Market Overview

The semiconductor metrology and inspection market in Europe is a critical component of the region’s semiconductor industry, which plays a pivotal role in various sectors, including electronics, automotive, healthcare, and telecommunications. Semiconductor metrology and inspection technologies are essential for ensuring the quality, reliability, and performance of semiconductor devices, enabling the production of advanced integrated circuits (ICs) with increasingly smaller feature sizes and higher complexity. As Europe continues to invest in semiconductor research, development, and manufacturing, the demand for advanced metrology and inspection solutions is expected to grow, driving innovation and competitiveness in the global semiconductor market.

Meaning

Semiconductor metrology and inspection refer to the process of measuring and analyzing the physical and chemical properties of semiconductor materials and devices, as well as detecting and identifying defects and irregularities in semiconductor manufacturing processes. These technologies encompass a wide range of tools and techniques, including optical inspection, scanning electron microscopy (SEM), atomic force microscopy (AFM), X-ray metrology, and spectroscopic ellipsometry, among others. Semiconductor metrology and inspection play a crucial role in semiconductor fabrication facilities (fabs) and research laboratories, enabling process control, yield optimization, defect analysis, and quality assurance throughout the semiconductor manufacturing lifecycle.

Executive Summary

The Europe semiconductor metrology and inspection market have witnessed steady growth in recent years, driven by factors such as increasing semiconductor manufacturing complexity, rising demand for advanced ICs, and technological advancements in metrology and inspection solutions. The market offers significant opportunities for industry players and stakeholders to capitalize on the region’s strong semiconductor ecosystem and leverage Europe’s leadership in areas such as automotive electronics, industrial automation, and smart manufacturing. However, the market also faces challenges such as intensifying competition, evolving customer requirements, and regulatory constraints, necessitating continuous innovation and strategic investments to maintain market leadership and meet customer needs effectively.

Key Market Insights

- Technological Advancements: The Europe semiconductor metrology and inspection market are characterized by ongoing technological advancements, including the development of next-generation metrology tools and inspection techniques with higher resolution, accuracy, and throughput. Innovations such as machine learning, artificial intelligence (AI), and advanced algorithms are being integrated into metrology and inspection systems to enhance performance and efficiency.

- Industry 4.0 Integration: The integration of metrology and inspection solutions into Industry 4.0 and smart manufacturing initiatives is gaining momentum in Europe, driving demand for connected, automated, and data-driven semiconductor manufacturing processes. Metrology data analytics, real-time monitoring, and predictive maintenance capabilities are becoming increasingly important for improving production efficiency and product quality in semiconductor fabs.

- Quality Assurance Requirements: The Europe semiconductor market is characterized by stringent quality assurance requirements, particularly in safety-critical applications such as automotive electronics and medical devices. Metrology and inspection solutions play a crucial role in ensuring compliance with industry standards, regulations, and customer specifications, thereby enhancing product reliability and safety.

- Research and Development: Europe is home to leading semiconductor research institutes, universities, and consortia engaged in the development of advanced metrology and inspection technologies. Collaborative research projects, public-private partnerships, and government funding initiatives support innovation and technology transfer in areas such as nanoelectronics, photonics, and materials science, driving the growth of the semiconductor metrology and inspection market in the region.

Market Drivers

- Increasing Semiconductor Complexity: The demand for advanced semiconductor devices with higher performance, energy efficiency, and functionality is driving the adoption of complex manufacturing processes and materials. Metrology and inspection technologies are essential for characterizing and validating these processes, enabling the production of cutting-edge ICs for applications such as artificial intelligence, 5G communication, and autonomous vehicles.

- Rising Demand for Quality Control: With the proliferation of electronic products and the growing importance of quality and reliability in semiconductor manufacturing, there is an increasing emphasis on quality control and defect detection throughout the production process. Metrology and inspection solutions enable fabs to identify, analyze, and address defects at the nanometer scale, ensuring the integrity and performance of semiconductor devices.

- Emerging Applications: Emerging applications such as Internet of Things (IoT), augmented reality (AR), virtual reality (VR), and edge computing are driving the demand for specialized semiconductor devices with unique performance and form factor requirements. Metrology and inspection technologies play a critical role in enabling the development and production of these devices, supporting innovation and differentiation in the market.

