444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The LAMEA Claims Processing Software Market is a crucial segment within the broader landscape of insurance technology, revolutionizing the way insurance claims are handled and processed in the Latin America, Middle East, and Africa (LAMEA) region. As insurers seek more efficient, accurate, and customer-centric solutions, claims processing software emerges as a pivotal component, streamlining workflows and enhancing overall operational effectiveness.

Meaning: Claims processing software refers to advanced technological solutions designed to automate and optimize the entire insurance claims management process. This includes the submission, verification, assessment, and settlement of claims. In the LAMEA context, where diverse regulatory environments and insurance landscapes exist, claims processing software becomes instrumental in ensuring compliance, reducing fraud, and improving customer satisfaction.

Executive Summary: The LAMEA Claims Processing Software Market is experiencing a paradigm shift, driven by the escalating need for digital transformation in the insurance sector. This executive summary encapsulates the transformative role of claims processing software, highlighting its impact on accelerating claims settlement, minimizing errors, and fostering a more responsive and customer-centric insurance ecosystem.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The LAMEA Claims Processing Software Market operates in a dynamic environment influenced by factors such as economic conditions, regulatory changes, technological advancements, and shifts in consumer behavior. Understanding these dynamics is essential for insurance providers to stay competitive and responsive to evolving market trends.

Regional Analysis: The claims processing landscape in the LAMEA region is characterized by its diversity, with unique market conditions prevailing in Latin America, the Middle East, and Africa. While Latin American countries experience a surge in insurance adoption, the Middle East presents opportunities for innovation, and Africa showcases potential for growth through increased insurance awareness.

Competitive Landscape:

Leading Companies in LAMEA Claims Processing Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

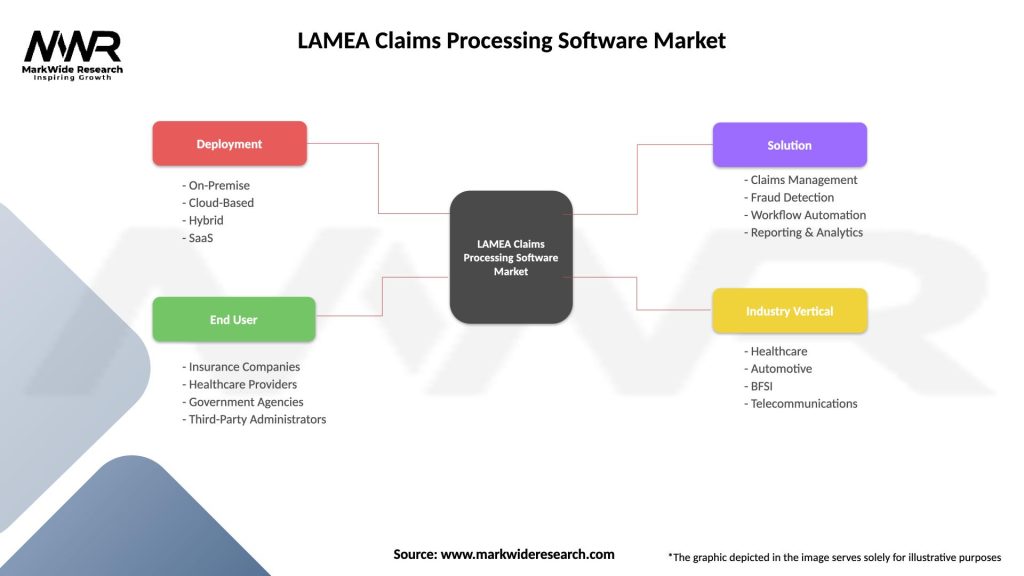

Segmentation: The Claims Processing Software Market in LAMEA can be segmented based on various factors, including:

Segmentation enables insurance providers to choose solutions that align with their specific business needs and operational requirements.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders: The adoption of claims processing software in the LAMEA region offers several benefits for insurance providers and stakeholders, including:

SWOT Analysis: A SWOT analysis provides an overview of the LAMEA Claims Processing Software Market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has accelerated the adoption of digital solutions in the insurance sector, including claims processing software. The need for contactless processes, remote collaboration, and faster claims settlements has become more pronounced. The pandemic has underscored the importance of technology in ensuring business continuity and resilience in the face of unforeseen challenges.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The future outlook for the LAMEA Claims Processing Software Market is promising, with sustained growth anticipated. As insurers increasingly recognize the value of claims processing software in enhancing operational efficiency, reducing costs, and improving customer satisfaction, the market is expected to witness continuous innovation and adoption. Insurers that leverage advanced technologies, foster collaboration, and stay agile in responding to market dynamics will be well-positioned for success.

Conclusion: In conclusion, the LAMEA Claims Processing Software Market is at the forefront of transforming the insurance industry in the region. With a focus on digital transformation, customer-centric solutions, and innovative technologies, claims processing software is reshaping the way insurance claims are managed. The industry’s ability to address challenges, embrace opportunities, and stay resilient in the face of evolving market trends will determine its continued success in providing efficient and effective claims processing solutions across Latin America, the Middle East, and Africa.

What is Claims Processing Software?

Claims Processing Software refers to applications designed to manage and automate the claims handling process in various industries, including insurance, healthcare, and finance. These tools streamline workflows, improve accuracy, and enhance customer service.

What are the key players in the LAMEA Claims Processing Software Market?

Key players in the LAMEA Claims Processing Software Market include companies like Guidewire Software, Inc., Duck Creek Technologies, and SAP SE, which provide innovative solutions for claims management and processing, among others.

What are the growth factors driving the LAMEA Claims Processing Software Market?

The growth of the LAMEA Claims Processing Software Market is driven by increasing demand for automation in claims management, the rise of digital transformation in the insurance sector, and the need for enhanced customer experience.

What challenges does the LAMEA Claims Processing Software Market face?

Challenges in the LAMEA Claims Processing Software Market include data security concerns, the complexity of integrating new software with existing systems, and the need for continuous updates to comply with regulatory changes.

What opportunities exist in the LAMEA Claims Processing Software Market?

Opportunities in the LAMEA Claims Processing Software Market include the growing adoption of artificial intelligence and machine learning for predictive analytics, the expansion of mobile claims processing solutions, and the increasing focus on customer-centric services.

What trends are shaping the LAMEA Claims Processing Software Market?

Trends in the LAMEA Claims Processing Software Market include the shift towards cloud-based solutions, the integration of advanced analytics for better decision-making, and the emphasis on user-friendly interfaces to enhance user experience.

LAMEA Claims Processing Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Insurance Companies, Healthcare Providers, Government Agencies, Third-Party Administrators |

| Solution | Claims Management, Fraud Detection, Workflow Automation, Reporting & Analytics |

| Industry Vertical | Healthcare, Automotive, BFSI, Telecommunications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at