444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Asia-Pacific Impact Investing Market stands as a beacon in the realm of finance, reflecting a transformative approach that integrates financial goals with environmental, social, and governance (ESG) considerations. Impact investing in the Asia-Pacific region goes beyond traditional profit-seeking motives, focusing on generating positive social and environmental outcomes alongside financial returns. This comprehensive overview explores the key dimensions of the Asia-Pacific Impact Investing Market, shedding light on its growth trajectory, challenges, and the pivotal role it plays in steering the region toward sustainable development.

Meaning: Impact investing entails deploying capital with the explicit intention of creating measurable social or environmental impact alongside financial returns. In the Asia-Pacific context, impact investing represents a powerful instrument to address regional challenges while fostering economic growth and resilience. This approach diverges from conventional investment paradigms, placing an emphasis on purpose-driven and socially responsible financial strategies.

Executive Summary: The Asia-Pacific Impact Investing Market has witnessed remarkable growth, propelled by an increasing recognition of the interconnectedness between financial success and positive societal outcomes. Investors, businesses, and governments in the region are aligning their strategies with sustainable development goals, contributing to the market’s expansion. With growing awareness of ESG factors, regulatory support, and a surge in investor appetite for responsible investments, impact investing in the Asia-Pacific region emerges as a key driver of positive change.

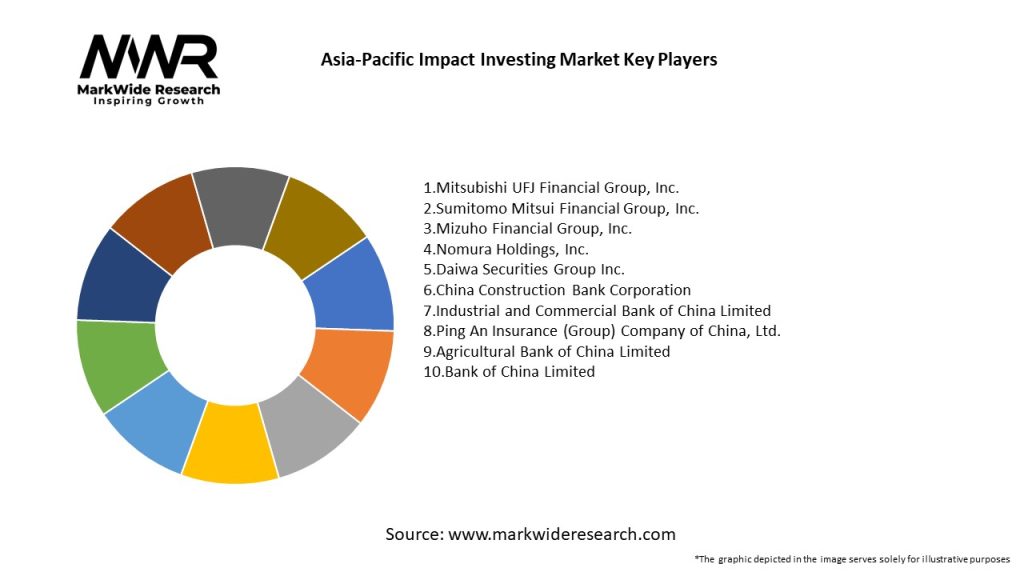

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Asia-Pacific Impact Investing Market operates in a dynamic environment influenced by shifting societal values, regulatory changes, and evolving investor preferences. Key dynamics include the integration of impact considerations into traditional financial strategies, the rise of impact-focused financial products, and collaborative efforts to drive positive change.

Regional Analysis: The impact investing landscape in the Asia-Pacific region exhibits regional variations influenced by socio-economic conditions, regulatory environments, and market maturity. Let’s explore the dynamics in key sub-regions:

Competitive Landscape:

Leading Companies in Asia-Pacific Impact Investing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

