444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Europe Electric Vehicle (EV) insurance market is a rapidly evolving sector that mirrors the continent’s commitment to sustainable and environmentally friendly transportation. With the increasing adoption of electric vehicles across European countries, insurers are adapting their offerings to cater specifically to the insurance needs of EV owners. This market presents unique challenges and opportunities, influenced by factors such as regulatory frameworks, technological advancements, and the overall growth of the electric vehicle industry in Europe.

Meaning:

The Europe EV insurance market refers to insurance policies specifically designed to address the unique needs and risks associated with electric vehicles. These policies go beyond traditional auto insurance, incorporating considerations such as coverage for battery damage, charging infrastructure, and emerging technologies in electric vehicles.

Executive Summary:

The Europe EV insurance market is experiencing a paradigm shift as electric vehicles gain prominence. Insurers are innovating to provide comprehensive coverage that addresses the distinct features and risks associated with EV ownership. This market’s growth is driven by factors such as the increasing number of electric vehicles on European roads, advancements in EV technology, and a growing emphasis on sustainable transportation.

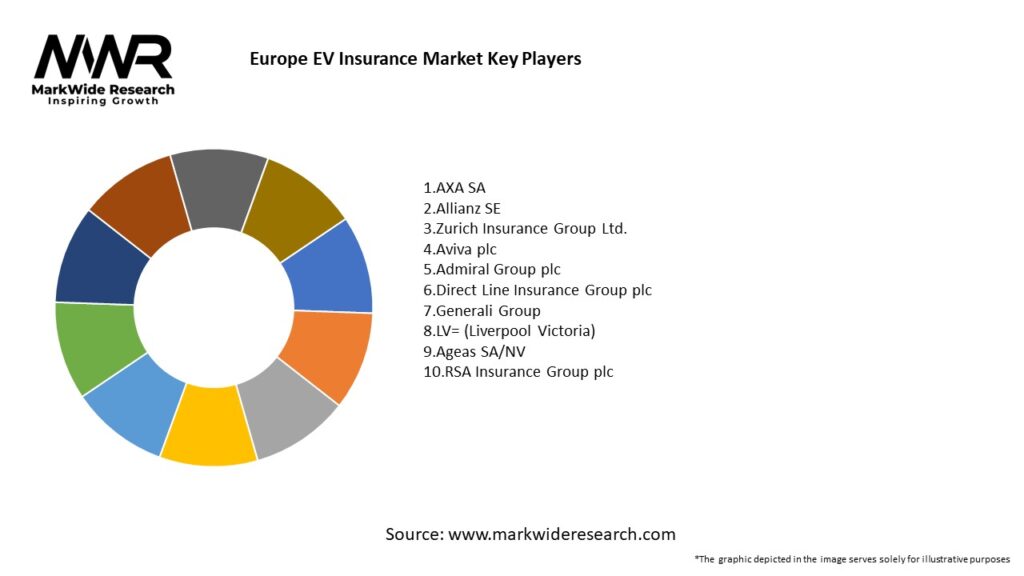

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Europe EV insurance market operates in a dynamic environment influenced by factors such as technological advancements, regulatory changes, consumer preferences, and the overall growth of the electric vehicle industry. Insurers must remain agile to adapt to these dynamics and provide innovative solutions that align with the evolving landscape.

Regional Analysis:

Competitive Landscape:

Leading Companies in Europe EV Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

