444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The global electromagnetic flow meter market has witnessed significant growth in recent years. This comprehensive analysis provides valuable insights into the market, covering its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a conclusion.

Meaning:

Electromagnetic flow meters, also known as magmeters, are instruments used to measure the flow rate of conductive fluids. These devices utilize Faraday’s law of electromagnetic induction to calculate the flow rate by measuring the voltage generated as the conductive fluid passes through a magnetic field. They find extensive applications in industries such as water and wastewater management, chemical processing, oil and gas, and pharmaceuticals.

Executive Summary:

The executive summary provides a concise overview of the global electromagnetic flow meter market. It highlights the key findings and insights from the analysis, including market size, growth rate, and major trends. This section serves as a quick reference for industry participants and stakeholders seeking a summary of the market analysis.

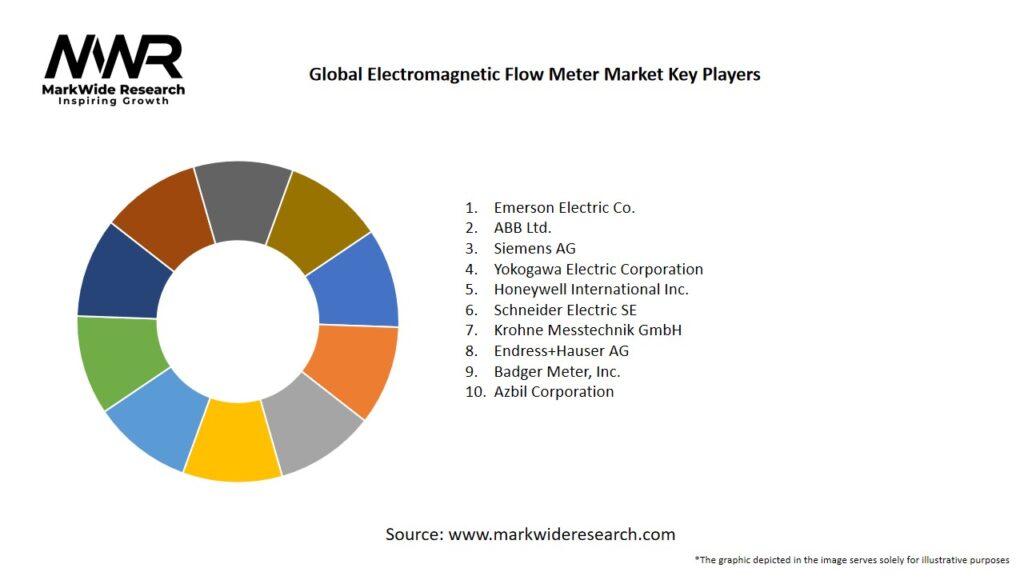

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Digitalization & IIoT Integration: Demand for smart EMFMs with remote monitoring, data logging, and analytics capabilities is accelerating.

Regulatory Compliance: Stringent wastewater discharge standards in North America, Europe, and Asia-Pacific drive adoption in municipal and industrial sectors.

Aging Infrastructure: Retrofit opportunities in mature markets (e.g., Western Europe, North America) support meter replacement and upgrades.

Customized Solutions: Vendors offering liners, coatings, and electrode materials tailored to aggressive fluids gain market share.

Competitive Landscape: A mix of global instrumentation giants (e.g., Endress+Hauser, Krohne, Emerson) and specialized regional players ensures robust innovation.

Market Drivers

Water & Wastewater Treatment Investment:

Governments and utilities worldwide are investing heavily in treatment and distribution networks to address water scarcity and pollution—boosting demand for reliable flow monitoring.

Industry 4.0 & Automation:

The shift toward fully automated plants necessitates flow meters with digital outputs (HART, Modbus, Foundation Fieldbus) and IIoT readiness.

Environmental Regulations:

Regulations such as the U.S. Clean Water Act and EU Water Framework Directive require accurate effluent measurement, favoring high-precision EMFMs.

Energy & Utilities Growth:

Expansion in power generation (especially thermal and hydropower) drives the need for precise cooling water and feedwater flow measurement.

Oil & Gas Process Safety:

In upstream and midstream operations, EMFMs support leak detection, custody transfer, and accurate upstream efficiency monitoring.

Market Restraints

High Capital Expenditure:

EMFMs generally carry a higher purchase cost than mechanical or differential pressure flow meters, limiting adoption in cost-sensitive applications.

Conductivity Requirements:

The technology requires a minimum fluid conductivity (typically >5 µS/cm), restricting use for ultrapure or hydrocarbon-based fluids.

Installation Complexity:

Proper grounding, straight-run requirements (5–10 D upstream, 2–5 D downstream), and piping support add to installation time and cost.

Competition from Alternative Technologies:

Ultrasonic and Coriolis flow meters can challenge EMFMs where conductivity or installation constraints apply.

Legacy Integration Issues:

Integrating IP-enabled EMFMs into older DCS/SCADA systems can require additional gateways or protocol converters, complicating deployment.

