444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Inhalation and nasal spray generic drugs play a crucial role in the pharmaceutical industry, offering cost-effective alternatives to brand-name medications. This market analysis aims to provide a comprehensive understanding of the inhalation and nasal spray generic drugs market, including its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and conclusion.

Inhalation and nasal spray generic drugs refer to pharmaceutical products that are similar to their brand-name counterparts in terms of active ingredients, dosage form, strength, and route of administration. These drugs are developed and approved by regulatory authorities after the expiration of the patent protection of the original brand-name drugs. Inhalation and nasal spray generic drugs offer a cost-effective option for patients and healthcare providers, ensuring access to essential medications while maintaining quality standards.

Executive Summary

The executive summary of the inhalation and nasal spray generic drugs market analysis provides a concise overview of the key findings, market trends, and opportunities. It highlights the market’s growth potential, challenges faced by industry participants, and key factors driving the market’s growth. The executive summary aims to provide a snapshot of the market landscape and serve as a quick reference for decision-makers and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Patent Expirations: Over the next five years, major branded inhalers (e.g., combination corticosteroid-LABA MDIs) will face generic competition, unlocking multi-billion-dollar opportunities.

Cost Savings: Health-economic analyses demonstrate 30–50% cost reductions when switching to generic inhalers and sprays, driving formulary inclusion.

Device Innovation: Superior DPI technologies and low-environmental-impact propellant MDIs (HFA-based) are differentiating generic offerings.

Regulatory Complexity: Bioequivalence for inhalation generics requires rigorous in vitro performance and, in many jurisdictions, limited clinical bridging studies.

Emerging Markets: Countries like India and Brazil are expanding generic manufacturing capacity and streamlining approvals to improve access.

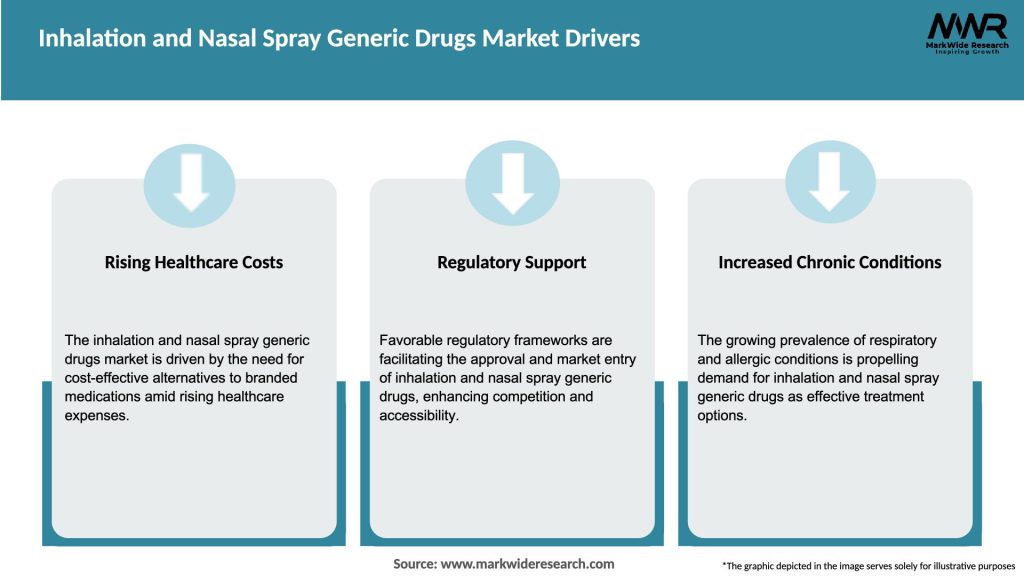

Market Drivers

Rising Respiratory Disease Burden: Increasing asthma and COPD prevalence—projected to affect over 400 million people globally—drives demand for maintenance inhalers.

Healthcare Cost Containment: Payers and government programs favor generics to reduce drug expenditure and expand patient coverage.

Growing Allergy Incidence: Escalating rates of allergic rhinitis and sinusitis boost nasal spray usage year-round.

Environmental Regulations: Transition from CFC to HFA propellants in MDIs has leveled the playing field for generic entrants.

Enhanced Patient Access: Expanded generic drug policies and accelerated approval pathways in emerging economies facilitate market entry.

Market Restraints

Regulatory Hurdles: Demonstrating device equivalence and mucosal deposition profiles adds complexity versus oral generics.

Perceived Quality Concerns: Some clinicians and patients remain cautious about switching from well-known branded inhalers.

Supply Chain Dependencies: API shortages and specialized device component constraints can disrupt manufacturing.

Reimbursement Variability: Inconsistent coverage policies across regions may limit generic substitution.

User Technique Issues: Incorrect inhaler or spray technique can undermine therapeutic equivalence, requiring patient education.

Market Opportunities

Propellant-Free Devices: Investment in breath-actuated DPIs that avoid HFA propellants appeals to environmentally conscious markets.

Combination Generics: Development of multi-drug generic inhalers (e.g., ICS + long-acting muscarinic antagonist) after patent cliffs.