- Government Support and Investments: European governments and regulatory bodies are actively supporting the semiconductor industry through research grants, tax incentives, and public-private partnerships. Initiatives such as Horizon Europe, Digital Europe, and the European Green Deal aim to strengthen Europe’s semiconductor ecosystem, promote technological sovereignty, and accelerate the adoption of advanced metrology and inspection solutions for sustainable and resilient semiconductor manufacturing.

Market Restraints

- Cost and Complexity: The high cost and complexity of semiconductor metrology and inspection equipment pose challenges for small and medium-sized enterprises (SMEs) and startups looking to enter the market. The capital investment required for advanced metrology tools and the expertise needed to operate and maintain these systems can be prohibitive for some companies, limiting market entry and competition.

- Technological Challenges: Despite technological advancements, semiconductor metrology and inspection still face challenges such as limited resolution, measurement accuracy, and compatibility with emerging materials and processes. Overcoming these challenges requires ongoing research and development efforts, collaboration across the semiconductor value chain, and investments in next-generation metrology and inspection solutions.

- Global Supply Chain Disruptions: The Europe semiconductor industry is susceptible to global supply chain disruptions, including trade tensions, geopolitical uncertainties, and natural disasters. Supply chain disruptions can impact the availability of critical components, materials, and equipment for semiconductor manufacturing, leading to delays, cost escalations, and supply chain vulnerabilities in the metrology and inspection market.

- Regulatory Compliance: Compliance with regulatory requirements such as export controls, data privacy regulations, and environmental standards can pose challenges for semiconductor metrology and inspection companies operating in Europe. Navigating complex regulatory landscapes, ensuring data security and privacy, and managing compliance costs are key considerations for market participants seeking to expand their presence in the region.

Market Opportunities

- Vertical Integration and Diversification: Vertical integration and diversification strategies enable semiconductor metrology and inspection companies to expand their product portfolios, enter new market segments, and capture additional value along the semiconductor value chain. Opportunities exist for companies to develop integrated metrology solutions, software platforms, and service offerings that address the evolving needs of semiconductor manufacturers in Europe.

- Strategic Partnerships and Collaborations: Collaborating with semiconductor manufacturers, research institutions, and technology partners allows metrology and inspection companies to leverage complementary expertise, resources, and networks. Partnerships can accelerate technology development, enhance market penetration, and foster innovation in areas such as process control, yield management, and defect analysis.

- Focus on Emerging Technologies: Emerging technologies such as AI, machine learning, quantum computing, and advanced materials present opportunities for semiconductor metrology and inspection companies to develop innovative solutions that address unmet market needs and enable future semiconductor manufacturing trends. Investing in R&D, talent acquisition, and technology scouting can position companies for long-term growth and competitiveness in the European market.

- Market Expansion and Localization: Expanding geographic presence and establishing local manufacturing, sales, and support capabilities in Europe allow metrology and inspection companies to better serve regional customers, address market-specific requirements, and strengthen relationships with key stakeholders. Localized strategies can enhance customer engagement, brand awareness, and market responsiveness, driving competitive advantage and growth in the European semiconductor market.

Market Dynamics

The Europe semiconductor metrology and inspection market operate in a dynamic environment influenced by various factors, including technological advancements, industry trends, regulatory changes, and macroeconomic conditions. These dynamics shape market demand, competitive dynamics, and growth opportunities, requiring market participants to stay agile, adaptive, and customer-focused to succeed in the rapidly evolving semiconductor industry.

Regional Analysis

The Europe semiconductor metrology and inspection market exhibit regional variations due to differences in semiconductor manufacturing capabilities, industry infrastructure, research expertise, and market demand. Key semiconductor clusters in Europe include Germany, France, the Netherlands, Belgium, and the United Kingdom, where leading semiconductor companies, research institutions, and technology hubs are concentrated. Each region offers unique market opportunities and challenges, requiring tailored strategies and localized approaches to effectively address customer needs and market dynamics.

