444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The Europe Heavy Construction Equipment Rental Market represents a segment of the construction industry focused on leasing heavy machinery and equipment for various infrastructure projects, including road construction, building construction, mining, and excavation. This market provides cost-effective solutions for contractors and construction companies to access high-quality equipment without the need for significant upfront investment.

Meaning: The Europe Heavy Construction Equipment Rental Market involves the rental or leasing of heavy machinery and equipment used in construction projects. It allows construction companies, contractors, and infrastructure developers to access a wide range of equipment, including excavators, bulldozers, cranes, loaders, and dump trucks, on a temporary basis, thereby minimizing capital expenditure and improving operational flexibility.

Executive Summary: The Europe Heavy Construction Equipment Rental Market is witnessing steady growth driven by factors such as increasing construction activities, infrastructure development projects, and the preference for rental solutions over equipment ownership. This executive summary provides an overview of key market trends, growth drivers, challenges, and strategic recommendations for stakeholders in the construction equipment rental industry.

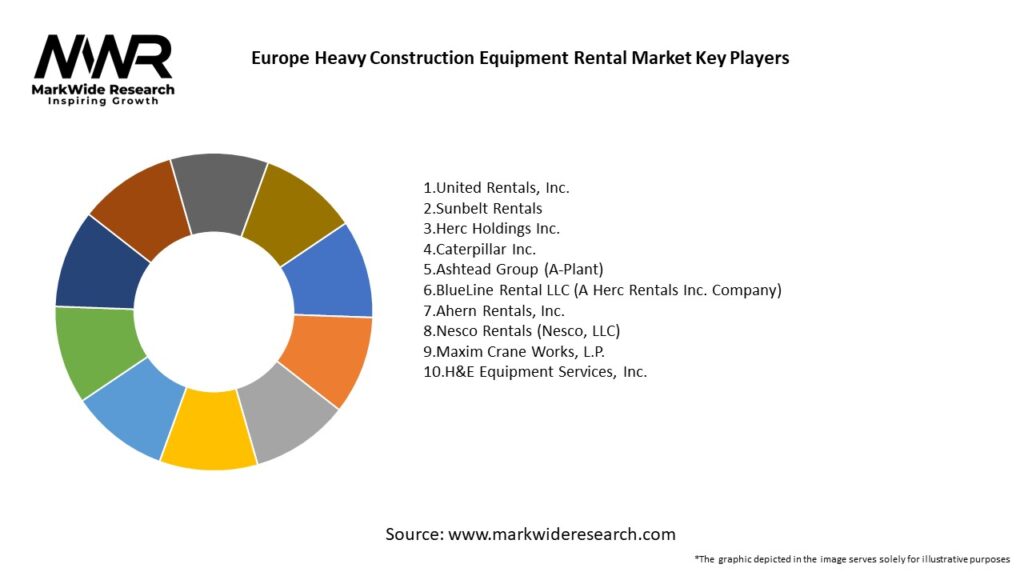

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Europe Heavy Construction Equipment Rental Market operates within a dynamic ecosystem shaped by factors such as economic conditions, regulatory frameworks, technological advancements, industry trends, and competitive pressures. Understanding these dynamics is crucial for rental companies to adapt their strategies, optimize operations, and capitalize on growth opportunities in the market.

Regional Analysis: The Europe Heavy Construction Equipment Rental Market exhibits regional variations in demand, pricing, rental rates, and market maturity across countries and sub-regions. Key markets such as Germany, France, the United Kingdom, and Italy drive market growth, supported by infrastructure investments, urban development projects, and construction activity.

Competitive Landscape:

Leading Companies in Europe Heavy Construction Equipment Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

