444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Uganda mobile money market has experienced remarkable growth over the years, revolutionizing the way financial transactions are conducted in the country. Mobile money refers to a digital payment system that allows individuals to perform financial transactions using their mobile devices, without the need for traditional banking infrastructure. It has emerged as a powerful tool for financial inclusion, especially in developing countries like Uganda, where a significant portion of the population remains unbanked.

Meaning

Mobile money is a technology-driven financial service that enables individuals to perform various transactions such as sending and receiving money, paying bills, purchasing goods and services, and accessing other financial services using their mobile phones. It leverages the widespread adoption of mobile phones to provide accessible and convenient financial services to the underserved population.

Executive Summary

The Uganda mobile money market has experienced exponential growth, driven by factors such as increasing mobile phone penetration, rising demand for convenient and secure financial services, and government initiatives to promote financial inclusion. The market has witnessed the entry of several mobile money providers, creating a competitive landscape. However, there are still untapped opportunities for further expansion and innovation in this sector.

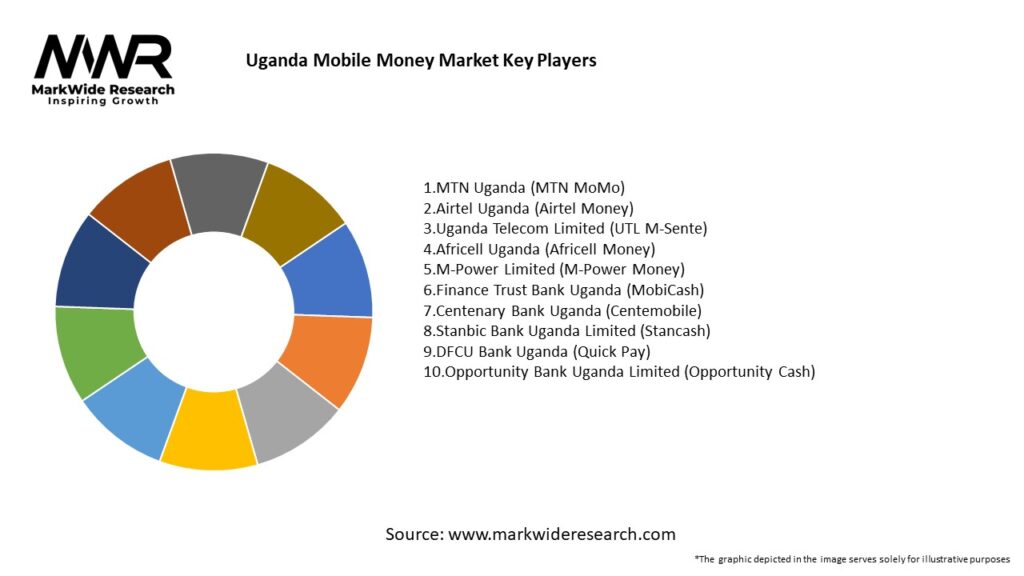

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Uganda mobile money market is characterized by intense competition among various mobile money providers. The market has witnessed the entry of both traditional financial institutions and telecom companies, each aiming to capture a significant market share. This competition has led to continuous innovation, improved service quality, and competitive pricing for the benefit of consumers.

Additionally, consumer preferences and behaviors are evolving, with a growing demand for advanced mobile money services beyond basic transactions. Users now expect seamless integration with other financial products, such as loans and savings accounts. Mobile money providers need to adapt to these changing dynamics and focus on delivering an enhanced user experience to maintain their competitive edge.

Regional Analysis

The adoption and growth of mobile money services vary across different regions of Uganda. Urban areas, including the capital city Kampala, have witnessed high penetration rates due to better network coverage and higher digital literacy levels. These regions also benefit from a more developed financial ecosystem and greater access to diverse service providers.

In contrast, rural areas face challenges such as limited network coverage, low digital literacy rates, and a lack of physical banking infrastructure. However, these regions offer significant growth opportunities for mobile money providers to expand their services and cater to the unbanked population.

