Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Modernization Drives Replacement: Aging Cold War‑era howitzers (e.g., M109, 2S3 Akatsiya) are being replaced by digitally enabled systems like the PzH 2000 and K9 Thunder.

-

Precision Munitions Surge: Guided artillery shells (e.g., Excalibur, BONUS) command premium margins and require compatible fire‑control upgrades.

-

Network‐Centric Warfare: Integration of artillery into C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, Reconnaissance) frameworks enhances responsiveness and mutual support with drones, UAVs, and reconnaissance assets.

-

Joint Fires Emphasis: Artillery is increasingly coordinated with air and naval fires through Joint Fires Observers (JFO) and Integrated Fire Commands.

-

Indigenous Development: Nations such as India, Türkiye, and South Korea invest in domestic artillery programs (Dhanush, T‑155 Fırtına, K9) to reduce foreign dependence and spur defense industrial bases.

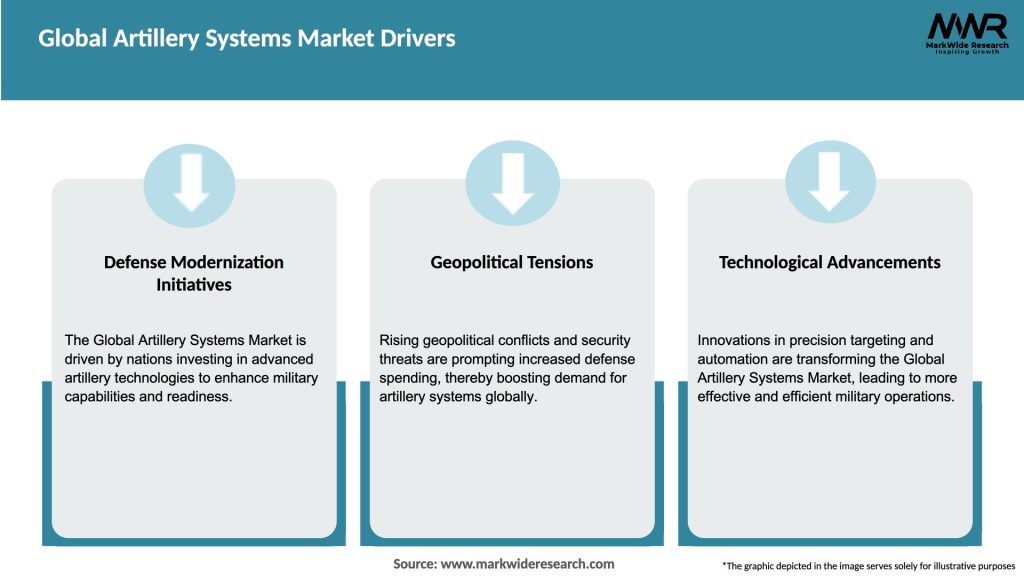

Market Drivers

-

Geopolitical Tensions: Regional conflicts and deterrence postures in Eastern Europe, East Asia, and the Middle East spur artillery acquisitions.

-

Defense Modernization: Upgrades to legacy systems with digital fire controls, extended‑range munitions, and automated loaders.

-

Precision and Lethality Needs: Demand for GPS/INS‑guided shells to strike point targets with minimal collateral damage—a growing requirement in urban and asymmetric warfare.

-

Networked Operations: Integration into battlefield management systems boosts demand for C4ISR‑capable artillery.

-

Export Opportunities: Developed‑nation manufacturers pursue export sales through FMS (Foreign Military Sales) and direct contracts to emerging markets seeking affordable, battle‑proven systems.

Market Restraints

-

High Acquisition Costs: Modern self‑propelled guns and guided munitions carry significant price tags, limiting purchases by lower‑tier defense budgets.

-

Complex Maintenance and Training: Sophisticated electronics and hydraulics demand extensive training, spares, and sustainment structures.

