444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US Retail Logistics market is a vital component of the retail industry, providing the necessary infrastructure and services to ensure the efficient movement of goods from manufacturers to consumers. Retail logistics encompasses various activities, including warehousing, transportation, inventory management, order fulfillment, and reverse logistics. It plays a crucial role in meeting customer demands and enhancing the overall shopping experience.

Meaning

Retail logistics refers to the processes involved in the management and movement of goods within the retail supply chain. It involves the coordination of various activities, such as procurement, transportation, warehousing, and distribution, to ensure the timely delivery of products to the end consumer. Retailers rely on efficient logistics systems to maintain product availability, reduce costs, and enhance customer satisfaction.

Executive Summary

The US Retail Logistics market is experiencing significant growth due to the rising consumer demand for e-commerce and online shopping. The increasing adoption of technology-driven logistics solutions, such as automation and artificial intelligence, has transformed the industry. Key market players are investing heavily in advanced logistics infrastructure and digital platforms to streamline operations and improve efficiency.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US Retail Logistics market is characterized by intense competition and rapid technological advancements. Market players are continuously innovating to stay ahead in the race. Collaboration and partnerships between retailers, logistics providers, and technology companies are becoming increasingly common to enhance the overall logistics ecosystem.

Consumer expectations are the driving force behind the market dynamics, with demand for faster, more convenient, and sustainable logistics solutions shaping industry trends. E-commerce penetration and the rise of omnichannel retailing are influencing the way logistics networks are designed and operated.

Regional Analysis

The US Retail Logistics market is geographically diverse, with different regions exhibiting unique characteristics and logistics requirements. Major metropolitan areas, such as New York, Los Angeles, and Chicago, have high population densities and complex logistics networks. On the other hand, rural areas have their own challenges related to last-mile delivery and access to logistics infrastructure.

The West Coast, with its busy ports and proximity to Asia, serves as a major gateway for international trade. The East Coast, with its strategic location and well-developed transportation networks, is a crucial hub for both domestic and international logistics. The Midwest is known for its extensive transportation infrastructure, making it a key region for warehousing and distribution activities.

Competitive Landscape

Leading Companies in the US Retail Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

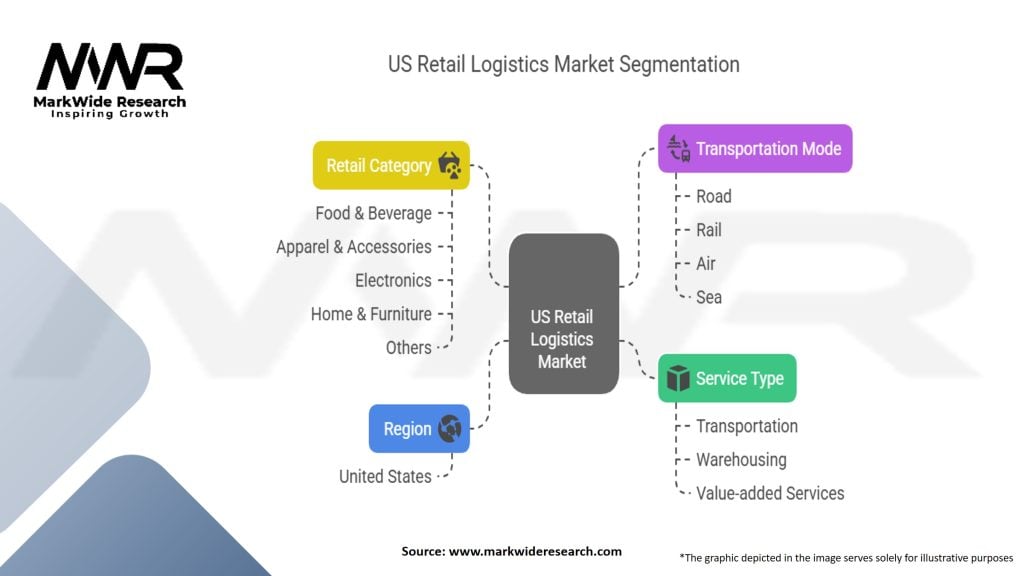

Segmentation

The US Retail Logistics market can be segmented based on various factors, including service type, transportation mode, and end-user. Common segmentation includes:

Segmentation allows market players to target specific customer segments and tailor their logistics solutions accordingly. It enables better understanding of customer needs and preferences, leading to improved service offerings.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the US Retail Logistics market. The lockdowns and social distancing measures imposed during the pandemic led to a surge in e-commerce and online shopping. Retailers had to quickly adapt their logistics operations to meet the increased demand for home deliveries.

The pandemic also highlighted the importance of robust and agile logistics networks. Retailers faced challenges such as disrupted supply chains, labor shortages, and increased pressure on last-mile delivery. The crisis accelerated the adoption of technology-driven logistics solutions, including contactless delivery, real-time tracking, and automation.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US Retail Logistics market is expected to continue its growth trajectory in the coming years. The rise of e-commerce, increasing consumer expectations, and technological advancements will be key drivers of the market. Companies will continue to invest in automation, digitization, and sustainable practices to stay competitive.

Last-mile delivery solutions will evolve, incorporating emerging technologies such as autonomous vehicles and drones. Data analytics and AI will play a crucial role in optimizing supply chain processes, improving inventory management, and enhancing customer experiences.

Overall, the US Retail Logistics market presents immense opportunities for innovation, collaboration, and growth, driven by the evolving needs of consumers and the dynamic nature of the retail industry.

Conclusion

The US Retail Logistics market is experiencing significant growth and transformation. The rise of e-commerce, technological advancements, and changing consumer expectations are shaping the industry landscape. Retailers and logistics providers are investing in advanced technologies, automation, and sustainable practices to enhance operational efficiency and meet customer demands.

Collaboration and partnerships are becoming essential for success, as industry participants seek to leverage specialized capabilities and shared resources. The future of the US Retail Logistics market looks promising, with continued innovation and a focus on providing fast, reliable, and sustainable logistics solutions to support the evolving retail industry.

What is the US Retail Logistics?

US Retail Logistics refers to the processes involved in the transportation, warehousing, and distribution of goods within the retail sector. It encompasses various activities that ensure products are delivered efficiently from manufacturers to consumers.

Who are the key players in the US Retail Logistics Market?

Key players in the US Retail Logistics Market include companies like Amazon, FedEx, UPS, and XPO Logistics, which provide essential services such as shipping, warehousing, and supply chain management among others.

What are the main drivers of growth in the US Retail Logistics Market?

The main drivers of growth in the US Retail Logistics Market include the rise of e-commerce, increasing consumer demand for faster delivery, and advancements in logistics technology. These factors are reshaping how goods are transported and delivered.

What challenges does the US Retail Logistics Market face?

The US Retail Logistics Market faces challenges such as rising transportation costs, labor shortages, and supply chain disruptions. These issues can impact efficiency and service levels in the logistics sector.

What opportunities exist in the US Retail Logistics Market?

Opportunities in the US Retail Logistics Market include the adoption of automation and AI technologies, the expansion of last-mile delivery services, and the growth of sustainable logistics practices. These trends can enhance operational efficiency and customer satisfaction.

What trends are shaping the US Retail Logistics Market?

Trends shaping the US Retail Logistics Market include the increasing use of data analytics for supply chain optimization, the rise of omnichannel retailing, and a focus on sustainability in logistics operations. These trends are influencing how retailers manage their logistics strategies.

US Retail Logistics Market

| Segmentation | Details |

|---|---|

| Service Type | Transportation, Warehousing, Value-added Services |

| Transportation Mode | Road, Rail, Air, Sea |

| Retail Category | Food & Beverage, Apparel & Accessories, Electronics, Home & Furniture, Others |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Retail Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at