444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The North America Guaranteed Auto Protection (GAP) insurance market is a crucial component of the automotive insurance sector, providing financial protection to vehicle owners in the event of a total loss. GAP insurance bridges the gap between the actual cash value of a vehicle and the outstanding balance on an auto loan or lease, offering financial security and peace of mind to car owners in North America.

Meaning: Guaranteed Auto Protection (GAP) insurance is a specialized form of insurance designed to cover the difference between the depreciated value of a vehicle (actual cash value) and the remaining amount owed on the auto loan or lease. In the event of a total loss due to factors like accidents or theft, GAP insurance ensures that car owners are not left financially responsible for the disparity between the insurance settlement and their outstanding loan or lease amount.

Executive Summary: The North America GAP insurance market has witnessed significant growth in recent years, driven by factors such as the increasing number of financed or leased vehicles, rising awareness about financial protection, and the desire for comprehensive coverage. The market presents opportunities for insurance providers to offer tailored solutions and for consumers to safeguard their financial interests in the automotive sector.

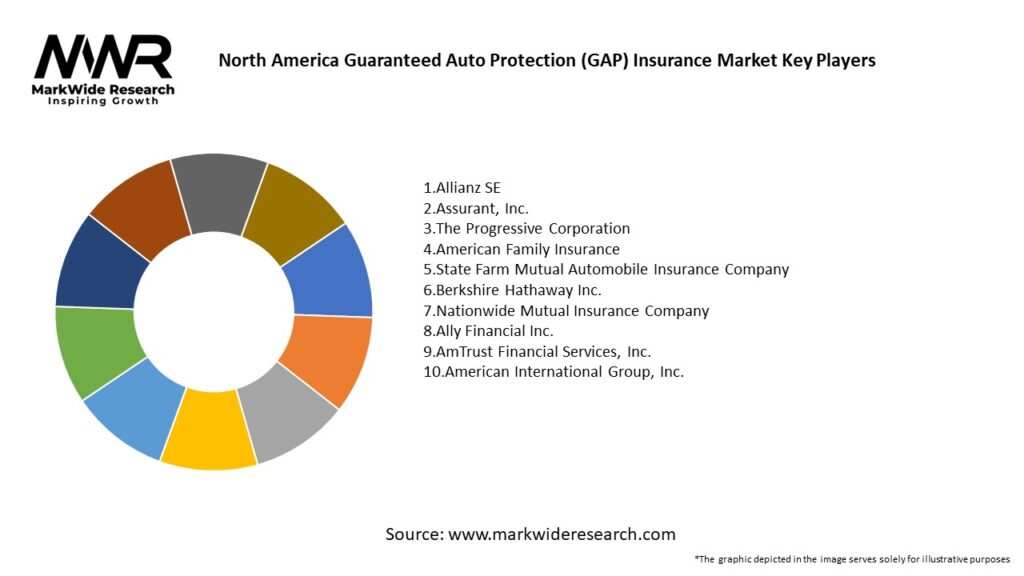

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights: Several key insights define the North America GAP insurance market:

Market Drivers: Several factors act as drivers for the North America GAP insurance market:

Market Restraints: Despite its growth, the North America GAP insurance market faces certain restraints:

Market Opportunities: The North America GAP insurance market presents various opportunities for industry participants:

Market Dynamics: The North America GAP insurance market operates in a dynamic environment influenced by factors such as economic conditions, regulatory changes, and shifts in consumer behavior. Understanding these dynamics is crucial for insurance providers to adapt and evolve, ensuring sustained growth and market relevance.

Regional Analysis: The North America GAP insurance market exhibits regional variations based on factors such as state or provincial regulations, economic conditions, and cultural preferences. Key regions include:

Competitive Landscape:

Leading Companies in the North America Guaranteed Auto Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The North America GAP insurance market can be segmented based on factors such as:

Category-wise Insights: Insights into specific categories within the North America GAP insurance market include:

Key Benefits for Industry Participants and Stakeholders: The North America GAP insurance market offers several benefits for industry participants and stakeholders:

SWOT Analysis: A SWOT analysis provides an overview of the North America GAP insurance market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis helps insurers align their strategies with market dynamics and customer expectations.

Market Key Trends: Key trends shaping the North America GAP insurance market include:

Covid-19 Impact: The COVID-19 pandemic has influenced the North America GAP insurance market in several ways:

Key Industry Developments: The North America GAP insurance market has experienced key developments:

Analyst Suggestions: To navigate the evolving North America GAP insurance market, insurance providers should consider the following suggestions:

Future Outlook: The future outlook for the North America GAP insurance market is optimistic, with continued growth expected. As the automotive industry evolves, the market will witness innovations in product design, distribution channels, and customer engagement. The increasing integration of digital technologies and collaborations with stakeholders across the automotive ecosystem will shape the market’s trajectory.

Conclusion: In conclusion, the North America Guaranteed Auto Protection (GAP) insurance market plays a vital role in providing financial security to vehicle owners. With the automotive landscape experiencing shifts in ownership patterns, financing trends, and consumer expectations, GAP insurance remains a relevant and valuable component of comprehensive auto insurance coverage. Insurers that embrace innovation, prioritize customer education, and adapt to regulatory dynamics will position themselves for sustained success in this dynamic market. As the automotive and insurance industries continue to intersect, the North America GAP insurance market will play a pivotal role in ensuring financial resilience for car owners in the face of unforeseen events.

North America Guaranteed Auto Protection (GAP) Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Standard Coverage, Comprehensive Coverage, Limited Coverage, Exclusionary Coverage |

| End User | Individual Consumers, Dealerships, Fleet Operators, Financial Institutions |

| Distribution Channel | Online Platforms, Insurance Brokers, Direct Sales, Agents |

| Policy Duration | Short-Term, Long-Term, Multi-Year, Annual |

Leading Companies in the North America Guaranteed Auto Protection (GAP) Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at