444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Group Health Insurance market in Spain is a dynamic sector that plays a pivotal role in providing healthcare coverage to a significant portion of the population. Group health insurance is a form of coverage that is offered by employers or organizations to their employees or members. It serves as a crucial employee benefit, enhancing the overall well-being of the workforce and contributing to a healthier and more productive society.

Meaning: Group Health Insurance in Spain refers to a comprehensive healthcare coverage plan provided by employers or organizations to a group of individuals, typically employees or members associated with the entity. This insurance model ensures that a collective group has access to medical services, offering financial protection against healthcare expenses.

Executive Summary: The Spain Group Health Insurance market has witnessed substantial growth, driven by the recognition of the importance of employee well-being, changing demographics, and an increased focus on health and wellness. Employers are realizing that offering comprehensive health insurance not only attracts top talent but also fosters a positive work environment. Understanding the key components and market dynamics is essential for businesses and organizations navigating the landscape of group health insurance in Spain.

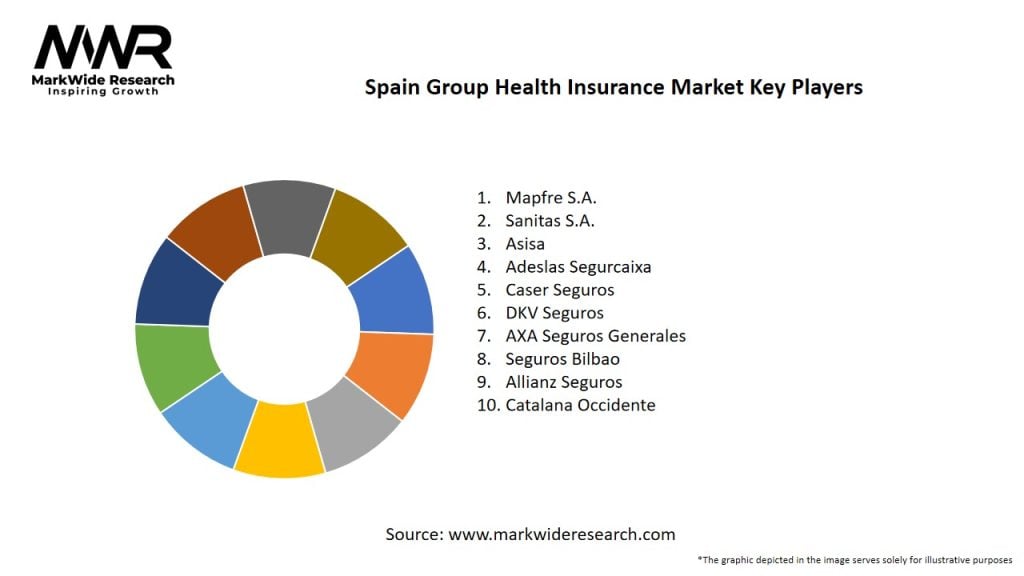

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Spain Group Health Insurance market operates in a dynamic environment influenced by various factors, including economic conditions, regulatory changes, healthcare trends, and the evolving needs of employers and employees. Navigating these dynamics requires insurers and employers to stay adaptive and responsive to emerging opportunities and challenges.

Regional Analysis: The landscape of group health insurance in Spain may vary regionally due to differences in economic development, industrial sectors, and healthcare infrastructure. Major urban centers may witness different trends and demands compared to rural or less-developed regions. Understanding regional nuances is essential for insurers targeting diverse geographical areas.

Competitive Landscape:

Leading Companies in Spain Group Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Group Health Insurance market in Spain can be segmented based on various factors:

Segmentation allows insurers to tailor their offerings to specific demographics and industries, ensuring that group health insurance plans meet the diverse needs of the market.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders: The Spain Group Health Insurance market offers several benefits for insurers, employers, and employees:

SWOT Analysis: A SWOT analysis provides insights into the internal strengths and weaknesses and external opportunities and threats in the Spain Group Health Insurance market.

Understanding these factors through a SWOT analysis helps insurers and employers navigate the market landscape effectively.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has significantly influenced the Spain Group Health Insurance market. Some key impacts include:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Spain Group Health Insurance market is optimistic, driven by ongoing trends and emerging opportunities:

Conclusion: The Spain Group Health Insurance market is a vital component of the country’s healthcare landscape, contributing to the well-being of employees and the overall health of the workforce. With a focus on customization, digital transformation, and holistic well-being, the market is poised for continued growth. Insurers, employers, and employees are encouraged to collaborate in creating innovative and adaptive solutions that address evolving healthcare needs. The Spain Group Health Insurance market, with its resilience and commitment to well-being, is set to play a pivotal role in shaping the future of healthcare coverage in the country.

What is Group Health Insurance?

Group Health Insurance refers to a health coverage plan that provides medical benefits to a group of people, typically employees of a company or members of an organization. It often includes a range of services such as hospitalization, outpatient care, and preventive services.

What are the key players in the Spain Group Health Insurance Market?

Key players in the Spain Group Health Insurance Market include companies like Sanitas, Adeslas, and Asisa, which offer various health insurance products tailored to different needs. These companies compete on factors such as coverage options, customer service, and pricing, among others.

What are the main drivers of the Spain Group Health Insurance Market?

The main drivers of the Spain Group Health Insurance Market include the increasing demand for comprehensive healthcare coverage, rising healthcare costs, and a growing awareness of health and wellness among employees. Additionally, businesses are recognizing the importance of offering health benefits to attract and retain talent.

What challenges does the Spain Group Health Insurance Market face?

The Spain Group Health Insurance Market faces challenges such as regulatory changes, rising claims costs, and the need for insurers to adapt to evolving consumer expectations. Additionally, competition among providers can lead to pricing pressures and reduced profit margins.

What opportunities exist in the Spain Group Health Insurance Market?

Opportunities in the Spain Group Health Insurance Market include the potential for digital transformation in service delivery, the introduction of personalized health plans, and the expansion of telemedicine services. These trends can enhance customer experience and improve access to healthcare.

What trends are shaping the Spain Group Health Insurance Market?

Trends shaping the Spain Group Health Insurance Market include the increasing integration of technology in health services, a focus on preventive care, and the rise of wellness programs. Insurers are also exploring partnerships with tech companies to enhance service offerings and improve health outcomes.

Spain Group Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Comprehensive Plans, Catastrophic Plans, Short-Term Plans, Indemnity Plans |

| End User | Corporations, Small Businesses, Non-Profits, Educational Institutions |

| Delivery Model | Direct Sales, Broker Sales, Online Platforms, Hybrid Models |

| Coverage Type | Inpatient Care, Outpatient Care, Preventive Services, Emergency Services |

Leading Companies in Spain Group Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at