444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Fixed Satellite Services (FSS) Market has witnessed substantial growth in recent years, driven by the increasing demand for reliable and high-speed communication services across various industries. Fixed Satellite Services refer to the use of geostationary satellites to provide telecommunications and broadcasting services. These services play a crucial role in enabling long-distance communication, especially in areas where terrestrial communication infrastructure is limited or unavailable.

Meaning

Fixed Satellite Services (FSS) involve the use of geostationary satellites to provide a wide range of communication services. These services include voice, data, video, and broadcasting, catering to diverse industries such as telecommunications, government, military, aerospace, maritime, and broadcasting. FSS utilizes the geostationary orbit, where satellites remain fixed relative to the Earth’s surface, ensuring continuous coverage over a specific geographic area.

Executive Summary

The Fixed Satellite Services (FSS) Market has experienced significant growth in recent years, driven by the increasing demand for reliable and uninterrupted communication services. The market is characterized by the deployment of advanced satellite technology, offering high-speed connectivity and expanded coverage. Key market players are focusing on strategic partnerships and technological advancements to enhance their market presence and meet the evolving customer requirements.

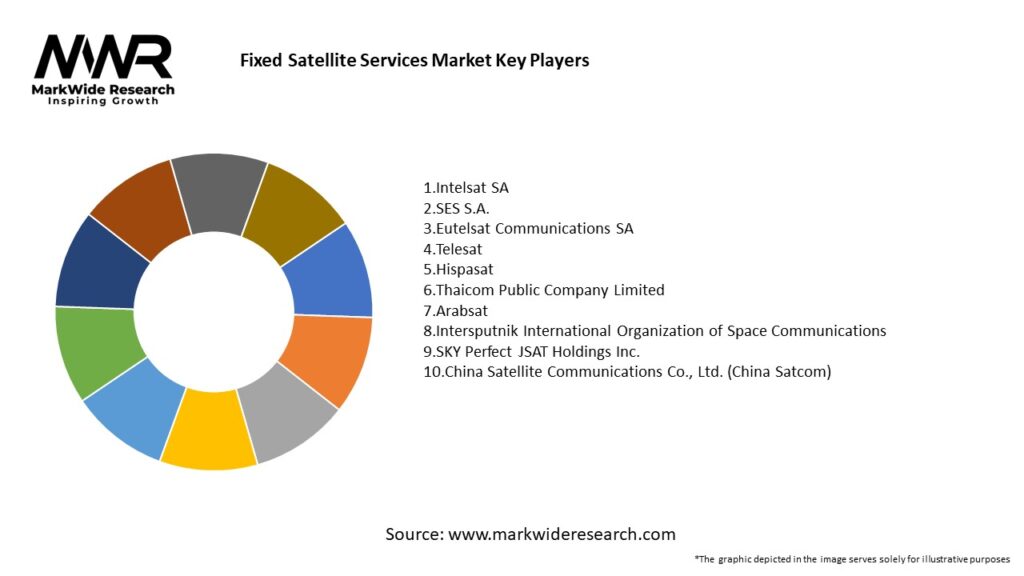

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Fixed Satellite Services (FSS) Market is driven by several dynamic factors, including technological advancements, increasing demand for high-speed connectivity, and government initiatives for digital inclusion. The market is also influenced by regulatory challenges, competition from terrestrial networks, and vulnerability to weather conditions. However, the expansion of 5G networks, the growth of IoT and M2M communication, emerging markets, and the use of FSS for remote sensing present significant opportunities for market players.

Regional Analysis

The FSS market exhibits a global presence, with regional variations in market dynamics and demand. North America holds a significant share in the market, driven by the presence of major market players, technological advancements, and the demand for high-speed connectivity. Europe and Asia Pacific also contribute significantly to market growth, propelled by the expansion of 5G networks and government initiatives for digital inclusion. Emerging economies in Latin America, the Middle East, and Africa offer substantial growth potential due to the increasing demand for connectivity and broadcasting services.

Competitive Landscape

Leading Companies in Fixed Satellite Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The FSS market can be segmented based on service type, end-user industry, and geography.

