Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Cost Reduction Imperative: BOP currently constitutes ~35–40% of fuel cell system cost; reducing BOP complexity and part counts is essential to achieve sub-€50/kW system targets.

-

Component Integration: Emerging trends in integrated air loop assemblies combining compressors, humidifiers, and after-coolers reduce footprint and simplify assembly.

-

Digitalization: Incorporation of IoT-enabled sensors and cloud-based analytics enables real-time performance optimization, remote diagnostics, and predictive maintenance.

-

Modular Architectures: Standardized, modular BOP skid designs facilitate mass manufacturing, rapid deployment, and easy scalability across power ratings from 5 kW to several MW.

-

Regulatory Drivers: Stringent emission regulations (e.g., EU’s Fit for 55, California’s Zero Emission Vehicle mandate) accelerate adoption of fuel cells, indirectly driving BOP demand.

Market Drivers

-

Decarbonization Policies: Global climate goals and incentives for clean energy solutions propel stationary and transport fuel cell uptake.

-

Data Center Backup Power: Fuel cells offer low-emission, reliable backup for mission-critical facilities, requiring robust BOP for continuous operation.

-

Material Handling Electrification: Warehouse and port operators increasingly adopt fuel cell forklifts for rapid refueling and zero-emissions, driving BOP module orders.

-

Automotive FCEVs: Growing models by Toyota, Hyundai, and GM heighten demand for compact, reliable BOP in vehicular power plants.

-

Distributed Generation Growth: Remote and off-grid power applications in telecom, microgrids, and combined heat and power (CHP) systems use fuel cells with advanced BOP for thermal integration.

Market Restraints

-

High Capital Cost: BOP component costs and integration complexity hinder competitiveness against batteries and diesel generators without subsidies.

-

Durability and Reliability: Frequent cycling and harsh operating conditions in some applications necessitate robust BOP designs, increasing R&D and warranty costs.

-

Hydrogen Infrastructure: Limited hydrogen refueling and supply networks constrain market growth, particularly in transportation.

-

System Complexity: Integration of multiple subsystems increases design, manufacturing, and maintenance challenges, requiring specialized engineering skill sets.

-

Standardization Gaps: Lack of global standards for BOP interfaces and performance metrics complicates OEM and supplier collaboration.

Market Opportunities

-

Advanced Manufacturing Techniques: Additive manufacturing and automation can lower BOP component costs and enable rapid prototyping of integrated assemblies.

-

Next-Gen Air Management: Development of oil-free, high-efficiency compressors and novel membrane humidifiers can reduce maintenance and improve system efficiency.

-

Waste Heat Utilization: Optimizing BOP for combined heat and power (CHP) applications in buildings and microgrids enhances overall system economics.

-

Emerging Economies: Growth in Asia-Pacific (Japan, South Korea, China) and the Middle East’s NEOM project present large-scale deployments requiring modular BOP solutions.

-

Aftermarket Services: Remote monitoring and digital twin platforms provide recurring revenue streams through predictive maintenance and performance optimization.

Market Dynamics

-

Supply Side: Consolidation among BOP component suppliers, vertical integration by fuel cell OEMs, and strategic partnerships with compressor and heat exchanger manufacturers drive innovation and cost reduction.

-

Demand Side: Enterprises with sustainability mandates, remote telecom operators, and fleet operators represent high-growth customer segments. BOP customization and rapid deployment capabilities are key buying criteria.

-

Economic Factors: Falling electrolyzer and hydrogen costs, combined with renewable electricity surpluses, enhance fuel cell attractiveness, indirectly stimulating BOP investment. Inflationary pressures on raw materials (aluminum, plastics, electronics) impact component margins.

Regional Analysis

-

North America: Leading due to hydrogen initiatives (U.S. DOE’s Hydrogen Shot, California’s H2 Hub), robust R&D ecosystem in BOP technologies, and early adopter data center deployments.

-

Europe: Driven by EU’s Green Deal, large-scale demonstration projects (e.g., H2Mare offshore hydrogen), and strong interest in CHP applications in Germany and Scandinavia.

-

Asia-Pacific: Japan and South Korea lead in automotive BOP innovation; China aggressively scales stationary and MHE fuel cells, with local content policies fueling domestic BOP suppliers.

-

Latin America: Emerging microgrid and remote telecom projects in Brazil, Chile, and Mexico create nascent demand for integrated BOP in off-grid applications.

