444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The packaged food products market in Saudi Arabia is a vital sector of the country’s food industry, catering to the diverse culinary preferences, dietary habits, and lifestyle choices of its population. Packaged food products encompass a wide range of food items, including snacks, bakery products, ready meals, dairy products, beverages, confectionery, and frozen foods, packaged and processed for convenience, freshness, and extended shelf life.

Meaning

Packaged food products refer to food items that undergo processing, preservation, and packaging for retail sale and consumption. These products offer convenience, portability, and longer shelf life compared to fresh or bulk foods, making them popular choices for busy consumers, households, and on-the-go lifestyles.

Executive Summary

The packaged food products market in Saudi Arabia is experiencing steady growth, driven by factors such as urbanization, changing consumer preferences, increasing disposable incomes, and the growing influence of Western dietary habits. The market offers significant opportunities for industry participants to introduce innovative products, expand distribution channels, and capitalize on evolving consumer trends.

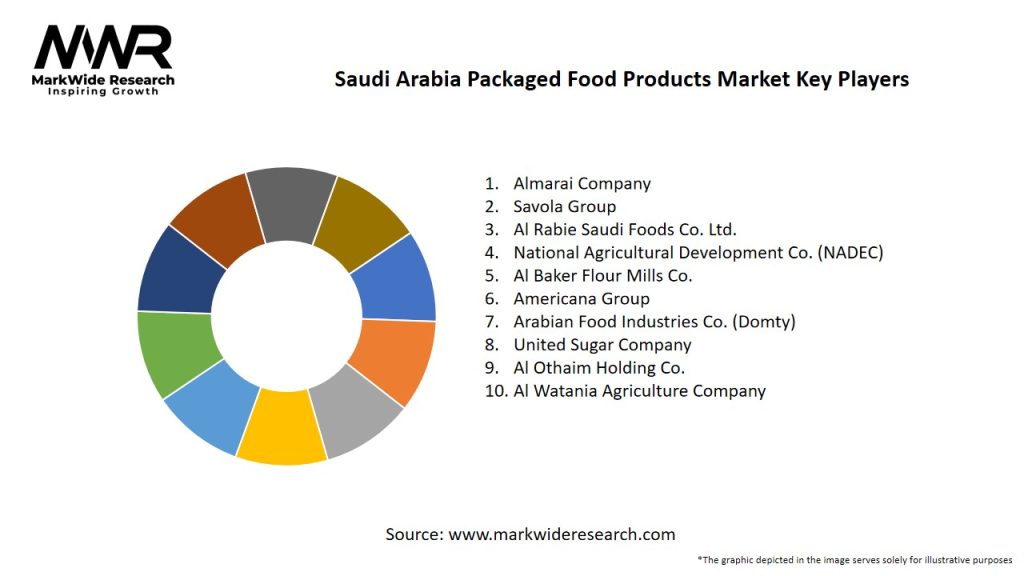

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The packaged food products market in Saudi Arabia operates in a dynamic environment influenced by various factors, including consumer trends, market competition, regulatory changes, and economic conditions. Understanding market dynamics is essential for industry participants to adapt, innovate, and capitalize on emerging opportunities.

Regional Analysis

The packaged food products market in Saudi Arabia exhibits regional variations in consumption patterns, distribution channels, and consumer preferences. Key regions such as Riyadh, Jeddah, and Dammam serve as major hubs for retail, hospitality, and foodservice sectors, driving demand for packaged food products.

Competitive Landscape

Leading Companies in Saudi Arabia Packaged Food Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The packaged food products market in Saudi Arabia can be segmented based on various factors such as product type, distribution channel, price segment, and consumer demographics, providing insights into market dynamics and consumer preferences.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the packaged food products market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had significant effects on the packaged food products market in Saudi Arabia, influencing consumer behavior, supply chain dynamics, and market trends:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the packaged food products market in Saudi Arabia is optimistic, with opportunities for growth, innovation, and market expansion driven by demographic shifts, urbanization, health trends, and digital transformation. Key factors shaping the future of the market include:

Conclusion

The packaged food products market in Saudi Arabia presents opportunities for industry stakeholders to innovate, differentiate, and capitalize on evolving consumer trends, preferences, and market dynamics. By focusing on health and wellness, digital engagement, sustainability, and innovation, packaged food companies can drive growth, enhance brand value, and meet the diverse needs of consumers in a dynamic and competitive market landscape. Embracing opportunities for digital transformation, product innovation, and sustainability initiatives enables packaged food companies to thrive and contribute to the future growth and development of the food industry in Saudi Arabia.

What is Packaged Food Products?

Packaged food products refer to food items that are processed and packaged for convenience, including snacks, ready-to-eat meals, and beverages. These products are designed for easy storage and consumption, catering to the growing demand for convenience in food consumption.

What are the key players in the Saudi Arabia Packaged Food Products Market?

Key players in the Saudi Arabia Packaged Food Products Market include Almarai, Savola Group, and Nestlé, among others. These companies are known for their diverse product offerings and strong distribution networks within the region.

What are the growth factors driving the Saudi Arabia Packaged Food Products Market?

The growth of the Saudi Arabia Packaged Food Products Market is driven by factors such as increasing urbanization, changing consumer lifestyles, and a rising preference for convenience foods. Additionally, the growing population and higher disposable incomes contribute to the demand for packaged food.

What challenges does the Saudi Arabia Packaged Food Products Market face?

The Saudi Arabia Packaged Food Products Market faces challenges such as fluctuating raw material prices and increasing health consciousness among consumers. Additionally, competition from local and international brands can impact market dynamics.

What opportunities exist in the Saudi Arabia Packaged Food Products Market?

Opportunities in the Saudi Arabia Packaged Food Products Market include the introduction of innovative products that cater to health-conscious consumers and the expansion of e-commerce platforms for food distribution. There is also potential for growth in organic and specialty packaged foods.

What trends are shaping the Saudi Arabia Packaged Food Products Market?

Trends shaping the Saudi Arabia Packaged Food Products Market include a shift towards healthier options, increased demand for plant-based products, and the rise of sustainable packaging solutions. These trends reflect changing consumer preferences and a focus on environmental impact.

Saudi Arabia Packaged Food Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Snacks, Beverages, Frozen Foods, Canned Goods |

| Packaging Type | Flexible Packaging, Rigid Packaging, Glass Containers, Tetra Packs |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Wholesale |

| End User | Households, Restaurants, Cafes, Catering Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Saudi Arabia Packaged Food Products Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at