Efforts should be made to bridge the urban-rural divide by improving network infrastructure and increasing digital literacy in rural areas. This would help unlock the full potential of mobile money services and promote financial inclusion throughout the country.

Competitive Landscape

Leading Companies in the Uganda Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Uganda mobile money market can be segmented based on user demographics, service offerings, and distribution channels.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Uganda mobile money market. It has accelerated the adoption of digital financial services as people turned to contactless transactions to reduce the risk of virus transmission. Mobile money services played a crucial role in facilitating remote payments, ensuring business continuity, and supporting individuals in need during lockdowns and movement restrictions.

The pandemic also highlighted the importance of financial inclusion and the need to bridge the digital divide. Mobile money providers collaborated with the government and other stakeholders to extend their services to vulnerable populations, enabling them to access funds and support during these challenging times.

The pandemic has acted as a catalyst for innovation and digital transformation in the financial sector. It has underscored the resilience and relevance of mobile money services, paving the way for continued growth and advancement in the post-pandemic era.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Uganda mobile money market looks promising, with significant growth potential. The market is expected to witness continued expansion, driven by the increasing adoption of mobile phones, government support for financial inclusion, and the growing demand for convenient and secure digital financial services.

Mobile money providers will continue to innovate and diversify their product portfolios, offering a comprehensive suite of financial services. Integration with digital platforms, collaborations with traditional financial institutions, and partnerships with other stakeholders will further strengthen the mobile money ecosystem.

To realize the full potential of mobile money, efforts should be made to bridge the digital divide, improve digital literacy, and address infrastructure challenges in remote areas. Policy and regulatory frameworks should continue to support innovation, competition, and consumer protection, ensuring a sustainable and inclusive mobile money market.

Conclusion

The Uganda mobile money market has witnessed remarkable growth, revolutionizing financial transactions and promoting financial inclusion. Mobile money services have provided a convenient and accessible way for individuals to access financial services, especially in underserved areas.

The market is driven by factors such as increasing mobile phone penetration, rising demand for convenient financial services, and government initiatives to promote financial inclusion. However, challenges such as limited digital literacy, infrastructure issues, and security concerns need to be addressed to unlock the market’s full potential.

What is Uganda Mobile Money?

Uganda Mobile Money refers to the digital financial services that allow users to send, receive, and store money using mobile devices. This service has transformed the way individuals and businesses conduct transactions in Uganda, promoting financial inclusion and accessibility.

Who are the key players in the Uganda Mobile Money Market?

Key players in the Uganda Mobile Money Market include MTN Uganda, Airtel Uganda, and Africell, which provide various mobile money services to consumers. These companies compete to offer innovative solutions and expand their user base, among others.

What are the main drivers of growth in the Uganda Mobile Money Market?

The main drivers of growth in the Uganda Mobile Money Market include the increasing smartphone penetration, the rising demand for cashless transactions, and the need for financial services in rural areas. Additionally, the convenience and speed of mobile money transactions contribute to its popularity.

What challenges does the Uganda Mobile Money Market face?

The Uganda Mobile Money Market faces challenges such as regulatory hurdles, security concerns regarding fraud, and competition from traditional banking services. These factors can hinder the growth and adoption of mobile money solutions.

What opportunities exist for the Uganda Mobile Money Market in the future?

Opportunities for the Uganda Mobile Money Market include the potential for partnerships with local businesses, the expansion of services to include savings and loans, and the integration of mobile money with e-commerce platforms. These developments can enhance user engagement and service offerings.

What trends are shaping the Uganda Mobile Money Market?

Trends shaping the Uganda Mobile Money Market include the rise of digital wallets, increased use of QR codes for transactions, and the growing adoption of mobile payment solutions among merchants. These trends reflect a shift towards more innovative and user-friendly financial services.

Uganda Mobile Money Market

| Segmentation | Details |

|---|---|

| Transaction Mode | Mobile Wallets, Mobile Money Apps |

| Transaction Type | Person-to-Person (P2P) Transfers, Bill Payments, Airtime Top-ups, Others |

| Country | Uganda |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Uganda Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at