444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC (Gulf Cooperation Council) Non-Alcoholic Beer Market refers to the market for non-alcoholic beer in the countries that comprise the GCC region, including Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Non-alcoholic beer, also known as alcohol-free or low-alcohol beer, is a beverage that is brewed like traditional beer but contains little to no alcohol content. It is gaining popularity in the GCC region due to various factors such as changing consumer preferences, increasing health consciousness, and religious and cultural norms.

Meaning

Non-alcoholic beer is a type of beverage that is brewed using similar processes as regular beer, but with significantly reduced alcohol content. While traditional beers typically have an alcohol content ranging from 4% to 6% or higher, non-alcoholic beers contain less than 0.5% alcohol by volume (ABV). This low alcohol content makes them suitable for individuals who prefer to avoid or limit alcohol consumption for various reasons, such as health, religion, or personal preference.

Executive Summary

The GCC Non-Alcoholic Beer Market has been witnessing substantial growth in recent years. The increasing demand for healthier alternatives to alcoholic beverages, coupled with the growing popularity of non-alcoholic lifestyles, has been driving the market. Consumers are becoming more health-conscious and are seeking beverages that offer the taste and experience of beer without the intoxicating effects. This has led to a surge in the production and consumption of non-alcoholic beer in the GCC region.

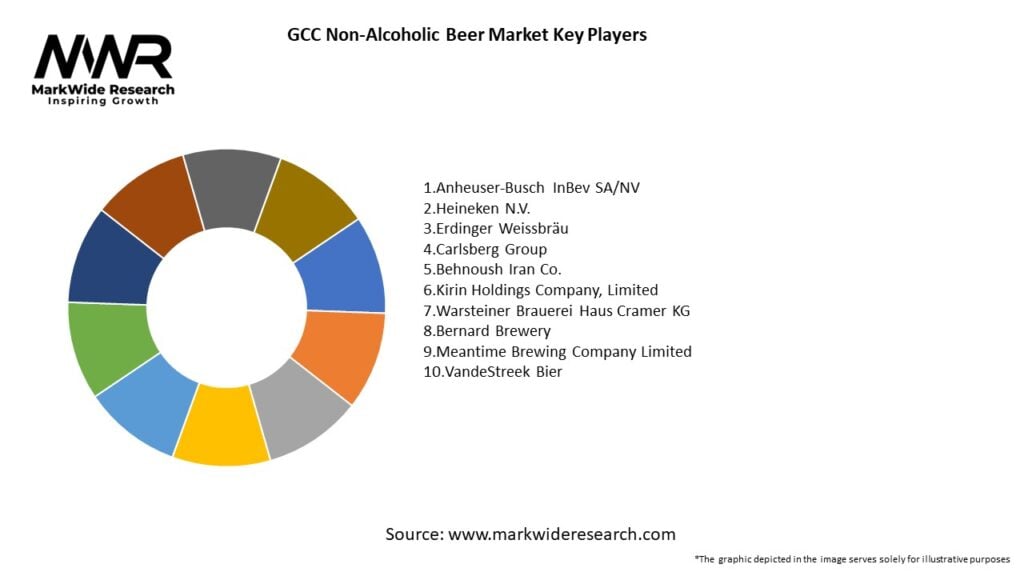

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC Non-Alcoholic Beer Market is a dynamic and evolving sector, influenced by various factors such as consumer preferences, cultural norms, health consciousness, and regulatory frameworks. The market dynamics include changing consumer behavior, technological advancements, competitive landscape, and the impact of external factors such as the COVID-19 pandemic.

The demand for non-alcoholic beer is driven by the increasing number of health-conscious consumers and the rising popularity of non-alcoholic lifestyles. Consumer behavior plays a crucial role in shaping the market, as preferences for healthier beverages and alcohol alternatives continue to grow. Manufacturers are responding to these trends by introducing innovative products and investing in marketing strategies to cater to the evolving consumer demands.

The competitive landscape of the GCC Non-Alcoholic Beer Market is characterized by the presence of both regional and international players. Key market participants are focusing on product development, expanding their distribution networks, and implementing effective marketing campaigns to gain a competitive edge. The market is also witnessing collaborations and partnerships between breweries and non-alcoholic beverage producers, further intensifying the competition.

