444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Spain online trading platform market refers to the digital platforms that facilitate the buying and selling of financial instruments such as stocks, bonds, commodities, and currencies over the internet. These platforms offer investors access to real-time market data, trading tools, and investment opportunities, revolutionizing the way individuals and institutions engage in financial markets.

Meaning: Online trading platforms in Spain provide investors with a convenient and efficient way to execute trades, manage investment portfolios, and access financial markets from anywhere with an internet connection. These platforms cater to a wide range of investors, from beginners to experienced traders, offering diverse investment products and trading functionalities.

Executive Summary: The Spain online trading platform market is experiencing rapid growth driven by factors such as technological advancements, increasing internet penetration, and a growing interest in financial markets among retail investors. The market offers significant opportunities for platform providers, investors, and financial institutions but also faces challenges related to regulatory compliance, cybersecurity, and market volatility.

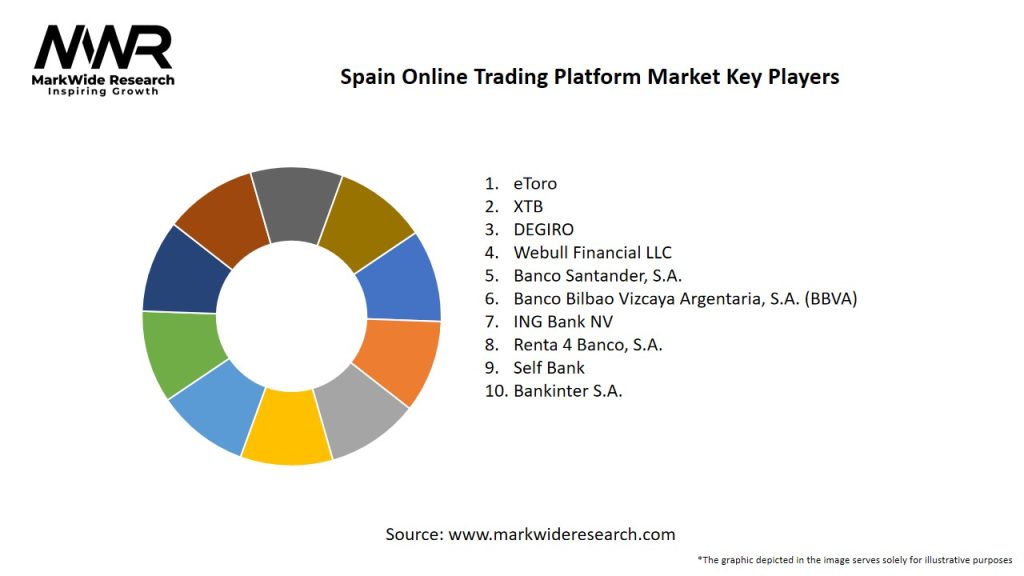

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Spain online trading platform market operates within a dynamic ecosystem shaped by technological innovation, regulatory developments, market trends, and investor behavior. Adapting to changing market dynamics, customer preferences, and emerging opportunities is essential for platform providers to remain competitive and sustain growth in the long term.

Regional Analysis: The Spain online trading platform market benefits from a favorable regulatory environment, a digitally literate population, and a growing interest in financial markets. Key regions such as Madrid and Barcelona serve as hubs for financial services, technology innovation, and investor education, driving market growth and innovation in online trading platforms.

Competitive Landscape:

Leading Companies in Spain Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Spain online trading platform market can be segmented based on factors such as trading platform type (web-based, mobile app), target audience (retail investors, institutional investors), investment products (stocks, bonds, derivatives), and trading strategies (day trading, long-term investing).

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis of the Spain online trading platform market highlights key strengths, weaknesses, opportunities, and threats, informing strategic decision-making, market positioning, and competitive advantage for industry participants.

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has accelerated digitalization trends and increased demand for online trading platforms in Spain, as lockdowns, social distancing measures, and remote work arrangements drive individuals and institutions to seek alternative channels for investment, wealth management, and financial planning.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Spain online trading platform market is promising, driven by factors such as increasing digital adoption, regulatory reforms, and investor demand for accessible, transparent, and innovative investment solutions. With continued technological innovation, regulatory compliance, and customer-centricity, online trading platforms are poised to play a central role in shaping the future of investing and wealth management in Spain.

Conclusion: In conclusion, the Spain online trading platform market presents significant opportunities for investors, platform providers, and financial institutions to capitalize on the growing popularity of digital investing, technological innovation, and changing consumer preferences. By embracing digital transformation, regulatory compliance, and customer-centricity, online trading platforms can unlock value, drive innovation, and empower investors with access to financial markets, wealth-building opportunities, and personalized investment solutions in Spain and beyond.

What is Online Trading Platform?

An Online Trading Platform is a software application that allows users to buy and sell financial securities via the internet. These platforms provide tools for trading various assets, including stocks, forex, and cryptocurrencies, enabling users to manage their investments efficiently.

What are the key players in the Spain Online Trading Platform Market?

Key players in the Spain Online Trading Platform Market include companies like eToro, Plus500, and Interactive Brokers, which offer diverse trading services and platforms tailored to different types of investors, among others.

What are the growth factors driving the Spain Online Trading Platform Market?

The growth of the Spain Online Trading Platform Market is driven by increasing internet penetration, a rise in retail trading activities, and the growing popularity of mobile trading applications. Additionally, the demand for real-time data and analytics is enhancing user engagement.

What challenges does the Spain Online Trading Platform Market face?

The Spain Online Trading Platform Market faces challenges such as regulatory compliance, cybersecurity threats, and market volatility. These factors can impact user trust and the overall stability of trading platforms.

What opportunities exist in the Spain Online Trading Platform Market?

Opportunities in the Spain Online Trading Platform Market include the expansion of cryptocurrency trading options, the integration of advanced trading technologies like AI, and the potential for partnerships with financial institutions to enhance service offerings.

What trends are shaping the Spain Online Trading Platform Market?

Trends shaping the Spain Online Trading Platform Market include the rise of social trading, where users can follow and copy the trades of experienced investors, and the increasing focus on user-friendly interfaces and educational resources for novice traders.

Spain Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Platform Type | Web-Based, Mobile App, Desktop Application, Hybrid |

| Asset Class | Stocks, Forex, Commodities, Cryptocurrencies |

| Customer Type | Retail Investors, Institutional Investors, Day Traders, Long-Term Investors |

| Service Model | Commission-Based, Subscription-Based, Freemium, Managed Accounts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Spain Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at