444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

Africa Mobile Money Market is experiencing significant growth and is poised to become one of the fastest-growing markets in the region. Mobile money has emerged as a transformative technology, revolutionizing the way people conduct financial transactions across the continent. With its convenience, accessibility, and affordability, mobile money has become a key driver of financial inclusion, providing individuals and businesses with access to formal financial services.

Meaning

Mobile money refers to the use of mobile phones and associated technologies to facilitate financial transactions. It enables users to store, send, and receive money electronically using their mobile devices. Mobile money services typically involve partnerships between mobile network operators and financial institutions, allowing users to create virtual accounts linked to their mobile phone numbers. This enables them to perform a wide range of financial activities, such as transferring money, paying bills, making purchases, and accessing other financial services.

Executive Summary

The Africa Mobile Money Market has witnessed rapid growth in recent years, driven by factors such as the increasing adoption of smartphones, expanding mobile network coverage, and the growing need for financial services in underserved areas. The market is characterized by intense competition among mobile network operators and financial institutions, with several players offering a diverse range of mobile money services.

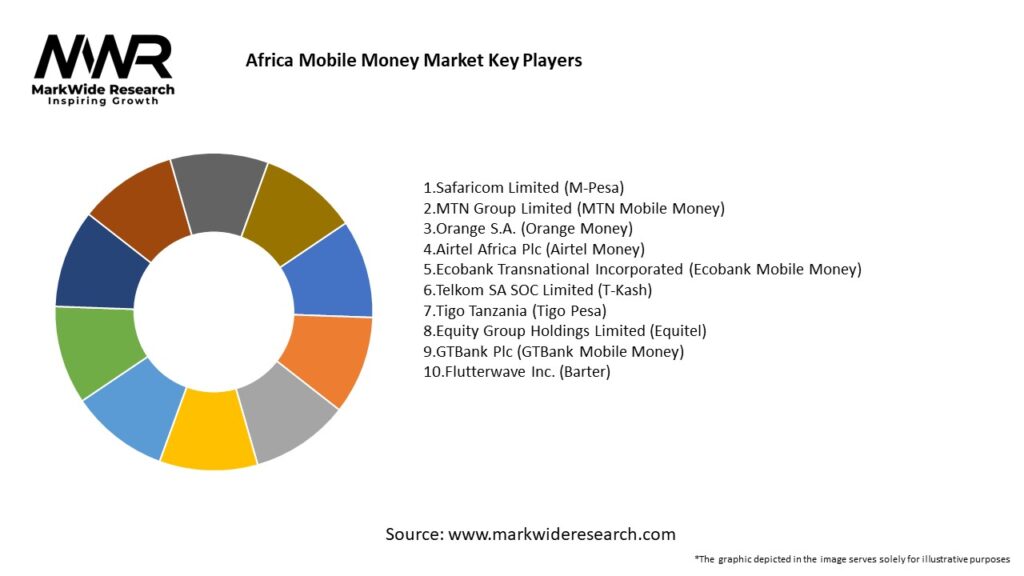

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Africa Mobile Money Market is experiencing robust growth, driven by various key factors. The increasing penetration of smartphones and internet connectivity has played a crucial role in expanding the reach of mobile money services. Additionally, the rise of e-commerce and digital payments has further fueled the demand for mobile money solutions. Furthermore, governments and regulatory bodies are actively promoting financial inclusion initiatives, providing a favorable environment for the growth of the mobile money market.

Market Drivers

Several drivers are propelling the growth of the Africa Mobile Money Market. Firstly, the large unbanked population in the region presents a significant opportunity for mobile money providers to offer financial services to underserved individuals. Secondly, the convenience and accessibility of mobile money services, especially in remote areas with limited access to traditional banking infrastructure, have contributed to the market’s expansion. Lastly, the emergence of innovative technologies such as mobile wallets and mobile banking applications has made mobile money more user-friendly and attractive to consumers.

Market Restraints

Despite its rapid growth, the Africa Mobile Money Market faces certain challenges and restraints. One of the key concerns is the limited interoperability between different mobile money platforms, which can create fragmentation and hinder seamless transactions. Additionally, issues related to regulatory compliance, security, and fraud prevention pose significant challenges to the market. Furthermore, the lack of awareness and digital literacy among certain population segments acts as a barrier to the adoption of mobile money services.