The COVID-19 pandemic has had a significant impact on the global beverage industry, including the non-alcoholic beer market. The restrictions on social gatherings and closure of on-premise establishments during the pandemic resulted in a decline in overall beer consumption. However, the non-alcoholic beer segment showed resilience, with consumers turning to healthier alternatives for at-home consumption. This trend has accelerated the growth of the non-alcoholic beer market in the GCC region.

Regional Analysis

The GCC Non-Alcoholic Beer Market can be analyzed based on the countries that make up the Gulf Cooperation Council, namely Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Each country in the region has its unique market dynamics and consumer preferences.

Saudi Arabia and the United Arab Emirates are the largest markets for non-alcoholic beer in the GCC region. These countries have a significant population, and the demand for non-alcoholic beverages is driven by factors such as health consciousness, religious norms, and an increasing preference for alcohol-free alternatives. Bahrain, Kuwait, Oman, and Qatar also contribute to the market growth, albeit on a smaller scale. The market potential in these countries is expanding as consumers become more aware of non-alcoholic beer and its benefits.

The GCC region presents opportunities for both regional and international players to tap into a growing market. With increasing disposable incomes, changing consumer preferences, and a shift towards healthier lifestyles, the demand for non-alcoholic beer is expected to continue growing across the entire region.

Competitive Landscape

Leading Companies in the GCC Non-Alcoholic Beer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

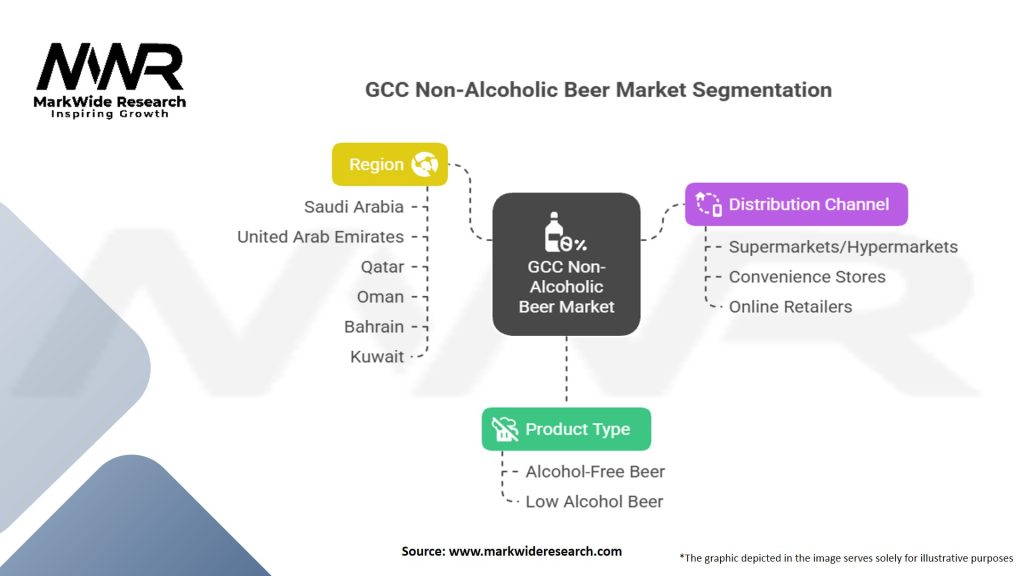

Segmentation

The GCC Non-Alcoholic Beer Market can be segmented based on various factors, including product type, distribution channel, and packaging.

The segmentation allows companies to target specific consumer segments and tailor their products and marketing strategies accordingly. Different product types offer diverse flavor profiles, catering to the varying taste preferences of consumers. Distribution channel segmentation helps companies identify the most effective channels to reach their target audience. The packaging segment provides insights into the preferred packaging formats and their impact on consumer perception.

Category-wise Insights

Each category presents opportunities for breweries to cater to different consumer preferences and expand their product portfolios. By offering a diverse range of non-alcoholic beer categories, companies can capture a wider consumer base and drive market growth.

Key Benefits for Industry Participants and Stakeholders

The GCC Non-Alcoholic Beer Market presents several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides insights into the internal and external factors that can impact the GCC Non-Alcoholic Beer Market.

Strengths:

Weaknesses:

Opportunities:

Threats:

By understanding these internal and external factors, industry participants can develop strategies to capitalize on strengths, address weaknesses, exploit opportunities, and mitigate threats.

Market Key Trends

These key trends shape the market landscape and offer insights into the evolving preferences and behaviors of consumers.

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the beverage industry, including the non-alcoholic beer market in the GCC region. The pandemic resulted in various challenges and opportunities for industry participants.

