444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global automotive vehicle oxidation catalyst market has witnessed significant growth in recent years. An oxidation catalyst is a crucial component of a vehicle’s exhaust system, designed to convert harmful gases emitted during combustion into less harmful substances. This market analysis aims to provide comprehensive insights into the current state and future prospects of the global automotive vehicle oxidation catalyst market.

An automotive vehicle oxidation catalyst is a device that facilitates the oxidation of harmful exhaust gases emitted from internal combustion engines. It uses precious metals such as platinum, palladium, and rhodium as catalysts to promote chemical reactions that convert carbon monoxide (CO) and unburned hydrocarbons (HC) into carbon dioxide (CO2) and water vapor (H2O). By reducing the emission of harmful pollutants, oxidation catalysts contribute to environmental protection and improved air quality.

Executive Summary:

The executive summary of the global automotive vehicle oxidation catalyst market analysis provides a concise overview of the key findings and insights derived from the comprehensive research. It highlights the market’s growth potential, major trends, key drivers and restraints, and competitive landscape. This summary serves as a quick reference for industry participants and stakeholders to grasp the essence of the market analysis.

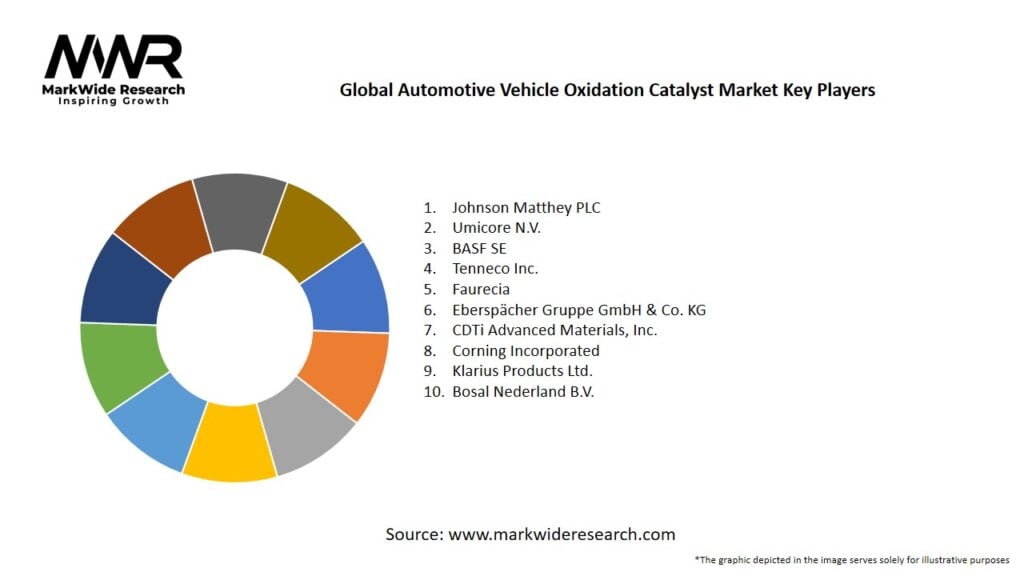

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regulatory Pressure: Governments globally are tightening tailpipe emission norms, with Euro 7 regulations on the horizon and China’s National VI (Stage 6B) standards already in effect.

Diesel Oxidation Catalyst Demand: Despite declining diesel passenger car sales in Europe, diesel LCVs and HDVs continue to drive DOC adoption in Asia-Pacific and Latin America.

Precious Metal Load Optimization: Innovations in washcoat microstructures are reducing the amount of platinum group metals (PGMs) required, lowering material costs.

Catalyst Recycling Programs: Closed-loop PGM recycling programs are becoming integral to cost management and sustainability practices.

Aftermarket Growth: Aging vehicle populations in North America and Europe sustain strong demand for replacement oxidation catalysts.

Market Drivers

Stringent Emission Norms: Implementation of stricter regulations such as Euro 6d, Euro 7, China VI, and U.S. EPA Tier 3 increases the need for advanced oxidation catalysts.

Diesel Commercial Vehicle Growth: In emerging markets, the expansion of freight and logistics sectors drives diesel engine registrations, fueling DOC installations.