Digital Inhalers: Adding dose-tracking sensors to generics offers adherence monitoring and value-added service models.

Local Partnerships: Licensing alliances with regional manufacturers accelerate market penetration in APAC and Latin America.

OTC Switch Potential: Some nasal decongestants and antihistamines may shift to over-the-counter status, broadening consumer reach.

Market Dynamics

Price Erosion: Rapid price declines—up to 80% within 12 months of generic entry—benefit payers but narrow margins for manufacturers.

Device Standardization: Industry efforts to harmonize inhaler interfaces could reduce training burdens and device-specific challenges.

Formulary Competition: Pharmacy benefit managers (PBMs) use aggressive contracting to steer prescriptions to select generic brands.

Education Programs: Manufacturers collaborate with HCPs on inhaler technique training to support generic adoption.

Sustainability Initiatives: Environmental targets drive interest in lower-carbon inhaler options, favoring certain generic technologies.

Regional Analysis

North America: Largest share driven by high per-capita inhaler use and supportive generic policies; CMS and Medicaid programs emphasize switching.

Europe: High generic penetration in countries like Germany and UK; shared-savings programs encourage generic inhaler trials.

Asia Pacific: Fastest CAGR; governments in China and India expanding generic API production and local device assembly.

Latin America: Growing awareness and insurance coverage of respiratory generics; Brazil leads with robust local manufacturing.

Middle East & Africa: Early-stage market; reliance on imported generics but poised for growth as healthcare infrastructure improves.

Competitive Landscape

Leading Companies in the Inhalation and Nasal Spray Generic Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

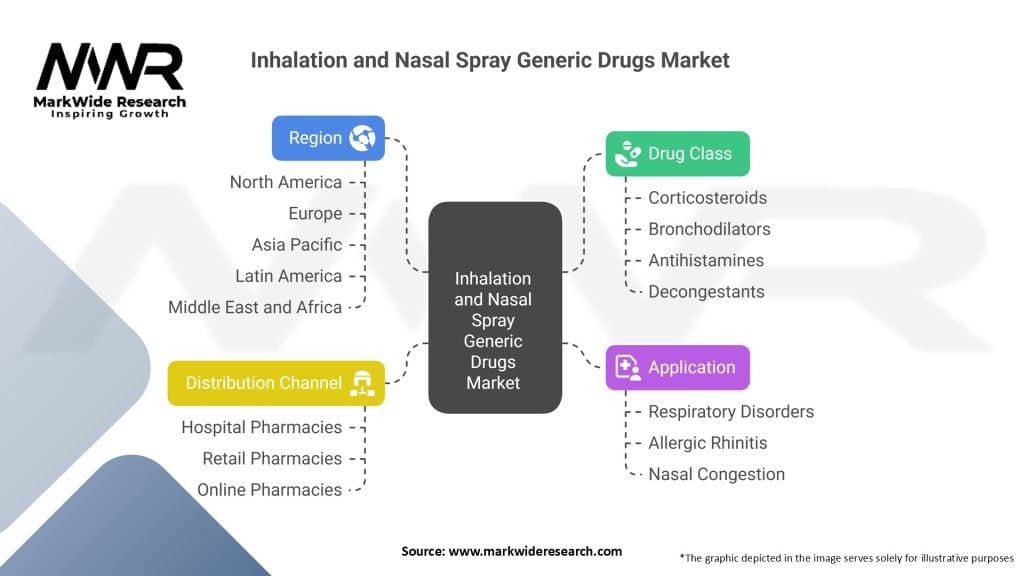

Segmentation

By Product Type: MDIs, DPIs, Nebulizer Solutions, Nasal Sprays.

By Therapeutic Class: Corticosteroids, β₂-Agonists, Anticholinergics, Antihistamines, Decongestants.

By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies.

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Category-wise Insights

MDIs: Require matching propellant formulations and actuator geometries for dose uniformity; HFA generics see steady uptake.

DPIs: Growing fastest due to environmental advantages; device resistance profiles and powder flow characteristics are critical.

Nebulizer Solutions: Less device complexity but face competition from portable inhalers; focus on cost and sterility.

Nasal Sprays: Broad OTC potential; ease of manufacturing and minimal device variability aid rapid generic launches.

Key Benefits for Industry Participants and Stakeholders

Cost Reduction: Generics deliver substantial savings for healthcare systems and patients.

Expanded Access: Lower prices improve therapy adherence and outcomes in underserved populations.

Portfolio Diversification: Brand-originator firms can supplement revenue by launching authorized generics.

Environmental Impact: Transition to propellant–free devices reduces greenhouse gases associated with MDIs.

Value-Added Services: Digital dose trackers and patient support programs differentiate generic offerings.

SWOT Analysis

Strengths:

Established regulatory pathways for inhalation and nasal generics.

Strong demand driven by chronic respiratory and allergy incidence.

Weaknesses:

Technical complexities in device-drug equivalence studies.

Rapid price erosion compresses margins.

Opportunities:

Digital inhalers and adherence monitoring as premium add-ons.

