444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Payment Orchestration Platform market is experiencing significant growth and is expected to continue its upward trajectory in the coming years. As businesses increasingly shift their operations online, the need for streamlined and efficient payment processes has become paramount. Payment orchestration platforms play a vital role in simplifying payment workflows, enabling businesses to accept various payment methods, manage transactions, and enhance the overall customer experience.

Meaning

Payment orchestration platforms are comprehensive solutions that enable businesses to consolidate and manage multiple payment gateways, acquirers, and payment service providers (PSPs) through a single integration. These platforms act as intermediaries between merchants and payment service providers, offering a centralized hub to handle payment processing, routing, and reconciliation. By connecting with various payment providers, these platforms ensure seamless transactions and optimize the payment flow, reducing complexities and costs associated with managing multiple integrations.

Executive Summary

The Payment Orchestration Platform market has witnessed substantial growth in recent years, driven by the rapid digitalization of businesses across industries. These platforms have emerged as essential tools for e-commerce companies, online marketplaces, and enterprises operating in the digital realm. The ability to accept multiple payment methods, optimize routing, and manage transactions efficiently has become critical for businesses to stay competitive and meet customer expectations.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Several key market insights are shaping the Payment Orchestration Platform landscape. Firstly, the increasing adoption of e-commerce and online payments is driving the demand for these platforms. As more consumers prefer online shopping, businesses need to ensure seamless payment experiences across different channels and devices. Payment orchestration platforms facilitate this by integrating various payment methods, such as credit cards, digital wallets, and alternative payment solutions.

Secondly, the rise of mobile commerce has propelled the need for mobile-friendly payment solutions. Payment orchestration platforms enable businesses to offer optimized payment experiences on mobile devices, accommodating the growing number of consumers who prefer to shop and transact on their smartphones.

Thirdly, the globalization of businesses has created the necessity for cross-border payment capabilities. Payment orchestration platforms simplify cross-border transactions by integrating with international payment providers and handling currency conversions and compliance requirements.

Market Drivers

The Payment Orchestration Platform market is driven by several factors that contribute to its growth. One of the primary drivers is the increasing consumer demand for seamless and secure payment experiences. Customers expect frictionless transactions, regardless of the payment method or channel they choose. Payment orchestration platforms provide businesses with the flexibility to offer diverse payment options and ensure a smooth checkout process, enhancing customer satisfaction and loyalty.

Another driver is the need for businesses to optimize payment operations and reduce costs. Payment orchestration platforms streamline payment workflows by consolidating multiple payment providers into a unified interface. This eliminates the need for maintaining separate integrations with each payment service provider, saving time and resources. Additionally, these platforms often provide advanced reporting and analytics capabilities, enabling businesses to gain valuable insights into their payment performance and make data-driven decisions.

Market Restraints

While the Payment Orchestration Platform market is experiencing robust growth, certain restraints hinder its full potential. One significant restraint is the complexity of integrating and maintaining payment orchestration platforms. Businesses must invest in skilled resources or rely on third-party experts to handle the integration process effectively. Additionally, ensuring compatibility with existing systems and infrastructure can pose challenges, especially for large enterprises with complex IT landscapes.

Another restraint is the security and compliance concerns associated with payment processing. As payment orchestration platforms handle sensitive customer data and financial information, maintaining stringent security measures is crucial. Compliance with industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), is necessary to protect customer data and build trust.

Market Opportunities

The Payment Orchestration Platform market presents several opportunities for both existing and new players. The increasing adoption of subscription-based business models, such as Software-as-a-Service (SaaS), creates a demand for flexible and scalable payment solutions. Payment orchestration platforms can cater to this need by offering subscription management features, recurring billing options, and subscription analytics.

Furthermore, the integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), presents opportunities for enhanced payment orchestration capabilities. AI and ML algorithms can analyze transaction data, detect fraud, and optimize payment routing based on historical patterns. By leveraging these technologies, payment orchestration platforms can provide intelligent payment decision-making and enhance the overall payment experience.