Technological Advances: Development of high-activity catalyst formulations and substrate technologies (e.g., metal foils, micro-ceramics) enhances conversion efficiency and durability.

Consumer and Corporate Sustainability Goals: Automakers’ commitments to reducing CO₂ and smog-forming pollutants encourage adoption of next-generation catalysts.

Aftermarket and Retrofits: Aging exhaust systems in older vehicles require replacement catalysts, creating steady aftermarket demand.

Market Restraints

Electrification Trend: Growing penetration of electric vehicles (EVs) may reduce internal combustion engine (ICE) vehicle sales, impacting long-term catalyst demand.

Precious Metal Volatility: Fluctuating platinum, palladium, and rhodium prices can squeeze manufacturer margins and lead to higher end-customer prices.

Complexity of Hybrid Powertrains: Integrating catalysts into start-stop and mild-hybrid systems poses engineering challenges, potentially increasing development costs.

Regulatory Uncertainty: Delays or rollbacks in emission standards—such as in the U.S.—can disrupt market forecasts and investment plans.

Competition from Alternative Technologies: Emerging non-PGM catalysts and aftertreatment approaches (urea-SCR, ammonia injection) may encroach on oxidation catalyst applications.

Market Opportunities

Development of Non-PGM Catalysts: Research into base metal catalysts (e.g., copper, manganese) could reduce reliance on expensive PGMs.

Modular Catalyst Systems: Designing modular exhaust aftertreatment modules enables easier upgrades to meet future regulations.

Global Fleet Renewal Programs: Scrappage schemes in Europe and Asia-Pacific present opportunities for new catalyst installations.

Integration with IoT and Diagnostics: Smart catalysts with embedded sensors for real-time performance monitoring can improve maintenance and compliance.

Catalyst Recycling and Sustainability: Expanding PGM recovery and recycling facilities supports a circular economy and cost reduction.

Market Dynamics

Supply Side: PGM supply chains are concentrated, with recycling accounting for ~30% of global PGM supply. Technological innovation in washcoat and substrate manufacturing drives cost efficiencies.

Demand Side: Vehicle production volumes, emission standard ramp-ups, and regional fuel quality (sulfur levels, biofuel blends) directly influence catalyst requirements.

Economic Factors: Global GDP growth rates, automotive manufacturing indices, and commodity price fluctuations affect market expansion and investment cycles.

Regional Analysis

Asia-Pacific: Largest market share (~40%) due to high production volumes in China, India, Japan, and Southeast Asia; rapid commercial vehicle growth sustains DOC demand.

Europe: Strong regulatory environment (Euro 6d, upcoming Euro 7) and established OEM base drive TWC and DOC applications; mature aftermarket.

North America: Moderate growth; U.S. EPA Tier 3 and Canadian emission rules ensure steady demand; rising HDV registrations support diesel DOC installations.

Latin America: Emerging market potential; Brazil and Mexico lead adoption as vehicle parc modernizes; uneven fuel quality poses technical challenges.

Middle East & Africa: Early-stage growth; major Gulf states investing in environmental regulation; infrastructure for catalyst recycling still developing.

Competitive Landscape

Leading Companies in the Global Automotive Vehicle Oxidation Catalyst Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