-

Middle East & Africa: Investment in hydrogen megaprojects (NEOM, NEOM-ACWA) and solar-hydrogen coupling drives future BOP demand in utility-scale and captive power installations.

Competitive Landscape

Leading Companies in the Global Fuel Cell Balance of Plant (BOP) Market:

- Ballard Power Systems Inc.

- Plug Power Inc.

- Bloom Energy Corporation

- Hydrogenics Corporation

- PowerCell Sweden AB

- SFC Energy AG

- Doosan Fuel Cell America, Inc.

- NEL ASA

- FuelCell Energy, Inc.

- ITM Power plc

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

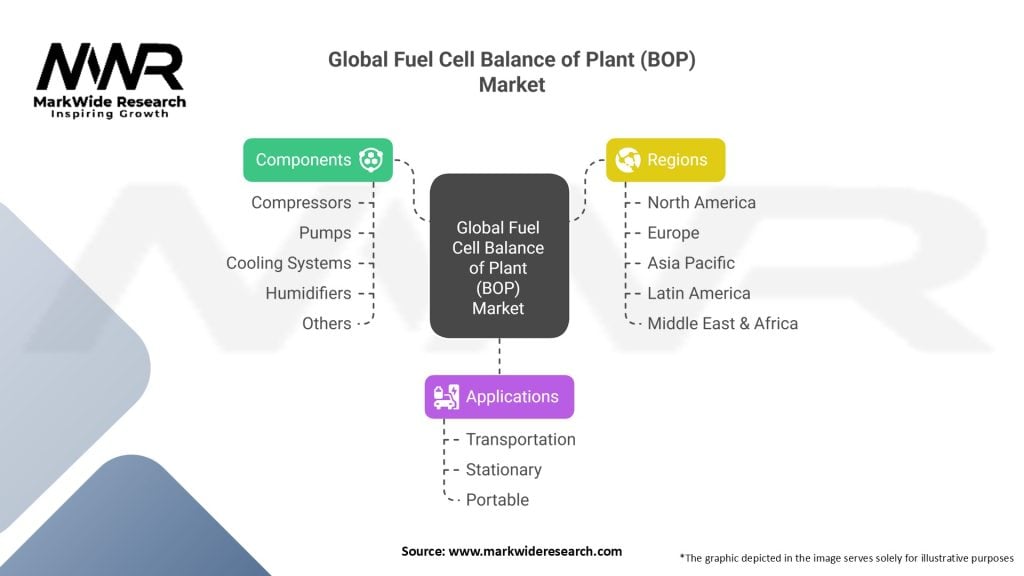

Segmentation

-

By Application:

-

Stationary Power Generation (Data Centers, Telecom, CHP)

-

Material Handling Equipment (Forklifts, Automated Guided Vehicles)

-

Transportation (FCEVs: buses, trucks, trains)

-

Portable and Remote Power

-

-

By Component:

-

Air & Fuel Supply Systems

-

Thermal & Water Management

-

Power Electronics & Controls

-

Safety & Storage Systems

-

Auxiliary Infrastructure (piping, manifolds)

-

-

By Technology:

-

Proton Exchange Membrane (PEMFC) BOP

-

Solid Oxide (SOFC) BOP

-

Alkaline (AFC) BOP

-

-

By End-User:

-

Commercial & Industrial

-

Automotive OEMs

-

Telecom Operators

-

Government & Defense

-

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Category-wise Insights

-

PEMFC BOP: High humidity and low operating temperature (60–80 °C) require robust air humidification and hydrogen purification systems.

-

SOFC BOP: High-temperature (600–800 °C) systems focus on heat exchangers and fuel processing (internal reformation), increasing emphasis on thermal insulation.

-

Automotive BOP: Prioritizes compactness, dynamic control, and vibration resistance; suppliers optimize skids for vehicular packaging constraints.

-

Stationary CHP BOP: Integration with building HVAC and hot water systems demands versatile heat exchangers and control integration.

Key Benefits for Industry Participants and Stakeholders

-

System Optimization: Tailored BOP solutions maximize overall fuel cell system efficiency, uptime, and lifetime, reducing TCO.

-

Regulatory Compliance & Safety: Certified BOP components ensure adherence to hydrogen and pressure vessel codes, mitigating operational risks.

-

Scalability & Modularity: Pre‑engineered BOP skids enable rapid system scaling from kilowatt to megawatt levels.

-

Data-Driven Maintenance: Integrated sensors and cloud analytics facilitate condition-based maintenance, reducing unplanned downtime.

