integration with smart vehicle technologies.

What trends are shaping the South Korea Automotive Automatic Tire Inflation System (ATIS) Market?

Trends in the South Korea Automotive Automatic Tire Inflation System (ATIS) Market include the increasing adoption of connected vehicle technologies, the development of more compact and efficient inflation systems, and a focus on sustainability through improved tire performance and reduced waste.

South Korea Automotive Automatic Tire Inflation System (ATIS) Market

| Segmentation Details | Description |

|---|---|

| Product Type | On-Board Systems, Portable Systems, Centralized Systems, Hybrid Systems |

| Technology | Mechanical, Electronic, Pneumatic, Hydraulic |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Vehicle Assemblers |

| Installation | Factory Installed, Retrofitted, DIY Kits, Professional Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies South Korea Automotive Automatic Tire Inflation System (ATIS) Market :

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at