444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The GCC (Gulf Cooperation Council) region has witnessed significant growth in the baby food and infant formula market in recent years. Baby food and infant formula products are specially designed to meet the nutritional requirements of infants and young children. These products provide essential nutrients such as proteins, vitamins, and minerals, which are crucial for the healthy growth and development of babies.

Meaning

Baby food refers to the soft, easily consumable food specifically made for infants and toddlers who are transitioning from breastfeeding or bottle-feeding to solid foods. Infant formula, on the other hand, is a substitute for breast milk and is used when breastfeeding is not possible or insufficient. It is a powdered or liquid product that contains essential nutrients to support a baby’s growth and development.

Executive Summary

The GCC baby food and infant formula market has experienced steady growth in recent years. The market is primarily driven by factors such as the increasing population, rising disposable income, and changing lifestyles of consumers in the region. Furthermore, the growing awareness about the importance of early nutrition and the increasing number of working mothers have also contributed to the market’s growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The GCC baby food and infant formula market exhibit dynamic trends driven by various factors. The market dynamics are influenced by changing consumer preferences, economic factors, regulatory policies, and technological advancements. It is essential for market players to stay updated with these dynamics to make informed business decisions and effectively navigate the market landscape.

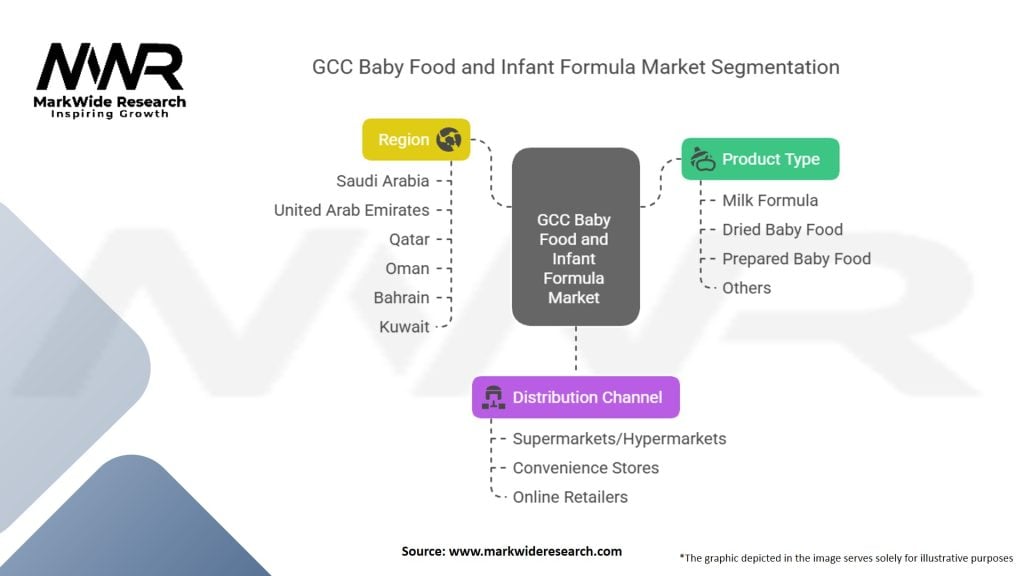

Regional Analysis

The GCC baby food and infant formula market can be analyzed by considering the individual countries within the region, including Saudi Arabia, United Arab Emirates, Bahrain, Oman, Qatar, and Kuwait. Each country has its unique market characteristics, influenced by factors such as population size, income levels, cultural practices, and regulatory frameworks. Understanding the regional dynamics is crucial for manufacturers to tailor their strategies and offerings to specific market requirements.

Competitive Landscape

Leading Companies in the GCC Baby Food and Infant Formula Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The GCC baby food and infant formula market can be segmented based on product type, distribution channel, and age group.

Understanding the preferences and buying behavior of consumers in each segment is crucial for manufacturers to develop targeted marketing strategies and optimize their product offerings.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the GCC baby food and infant formula market. On one hand, the lockdowns and movement restrictions imposed during the pandemic led to supply chain disruptions, affecting the availability of products. Additionally, economic uncertainties and job losses affected consumer purchasing power.

However, the pandemic also brought about certain positive changes in consumer behavior. With increased health and hygiene consciousness, there was a heightened emphasis on ensuring the well-being and nutrition of infants. This resulted in a surge in demand for baby food and infant formula products as parents prioritized their children’s health.

The pandemic also accelerated the shift towards online shopping, with consumers turning to e-commerce platforms to purchase baby food and infant formula products. This shift in consumer behavior opened up new opportunities for online retailers and manufacturers to expand their digital presence and cater to changing customer preferences.

Key Industry Developments

Analyst Suggestions

Future Outlook

The GCC baby food and infant formula market are expected to continue growing in the coming years. Factors such as population growth, increasing disposable income, and changing consumer preferences towards organic and natural products will contribute to market expansion.

The demand for premium and value-added baby food and infant formula products is likely to rise, driven by the growing awareness about early nutrition and parents’ willingness to invest in their children’s health. The e-commerce sector will continue to play a significant role, providing convenience and accessibility to consumers.

Manufacturers will focus on product innovation, sustainability, and technological advancements to meet evolving consumer demands and gain a competitive edge. Strategic partnerships, efficient distribution networks, and effective marketing strategies will be key factors for success in the competitive market landscape.

Conclusion

The GCC baby food and infant formula market is experiencing steady growth, driven by factors such as increasing population, rising disposable income, and changing consumer preferences. The market offers opportunities for industry participants to cater to the demand for organic and natural products, innovate their offerings, and expand into untapped markets.

While the market is competitive, companies can succeed by focusing on quality, compliance, and consumer engagement. The COVID-19 pandemic has brought both challenges and opportunities, with changes in consumer behavior and the accelerated adoption of e-commerce.

GCC Baby Food and Infant Formula Market

| Segmentation | Details |

|---|---|

| Product Type | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Online Retailers |

| Region | Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, Kuwait |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the GCC Baby Food and Infant Formula Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at