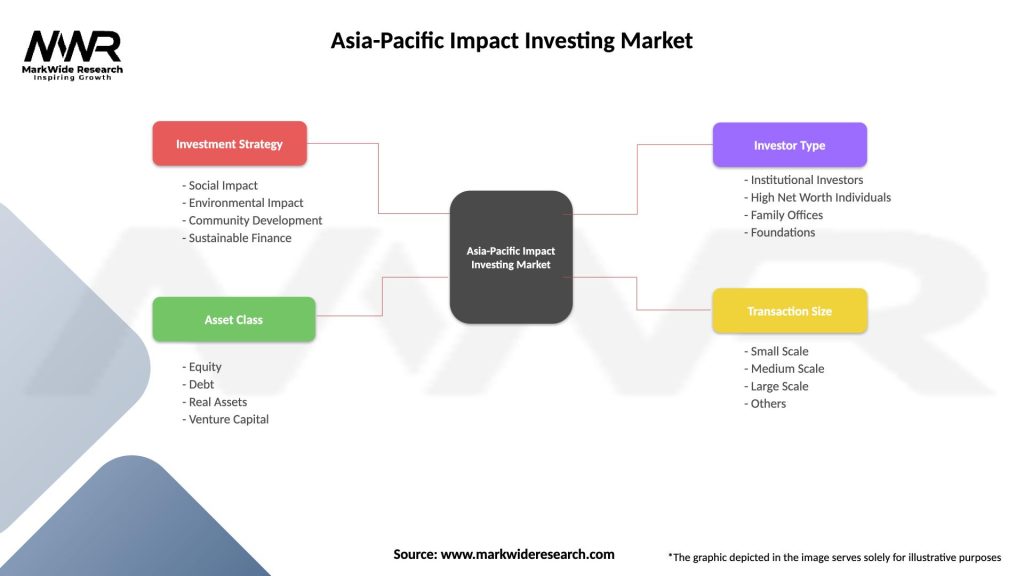

Segmentation: The Asia-Pacific Impact Investing Market can be segmented based on impact themes, sectors, and investment instruments. Common segmentation includes:

Segmentation facilitates a nuanced understanding of the market, allowing investors to tailor their impact portfolios to specific themes or sectors aligned with their values.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has brought both challenges and opportunities for the Asia-Pacific Impact Investing Market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the Asia-Pacific Impact Investing Market is optimistic, driven by increasing awareness, regulatory support, and a growing sense of responsibility among investors. The market is poised to play a pivotal role in shaping sustainable and resilient futures for the Asia-Pacific region, addressing pressing social and environmental challenges.

Conclusion: In conclusion, the Asia-Pacific Impact Investing Market represents a transformative force in the financial landscape, ushering in an era where financial success intertwines with positive societal and environmental outcomes. As the region embraces sustainable development goals, impact investing emerges as a catalyst for change, creating a pathway to address complex challenges while fostering economic growth. Overcoming challenges, fostering innovation, and building collaborative partnerships will be essential to harness the full potential of impact investing in shaping a sustainable and inclusive future for the diverse and dynamic Asia-Pacific region.

What is Impact Investing?

Impact investing refers to investments made with the intention to generate positive social and environmental impacts alongside a financial return. This approach often targets sectors such as renewable energy, sustainable agriculture, and affordable housing.

What are the key players in the Asia-Pacific Impact Investing Market?

Key players in the Asia-Pacific Impact Investing Market include organizations like LeapFrog Investments, Blue Horizon, and the Asia Venture Philanthropy Network, among others. These companies focus on various sectors, including healthcare, education, and clean technology.

What are the main drivers of the Asia-Pacific Impact Investing Market?

The main drivers of the Asia-Pacific Impact Investing Market include increasing awareness of social issues, a growing demand for sustainable investment options, and supportive government policies promoting responsible investing. Additionally, the rise of millennial investors seeking impact-driven opportunities is contributing to market growth.

What challenges does the Asia-Pacific Impact Investing Market face?

The Asia-Pacific Impact Investing Market faces challenges such as a lack of standardized metrics for measuring impact, limited access to capital for smaller enterprises, and regulatory hurdles that can impede investment flows. These factors can create uncertainty for investors and hinder market expansion.

What opportunities exist in the Asia-Pacific Impact Investing Market?

Opportunities in the Asia-Pacific Impact Investing Market include the potential for innovation in sectors like clean energy and sustainable agriculture, as well as the growing interest from institutional investors in impact-focused funds. Additionally, emerging technologies can enhance transparency and efficiency in impact measurement.

What trends are shaping the Asia-Pacific Impact Investing Market?

Trends shaping the Asia-Pacific Impact Investing Market include the integration of environmental, social, and governance (ESG) criteria into investment decisions, the rise of social enterprises, and increased collaboration between public and private sectors. These trends are fostering a more robust ecosystem for impact investing.

Asia-Pacific Impact Investing Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Social Impact, Environmental Impact, Community Development, Sustainable Finance |

| Asset Class | Equity, Debt, Real Assets, Venture Capital |

| Investor Type | Institutional Investors, High Net Worth Individuals, Family Offices, Foundations |

| Transaction Size | Small Scale, Medium Scale, Large Scale, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Asia-Pacific Impact Investing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at