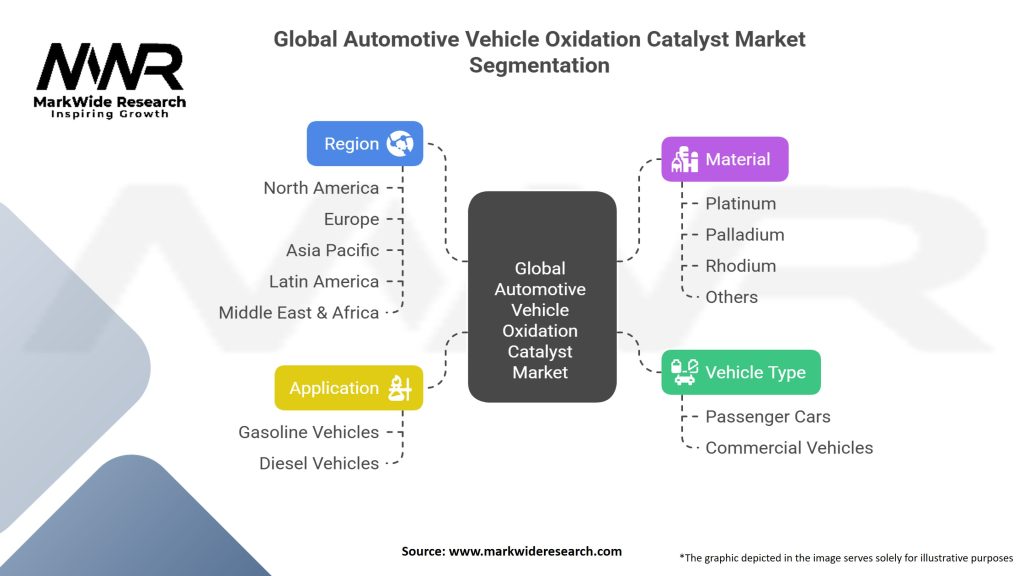

Segmentation

By Catalyst Type:

Three-Way Catalysts (TWC)

Diesel Oxidation Catalysts (DOC)

Combined DOC + DPF (Diesel Particulate Filter) Modules

Lean NOₓ Traps (LNT)

By Vehicle Type:

Passenger Cars

Light Commercial Vehicles (LCV)

Heavy Duty Vehicles (HDV)

Two-Wheelers (in select markets)

By Substrate Material:

Ceramic Monolith

Metallic Foil

By Distribution Channel:

OEM

Aftermarket

By Region:

Asia-Pacific

Europe

North America

Latin America

Middle East & Africa

Category-wise Insights

Three-Way Catalysts: Essential for gasoline engines; face ultra-low sulfur gasoline requirements and direct-injection emission challenges.

Diesel Oxidation Catalysts: Key for reducing CO and HC in diesel engines; feed gas quality and low-temperature light-off performance are critical.

Combined DOC + DPF Modules: Address both gas-phase and particulate emissions; increasing adoption in Euro 6d and beyond.

Lean NOₓ Traps: Niche for lean-burn and gasoline direct-injection engines; challenged by durability under thermal cycling.

Key Benefits for Industry Participants and Stakeholders

Regulatory Compliance: Enables OEMs to meet evolving emission standards, avoiding fines and market access restrictions.

Brand Reputation: High-efficiency catalysts support automaker sustainability goals and consumer perceptions of environmental responsibility.

Operational Savings: Optimized PGM usage and improved light-off performance reduce fuel penalty and system costs over vehicle life.

Aftermarket Revenue: Replacement catalysts represent a significant revenue stream, especially in mature vehicle parks.

Recycling Value: PGM recovery from spent catalysts generates additional revenue and reduces dependence on mined metals.

SWOT Analysis

Strengths:

· Proven technology with decades of performance data

· High conversion efficiencies (>90% of CO and HC)

Weaknesses:

· Heavy reliance on volatile PGM supply

· Complex integration in hybrid and start-stop powertrains

Opportunities:

· Non-PGM catalyst development

· Digital diagnostics and IoT-enabled maintenance

Threats:

· Accelerated EV adoption reducing ICE vehicle population

· Potential regulatory shifts delaying Euro 7 implementation

Market Key Trends

Light-Off Temperature Reduction: Catalyst designs focusing on ultra-fast light-off at low exhaust temperatures, critical for cold-start emission control.

Non-PGM Research: Pilot programs exploring manganese oxide, perovskite, and spinel catalysts as cost-effective alternatives.

Miniaturization: Compact catalyst substrates for hybrid powertrains and start-stop vehicles to reduce weight and volume.

Sensor-Integrated Catalysts: In-situ monitoring of catalyst health and conversion efficiency, enabling predictive maintenance.

Circular Economy Initiatives: Expansion of PGM recycling networks in Asia-Pacific and Latin America to secure material supply.

Covid-19 Impact

Production Disruptions: Temporary shutdowns in automotive plants led to reduced catalyst demand in 2020–21.

Shift in Vehicle Use: Lower vehicle miles traveled (VMT) initially decreased exhaust emissions, delaying replacement catalyst uptake.

Supply Chain Resilience: Manufacturers diversified supplier bases and expanded regional recycling to mitigate PGM supply risks.

Acceleration of Digital Solutions: Increased adoption of remote diagnostics and virtual commissioning for exhaust systems.

