444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Nigeria Mobile Money Market is witnessing rapid growth and transformation, driven by the increasing penetration of smartphones, rising internet connectivity, and the government’s push for financial inclusion. Mobile money refers to the use of mobile devices to access and manage financial services, such as making payments, transferring money, and accessing banking services. This market overview provides an in-depth analysis of the Nigeria Mobile Money Market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and a concluding remark.

Meaning

Mobile money refers to a digital financial service that enables individuals to conduct financial transactions using their mobile devices. It allows users to perform various functions, such as transferring money, making payments, accessing banking services, and managing their finances, without the need for a traditional bank account. Mobile money services are typically provided by telecommunication companies, financial institutions, or third-party providers, and they leverage mobile technology and digital platforms to facilitate secure and convenient financial transactions.

Executive Summary

The Nigeria Mobile Money Market is experiencing significant growth due to the widespread adoption of mobile devices and increasing demand for digital financial services. With a large unbanked population, mobile money offers an opportunity to bridge the gap and provide financial services to underserved communities. The market is characterized by intense competition among telecommunication companies, financial institutions, and fintech startups, each striving to capture a significant market share. The regulatory environment has also been favorable, with the Central Bank of Nigeria implementing policies to promote financial inclusion and create a conducive ecosystem for mobile money providers.

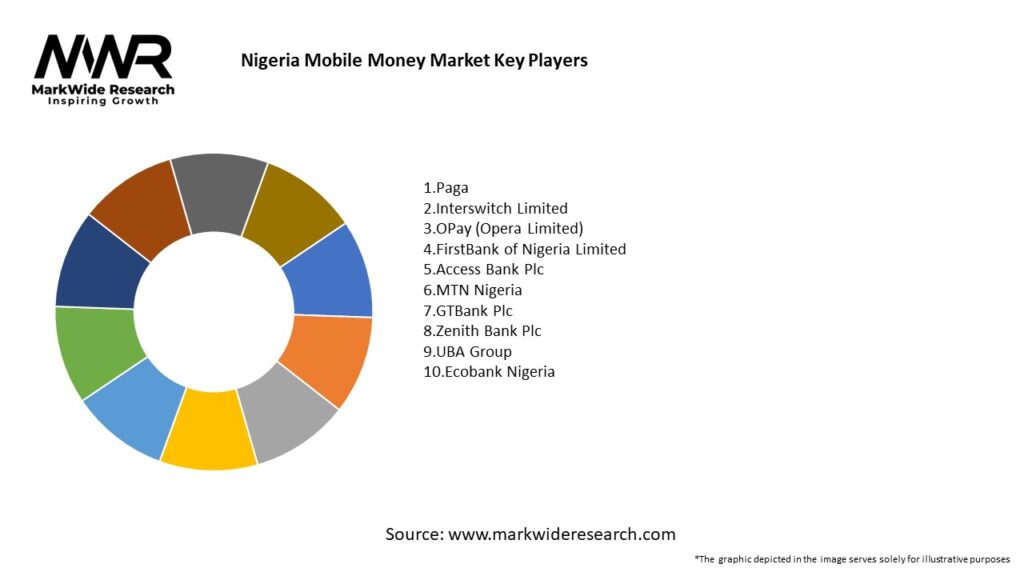

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Nigeria Mobile Money Market is characterized by intense competition, rapid technological advancements, evolving consumer preferences, and regulatory developments. Telecommunication companies, financial institutions, and fintech startups are engaged in a race to capture market share and differentiate their mobile money offerings. The market is witnessing collaborations and partnerships among players to leverage their respective strengths and expand the reach of mobile money services. Additionally, regulatory interventions and policies by the Central Bank of Nigeria are shaping the market landscape and driving the adoption of mobile money.

Regional Analysis

The adoption of mobile money services in Nigeria is not evenly distributed across the country. Urban areas, such as Lagos, Abuja, and Port Harcourt, have higher penetration rates due to better infrastructure and higher smartphone adoption. Rural areas, on the other hand, face challenges related to connectivity, awareness, and access to mobile devices. However, there is immense potential for mobile money growth in these underserved regions, presenting an opportunity for mobile money providers to expand their reach and promote financial inclusion.

Competitive Landscape

Leading Companies in the Nigeria Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