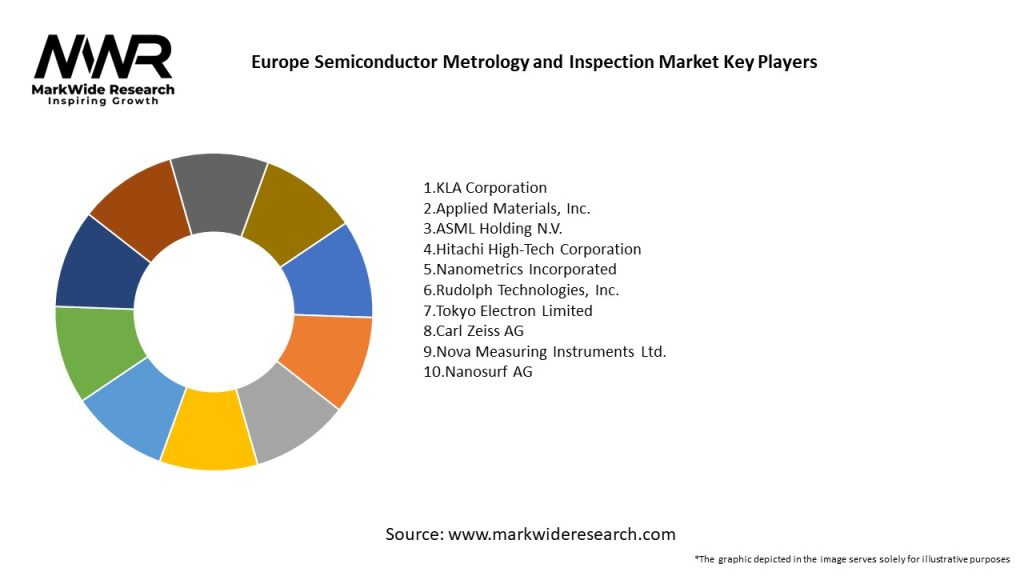

Competitive Landscape

The Europe semiconductor metrology and inspection market are highly competitive, with numerous global and regional players competing based on factors such as technology innovation, product performance, customer service, and market reach. Key players in the market include:

- ASML Holding N.V.

- KLA Corporation

- Applied Materials, Inc.

- Nova Measuring Instruments Ltd.

- Nanometrics Incorporated

- Rudolph Technologies, Inc.

- Carl Zeiss AG

- Hitachi High-Tech Corporation

- HORIBA, Ltd.

- Oxford Instruments plc

These companies offer a diverse range of metrology and inspection solutions for semiconductor manufacturing, including optical inspection systems, metrology tools, defect review systems, and process control software. Continuous innovation, strategic partnerships, and customer-centricity are essential for maintaining competitiveness and driving growth in the Europe semiconductor metrology and inspection market.

Segmentation

The Europe semiconductor metrology and inspection market can be segmented based on various factors, including:

- Product Type: Segmentation by product type includes optical inspection systems, scanning electron microscopes (SEMs), atomic force microscopes (AFMs), X-ray metrology tools, and spectroscopic ellipsometers.

- End-User Industry: Segmentation by end-user industry includes semiconductor manufacturing, research and development (R&D), and academic institutions.

- Application: Segmentation by application includes wafer inspection, defect review, film thickness measurement, critical dimension (CD) metrology, and overlay metrology.

- Geography: The market can be segmented into regions, countries, and cities based on their unique semiconductor manufacturing ecosystems, customer profiles, and market demand patterns.

Segmentation provides a more detailed understanding of the Europe semiconductor metrology and inspection market dynamics, allowing companies to tailor their strategies, product offerings, and marketing initiatives to specific customer needs and market segments.

Category-wise Insights

- Wafer Inspection: Wafer inspection is a critical application in semiconductor manufacturing, enabling the detection and characterization of defects, particles, and irregularities on semiconductor wafers. Advanced optical inspection systems, electron microscopes, and laser scanning techniques are used for wafer inspection, supporting yield enhancement, process optimization, and quality control in fabs.

- Defect Review: Defect review involves the detailed analysis and classification of defects detected during wafer inspection, helping semiconductor manufacturers identify root causes, troubleshoot process issues, and implement corrective actions. High-resolution SEMs, focused ion beam (FIB) systems, and automated defect review algorithms are employed for defect review, supporting rapid defect characterization and process improvement in fabs.