Market Opportunities

The Africa Mobile Money Market presents significant opportunities for both existing players and new entrants. The market’s potential for growth remains high, driven by the untapped market of unbanked individuals and the increasing demand for digital financial services. Furthermore, the integration of mobile money with other sectors, such as e-commerce, healthcare, and transportation, opens up new avenues for expansion. Additionally, the use of mobile money for international remittances has gained traction, providing an opportunity for market players to tap into the cross-border payment market.

Market Dynamics

The Africa Mobile Money Market is characterized by intense competition, with several mobile network operators and financial institutions vying for market share. To gain a competitive edge, market players are focusing on continuous innovation, offering enhanced features and services to attract and retain customers. Partnerships and collaborations between mobile network operators, financial institutions, and technology providers have also become common, enabling the expansion of mobile money services and the development of innovative solutions.

Regional Analysis

The Africa Mobile Money Market exhibits regional variations in terms of market penetration and adoption. East Africa, particularly countries like Kenya, Tanzania, and Uganda, has emerged as a leading region in mobile money adoption, driven by the success of pioneering mobile money platforms. West Africa, with countries like Nigeria and Ghana, has also experienced significant growth, fueled by a large unbanked population and a favorable regulatory environment. Southern and North Africa, although witnessing slower adoption, are gradually embracing mobile money as a means to drive financial inclusion.

Competitive Landscape

Leading Companies in the Africa Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

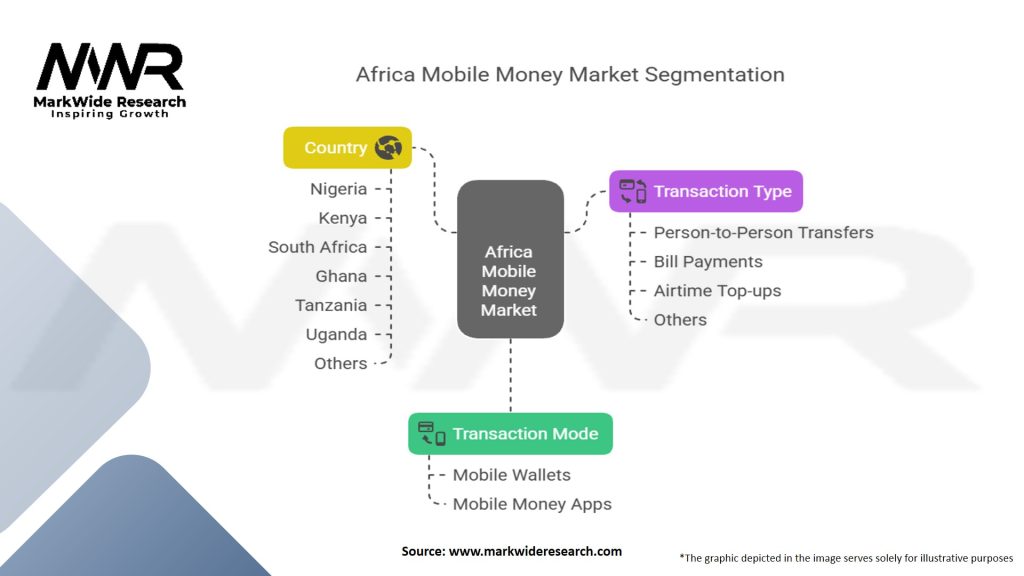

Segmentation

The Africa Mobile Money Market can be segmented based on the type of mobile money services and the target user segments. In terms of services, the market can be divided into person-to-person (P2P) transfers, bill payments, merchant payments, airtime top-ups, savings, and loans. When considering user segments, mobile money services cater to both individual consumers and businesses, offering customized solutions to meet their specific needs.

Category-wise Insights

In the Africa Mobile Money Market, person-to-person (P2P) transfers account for a significant share of transactions. P2P transfers are widely used by individuals to send money to family and friends, especially in rural areas where traditional banking services are limited. Bill payments through mobile money platforms have also gained popularity, providing users with a convenient and secure method to settle utility bills and other recurring payments. Merchant payments are witnessing steady growth, with businesses increasingly accepting mobile money as a form of payment.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the Africa Mobile Money Market can enjoy several key benefits. For mobile network operators, mobile money services serve as a diversification strategy, generating additional revenue streams beyond traditional voice and data services. Financial institutions can expand their reach to underserved populations and leverage mobile money as a customer acquisition tool. Governments and regulatory bodies can promote financial inclusion and drive economic growth by supporting the development of mobile money ecosystems.

