444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The North America Insurance BPO market plays a pivotal role in the insurance sector, providing efficient and outsourced solutions for various business processes. It involves the outsourcing of tasks such as policy administration, claims processing, and customer support to specialized service providers. With the ever-evolving landscape of the insurance industry, the demand for streamlined and cost-effective business process outsourcing (BPO) services in North America continues to grow.

Meaning: Insurance BPO in North America involves the delegation of specific insurance-related tasks to external service providers. These tasks encompass a wide range of functions, including policy management, underwriting, data entry, and customer service. Outsourcing these processes allows insurance companies to focus on core competencies while benefiting from enhanced efficiency and reduced operational costs.

Executive Summary: The North America Insurance BPO market has witnessed substantial growth driven by the need for operational efficiency, cost optimization, and the rapid digital transformation within the insurance sector. This executive summary encapsulates the market’s key aspects, outlining opportunities, challenges, and the overarching trends that shape the landscape.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The North America Insurance BPO market operates in a dynamic environment shaped by evolving consumer expectations, technological advancements, and regulatory shifts. Adapting to these dynamics is crucial for both insurance companies and BPO service providers to stay competitive and meet industry demands.

Regional Analysis:

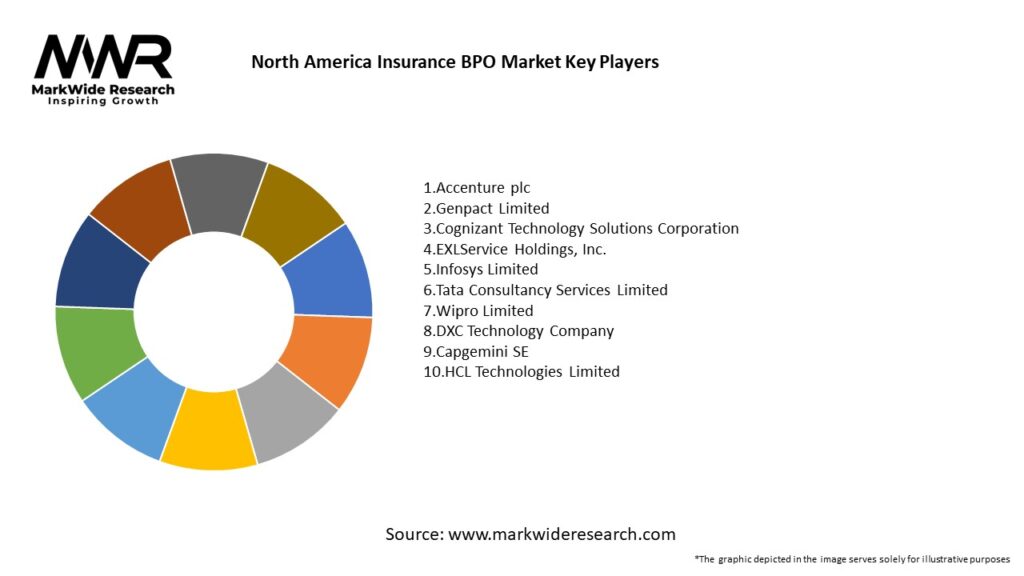

Competitive Landscape: The North America Insurance BPO market is characterized by the presence of established players and emerging entrants. Key players include:

Competition revolves around service quality, technological capabilities, and the ability to offer innovative solutions tailored to the evolving needs of the North American insurance sector.

Segmentation: The North America Insurance BPO market can be segmented based on various factors such as:

Segmentation allows for a more nuanced understanding of the market dynamics and aids in tailoring BPO solutions to specific requirements.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The North America Insurance BPO market is poised for sustained growth, driven by the increasing complexities of the insurance landscape and the continuous need for operational optimization. The future will see further integration of advanced technologies and a shift towards more personalized and customer-centric BPO solutions.

Conclusion: In conclusion, the North America Insurance BPO market stands as a key enabler for insurance companies seeking to enhance operational efficiency, reduce costs, and navigate the challenges of the dynamic insurance sector. By embracing technological advancements, addressing data security concerns, and fostering a customer-centric approach, industry participants can position themselves for success in the evolving North American Insurance BPO landscape.

| Segmentation | Details |

|---|---|

| Service Type | Policy Administration, Claims Management, Billing and Payments, Others |

| End-user | Life & Annuities, Property & Casualty, Health Insurance, Others |

| Region | United States, Canada |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Insurance BPO Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at