444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America syndicated loans market is a crucial segment of the region’s financial landscape, facilitating corporate financing needs through the syndication of large loan facilities. Syndicated loans play a vital role in providing capital for various purposes, including mergers and acquisitions, corporate expansions, working capital requirements, and project financing. With a diverse range of borrowers and lenders participating in syndicated loan transactions, the market serves as a key mechanism for capital allocation and risk management in North America’s financial sector.

Meaning

Syndicated loans refer to large loan facilities provided by a group of lenders, typically banks or financial institutions, to a single borrower. These loans are structured, arranged, and administered by one or more lead arrangers or underwriters, who coordinate the syndication process and negotiate the loan terms on behalf of the borrower and the syndicate of lenders. Syndicated loans may take various forms, including term loans, revolving credit facilities, and bridge loans, and they serve as a flexible financing option for corporate borrowers with diverse capital needs.

Executive Summary

The North America syndicated loans market is characterized by robust activity driven by corporate demand for financing, investor appetite for fixed-income assets, and favorable market conditions. Syndicated loans offer numerous benefits for both borrowers and lenders, including access to large funding amounts, diversification of credit exposure, and potential for attractive returns. The market is highly competitive, with banks, institutional investors, and private equity firms actively participating in syndicated loan transactions across various industries and sectors.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America syndicated loans market operates within a dynamic ecosystem shaped by macroeconomic trends, regulatory developments, market sentiment, and industry-specific factors. Market dynamics influence borrower behavior, lender preferences, pricing dynamics, and risk management practices, impacting the overall functioning and stability of the syndicated loan market.

Regional Analysis

The North America syndicated loans market encompasses a diverse range of borrowers, lenders, and transaction participants across the United States, Canada, and Mexico. The market’s depth and breadth vary by country, reflecting differences in economic conditions, regulatory frameworks, industry composition, and market maturity. The United States, as the largest and most developed financial market in the region, dominates syndicated loan issuance and trading activity, attracting domestic and international investors seeking exposure to North American credit markets.

Competitive Landscape

Leading Companies in the North America Syndicated Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

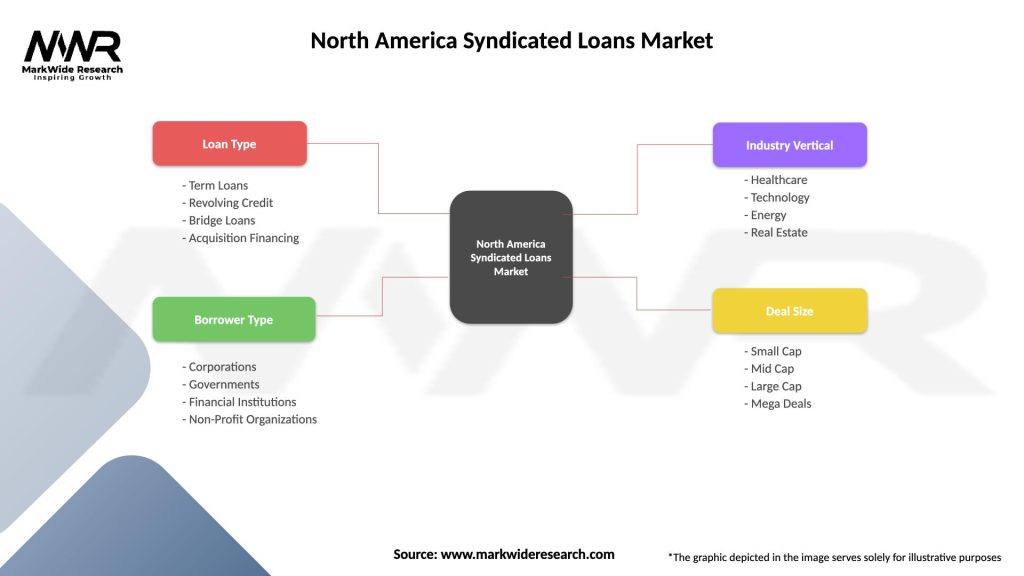

Segmentation

The North America syndicated loans market can be segmented based on various criteria, including loan size, borrower profile, industry sector, loan purpose, and geographic region. Segmentation enables lenders, borrowers, and investors to identify targeted opportunities, assess credit risk, and tailor financing solutions to specific market segments and client needs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the North America syndicated loans market, leading to disruptions in economic activity, capital markets volatility, and changes in borrower and lender behavior. Pandemic-related challenges, including lockdown measures, supply chain disruptions, and financial market uncertainty, affected syndicated loan origination, syndication, and secondary trading activities, prompting lenders to reassess credit risk, liquidity needs, and portfolio allocations in response to changing market conditions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America syndicated loans market is poised for continued growth and evolution, driven by factors such as economic recovery, technological innovation, regulatory reform, and investor demand for diversified fixed-income assets. Market participants are expected to adapt to changing market dynamics, embrace innovation, and collaborate to navigate challenges, seize opportunities, and contribute to the resilience and vitality of the syndicated loans market in North America.

Conclusion

The North America syndicated loans market plays a pivotal role in facilitating corporate financing, capital allocation, and risk management across diverse industries and sectors. With its depth, liquidity, and flexibility, the syndicated loans market serves as a critical source of funding for corporate borrowers and an attractive investment opportunity for lenders and investors seeking exposure to North American credit markets. By embracing innovation, sustainability, and regulatory compliance, market participants can harness the market’s potential, promote market integrity, and support economic growth and prosperity in North America.

What is Syndicated Loans?

Syndicated loans are loans provided by a group of lenders to a single borrower, typically used for large-scale financing needs. These loans are often utilized by corporations, governments, or large projects requiring substantial capital.

What are the key players in the North America Syndicated Loans Market?

Key players in the North America Syndicated Loans Market include JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, among others. These institutions play a significant role in structuring and distributing syndicated loans to various borrowers.

What are the growth factors driving the North America Syndicated Loans Market?

The North America Syndicated Loans Market is driven by factors such as increasing corporate mergers and acquisitions, rising demand for capital in infrastructure projects, and favorable interest rates. These elements encourage companies to seek syndicated loans for financing.

What challenges does the North America Syndicated Loans Market face?

Challenges in the North America Syndicated Loans Market include regulatory scrutiny, potential credit risks associated with borrowers, and market volatility. These factors can impact the willingness of lenders to participate in syndications.

What opportunities exist in the North America Syndicated Loans Market?

Opportunities in the North America Syndicated Loans Market include the growing trend of private equity investments and the increasing need for financing in renewable energy projects. These areas present potential for growth in syndicated lending.

What trends are shaping the North America Syndicated Loans Market?

Trends in the North America Syndicated Loans Market include the rise of technology-driven lending platforms and the increasing focus on sustainable financing. These trends are influencing how loans are structured and offered to borrowers.

North America Syndicated Loans Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Term Loans, Revolving Credit, Bridge Loans, Acquisition Financing |

| Borrower Type | Corporations, Governments, Financial Institutions, Non-Profit Organizations |

| Industry Vertical | Healthcare, Technology, Energy, Real Estate |

| Deal Size | Small Cap, Mid Cap, Large Cap, Mega Deals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Syndicated Loans Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at