SWOT Analysis

Market Key Trends

Several key trends are shaping the Africa Mobile Money Market. First, the integration of mobile money with digital wallets and other financial services is gaining traction, providing users with a comprehensive platform for managing their finances. Second, the use of mobile money for microfinance and loans is growing, enabling individuals and small businesses to access credit easily. Third, the emergence of mobile money super-agents and agents networks is expanding the reach of mobile money services to remote areas.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Africa Mobile Money Market. As movement restrictions and social distancing measures were implemented, the demand for digital financial services, including mobile money, surged. Mobile money platforms served as a lifeline, allowing individuals to send and receive money, pay bills, and make purchases without physical contact. The pandemic accelerated the adoption of mobile money, highlighting its importance in ensuring financial resilience during crises.

Key Industry Developments

The Africa Mobile Money Market has witnessed several key industry developments. One notable development is the collaboration between mobile network operators and fintech companies to enhance the capabilities of mobile money platforms. These partnerships have led to the introduction of new features such as international remittances, savings accounts, and insurance products. Additionally, regulatory bodies in various African countries have taken steps to promote financial inclusion and create an enabling environment for mobile money providers.

Analyst Suggestions

To capitalize on the growth opportunities in the Africa Mobile Money Market, industry participants should focus on the following strategies:

Future Outlook

The future of the Africa Mobile Money Market looks promising, with sustained growth expected in the coming years. The combination of a large unbanked population, increasing smartphone penetration, and supportive regulatory frameworks will continue to drive the adoption of mobile money services. As technology evolves and user demands evolve, market players will need to innovate and expand their offerings to stay competitive and meet the diverse needs of consumers and businesses.

Conclusion

The Africa Mobile Money Market has emerged as a transformative force in the region’s financial landscape, driving financial inclusion, economic growth, and digital transformation. With its convenience, accessibility, and innovative features, mobile money has revolutionized the way people conduct financial transactions. While facing challenges such as interoperability and security, the market presents immense opportunities for industry participants and stakeholders. By embracing collaboration, innovation, and partnerships, the Africa Mobile Money Market can continue to thrive and unlock the potential of millions of unbanked individuals, paving the way for a more inclusive and prosperous future.

What is Africa Mobile Money?

Africa Mobile Money refers to financial services that allow users to conduct transactions via mobile devices, including sending and receiving money, paying bills, and making purchases. This system is particularly significant in regions with limited access to traditional banking services.

Who are the key players in the Africa Mobile Money market?

Key players in the Africa Mobile Money market include companies like M-Pesa, Orange Money, and Airtel Money, which provide various mobile financial services. These companies have established a strong presence in multiple African countries, facilitating financial inclusion among others.

What are the main drivers of growth in the Africa Mobile Money market?

The growth of the Africa Mobile Money market is driven by increasing smartphone penetration, the need for financial inclusion, and the rising adoption of digital payment solutions. Additionally, the growing youth population and urbanization contribute to the demand for mobile financial services.

What challenges does the Africa Mobile Money market face?

The Africa Mobile Money market faces challenges such as regulatory hurdles, security concerns regarding fraud, and the need for consumer education. Additionally, competition from traditional banking institutions can hinder the growth of mobile money services.

What opportunities exist in the Africa Mobile Money market?

Opportunities in the Africa Mobile Money market include expanding services to rural areas, integrating with e-commerce platforms, and developing new financial products tailored to local needs. The increasing acceptance of mobile payments in various sectors presents significant growth potential.

What trends are shaping the Africa Mobile Money market?

Trends shaping the Africa Mobile Money market include the rise of fintech innovations, partnerships between telecom operators and banks, and the integration of blockchain technology for enhanced security. Additionally, the focus on user-friendly interfaces and customer experience is becoming increasingly important.

Africa Mobile Money Market

| Segmentation | Details |

|---|---|

| Transaction Mode | Mobile Wallets, Mobile Money Apps |

| Transaction Type | Person-to-Person (P2P) Transfers, Bill Payments, Airtime Top-ups, Others |

| Country | Africa (including countries such as Nigeria, Kenya, South Africa, Ghana, Tanzania, Uganda, Others) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Africa Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at