444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Europe Autonomous Mobile Robot (AMR) Market encompasses the provision of advanced robotic systems equipped with artificial intelligence (AI) and autonomous navigation capabilities for various applications across industries such as manufacturing, logistics, healthcare, and retail. These robots are designed to operate independently, perform tasks autonomously, and navigate dynamic environments using sensors, cameras, and advanced algorithms.

Meaning: The Europe Autonomous Mobile Robot (AMR) Market refers to the supply of robotic systems capable of autonomous navigation, path planning, and task execution in diverse industrial and commercial settings. These robots leverage AI, machine learning, and sensor technologies to perceive their surroundings, adapt to changing conditions, and perform tasks such as material handling, goods transportation, inventory management, and surveillance without human intervention.

Executive Summary: The Europe Autonomous Mobile Robot (AMR) Market is witnessing rapid growth driven by factors such as increasing labor costs, rising demand for automation and efficiency in industrial operations, advancements in robotics and AI technologies, and the expansion of e-commerce and logistics sectors. This executive summary provides an overview of key market trends, growth drivers, challenges, and strategic recommendations for industry stakeholders to capitalize on emerging opportunities.

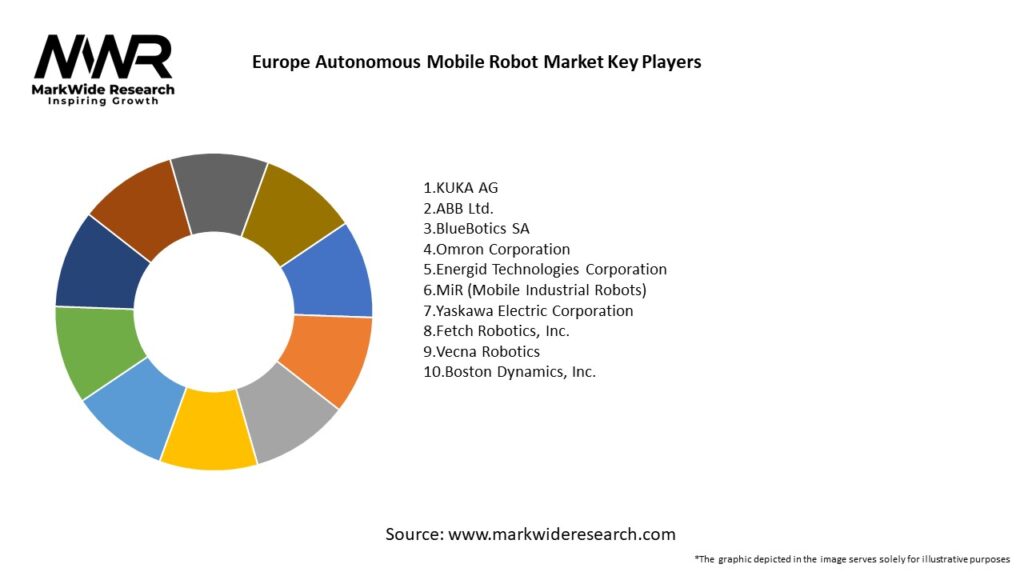

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Europe Autonomous Mobile Robot (AMR) Market operates within a dynamic ecosystem influenced by technological advancements, market trends, regulatory frameworks, competitive pressures, and end-user requirements. Understanding these dynamics is essential for stakeholders to navigate challenges, capitalize on opportunities, and drive innovation and growth in the market.

Regional Analysis: The Europe Autonomous Mobile Robot (AMR) Market exhibits regional variations driven by factors such as industrial automation adoption, labor market dynamics, regulatory frameworks, and technological innovation. Key regions such as Germany, France, the United Kingdom, Italy, and the Nordic countries are hubs of robotics research, manufacturing, and adoption in Europe.

Competitive Landscape:

Leading Companies in Europe Autonomous Mobile Robot Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The Europe Autonomous Mobile Robot (AMR) Market can be segmented based on various parameters, including robot type (AGVs, mobile manipulators, drones, etc.), application (manufacturing, logistics, healthcare, retail, hospitality, etc.), payload capacity, navigation technology (laser-based, vision-based, lidar-based, etc.), and geographic region (Western Europe, Eastern Europe, etc.). Segmentation enables vendors to target specific market segments and tailor their offerings to meet customer needs effectively.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Europe Autonomous Mobile Robot (AMR) Market is poised for robust growth driven by factors such as Industry 4.0 adoption, e-commerce logistics expansion, healthcare robotics adoption, and AI-driven navigation advancements. Key trends such as collaborative robotics, AI integration, customization, and service-oriented robotics models will shape market dynamics and offer opportunities for innovation, collaboration, and market expansion in the coming years.

Conclusion: In conclusion, the Europe Autonomous Mobile Robot (AMR) Market presents significant growth opportunities driven by technological advancements, industrial automation adoption, and the expansion of key application sectors such as logistics, manufacturing, healthcare, and retail. Despite challenges such as technical complexities, integration hurdles, and regulatory uncertainties, the market is poised for sustained expansion fueled by emerging trends, market demand, and industry collaborations. By embracing innovation, fostering collaboration, and addressing key challenges, stakeholders can capitalize on emerging opportunities, drive positive outcomes, and contribute to the advancement of robotics and automation in Europe.

What is Autonomous Mobile Robot?

Autonomous Mobile Robots (AMRs) are robotic systems capable of navigating and performing tasks in various environments without human intervention. They are commonly used in logistics, manufacturing, and healthcare for tasks such as material handling and delivery.

What are the key players in the Europe Autonomous Mobile Robot Market?

Key players in the Europe Autonomous Mobile Robot Market include companies like KUKA AG, ABB Ltd., and Fetch Robotics, which are known for their innovative solutions in automation and robotics, among others.

What are the growth factors driving the Europe Autonomous Mobile Robot Market?

The growth of the Europe Autonomous Mobile Robot Market is driven by increasing demand for automation in industries such as warehousing and manufacturing, advancements in AI and machine learning technologies, and the need for efficient supply chain management.

What challenges does the Europe Autonomous Mobile Robot Market face?

Challenges in the Europe Autonomous Mobile Robot Market include high initial investment costs, integration complexities with existing systems, and concerns regarding safety and regulatory compliance in operational environments.

What opportunities exist in the Europe Autonomous Mobile Robot Market?

The Europe Autonomous Mobile Robot Market presents opportunities in sectors like e-commerce and healthcare, where the demand for efficient delivery systems and automated patient care solutions is growing. Additionally, advancements in battery technology and AI are expected to enhance robot capabilities.

What trends are shaping the Europe Autonomous Mobile Robot Market?

Trends in the Europe Autonomous Mobile Robot Market include the increasing adoption of collaborative robots, advancements in navigation technologies such as LiDAR, and the integration of IoT for real-time data analytics and monitoring.

Europe Autonomous Mobile Robot Market

| Segmentation Details | Description |

|---|---|

| Product Type | Logistics Robots, Inspection Robots, Delivery Robots, Cleaning Robots |

| End User | Manufacturing, Healthcare, Retail, Warehousing |

| Technology | LiDAR, Computer Vision, SLAM, AI |

| Application | Material Handling, Surveillance, Inventory Management, Waste Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at