During the initial phases of the pandemic, the closure of on-premise establishments, such as bars and restaurants, led to a decline in overall beer consumption. However, the non-alcoholic beer segment showed resilience, as consumers turned to at-home consumption and sought healthier alternatives. This trend was fueled by the growing health consciousness and the desire to maintain a sense of normalcy during uncertain times.

The pandemic also accelerated the shift towards online retail channels. With restrictions on physical retail outlets, consumers increasingly relied on e-commerce platforms to purchase non-alcoholic beer. This digital transformation opened new opportunities for breweries to expand their online presence and reach a wider consumer base.

While the pandemic presented challenges in terms of disrupted supply chains, changing consumer behaviors, and economic uncertainties, it also highlighted the importance of adaptability and innovation. Industry participants that could quickly adapt to the changing market dynamics and consumer demands were better positioned to navigate the challenges and sustain growth.

Key Industry Developments

These industry developments reflect the commitment of market players to meet the evolving consumer demands and contribute to the sustainable growth of the non-alcoholic beer market in the GCC region.

Analyst Suggestions

Based on market analysis and trends, analysts provide the following suggestions for industry participants:

These suggestions aim to guide industry participants in optimizing their strategies to effectively navigate the market dynamics and capitalize on growth opportunities.

Future Outlook

The future outlook for the GCC Non-Alcoholic Beer Market is promising. The market is expected to witness significant growth in the coming years, driven by the increasing demand for healthier beverage alternatives, changing consumer preferences, and the growing popularity of non-alcoholic lifestyles.

Factors such as rising health consciousness, religious and cultural norms, and the availability of diverse product offerings will contribute to the market’s expansion. The introduction of new flavors and variants, technological advancements in brewing processes, and strategic marketing initiatives will further stimulate market growth.

Additionally, the expansion of distribution channels, including online retail platforms, will increase the accessibility and availability of non-alcoholic beer to a wider consumer base. Collaborations and partnerships between breweries and non-alcoholic beverage producers will enhance product innovation, quality, and market reach.

While challenges such as taste perception and limited availability remain, industry participants that effectively address these concerns and adapt to changing consumer demands will be well-positioned to capitalize on the growth opportunities in the GCC Non-Alcoholic Beer Market.

Conclusion

The GCC Non-Alcoholic Beer Market is experiencing significant growth driven by changing consumer preferences, increasing health consciousness, and cultural norms. Non-alcoholic beer provides a healthier alternative to traditional beer, aligns with religious and cultural norms, and offers consumers the opportunity to enjoy the taste and experience of beer without the alcohol content.

What is GCC non-alcoholic beer?

GCC non-alcoholic beer refers to beer products produced in the Gulf Cooperation Council region that contain little to no alcohol. These beverages are designed to provide the taste and experience of traditional beer while catering to consumers who prefer or require non-alcoholic options.

Who are the key players in the GCC non-alcoholic beer market?

Key players in the GCC non-alcoholic beer market include companies like Heineken, BrewDog, and Carlsberg, which have developed non-alcoholic variants to meet the growing demand. Additionally, local breweries are emerging to capture market share, among others.

What are the main drivers of growth in the GCC non-alcoholic beer market?

The growth of the GCC non-alcoholic beer market is driven by increasing health consciousness among consumers, a rise in the number of social occasions where alcohol consumption is restricted, and the expanding variety of flavors and styles available in non-alcoholic options.

What challenges does the GCC non-alcoholic beer market face?

Challenges in the GCC non-alcoholic beer market include cultural perceptions of non-alcoholic beverages, limited distribution channels, and competition from other non-alcoholic drinks such as soft drinks and juices.

What opportunities exist for the GCC non-alcoholic beer market in the future?

Opportunities for the GCC non-alcoholic beer market include the potential for product innovation, such as new flavors and brewing techniques, and the growing acceptance of non-alcoholic beverages in social settings, which can lead to increased consumer interest.

What trends are shaping the GCC non-alcoholic beer market?

Trends in the GCC non-alcoholic beer market include the rise of craft non-alcoholic beers, increased marketing efforts targeting younger consumers, and a focus on sustainability in production processes, which are all contributing to the market’s evolution.

GCC Non-Alcoholic Beer Market

| Segmentation | Details |

|---|---|

| Product Type | Alcohol-Free Beer, Low Alcohol Beer |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retailers |

| Region | Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, Kuwait |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Non-Alcoholic Beer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at