-

Interoperability Challenges: Integrating diverse systems across allied forces requires adherence to standards (NATO STANAGs) and extensive testing.

-

Budgetary Constraints: Shifting government spending priorities—toward cyber, air defense, and naval—may limit artillery procurements.

-

Logistical Footprint: Towed artillery, while cheaper, imposes higher transport demands; self‑propelled units require heavy‑duty carriers and fuel supplies.

Market Opportunities

-

Retrofit and Upgrade Programs: Modernizing existing howitzer fleets with digital fire controls, auto‑loaders, and inertial navigation kits.

-

Indigenous Production: Technology transfers and joint ventures in India, Türkiye, GCC states, and South America for local manufacturing.

-

Dual‑Use Technologies: Civilian applications for precision landing systems, seismic surveying, and high‑energy research.

-

Modular Artillery Systems: Development of lightweight, containerized gun modules deployable on wheeled vehicles or naval platforms.

-

Munitions Innovation: Next‑generation highly automated guided projectiles, rocket‑assisted rounds, and hypersonic artillery shells.

Market Dynamics

-

Supply Side:

-

R&D Investments: Focus on barrel life extension, recoil mitigation, and digital fire‑control integration.

-

Defense Collaborations: Consortiums (e.g., NATO, AUKUS) drive standardization and shared development costs.

-

Manufacturing Scalability: Production lines for guns and munitions ramp up following major government orders.

-

-

Demand Side:

-

Force Posture Shifts: Adapting armies from counter‑insurgency to high‑intensity conflict drives artillery reacquisition.

-

Coalition Operations: Allied interoperability places premium on STANAG‑compliant systems.

-

-

Economic Factors:

-

Offset Agreements: Major procurements often include local industry participation, stimulating domestic defense sectors.

-

Currency Fluctuations: Defense imports are sensitive to exchange rate volatilities, affecting procurement volumes.

-

Regional Analysis

-

North America:

-

Market Leader: U.S. Army modernization programs (M109A7 Paladin & ERCA, Precision Strike Missile) drive domestic procurement and R&D.

-

Export Push: General Dynamics and BAE Systems secure foreign sales of M777 (lightweight howitzer) and HIMARS MLRS.

-

-

Europe:

-

Renewed Investment: NATO’s Enhanced Forward Presence accelerates upgrades of PzH 2000, Caesar, and FH‑70 systems.

-

Joint Initiatives: Franco‑German Main Ground Combat System (MGCS) roadmap includes next‑gen artillery modules.

-

-

Asia‑Pacific:

-

Rapid Modernization: India’s Dhanush, K9 Thunder in RoKA, and Indigenous DRDO programs reflect regional artillery emphasis.

-

Export Potential: South Korea’s Hanwha Defense eyes Southeast Asian markets for K9 SPHs and K239 Chunmoo MLRS.

-

-

Middle East and Africa:

-

GCC Procurements: Saudi Arabia and UAE invest in Caesar 6×6 systems and MLRS variants; Egypt modernizes towed fleets.

-

African Modernization: Nigeria and South Africa upgrade legacy 2S1 Gvozdika and G‑5 howitzers with digital kits.

-

-

Latin America:

-

Affordable Upgrades: Chile and Brazil enhance M114, M109 fleets with digital fire‑control retrofits; Brazil develops Astros II MLRS variants.

-

Competitive Landscape

Leading Companies in the Global Artillery Systems Market:

- BAE Systems plc

- Lockheed Martin Corporation

- General Dynamics Corporation

- Hanwha Defense

- Rheinmetall AG

- Elbit Systems Ltd.

- Nexter Group

- NORINCO International Cooperation Ltd.