By Service Type:

By End-User Industry:

By Geography:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Fixed Satellite Services (FSS) Market. While the pandemic has caused disruptions in various industries, it has also highlighted the importance of reliable communication services. The increased reliance on remote work, e-learning, telemedicine, and digital entertainment during lockdowns has driven the demand for high-speed connectivity and broadband services. FSS has played a crucial role in supporting these activities, ensuring uninterrupted communication and access to essential services.

However, the pandemic has also posed challenges to the FSS market. Supply chain disruptions, delays in satellite manufacturing, and restrictions on satellite launches have affected the deployment of new satellite systems. The economic slowdown and financial uncertainties have impacted investment decisions, especially for new projects and infrastructure development. Additionally, the cancellation or postponement of live events, sports tournaments, and broadcasting activities have impacted the demand for broadcasting services.

Overall, the long-term impact of the pandemic on the FSS market is expected to be positive, as the need for reliable and resilient communication services becomes increasingly evident in a post-pandemic world.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Fixed Satellite Services (FSS) Market is poised for significant growth in the coming years. The increasing demand for high-speed connectivity, the expansion of 5G networks, and the growing adoption of IoT and M2M communication will drive market expansion. Technological advancements, such as high-throughput satellites and software-defined networking, will further enhance the capabilities of FSS, offering improved coverage, efficiency, and customer experience. Emerging markets and remote sensing applications present additional growth opportunities.

However, market players should address challenges related to regulatory frameworks, spectrum allocation, and competition from terrestrial networks. By focusing on technological advancements, strategic partnerships, and market diversification, companies can position themselves for long-term success in the evolving FSS landscape.

Conclusion

The Fixed Satellite Services (FSS) Market plays a crucial role in providing reliable and high-speed communication services across various industries. The market is driven by the increasing demand for broadband connectivity, HD video and broadcasting services, and government initiatives for digital inclusion. Technological advancements, such as high-throughput satellites and software-defined networking, offer enhanced capabilities and expanded coverage.

While the market faces challenges related to regulatory frameworks, competition from terrestrial networks, and vulnerability to weather conditions, it also presents significant opportunities, including the expansion of 5G networks, the growth of IoT and M2M communication, and emerging markets. The Covid-19 pandemic has highlighted the importance of reliable communication services, and the market is expected to witness sustained growth in the post-pandemic era.

What are Fixed Satellite Services (FSS)?

Fixed Satellite Services (FSS) refer to satellite communication services that provide fixed links between designated points on the Earth’s surface. These services are commonly used for broadcasting, telecommunications, and data transmission across various industries.

Who are the key players in the Fixed Satellite Services (FSS) market?

Key players in the Fixed Satellite Services (FSS) market include Intelsat, SES S.A., Eutelsat, and Telesat, among others. These companies provide a range of satellite communication solutions and have a significant presence in various regions.

What are the main drivers of growth in the Fixed Satellite Services (FSS) market?

The growth of the Fixed Satellite Services (FSS) market is driven by increasing demand for broadband connectivity, the expansion of satellite-based broadcasting services, and the rising need for reliable communication in remote areas.

What challenges does the Fixed Satellite Services (FSS) market face?

The Fixed Satellite Services (FSS) market faces challenges such as high operational costs, competition from terrestrial communication technologies, and regulatory hurdles that can impact service deployment.

What opportunities exist in the Fixed Satellite Services (FSS) market?

Opportunities in the Fixed Satellite Services (FSS) market include advancements in satellite technology, the growing demand for Internet of Things (IoT) applications, and the potential for expanding services in emerging markets.

What trends are shaping the Fixed Satellite Services (FSS) market?

Trends in the Fixed Satellite Services (FSS) market include the adoption of high-throughput satellites, increased focus on hybrid communication solutions, and the integration of satellite services with cloud-based applications.

Fixed Satellite Services (FSS) Market

| Segmentation Details | Description |

|---|---|

| Service | Wholesale, Managed Services, Value-Added Services |

| Band | C-Band, Ku-Band, Ka-Band, Others |

| End User | Media and Entertainment, Telecom and IT, Government and Military, Others |

| Region | Global (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Fixed Satellite Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at