-

Market Differentiation: Innovative BOP designs (e.g., all-in-one air loop modules) provide competitive edge for system integrators and OEMs.

SWOT Analysis

-

Strengths:

• Critical enabler for reliable fuel cell operation.

• Large addressable market across multiple applications.

• High barriers to entry due to technical complexity. -

Weaknesses:

• Significant share of system cost.

• Complexity in integration and maintenance.

• Dependence on nascent hydrogen infrastructure. -

Opportunities:

• Digital twin and AI for predictive maintenance.

• Hybridization with batteries for load management.

• Expanding into maritime and aviation niche markets. -

Threats:

• Rapid battery price declines impacting stationary and transport segments.

• Regulatory uncertainty in hydrogen and fuel cell safety codes.

• Supply chain disruptions for specialized components.

Market Key Trends

-

Digital Twin & Software-Defined BOP: Simulating BOP performance for design optimization and predictive control.

-

All-in-One Modules: Consolidating multiple BOP functions (air, thermal, power electronics) in compact units.

-

Hydrogen Quality Monitoring: Advanced in-line sensors ensuring compliance with ISO 14687 fuel quality standards.

-

Hybrid Energy Systems: Coupling BOP-equipped fuel cells with batteries and renewable sources for microgrid solutions.

-

Lifecycle Sustainability: Use of recyclable materials and end‑of‑life BOP component retrieval for circular economy.

Covid-19 Impact

-

Supply Chain Disruptions: Temporary delays in sourcing compressors, control electronics, and specialty alloys slowed BOP production.

-

CapEx Delays: Some data center and MHE projects deferred, affecting short‑term BOP orders.

-

Accelerated Remote Monitoring: Lockdowns prompted rapid deployment of IoT‑enabled BOP for remote diagnostics.

-

Resilience Focus: Emphasis on reliable backup power solutions increased interest in fuel cell + BOP systems among telecom operators.

Key Industry Developments

-

DOE H2@Scale Funding: U.S. investments in hydrogen R&D include BOP innovations for improved efficiency and cost reduction.

-

Maritime Charter Pilots: Trials of fuel cell + integrated BOP systems for inland vessels in Europe.

-

ISO BOP Interface Standards: Drafting of common mechanical and control interfaces to simplify OEM integration.

-

OEM BOP Alliances: Collaborative consortia (e.g., Hydrogen Council partnerships) driving pre‑qualified BOP modules for OEMs.

-

5G‐Enabled BOP Monitoring: Use of 5G networks for high‑speed telemetric data from fuel cell BOP systems in remote installations.

Analyst Suggestions

-

Standardize Modular Interfaces: Develop and adopt global BOP interface standards (mechanical, control, communication) to reduce customization costs.

-

Invest in Next‑Gen Components: Prioritize R&D in oil‐free compressors, advanced membranes for humidification, and high‐efficiency power electronics.

-

Leverage Digital Platforms: Expand BOP offerings from hardware to Software-as-a-Service (SaaS) for performance monitoring and predictive maintenance.

-

Expand Aftermarket Services: Offer integrated maintenance, spare‑parts subscriptions, and performance optimization services to create recurring revenue.

-

Forge Cross‑Sector Partnerships: Collaborate with battery and renewable energy integrators to package hybrid microgrid solutions combining fuel cells and BOP.

Future Outlook

The Global Fuel Cell BOP Market is set for accelerated growth as fuel cell deployments scale across stationary, material handling, and transport segments. Falling hydrogen costs, maturing supply chains, and digital BOP innovations will collectively reduce system costs and improve reliability. By 2030, modular BOP solutions with plug‑and‑play capabilities and digital twins for real‑time optimization are expected to become standard. Continued policy support for clean hydrogen and ZEV mandates will further amplify BOP demand, positioning the market for strong double-digit CAGR well into the next decade.

Conclusion

Fuel cell Balance of Plant (BOP) systems are indispensable to the commercial viability and operational excellence of fuel cell power plants. As the hydrogen economy and fuel cell adoption accelerate, BOP innovation—encompassing modular design, digital integration, and component cost reduction—will dictate system competitiveness. Stakeholders who invest in standardized, digitally enabled BOP architectures and forge cross‑industry collaborations will capture significant value in this growing market. This comprehensive analysis offers strategic insights into the evolving landscape of fuel cell BOP, guiding manufacturers, integrators, policymakers, and investors toward informed decision‑making and successful market participation.