- Artillery Plant No. 9

- VPK LLC

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

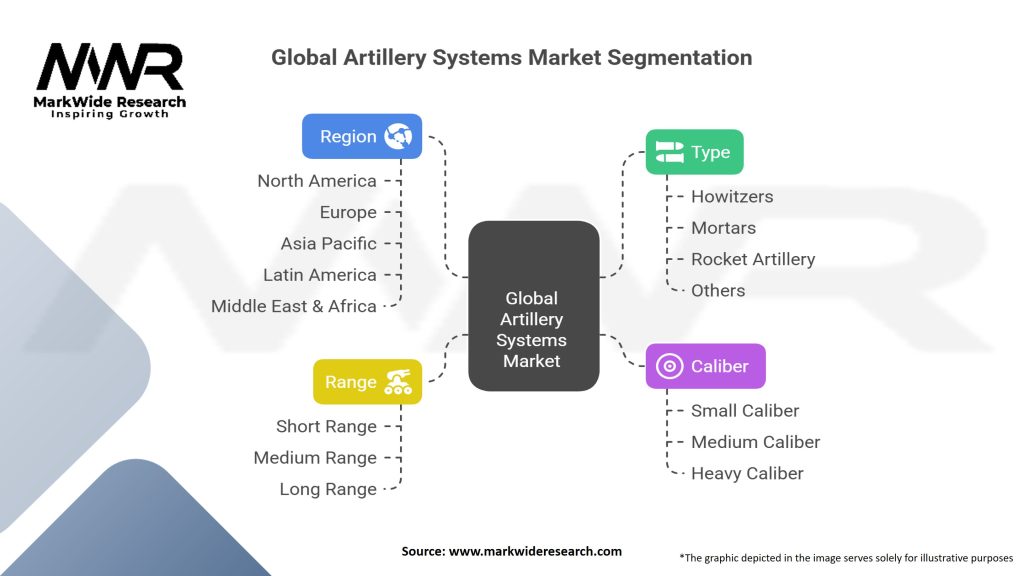

Segmentation

-

By System Type:

-

Towed Howitzers (e.g., LG1, M777)

-

Self‑Propelled Howitzers (e.g., PzH 2000, K9 Thunder)

-

Multiple Launch Rocket Systems (e.g., HIMARS, ASTROS)

-

Mortars and Light Artillery (60 mm–120 mm)

-

-

By Caliber:

-

< 105 mm

-

105–155 mm

-

> 155 mm

-

Rocket Artillery (guided rockets 122 mm–300 mm)

-

-

By Mobility:

-

Tracked

-

Wheeled

-

Vehicle‑Independent (air‑portable/modular)

-

-

By Region:

-

North America

-

Europe

-

Asia‑Pacific

-

Middle East & Africa

-

Latin America

-

Category‑wise Insights

-

Towed vs. SPH: Towed guns offer cost‑effectiveness and simplicity; SPHs provide shoot‑and‑scoot survivability.

-

MLRS vs. Guns: MLRS excel at saturation and standoff fires; howitzers offer sustained direct‑fire support.

-

Lightweight Systems: Air‑portable solutions (e.g., M777) support expeditionary and special operations forces.

-

Guided Munitions: Market for Excalibur, M982 and equivalent is expanding rapidly among advanced armies.

Key Benefits for Industry Participants and Stakeholders

-

Enhanced Operational Effectiveness: Modern artillery boosts force projection, area denial, and counter‑battery capabilities.

-

Improved Survivability: Automated loading and rapid relocation reduce crew exposure and counter‑strike risk.

-

Cost Savings Over Lifecycle: Digital fire‑control and predictive maintenance lower sustainment costs.

-

Strategic Deterrence: State‑of‑the‑art artillery underpins national defense doctrines and deterrence postures.

-

Industrial Growth: Localized production and technology transfers spur defense industrial bases in emerging nations.

SWOT Analysis

Strengths:

-

Proven Battlefield Value: Artillery remains a decisive combat arm, proven in high‑intensity and asymmetric conflicts.

-

Technological Maturity: Robust, field‑tested platforms with continuous digital upgrades.

-

Strong Export Demand: Wide global base for upgrades, spares, and new systems.

