444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Asia-Pacific Venture Capital Investment Market stands as a dynamic and thriving sector within the broader financial landscape, playing a pivotal role in fueling innovation, fostering entrepreneurship, and driving economic growth across the Asia-Pacific region. Venture capital (VC) serves as a crucial source of funding for early-stage and high-potential startups, contributing to the vibrant startup ecosystem in Asia-Pacific.

Meaning:

Venture capital investment involves the provision of funding by investors, known as venture capitalists, to startup companies and small businesses that exhibit high growth potential. In return for their investment, venture capitalists often receive equity or ownership stakes in the companies they support. This form of financing is essential for startups in their early stages, where traditional financing may be challenging to secure.

Executive Summary:

The Asia-Pacific Venture Capital Investment Market has experienced significant growth and evolution in recent years, driven by a combination of factors, including technological advancements, increasing entrepreneurial activity, and a supportive regulatory environment. This market provides unique opportunities for investors to engage with innovative startups across various industries, contributing to the region’s economic development.

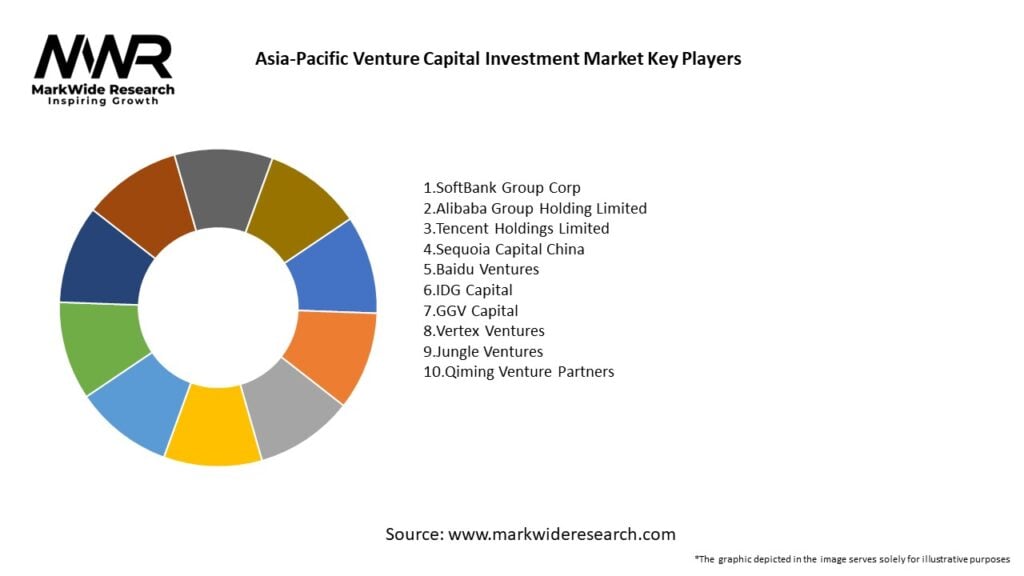

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Asia-Pacific Venture Capital Investment Market operates in a dynamic environment shaped by factors such as economic conditions, technological trends, geopolitical influences, and shifts in consumer behavior. Staying attuned to these dynamics is essential for venture capitalists to make informed investment decisions.

Regional Analysis:

The Asia-Pacific region comprises diverse markets, each with its unique characteristics and opportunities for venture capital investment:

Competitive Landscape:

Leading Companies in Asia-Pacific Venture Capital Investment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Asia-Pacific Venture Capital Investment Market can be segmented based on various factors, including:

Segmentation allows investors to tailor their strategies based on the risk profile, sectoral preferences, and geographic considerations, optimizing their portfolios for maximum impact.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

A SWOT analysis provides a snapshot of the Asia-Pacific Venture Capital Investment Market’s strengths, weaknesses, opportunities, and threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has influenced the Asia-Pacific Venture Capital Investment Market in several ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the Asia-Pacific Venture Capital Investment Market is optimistic, with several trends shaping its trajectory:

Conclusion:

The Asia-Pacific Venture Capital Investment Market stands at the forefront of fostering innovation, supporting entrepreneurship, and driving economic development across the region. With a diverse and dynamic landscape, venture capitalists play a pivotal role in identifying and nurturing high-potential startups. The ongoing trends of sustainability, technology-driven innovation, and cross-industry collaborations indicate a promising future for the venture capital ecosystem in the Asia-Pacific region. As investors navigate challenges and capitalize on opportunities, the collaborative efforts between venture capitalists and startups will continue to shape the region’s innovation landscape and contribute to its economic vibrancy.

What is Venture Capital Investment?

Venture Capital Investment refers to funding provided to startups and small businesses with perceived long-term growth potential. This type of investment is crucial for innovation and entrepreneurship, particularly in technology, healthcare, and consumer services sectors.

What are the key players in the Asia-Pacific Venture Capital Investment Market?

Key players in the Asia-Pacific Venture Capital Investment Market include Sequoia Capital, SoftBank Vision Fund, and GGV Capital, among others. These firms are known for their significant investments in technology and fintech startups across the region.

What are the main drivers of the Asia-Pacific Venture Capital Investment Market?

The main drivers of the Asia-Pacific Venture Capital Investment Market include the rapid growth of technology startups, increasing digital transformation across industries, and a rising number of entrepreneurial ventures. Additionally, supportive government policies and a growing pool of investors contribute to this growth.

What challenges does the Asia-Pacific Venture Capital Investment Market face?

The Asia-Pacific Venture Capital Investment Market faces challenges such as regulatory hurdles, market volatility, and competition for funding. Additionally, the varying maturity levels of startup ecosystems across different countries can create inconsistencies in investment opportunities.

What opportunities exist in the Asia-Pacific Venture Capital Investment Market?

Opportunities in the Asia-Pacific Venture Capital Investment Market include investments in emerging technologies like artificial intelligence, blockchain, and renewable energy. The increasing demand for innovative solutions in healthcare and e-commerce also presents significant investment potential.

What trends are shaping the Asia-Pacific Venture Capital Investment Market?

Trends shaping the Asia-Pacific Venture Capital Investment Market include a focus on sustainability and ESG criteria, the rise of remote work technologies, and increased interest in healthtech startups. Additionally, there is a growing emphasis on diversity and inclusion within the investment community.

Asia-Pacific Venture Capital Investment Market

| Segmentation Details | Description |

|---|---|

| Investment Stage | Seed, Early Stage, Growth Stage, Late Stage |

| Industry Vertical | Technology, Healthcare, Consumer Goods, Fintech |

| Investor Type | Institutional Investors, Angel Investors, Corporate VCs, Family Offices |

| Fund Structure | Closed-End Funds, Open-End Funds, Fund of Funds, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Asia-Pacific Venture Capital Investment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at