- Film Thickness Measurement: Film thickness measurement is essential for monitoring and controlling the thickness of thin films and layers deposited on semiconductor wafers during the fabrication process. Spectroscopic ellipsometers, X-ray reflectometers, and optical interferometers are commonly used for film thickness measurement, providing accurate and non-destructive characterization of thin films in fabs.

- Critical Dimension (CD) Metrology: CD metrology involves the measurement of critical dimensions such as linewidths, sidewall angles, and feature sizes on semiconductor devices, enabling process control and device performance optimization. CD-SEM systems, atomic force microscopes, and optical CD metrology tools are employed for CD metrology, supporting advanced process nodes and semiconductor technology nodes in fabs.

- Overlay Metrology: Overlay metrology is essential for aligning and patterning multiple layers of semiconductor devices with nanometer-scale accuracy, ensuring the precise registration and alignment of device features. Overlay metrology systems, including optical alignment tools, image-based overlay metrology (IBO), and scatterometry-based overlay (SCOL), are used for overlay control and optimization in advanced semiconductor manufacturing processes.

Key Benefits for Industry Participants and Stakeholders

- Process Optimization: Semiconductor metrology and inspection enable process optimization, yield improvement, and defect reduction in semiconductor manufacturing, supporting higher productivity, lower manufacturing costs, and improved product quality for fabs and foundries.

- Quality Assurance: Metrology and inspection technologies ensure the quality, reliability, and performance of semiconductor devices, meeting stringent customer requirements, industry standards, and regulatory compliance for safety-critical applications.

- Technology Innovation: Innovation in metrology and inspection drives technological advancements, product differentiation, and competitive advantage for semiconductor equipment manufacturers, enabling the development of next-generation semiconductor devices and technologies.

- Customer Satisfaction: Metrology and inspection solutions enhance customer satisfaction by providing accurate, reliable, and timely measurement data and defect analysis, supporting collaborative partnerships and long-term relationships between semiconductor manufacturers and equipment suppliers.

- Market Leadership: Investment in metrology and inspection capabilities strengthens market leadership, brand reputation, and market share for semiconductor equipment suppliers, positioning them as trusted partners and preferred suppliers in the global semiconductor industry.

SWOT Analysis

A SWOT analysis provides an overview of the Europe semiconductor metrology and inspection market’s strengths, weaknesses, opportunities, and threats:

Strengths:

- Strong semiconductor manufacturing ecosystem

- Technological leadership in metrology and inspection

- Robust research and development capabilities

- Regulatory support for semiconductor industry

Weaknesses:

- Dependence on global supply chain

- High cost and complexity of metrology equipment

- Technological challenges in defect detection and analysis

- Market concentration among key players

Opportunities:

- Emerging applications in IoT, 5G, and automotive electronics

- Strategic partnerships and collaborations

- Focus on sustainable and green manufacturing

- Market expansion and localization strategies

Threats:

- Global competition from Asian semiconductor markets

- Supply chain disruptions and geopolitical uncertainties

- Regulatory compliance and data privacy concerns

- Rapid technological obsolescence and market consolidation

Understanding these factors through a SWOT analysis helps semiconductor metrology and inspection companies identify their competitive advantages, address weaknesses, capitalize on opportunities, and mitigate potential threats in the Europe market.

Market Key Trends

- Advanced Process Nodes: The Europe semiconductor industry is transitioning to advanced process nodes such as 7nm, 5nm, and beyond, driving the demand for metrology and inspection solutions with higher resolution, accuracy, and sensitivity to support sub-nanometer feature sizes and complex device architectures.

- 3D Integration and Packaging: 3D integration and packaging technologies such as through-silicon vias (TSVs), fan-out wafer-level packaging (FOWLP), and heterogeneous integration are gaining traction in Europe, necessitating metrology and inspection solutions for vertical stacking, interconnect reliability, and package integrity.

- Materials Innovation: Materials innovation and diversification, including the adoption of novel materials such as gallium nitride (GaN), silicon carbide (SiC), and 2D materials, present opportunities and challenges for metrology and inspection companies to develop new measurement techniques and analysis methodologies.