Weaknesses:

-

High Acquisition & Sustainment Costs: Premium systems require significant capital outlays and logistics chains.

-

Complexity of Integration: Upgrading legacy fleets with modern digital kits can be challenging.

Opportunities:

-

Next‑Gen Munitions: Hypersonic and ramjet artillery shells promise extended ranges and speed of effects.

-

Autonomous Operation: Integration with UGVs and remote operation could reduce crew risk and improve deployment flexibility.

-

Aftermarket Services: Training, simulation, and sustainment contracts offer recurring revenue streams.

Threats:

-

Shifts to A2/AD Environments: Anti‑access/area‑denial systems (e.g., long‑range rockets, drones) may challenge conventional artillery paradigms.

-

Budgetary Reallocations: Increased focus on cyber, air defense, and naval capabilities may divert funds.

-

Emerging Counter‑Artillery Technologies: Counter‑battery radars and loitering munitions may erode artillery’s tactical advantage.

Market Key Trends

-

Digital Fires Integration: Seamless link of artillery into Joint Fires networks and AI‑driven targeting systems.

-

Precision Fires Focus: Rapid adoption of guided munitions to reduce footprint and collateral damage.

-

Mobility & Expeditionary Capability: Development of lighter, modular artillery deployable by air or sea.

-

Retrofit & Upgrade Kits: High aftermarket growth for digital conversion of legacy howitzers.

-

Sustainment & Training Technologies: Simulators, VR/AR training, and predictive maintenance platforms expand alongside hardware.

Covid‑19 Impact

-

Procurement Delays: Supply chain disruptions affected delivery schedules for artillery hardware and munitions.

-

Sustainment Priorities: Nations emphasized upgrading existing systems over new procurements amid budget constraints.

-

Digital Acceleration: Remote maintenance and training solutions accelerated adoption post‑pandemic.

-

Budget Shifts: Some defense budgets reprioritized to health emergencies, delaying planned artillery acquisitions.

Key Industry Developments

-

Extended Range Cannon Artillery (ERCA): U.S. Army’s program to achieve 70 km+ range, driving munitions R&D.

-

Caesar NG: Nexter’s next‑gen truck‑mounted 155 mm howitzer with digital integration and 360° turret rotation.

-

K9A1 Upgrades: Hanwha Defense’s improved chassis, fire control, and precision artillery enhancements.

-

Digital Fire‑Control Suites: Open architecture systems enabling multi‑national interoperability.

-

Green Propellants: Research into insensitive and environmentally safer artillery propellants.

Analyst Suggestions

-

Invest in Guided Munitions R&D: High‑value, precision rounds command premium returns and enlarge market share.

-

Expand Retrofit Offerings: Develop modular digital upgrade kits for legacy systems to capture aftermarket segments.

-

Forge Global Partnerships: Joint development and co‑production agreements open emerging market channels.

-

Emphasize Autonomous Integration: Pursue UGV‑mounted artillery concepts and remote‑operation capabilities.

-

Balance New Procurements & Upgrades: Offer scalable solutions for both green‑field acquisitions and fleet modernizations.

Future Outlook

The Global Artillery Systems Market is poised for steady growth, driven by modernization imperatives, precision fires requirements, and digitized battlefield concepts. Key developments will include extended‑range capabilities, networked fires integration, autonomous operation, and sustainment‑focused business models. While budgetary pressures and emerging threat environments introduce risk, artillery’s enduring strategic value and adaptability to next‑generation warfare will sustain demand well beyond 2030.

Conclusion

Artillery systems remain a vital component of national defense arsenals, delivering decisive long‑range firepower and strategic deterrence. The Global Artillery Systems Market—bolstered by digital transformation, precision‑guided munitions, and mobility enhancements—will continue to evolve to meet the demands of modern warfare. Stakeholders who invest in R&D, retrofit solutions, and strategic partnerships will capture the emerging opportunities in this resilient and technologically dynamic sector.