Market Opportunities

Emerging Economies Infrastructure:

Rapid industrialization and urbanization in Asia-Pacific, Latin America, and Africa create vast opportunities for EMFM deployment.

Smart City Initiatives:

Urban water networks are implementing digital twins and real-time monitoring platforms—requiring networked EMFMs.

Retrofitting Aging Pipelines:

Replacement of obsolete mechanical meters in refineries, chemical plants, and water utilities supports aftermarket growth.

Customized Solutions for Harsh Environments:

Development of specialty liners (PTFE, PVDF) and remote electronics for hazardous areas expands applicability.

Service & Maintenance Contracts:

As meters become more intelligent, vendors can offer predictive maintenance, calibration, and remote diagnostic services as recurring revenue streams.

Market Dynamics

Supply Side:

– Technological Innovation: Continuous R&D in sensor materials, digital electronics, and low-power wireless communication.

– Cost Optimization: Automated production and modular designs reduce manufacturing costs.

– Strategic Alliances: Partnerships between instrumentation and system integrators drive turnkey solutions.

Demand Side:

– Regulatory Pressure: Ongoing tightening of water quality and emissions standards.

– Sustainability Initiatives: Water reuse, effluent recycling, and circular economy principles emphasize flow monitoring.

– Operational Efficiency: Real-time flow data feeds advanced process control algorithms, reducing energy and chemical consumption.

Economic Factors:

– CAPEX vs OPEX Balancing: Shift toward service-based models and rental/ leasing of instrumentation to offset high upfront costs.

– Global Trade Fluctuations: Depend on oil & gas, chemical, and water infrastructure spending trends.

Regional Analysis

North America:

– Mature Utilities Sector: Widespread EMFM deployment in municipal water, wastewater, and power sectors.

– IIoT Adoption: Aggressive digital transformation in shale plays and industrial plants.

Europe:

– Stringent Environmental Norms: EU directives fuel replacement of older mechanical meters.

– Emphasis on Sustainability: Smart water network pilot projects lead to EMFM integration.

Asia-Pacific:

– Infrastructure Boom: China, India, and Southeast Asia invest heavily in water sanitation, power plants, and petrochemical facilities.

– Cost Sensitivity: Growth of local OEMs offering value-focused EMFMs.

Latin America:

– Water Scarcity: Brazil and Mexico modernize water networks.

– Mining Sector Demand: High use of EMFMs in slurry transport and process water monitoring.

Middle East & Africa:

– Oil & Gas Investments: GCC countries upgrade metering for enhanced safety and process optimization.

– Municipal Projects: South Africa modernizes water infrastructure.

Competitive Landscape

Leading Companies in the Global Electromagnetic Flow Meter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

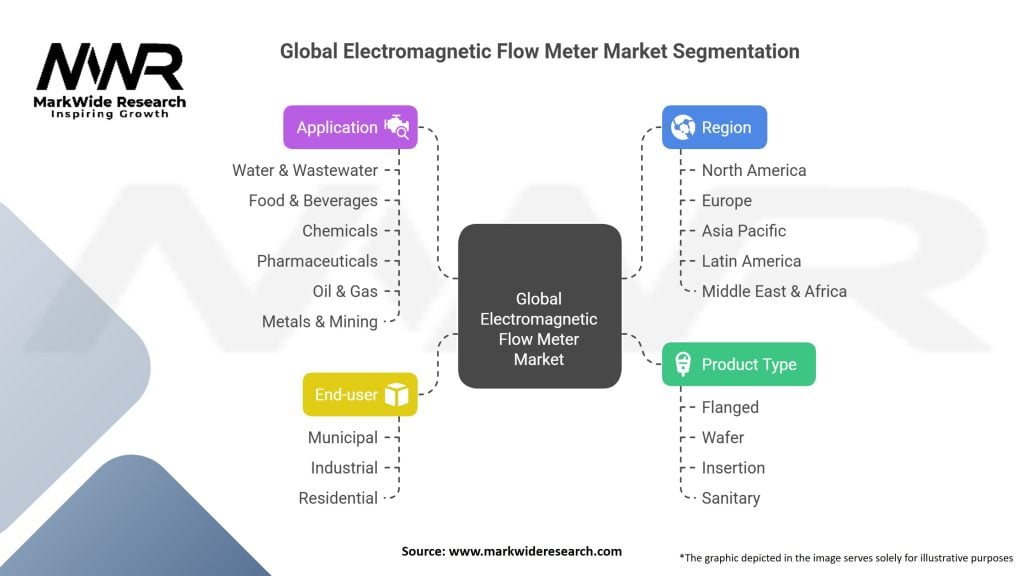

Segmentation

By Product Type:

Insertion EMFMs: For large pipes and retrofit applications.

Full-Bore EMFMs: For new installations requiring highest accuracy.

Subtotalizer & Clamp-on EMFMs: Portable options for spot checks and maintenance.

