444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Decentralized Finance, commonly known as DeFi, is a rapidly emerging sector in the financial industry. It leverages blockchain technology and smart contracts to provide a decentralized and open ecosystem for financial transactions and services. Unlike traditional finance, which relies on intermediaries such as banks and brokers, DeFi operates on decentralized platforms, allowing users to interact directly with each other, eliminating the need for intermediaries.

Meaning

Decentralized Finance refers to a system where financial transactions, services, and products are built on blockchain technology and operate without central authorities. It aims to democratize finance by providing equal access to financial services for individuals across the globe. DeFi platforms offer a wide range of services, including lending and borrowing, decentralized exchanges, yield farming, asset management, and insurance, all governed by smart contracts.

Executive Summary

The Decentralized Finance market has witnessed significant growth in recent years, driven by the increasing adoption of blockchain technology and the desire for financial inclusivity. The market has seen a surge in decentralized applications (DApps) built on blockchain platforms like Ethereum, Binance Smart Chain, and others. These DApps have attracted a substantial user base, contributing to the growth of the DeFi market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The DeFi market is characterized by rapid innovation, intense competition, and evolving regulations. New projects and protocols are constantly being launched, offering innovative financial services and investment opportunities. The market dynamics are influenced by technological advancements, regulatory developments, and user demand for innovative DeFi applications.

Regional Analysis

The adoption and growth of DeFi vary across different regions. Currently, North America and Europe are the leading regions in terms of DeFi development and user activity. However, Asia-Pacific is emerging as a significant player, driven by the rapid adoption of cryptocurrencies and blockchain technology in countries like China, Singapore, and South Korea. Developing regions in Africa and Latin America also show great potential for DeFi growth, given the need for financial inclusion and access to banking services.

Competitive Landscape

Leading Companies in the Decentralized Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

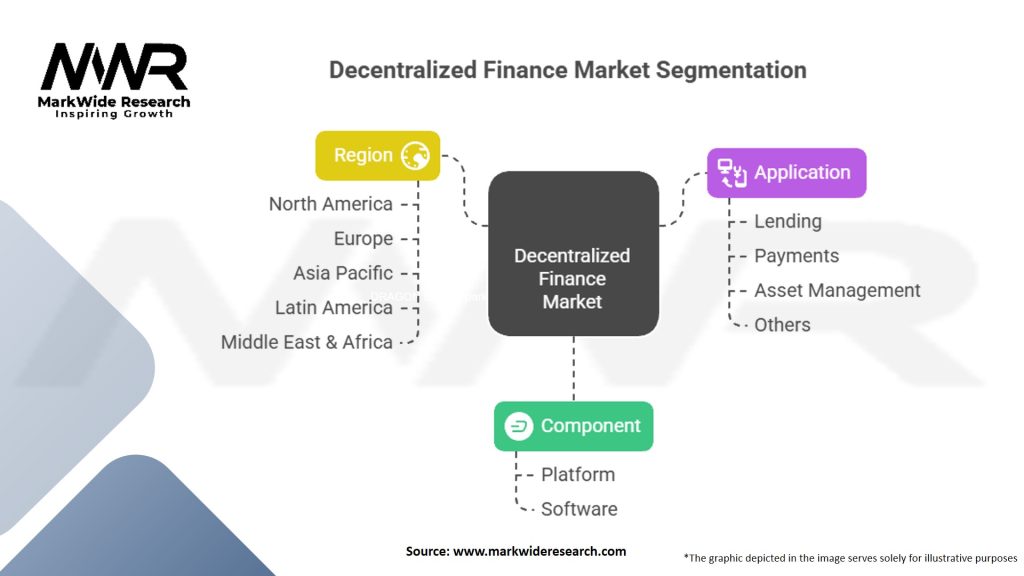

Segmentation

The DeFi market can be segmented based on the type of services offered:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has highlighted the importance of decentralized finance and its potential resilience in times of crisis. The pandemic has disrupted traditional financial systems, causing economic uncertainties and emphasizing the need for accessible and inclusive financial services. DeFi, with its decentralized nature, has showcased its ability to continue functioning and providing financial services without relying on physical infrastructure or intermediaries.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Decentralized Finance market looks promising, with continued growth and innovation expected. The market will likely see increased integration with traditional finance, broader adoption of decentralized applications, and improved scalability solutions. Regulatory frameworks will evolve to strike a balance between innovation and investor protection. As DeFi continues to mature, it has the potential to reshape the financial industry, democratize access to financial services, and foster global financial inclusion.

Conclusion

Decentralized Finance is revolutionizing the financial industry by providing an open, transparent, and inclusive ecosystem. The market has experienced rapid growth, driven by the increasing demand for decentralized financial services and the potential for high yields. While there are challenges such as regulatory uncertainties and smart contract risks, the opportunities for global expansion, integration with traditional finance, and cross-chain interoperability are immense. As the DeFi market continues to evolve, it is essential for industry participants, regulators, and users to collaborate and navigate the complexities of this transformative sector.

What is decentralized finance?

Decentralized finance, often referred to as DeFi, is a financial system built on blockchain technology that allows for peer-to-peer transactions without intermediaries. It encompasses various applications such as lending, borrowing, and trading, enabling users to maintain control over their assets.

What are the key players in the decentralized finance market?

Key players in the decentralized finance market include platforms like Uniswap, Aave, and Compound, which facilitate decentralized trading and lending. These companies are at the forefront of innovation in the DeFi space, among others.

What are the main drivers of growth in the decentralized finance market?

The main drivers of growth in the decentralized finance market include the increasing demand for financial inclusion, the rise of blockchain technology, and the growing interest in cryptocurrencies. Additionally, the potential for higher yields compared to traditional finance attracts more users.

What challenges does the decentralized finance market face?

The decentralized finance market faces challenges such as regulatory uncertainty, security vulnerabilities, and the complexity of user interfaces. These factors can hinder widespread adoption and trust among potential users.

What opportunities exist for the future of the decentralized finance market?

Opportunities for the future of the decentralized finance market include the integration of traditional financial services with DeFi, the development of more user-friendly platforms, and the potential for innovative financial products. As the ecosystem matures, it may attract institutional investors.

What trends are shaping the decentralized finance market?

Trends shaping the decentralized finance market include the rise of yield farming, the growth of decentralized exchanges, and the increasing use of stablecoins. These trends reflect a shift towards more accessible and efficient financial services.

Decentralized Finance Market

| Segmentation | Details |

|---|---|

| Component | Platform, Software |

| Application | Lending, Payments, Asset Management, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Decentralized Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at