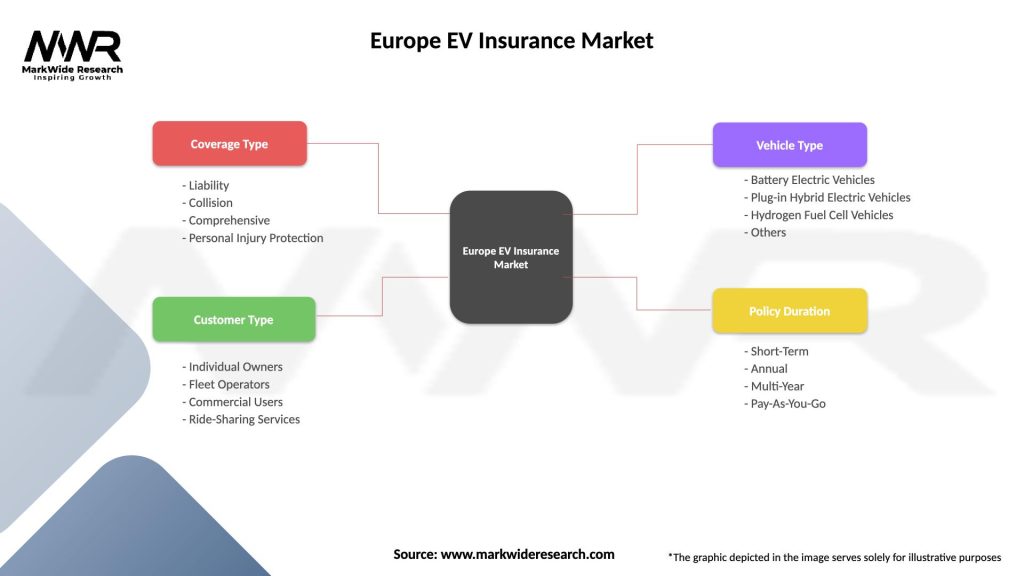

Segmentation:

The Europe EV insurance market can be segmented based on:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The COVID-19 pandemic has influenced the Europe EV insurance market by accelerating the shift towards online and digital services. Insurers have adapted to provide seamless digital experiences for policyholders, including online claims processing, virtual assistance, and remote consultations.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The Europe EV insurance market is poised for significant growth as electric vehicles become increasingly prevalent. Insurers that proactively address the evolving risks, collaborate with key stakeholders, and provide innovative, technology-driven solutions will be well-positioned to capitalize on the expanding opportunities in this dynamic market.

Conclusion:

The Europe EV insurance market reflects the transformative shift in the automotive industry towards sustainable and eco-friendly transportation. As insurers navigate the complexities of this evolving market, a strategic focus on technological integration, customer engagement, and flexibility in policy offerings will be crucial for long-term success.

What is EV Insurance?

EV Insurance refers to insurance policies specifically designed for electric vehicles, covering aspects such as liability, collision, and comprehensive coverage tailored to the unique needs of EV owners.

What are the key players in the Europe EV Insurance Market?

Key players in the Europe EV Insurance Market include companies like Allianz, AXA, and Zurich Insurance, which offer specialized coverage options for electric vehicles, among others.

What are the main drivers of the Europe EV Insurance Market?

The main drivers of the Europe EV Insurance Market include the increasing adoption of electric vehicles, government incentives for EV purchases, and the growing awareness of environmental sustainability among consumers.

What challenges does the Europe EV Insurance Market face?

Challenges in the Europe EV Insurance Market include the higher initial costs of EVs leading to increased insurance premiums, limited charging infrastructure, and the evolving technology of electric vehicles that may complicate risk assessment.

What opportunities exist in the Europe EV Insurance Market?

Opportunities in the Europe EV Insurance Market include the potential for innovative insurance products tailored to new EV technologies, partnerships with EV manufacturers, and the expansion of coverage options as consumer demand grows.

What trends are shaping the Europe EV Insurance Market?

Trends shaping the Europe EV Insurance Market include the integration of telematics for personalized insurance premiums, the rise of usage-based insurance models, and an increasing focus on sustainability and green initiatives in insurance offerings.

Europe EV Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Liability, Collision, Comprehensive, Personal Injury Protection |

| Customer Type | Individual Owners, Fleet Operators, Commercial Users, Ride-Sharing Services |

| Vehicle Type | Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hydrogen Fuel Cell Vehicles, Others |

| Policy Duration | Short-Term, Annual, Multi-Year, Pay-As-You-Go |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe EV Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at