- Smart Manufacturing: The adoption of smart manufacturing concepts such as digital twins, predictive maintenance, and autonomous process control is driving the integration of metrology and inspection solutions into Industry 4.0 initiatives, enabling real-time monitoring, data-driven decision-making, and adaptive manufacturing in Europe.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Europe semiconductor metrology and inspection market, affecting supply chains, manufacturing operations, and customer demand. Some key impacts of COVID-19 on the market include:

- Supply Chain Disruptions: The pandemic disrupted global semiconductor supply chains, leading to shortages of critical components, materials, and equipment for metrology and inspection. Supply chain disruptions impacted production schedules, delivery timelines, and market dynamics in Europe.

- Remote Workforce: Remote work arrangements and travel restrictions imposed during the pandemic affected metrology and inspection service operations, customer support, and field service activities in Europe. Companies adapted to remote work practices, virtual collaboration tools, and online training programs to support customers and maintain business continuity.

- Demand Shifts: Changes in consumer behavior, market demand, and product priorities during the pandemic impacted semiconductor manufacturing volumes and production requirements in Europe. Some applications such as consumer electronics experienced surging demand, while others such as automotive and industrial sectors faced declines, affecting metrology and inspection market dynamics.

- Accelerated Digitalization: The pandemic accelerated digitalization and automation trends in semiconductor manufacturing, driving the adoption of remote monitoring, predictive analytics, and autonomous systems for metrology and inspection processes in Europe. Companies invested in digital transformation initiatives to enhance operational resilience and agility in response to pandemic-related disruptions.

Key Industry Developments

- Next-Generation Metrology Tools: Semiconductor metrology and inspection companies are developing next-generation tools with enhanced capabilities such as higher resolution, faster throughput, and multi-modal imaging for advanced process control and yield optimization in Europe.

- In-line Process Monitoring: In-line metrology and inspection solutions integrated into semiconductor manufacturing equipment enable real-time process monitoring, defect detection, and feedback control, reducing cycle times and improving production efficiency in European fabs.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are being applied to metrology and inspection data analysis, pattern recognition, and anomaly detection, enabling predictive maintenance, adaptive control, and smart decision-making in semiconductor fabs across Europe.

- Materials Characterization: Materials characterization techniques such as Raman spectroscopy, X-ray diffraction (XRD), and energy-dispersive X-ray spectroscopy (EDS) are being employed for advanced materials analysis and characterization in Europe, supporting the development of novel semiconductor devices and technologies.

Analyst Suggestions

- Invest in Innovation: Semiconductor metrology and inspection companies should invest in innovation and technology development to address emerging market trends, customer requirements, and industry challenges in Europe. R&D investments in areas such as AI, machine learning, materials science, and process integration can drive product differentiation and market leadership.

- Enhance Customer Engagement: Building strong customer relationships, understanding customer needs, and providing value-added solutions and services are essential for success in the Europe semiconductor metrology and inspection market. Companies should focus on customer-centricity, responsiveness, and collaboration to drive customer satisfaction and loyalty.

- Expand Market Reach: Expanding market reach and geographic presence in Europe through strategic partnerships, acquisitions, and local subsidiaries enable semiconductor metrology and inspection companies to access new customers, penetrate emerging market segments, and strengthen their competitive position in the region.

- Diversify Product Portfolio: Diversifying product portfolio and service offerings to address a broad range of semiconductor manufacturing applications, process nodes, and materials enable companies to capture market opportunities and mitigate risks associated with technology cycles and industry fluctuations in Europe.

Future Outlook

The Europe semiconductor metrology and inspection market are poised for continued growth and innovation, driven by factors such as increasing semiconductor complexity, emerging applications, and digital transformation trends. However, market participants must navigate challenges such as global competition, supply chain disruptions, and technological advancements to capitalize on market opportunities and sustain long-term growth in Europe.

Conclusion

The Europe semiconductor metrology and inspection market play a critical role in ensuring the quality, reliability, and performance of semiconductor devices, supporting the region’s leadership in areas such as automotive electronics, industrial automation, and smart manufacturing. Despite challenges such as global competition, supply chain disruptions, and regulatory constraints, the market offers significant opportunities for innovation, collaboration, and market expansion in Europe. By investing in technology innovation, enhancing customer engagement, and diversifying market reach, semiconductor metrology and inspection companies can thrive in the dynamic and competitive European semiconductor industry landscape.

![]()