444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The North America online trading platform market is a dynamic and rapidly evolving sector within the financial industry. Online trading platforms have become integral tools for investors and traders, providing a digital interface to buy and sell financial instruments such as stocks, bonds, and cryptocurrencies.

Meaning:

Online trading platforms are digital systems that enable individuals and institutional investors to execute trades in financial markets. These platforms provide a user-friendly interface, real-time market data, and various tools for analysis, allowing users to make informed investment decisions.

Executive Summary:

The North America online trading platform market has experienced substantial growth, driven by the increasing participation of retail investors, advancements in technology, and the democratization of financial markets. This executive summary offers a concise overview of key trends, market dynamics, and factors influencing the adoption of online trading platforms in North America.

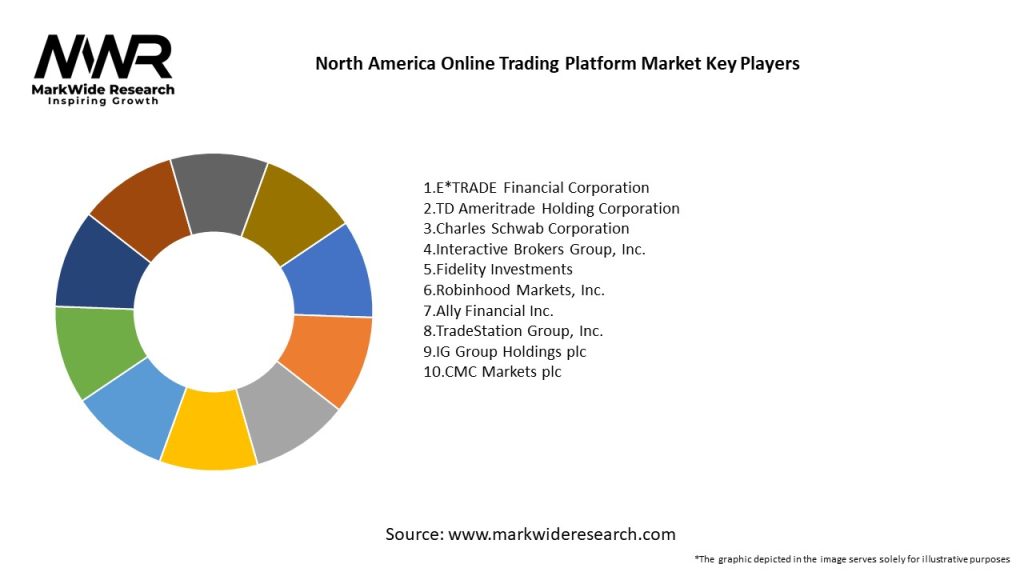

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The North America online trading platform market operates in a dynamic environment shaped by technological innovations, market trends, regulatory changes, and user preferences. Understanding these dynamics is essential for stakeholders to adapt to market shifts and capitalize on emerging opportunities.

Regional Analysis:

The demand and growth of online trading platforms can vary across North America due to factors such as regulatory environments, investor demographics, and market trends. A regional analysis provides insights into specific dynamics within key areas:

Competitive Landscape:

Leading Companies in the North America Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The online trading platform market in North America can be segmented based on various factors, including:

Segmentation allows for a detailed understanding of user preferences, market trends, and specific demands within the online trading platform landscape.

Category-wise Insights:

Key Benefits for Users:

SWOT Analysis:

A SWOT analysis provides an overview of the North America online trading platform market’s strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis helps stakeholders formulate strategies to capitalize on strengths, address weaknesses, explore opportunities, and mitigate potential threats in the North America online trading platform market.

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has influenced the North America online trading platform market in several ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The North America online trading platform market is poised for continued growth. The future outlook is influenced by factors such as technological advancements, regulatory developments, market trends, and the evolving needs of users. The market is expected to remain dynamic, with opportunities for innovation and expansion.

Conclusion:

The North America online trading platform market is a vital component of the financial industry, providing individuals and institutions with convenient access to financial markets. The market’s growth is fueled by factors such as technological innovation, increased retail participation, and the integration of diverse asset classes. While challenges exist, including security concerns and regulatory complexities, the industry’s future outlook is optimistic. Online trading platforms play a pivotal role in shaping the democratization of finance, offering users the tools and resources needed to navigate the complexities of financial markets. As the market continues to evolve, stakeholders should prioritize user education, security measures, and adaptability to regulatory changes to ensure sustained success and contribute to the broader financial ecosystem.

What is Online Trading Platform?

An Online Trading Platform is a software application that allows users to buy and sell financial securities via the internet. These platforms provide tools for trading, market analysis, and account management, catering to both individual and institutional investors.

What are the key players in the North America Online Trading Platform Market?

Key players in the North America Online Trading Platform Market include Charles Schwab, E*TRADE, TD Ameritrade, and Robinhood, among others. These companies offer various services such as stock trading, options trading, and investment management.

What are the growth factors driving the North America Online Trading Platform Market?

The growth of the North America Online Trading Platform Market is driven by increasing internet penetration, the rise of mobile trading applications, and a growing interest in personal finance among younger investors. Additionally, advancements in technology and the availability of real-time data are enhancing trading experiences.

What challenges does the North America Online Trading Platform Market face?

Challenges in the North America Online Trading Platform Market include regulatory compliance, cybersecurity threats, and market volatility. These factors can impact user trust and the overall stability of trading platforms.

What opportunities exist in the North America Online Trading Platform Market?

Opportunities in the North America Online Trading Platform Market include the expansion of cryptocurrency trading, the integration of artificial intelligence for personalized trading strategies, and the potential for partnerships with fintech companies to enhance service offerings.

What trends are shaping the North America Online Trading Platform Market?

Trends in the North America Online Trading Platform Market include the rise of commission-free trading, increased focus on user-friendly interfaces, and the growing popularity of social trading features. These trends are attracting a new generation of investors looking for accessible trading solutions.

North America Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Service Type | Brokerage, Investment Advisory, Wealth Management, Research |

| Client Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Day Traders |

| Technology | Web-Based, Mobile Applications, Algorithmic Trading, Social Trading |

| Asset Class | Stocks, Options, ETFs, Cryptocurrencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at