Market Dynamics

The Payment Orchestration Platform market is characterized by intense competition and rapid technological advancements. Established payment service providers, financial technology companies, and specialized payment orchestration platform vendors compete to gain market share. To differentiate themselves, vendors focus on providing seamless integrations, comprehensive payment method support, robust security measures, and value-added features such as real-time analytics and reporting.

Technological advancements drive market dynamics, with innovations such as tokenization, biometric authentication, and omnichannel payment capabilities shaping the industry. Payment orchestration platforms must continually evolve to support these emerging technologies and meet evolving customer expectations.

Regional Analysis

The Payment Orchestration Platform market exhibits a global presence, with regional variations in adoption and market maturity. North America and Europe are prominent regions in terms of market share, driven by the widespread adoption of e-commerce and digital payments. These regions also have well-established financial infrastructures, making them conducive to the growth of payment orchestration platforms.

Asia Pacific is a rapidly growing market, fueled by the increasing penetration of smartphones and internet access. The region’s large population, coupled with the growing middle class and rising disposable incomes, presents significant opportunities for market players. Additionally, the government initiatives to promote digital payments and the flourishing e-commerce industry further contribute to the market’s growth in Asia Pacific.

Competitive Landscape

Leading Companies in the Payment Orchestration Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

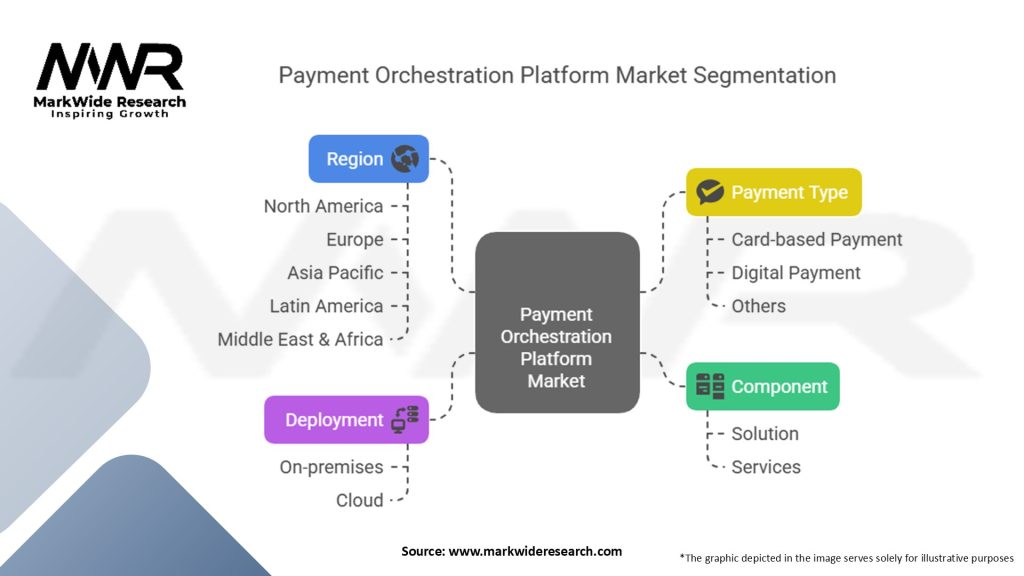

Segmentation

The Payment Orchestration Platform market can be segmented based on deployment mode, enterprise size, and end-user industry.

By deployment mode, the market can be categorized into on-premises and cloud-based solutions. On-premises solutions involve the installation and management of the payment orchestration platform within the organization’s infrastructure, providing greater control and customization options. Cloud-based solutions, on the other hand, offer flexibility, scalability, and ease of maintenance, as the platform is hosted and managed by the vendor.

Based on enterprise size, the market can be segmented into small and medium-sized enterprises (SMEs) and large enterprises. SMEs often opt for cloud-based payment orchestration platforms due to their affordability and ease of implementation, while large enterprises may choose on-premises solutions for greater control and integration with existing systems.

End-user industry segmentation includes e-commerce, retail, travel and hospitality, healthcare, and others. Each industry has specific payment requirements and challenges, making industry-specific payment orchestration solutions highly valuable.

