444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Europe Automated Algo Trading market is a dynamic and rapidly evolving segment within the broader financial industry. Automated algorithmic trading, often referred to as algo trading, involves the use of computer algorithms to execute trading strategies with speed and precision. This market has witnessed significant growth as advancements in technology, data analytics, and artificial intelligence have transformed the landscape of financial trading across Europe.

Meaning:

Automated algorithmic trading, or algo trading, refers to the use of computer algorithms and mathematical models to execute trading orders in financial markets. These algorithms are designed to analyze market data, identify trading opportunities, and automatically place orders based on predefined criteria. Algo trading aims to achieve efficient and optimized execution of trades, taking advantage of price discrepancies and market inefficiencies.

Executive Summary:

The Europe Automated Algo Trading market has experienced a paradigm shift in recent years, with an increasing number of financial institutions and traders adopting automated trading strategies. This shift is driven by the need for faster execution, reduced transaction costs, and the ability to capitalize on market opportunities in real-time. The market’s executive summary highlights the transformative impact of automation on traditional trading practices and the resulting benefits for market participants.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Europe Automated Algo Trading market operates within a dynamic environment shaped by factors such as market trends, technological advancements, regulatory changes, and global economic conditions. These dynamics influence the behavior of market participants, creating both challenges and opportunities that require strategic adaptation.

Regional Analysis:

The Europe Automated Algo Trading market exhibits regional variations influenced by factors such as regulatory frameworks, market infrastructure, and the level of technological adoption. Key European financial centers, including London, Frankfurt, and Paris, play significant roles in shaping the market’s regional dynamics.

Competitive Landscape:

Leading Companies in Europe Automated Algo Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

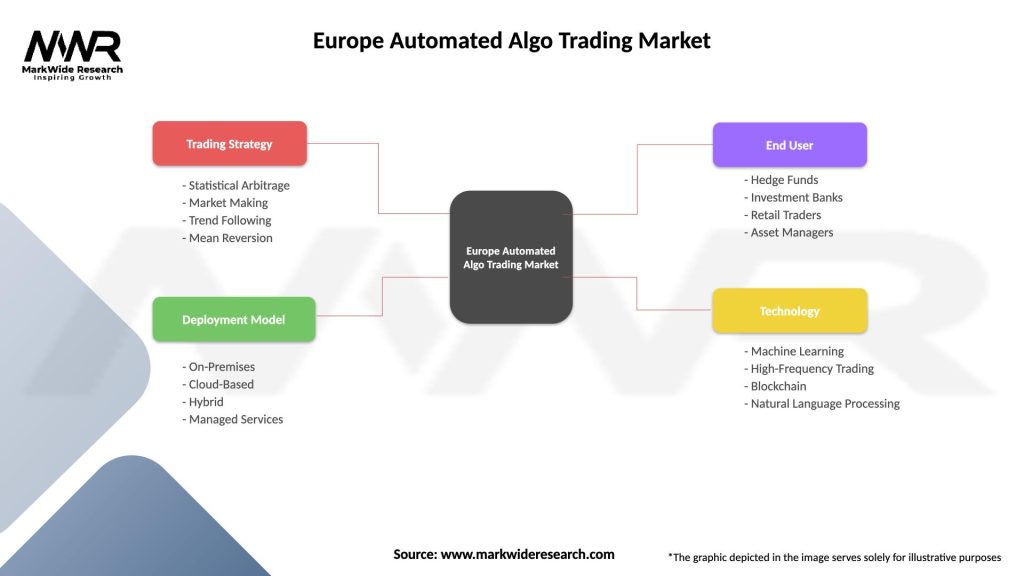

Segmentation:

The Europe Automated Algorithmic Trading market can be segmented based on various factors, including:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

The Europe Automated Algorithmic Trading market offers several benefits for industry participants and stakeholders:

SWOT Analysis:

A SWOT analysis provides an overview of the Europe Automated Algorithmic Trading market’s strengths, weaknesses, opportunities, and threats:

Understanding these factors through a SWOT analysis helps market participants navigate challenges, capitalize on strengths, and position themselves to take advantage of emerging opportunities.

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a multifaceted impact on the Europe Automated Algorithmic Trading market:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the Europe Automated Algo Trading market is marked by several key trends and developments:

Conclusion:

The Europe Automated Algo Trading market stands at the forefront of technological innovation, reshaping traditional approaches to financial trading. The adoption of automated algorithms has transformed the speed, efficiency, and complexity of trading strategies, offering market participants new opportunities and challenges. As the market continues to evolve, adapting to regulatory changes, addressing technological risks, and embracing advancements in artificial intelligence will be crucial for sustained success. The Europe Automated Algorithmic Trading market’s future is characterized by a dynamic interplay of technological advancements, regulatory developments, and the industry’s ability to navigate the evolving landscape.

What is Automated Algo Trading?

Automated Algo Trading refers to the use of computer algorithms to execute trading strategies in financial markets. This technology allows for high-frequency trading, real-time data analysis, and the ability to manage large volumes of trades efficiently.

What are the key players in the Europe Automated Algo Trading Market?

Key players in the Europe Automated Algo Trading Market include firms like Deutsche Bank, UBS, and Citadel Securities, which leverage advanced algorithms for trading. These companies are known for their innovative trading solutions and market-making capabilities, among others.

What are the growth factors driving the Europe Automated Algo Trading Market?

The growth of the Europe Automated Algo Trading Market is driven by factors such as the increasing demand for efficient trading solutions, advancements in technology, and the rise of big data analytics. Additionally, the need for reduced trading costs and improved execution speeds contributes to market expansion.

What challenges does the Europe Automated Algo Trading Market face?

Challenges in the Europe Automated Algo Trading Market include regulatory scrutiny, the complexity of algorithm development, and the risk of market manipulation. These factors can hinder the adoption and effectiveness of automated trading strategies.

What opportunities exist in the Europe Automated Algo Trading Market?

Opportunities in the Europe Automated Algo Trading Market include the integration of artificial intelligence and machine learning to enhance trading strategies. Additionally, the growing interest in cryptocurrency trading presents new avenues for algorithmic trading applications.

What trends are shaping the Europe Automated Algo Trading Market?

Trends in the Europe Automated Algo Trading Market include the increasing use of cloud-based trading platforms and the adoption of multi-asset trading strategies. Furthermore, the focus on regulatory compliance and risk management is becoming more pronounced among market participants.

Europe Automated Algo Trading Market

| Segmentation Details | Description |

|---|---|

| Trading Strategy | Statistical Arbitrage, Market Making, Trend Following, Mean Reversion |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Hedge Funds, Investment Banks, Retail Traders, Asset Managers |

| Technology | Machine Learning, High-Frequency Trading, Blockchain, Natural Language Processing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Automated Algo Trading Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at