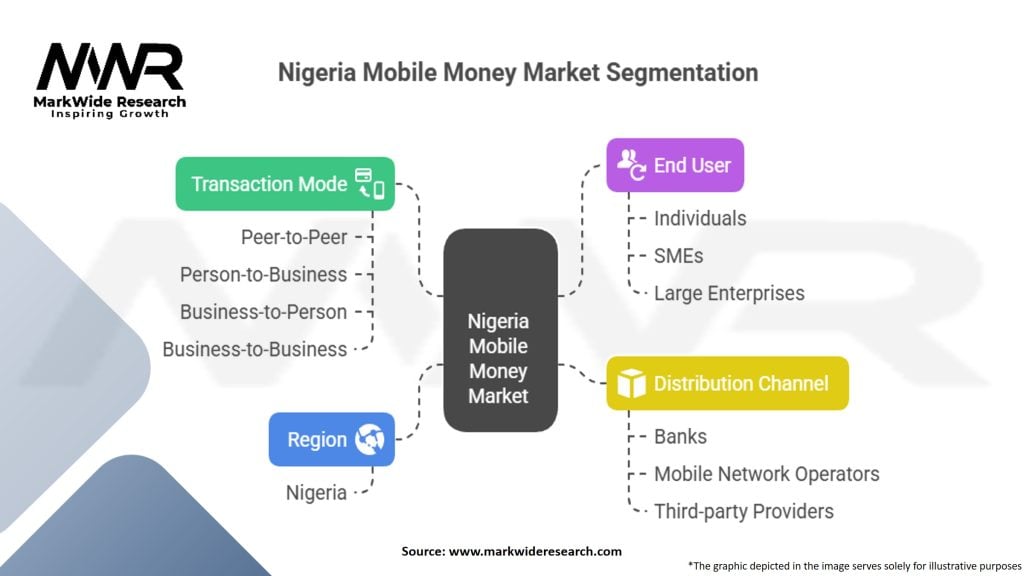

Segmentation

The Nigeria Mobile Money Market can be segmented based on user type, service type, and geography. User types include individual consumers, small businesses, and corporate users. Service types encompass basic transactions, savings, loans, insurance, investments, and bill payments. Geographically, the market can be segmented into urban and rural areas, each with its unique set of challenges and opportunities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of mobile money services in Nigeria. The lockdown measures and restrictions on movement have highlighted the need for digital financial services, as people have turned to mobile money for contactless payments, transfers, and accessing financial services. The pandemic has also underscored the importance of financial inclusion, as mobile money has provided a lifeline for individuals and businesses affected by the economic disruptions. Going forward, the pandemic’s impact is likely to drive further growth and innovation in the Nigeria Mobile Money Market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Nigeria Mobile Money Market looks promising, with significant opportunities for growth and innovation. As smartphone penetration and internet connectivity continue to improve, more individuals and businesses are expected to adopt mobile money services. The ongoing efforts by the government to promote financial inclusion and the emergence of new technologies will further accelerate market growth. Mobile money platforms are likely to evolve, offering a wide range of financial services and partnering with various sectors to provide a holistic digital financial experience. The market is expected to witness increased collaboration, competition, and investment in the coming years.

Conclusion

The Nigeria Mobile Money Market is experiencing rapid growth and transformation, driven by factors such as increasing smartphone penetration, government initiatives for financial inclusion, and the rising popularity of digital payments. Mobile money services provide a convenient and secure way for individuals and businesses to access financial services, transfer money, and make payments. While the market offers significant opportunities, challenges such as limited awareness, security concerns, and infrastructure gaps need to be addressed. By focusing on consumer education, enhancing security measures, and promoting interoperability, the mobile money market in Nigeria can unlock its full potential and drive financial inclusion, economic growth, and digital transformation in the country.

What is Nigeria mobile money?

Nigeria mobile money refers to the digital financial services that allow users to conduct transactions, such as sending and receiving money, paying bills, and making purchases, using their mobile devices. This system has gained popularity due to its convenience and accessibility, especially in regions with limited banking infrastructure.

Who are the key players in the Nigeria mobile money market?

Key players in the Nigeria mobile money market include companies like MTN Nigeria, Airtel Africa, and Paga, which provide various mobile financial services. These companies are competing to expand their user base and enhance service offerings, among others.

What are the main drivers of growth in the Nigeria mobile money market?

The main drivers of growth in the Nigeria mobile money market include the increasing smartphone penetration, the rise of e-commerce, and the need for financial inclusion among unbanked populations. Additionally, the growing acceptance of digital payments by merchants is contributing to this growth.

What challenges does the Nigeria mobile money market face?

The Nigeria mobile money market faces challenges such as regulatory hurdles, security concerns regarding fraud and data breaches, and competition from traditional banking services. These factors can hinder the adoption and growth of mobile money services.

What opportunities exist for the Nigeria mobile money market in the future?

Opportunities for the Nigeria mobile money market include the potential for partnerships with fintech companies, the expansion of services to rural areas, and the integration of advanced technologies like blockchain for enhanced security. These developments could significantly boost user engagement and service efficiency.

What trends are shaping the Nigeria mobile money market?

Trends shaping the Nigeria mobile money market include the increasing use of QR codes for payments, the rise of agent networks to facilitate transactions, and the growing focus on user-friendly mobile applications. These trends are enhancing the overall user experience and driving adoption.

Nigeria Mobile Money Market

| Segmentation Details | Description |

|---|---|

| Transaction Mode | Peer-to-Peer, Person-to-Business, Business-to-Person, Business-to-Business |

| End User | Individuals, SMEs, Large Enterprises |

| Distribution Channel | Banks, Mobile Network Operators, Third-party Providers |

| Region | Nigeria |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Nigeria Mobile Money Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at