Category-wise Insights

Within the Payment Orchestration Platform market, several categories offer unique insights into specific aspects of the industry:

Key Benefits for Industry Participants and Stakeholders

The Payment Orchestration Platform market offers several key benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the Payment Orchestration Platform market provides insights into its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The Payment Orchestration Platform market is influenced by several key trends:

Covid-19 Impact

The COVID-19 pandemic had a profound impact on the Payment Orchestration Platform market. As lockdowns and social distancing measures were implemented worldwide, businesses rapidly shifted their operations online. This digital transformation increased the demand for payment orchestration platforms, as businesses needed to optimize their online payment processes.

Furthermore, the pandemic accelerated the adoption of contactless payments, leading to increased demand for payment orchestration platforms that support contactless payment methods. Consumers, prioritizing safety and hygiene, embraced contactless payments, further emphasizing the need for seamless and secure payment experiences.

The pandemic also highlighted the importance of business continuity and resilience. Payment orchestration platforms that offered cloud-based solutions enabled businesses to adapt quickly to remote work environments and maintain uninterrupted payment operations.

Key Industry Developments

In recent years, several key industry developments have shaped the Payment Orchestration Platform market:

Analyst Suggestions

Industry analysts provide the following suggestions for businesses operating in the Payment Orchestration Platform market:

Future Outlook

The future of the Payment Orchestration Platform market looks promising, driven by the continuous growth of e-commerce, digital payments, and the need for streamlined payment operations. The market is expected to witness further technological advancements, such as AI-powered fraud detection, biometric authentication, and omnichannel payment capabilities.

Moreover, the increasing adoption of subscription-based business models, the expansion of cross-border e-commerce, and the proliferation of mobile commerce present significant growth opportunities for payment orchestration platforms.

To succeed in the evolving market, businesses should focus on innovation, customer-centricity, and strategic partnerships. By leveraging emerging technologies, enhancing security measures, and providing seamless payment experiences, businesses can capitalize on the market’s potential and gain a competitive edge.

Conclusion

The Payment Orchestration Platform market is experiencing robust growth, driven by the digitalization of businesses, increasing consumer demand for seamless payments, and the need for streamlined payment operations. These platforms offer businesses the ability to consolidate multiple payment service providers, support diverse payment methods, and optimize payment routing.

While the market presents opportunities, businesses should also address challenges such as integration complexity, security concerns, and evolving regulatory requirements. By prioritizing customer experience, embracing emerging technologies, and fostering strategic partnerships, businesses can thrive in the Payment Orchestration Platform market and meet the evolving needs of the digital economy.

What is a payment orchestration platform?

A payment orchestration platform is a technology solution that streamlines and manages the payment processing lifecycle for businesses. It integrates various payment methods, gateways, and services to enhance transaction efficiency and improve user experience.

Who are the key players in the Payment Orchestration Platform Market?

Key players in the Payment Orchestration Platform Market include companies like Adyen, Stripe, and Payoneer, which provide comprehensive solutions for payment processing and management, among others.

What are the main drivers of growth in the Payment Orchestration Platform Market?

The growth of the Payment Orchestration Platform Market is driven by the increasing demand for seamless payment experiences, the rise of e-commerce, and the need for businesses to manage multiple payment methods efficiently.

What challenges does the Payment Orchestration Platform Market face?

Challenges in the Payment Orchestration Platform Market include regulatory compliance issues, the complexity of integrating various payment systems, and the need for robust security measures to protect sensitive transaction data.

What opportunities exist in the Payment Orchestration Platform Market?

Opportunities in the Payment Orchestration Platform Market include the expansion of digital payment solutions, the growth of mobile commerce, and the potential for innovative technologies like blockchain to enhance payment processing.

What trends are shaping the Payment Orchestration Platform Market?

Trends in the Payment Orchestration Platform Market include the increasing adoption of artificial intelligence for fraud detection, the rise of subscription-based payment models, and the growing emphasis on customer experience in payment processing.

Payment Orchestration Platform Market

| Segmentation | Details |

|---|---|

| Component | Solution, Services |

| Deployment | On-premises, Cloud |

| Payment Type | Card-based Payment, Digital Payment, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Payment Orchestration Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at