Key Industry Developments

BASF’s Light-Off Catalyst: Commercial launch of an ultra-low‑temperature light‑off catalyst for gasoline direct-injection engines.

Johnson Matthey’s Ceramic Innovations: Introduction of a new ceramic monolith with 20% reduced precious metal loading.

Umicore’s PGM Recovery Plant: Expansion of a PGM recycling facility in China to meet Asia-Pacific demand.

Tenneco–GM Partnership: Joint development of modular DOC + DPF solutions optimized for GM’s new diesel platforms.

Heraeus–Valeo Collaboration: Pilot program integrating sensor-enabled catalysts in heavy-duty applications for real-time performance tracking.

Analyst Suggestions

Diversify Precious Metal Sources: Secure supply through off-take agreements and recycled feedstocks to mitigate price volatility.

Invest in Non-PGM R&D: Accelerate development of alternative catalysts to reduce material costs and dependence on PGMs.

Enhance Digital Aftermarket Services: Leverage IoT and data analytics to offer predictive maintenance and extended warranties.

Focus on Emerging Markets: Expand manufacturing footprint and recycling infrastructure in high-growth regions like India and Latin America.

Collaborate on Standards: Participate in industry consortiums to develop harmonized testing and performance standards for next-generation catalysts.

Future Outlook

The Global Automotive Vehicle Oxidation Catalyst Market is expected to maintain steady growth through 2030, underpinned by:

Regulatory Momentum: Continued tightening of emission norms across key markets.

Technological Innovation: Ongoing advancements in catalyst formulations and sensor integration.

Aftermarket Resilience: Replacement demand driven by aging global vehicle fleets.

Sustainability Focus: Expanded recycling and circular economy initiatives enhancing PGM supply stability.

Though the shift toward electrified powertrains poses a long-term challenge, hybrid and ICE vehicles will remain prevalent for the next decade, ensuring sustained demand for oxidation catalysts. Manufacturers and stakeholders who invest in cost-competitive technologies, robust supply chains, and digital service offerings will capture the greatest value from this evolving market.

Conclusion:

The global automotive vehicle oxidation catalyst market is witnessing significant growth driven by strict emission standards, environmental concerns, and increasing consumer awareness. However, challenges such as high costs and technological advancements need to be addressed. By capitalizing on emerging opportunities, investing in research and development, and staying abreast of market trends, industry participants can position themselves for sustainable growth in this dynamic market.

What is the Global Automotive Vehicle Oxidation Catalyst?

The Global Automotive Vehicle Oxidation Catalyst refers to a component used in vehicles to convert harmful exhaust gases into less harmful emissions, playing a crucial role in meeting environmental regulations and improving air quality.

Which companies are leading in the Global Automotive Vehicle Oxidation Catalyst market?

Leading companies in the Global Automotive Vehicle Oxidation Catalyst market include BASF, Johnson Matthey, and Umicore, among others.

What are the key drivers of growth in the Global Automotive Vehicle Oxidation Catalyst market?

Key drivers of growth in the Global Automotive Vehicle Oxidation Catalyst market include increasing vehicle production, stringent emission regulations, and the rising demand for fuel-efficient vehicles.

What challenges does the Global Automotive Vehicle Oxidation Catalyst market face?

Challenges in the Global Automotive Vehicle Oxidation Catalyst market include the high cost of raw materials, technological complexities in catalyst design, and competition from alternative emission reduction technologies.

What future opportunities exist in the Global Automotive Vehicle Oxidation Catalyst market?

Future opportunities in the Global Automotive Vehicle Oxidation Catalyst market include advancements in catalyst technology, the growth of electric vehicles, and increasing investments in sustainable automotive solutions.

What trends are shaping the Global Automotive Vehicle Oxidation Catalyst market?

Trends shaping the Global Automotive Vehicle Oxidation Catalyst market include the development of more efficient catalysts, the integration of smart technologies in vehicles, and a shift towards hybrid and electric vehicle platforms.

Global Automotive Vehicle Oxidation Catalyst Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Material | Platinum, Palladium, Rhodium, Others |

| Application | Gasoline Vehicles, Diesel Vehicles |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Automotive Vehicle Oxidation Catalyst Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at