By End-Use Industry:

Water & Wastewater Treatment

Oil & Gas

Chemicals & Petrochemicals

Power Generation

Mining & Metals

Food & Beverage

By Installation Type:

New Installations

Retrofit/Replacement

By Region:

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Category-wise Insights

Water & Wastewater: Largest segment, driven by stringent effluent and billing requirements.

Oil & Gas: High-value applications for custody transfer, leak detection, and process optimization.

Power: Critical for boiler feedwater and cooling loop monitoring.

Mining: Slurry and process water metering in harsh conditions, requiring specialized liners.

Key Benefits for Industry Participants and Stakeholders

Enhanced Process Control: Accurate flow data supports advanced control loops, improving yield and product quality.

Regulatory Adherence: Reliable measurement ensures compliance with environmental discharge and custody transfer regulations.

Operational Cost Reduction: Preventive maintenance and optimized chemical dosing drive OPEX savings.

Downtime Minimization: Robust design and remote diagnostics reduce unplanned outages.

Data-Driven Insights: Integration with SCADA/DCS and cloud analytics delivers actionable intelligence for continuous improvement.

SWOT Analysis

Strengths:

– Superior accuracy; no moving parts; low maintenance.

– Robust for dirty, abrasive, and corrosive fluids.

Weaknesses:

– Requires conductive fluid; sensitive to electromagnetic interference.

– Higher upfront cost vs alternative meters.

Opportunities:

– IIoT and analytics services; retrofit of aging infrastructure; emerging market growth.

– Service contracts and digital offerings.

Threats:

– Competition from ultrasonic/Coriolis meters; cyber threats targeting networked devices.

– Economic downturns reducing CAPEX.

Market Key Trends

IIoT & Cloud Analytics: Real-time flow monitoring, predictive maintenance, and remote configuration.

Wireless Connectivity (WirelessHART, LoRaWAN): Minimizes wiring, speeds installations, and supports mobile assets.

Energy Harvesting Sensors: Battery-free transmitters leveraging fluid motion or solar power.

Smart Water Networks: Digital twins and GIS integration for holistic asset management.

Sustainability Focus: Low-power, eco-friendly manufacturing and end-of-life recyclability.

Covid-19 Impact

Project Delays: Short-term slowdown in CAPEX projects, but classification as essential services mitigated long-term impact.

Remote Operations: Accelerated adoption of remote commissioning and diagnostics.

Supply Chain Resilience: Vendors diversified manufacturing and stock locations to ensure continuity.

Health & Safety: Contactless calibration and automated testing tools gained traction.

Key Industry Developments

Launch of Smart EMFMs: Integrating edge analytics and Bluetooth commissioning apps.

Acquisition of Niche Players: Large groups enhancing their EMFM portfolios and service reach.

Partnerships with IoT Platforms: Vendors embedding analytics and digital twins into their offerings.

Regional Manufacturing Expansion: Localized production to meet “Make in India” and similar programs.

Standardization Efforts: Industry consortia developing cybersecurity and interoperability standards for flow instrumentation.

Analyst Suggestions

Invest in Digital Services: Develop subscription-based analytics and remote support to foster recurring revenue.

Focus on Retrofit Solutions: Provide easy-to-install insertion meters and portable test rigs for aging installations.

Enhance Cybersecurity: Implement end-to-end encryption and device authentication to protect networked assets.

Expand Aftermarket Services: Calibration, repair, and consulting services can significantly boost margins.

Target Emerging Markets: Customize pricing, support, and training for cost-sensitive regions with growing infrastructure needs.

Future Outlook

The Global Electromagnetic Flow Meter Market is expected to maintain strong growth, driven by:

Digital Transformation: Continued IIoT integration and analytics services.

Infrastructure Upgrades: Water and wastewater network modernization globally.

Sustainability Mandates: Demand for precise resource monitoring under ESG frameworks.

Oil & Gas Greenfield Projects: New facilities in Middle East, Africa, and offshore renewables integration.

Smart Cities: Urban water distribution and smart utility initiatives.

Conclusion

Electromagnetic flow meters are a cornerstone technology for accurate, reliable flow measurement across critical industries. With the convergence of digitalization, sustainability mandates, and infrastructure investments, the market is poised for robust expansion. Stakeholders should capitalize on differentiation through service offerings, retrofit-friendly solutions, and secure, data-driven platforms to prosper in this evolving landscape.

In conclusion, the global electromagnetic flow meter market is poised for significant growth due to the increasing demand for accurate flow measurement solutions across industries. By understanding the market dynamics, leveraging key market insights, and capitalizing on emerging opportunities, industry participants can establish a strong market presence and drive sustainable growth. The future outlook for the electromagnetic flow meter market remains promising, driven by advancements in technology and the continuous need for efficient flow measurement solutions.

Global Electromagnetic Flow Meter Market

| Segmentation | Details |

|---|---|

| Product Type | Flanged, Wafer, Insertion, Sanitary |

| Application | Water & Wastewater, Food & Beverages, Chemicals, Pharmaceuticals, Oil & Gas, Metals & Mining |

| End-user | Municipal, Industrial, Residential |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Electromagnetic Flow Meter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at