Growth in combination and propellant-free formulations.

Threats:

Stringent device-specific regulations delaying approvals.

Supply chain constraints for specialized elastomers, plastics, and APIs.

Market Key Trends

Digital Health Integration: Generic inhalers with smart sensors to capture usage data and improve adherence.

Green Propellants: Development of low-GWP (global warming potential) propellants for next-generation MDIs.

Combination Therapies: Launch of multi-agent generic inhalers post-patent expiry of branded combinations.

Regulatory Harmonization: Moves toward unified global guidelines for bioequivalence of inhalation products.

Patient-Centric Design: Ergonomic inhaler shapes and intuitive feedback mechanisms to aid correct use.

Covid-19 Impact

The pandemic heightened demand for nebulized therapies and nasal sprays to alleviate respiratory symptoms, temporarily straining supply chains for generics. Telemedicine protocols increased reliance on patient-managed inhalers. Regulatory agencies offered expedited review pathways, accelerating approvals for critical generics. Post-pandemic, focus on respiratory health and preparedness sustains elevated interest in affordable inhalation therapies.

Key Industry Developments

FDA’s Final Guidance: New draft guidance clarifying in vitro and in vivo requirements for MDI and DPI generics.

Teva’s HFA MDI Launch: Entry of a lower-cost generic budesonide/formoterol MDI in the U.S. market.

Sandoz Digital Inhaler: Pilot program integrating dose-capture sensors into a generic DPI platform.

Cipla–Boehringer Partnership: Local manufacture of COPD generic inhalers in Latin America under license.

API Consortium Initiatives: Industry consortium formed to secure stable supply of key respiratory APIs.

Analyst Suggestions

Invest in Device R&D: Prioritize robust performance testing and user usability studies to support rapid approvals.

Embrace Digital Add-Ons: Collaborate with tech partners to integrate sensors and patient-support apps.

Diversify Supply Chains: Establish multiple API and device-component sources to mitigate shortages.

Engage Clinicians: Launch education programs highlighting equivalence and cost benefits to build prescriber confidence.

Future Outlook

The Inhalation and Nasal Spray Generic Drugs market is projected to grow at a CAGR of 5–7% over the next five years, driven by continued patent expiries and expanding access in emerging markets. Environmental policies promoting propellant-free devices, combined with digital health integration, will shape the next wave of generics. As healthcare systems globalize their formularies, generics will solidify their role as first-line respiratory and allergy therapies, ensuring broad patient access and system-wide cost savings.

Conclusion

The Inhalation and Nasal Spray Generic Drugs market stands at the intersection of public health need, cost containment, and technological innovation. By delivering bioequivalent, device-optimized therapies at lower prices, generic manufacturers not only alleviate financial burdens but also enhance patient adherence and outcomes. Stakeholders who invest in advanced device platforms, digital health integrations, and diversified supply chains will lead this dynamic market—driving sustainability, affordability, and improved respiratory health worldwide.

What are inhalation and nasal spray generic drugs?

Inhalation and nasal spray generic drugs are pharmaceutical products designed for delivery through the respiratory system or nasal passages. They are often used to treat conditions such as asthma, allergies, and respiratory infections, providing an alternative to brand-name medications.

What companies are leading the inhalation and nasal spray generic drugs market?

Key players in the inhalation and nasal spray generic drugs market include Teva Pharmaceutical Industries, Mylan N.V., and Sandoz, among others. These companies are known for their extensive portfolios of generic medications and their commitment to expanding access to affordable treatments.

What are the main drivers of growth in the inhalation and nasal spray generic drugs market?

The growth of the inhalation and nasal spray generic drugs market is driven by factors such as the increasing prevalence of respiratory diseases, the rising demand for cost-effective medication options, and advancements in drug delivery technologies. Additionally, the growing awareness of the benefits of generic drugs contributes to market expansion.

What challenges does the inhalation and nasal spray generic drugs market face?

The inhalation and nasal spray generic drugs market faces challenges such as stringent regulatory requirements, the complexity of manufacturing processes, and competition from branded products. These factors can hinder the entry of new players and affect the overall market dynamics.

What opportunities exist in the inhalation and nasal spray generic drugs market?

Opportunities in the inhalation and nasal spray generic drugs market include the potential for developing new formulations and delivery systems, as well as expanding into emerging markets. The increasing focus on personalized medicine and patient-centric approaches also presents avenues for growth.

What trends are shaping the inhalation and nasal spray generic drugs market?

Current trends in the inhalation and nasal spray generic drugs market include the rise of biologics and biosimilars, the integration of digital health technologies, and the growing emphasis on sustainability in drug manufacturing. These trends are influencing product development and market strategies.

Inhalation and Nasal Spray Generic Drugs Market:

| Segmentation | Details |

|---|---|

| Drug Class | Corticosteroids, Bronchodilators, Antihistamines, Decongestants, Others |

| Application | Respiratory Disorders, Allergic Rhinitis, Nasal Congestion, Others |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Inhalation and Nasal Spray Generic Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at