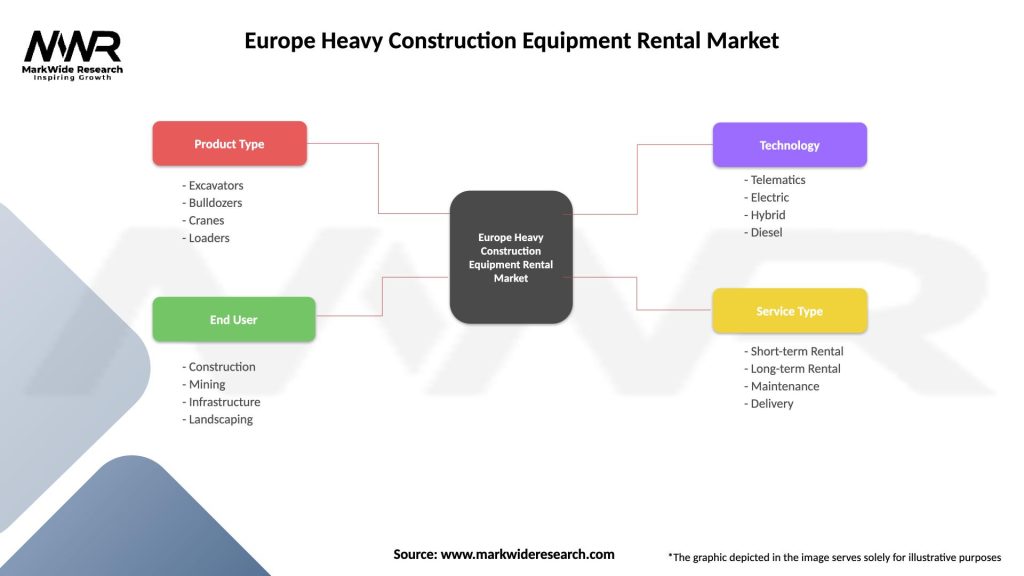

Segmentation: The Europe Heavy Construction Equipment Rental Market can be segmented based on equipment type (earthmoving equipment, material handling equipment, concrete equipment, etc.), rental duration (short-term, medium-term, long-term), end-user industry (construction, mining, agriculture, etc.), and geographic region (Western Europe, Eastern Europe). Segmentation enables rental companies to tailor their offerings to specific customer needs and market segments.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Europe Heavy Construction Equipment Rental Market is poised for continued growth driven by factors such as infrastructure investments, urbanization trends, technological advancements, and sustainability initiatives. While challenges such as regulatory compliance, economic volatility, and competitive pressures persist, opportunities abound for rental companies to innovate, diversify, and adapt to changing market dynamics, positioning themselves for sustained success and growth in the dynamic landscape of construction equipment rental in Europe.

Conclusion: In conclusion, the Europe Heavy Construction Equipment Rental Market offers significant opportunities for rental companies to meet the diverse equipment needs of construction projects, infrastructure developments, and industrial applications across the region. Despite challenges such as regulatory compliance, economic uncertainties, and competition from OEMs, strategic investments in technology, sustainability, customer engagement, and operational excellence enable rental companies to thrive, innovate, and differentiate themselves in the competitive marketplace. By embracing collaboration, innovation, and customer-centric strategies, stakeholders can navigate market dynamics, capitalize on emerging trends, and drive sustainable growth and success in the Europe Heavy Construction Equipment Rental Market.

What is Heavy Construction Equipment Rental?

Heavy Construction Equipment Rental refers to the practice of leasing heavy machinery and equipment used in construction projects, such as excavators, bulldozers, and cranes, rather than purchasing them outright. This approach allows companies to manage costs and access the latest technology without significant capital investment.

What are the key players in the Europe Heavy Construction Equipment Rental Market?

Key players in the Europe Heavy Construction Equipment Rental Market include companies like Ashtead Group, United Rentals, and Loxam, which provide a wide range of heavy equipment for various construction applications. These companies compete on factors such as equipment availability, pricing, and customer service, among others.

What are the main drivers of the Europe Heavy Construction Equipment Rental Market?

The main drivers of the Europe Heavy Construction Equipment Rental Market include the increasing demand for infrastructure development, the rise in construction activities, and the need for cost-effective solutions in project management. Additionally, the trend towards sustainable construction practices is also influencing rental decisions.

What challenges does the Europe Heavy Construction Equipment Rental Market face?

The Europe Heavy Construction Equipment Rental Market faces challenges such as fluctuating demand due to economic conditions, high maintenance costs of equipment, and competition from used equipment sales. Additionally, regulatory compliance and safety standards can also pose challenges for rental companies.

What opportunities exist in the Europe Heavy Construction Equipment Rental Market?

Opportunities in the Europe Heavy Construction Equipment Rental Market include the growing trend of urbanization, advancements in technology leading to more efficient equipment, and the increasing adoption of rental services by small and medium-sized enterprises. These factors are expected to drive market growth in the coming years.

What trends are shaping the Europe Heavy Construction Equipment Rental Market?

Trends shaping the Europe Heavy Construction Equipment Rental Market include the integration of digital technologies for fleet management, the rise of eco-friendly equipment options, and the increasing focus on safety and training for operators. These trends are influencing how rental companies operate and serve their clients.

Europe Heavy Construction Equipment Rental Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Loaders |

| End User | Construction, Mining, Infrastructure, Landscaping |

| Technology | Telematics, Electric, Hybrid, Diesel |

| Service Type | Short-term Rental, Long-term Rental, Maintenance, Delivery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at