444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Global Petroleum and Diesel Retail market encompasses the distribution and sale of refined petroleum products—primarily gasoline (petrol) and diesel—to end consumers via service stations, convenience stores, and commercial outlets. Despite surging interest in alternative fuels, petroleum and diesel remain the dominant transport fuels worldwide, owing to their high energy density, established infrastructure, and broad vehicle compatibility. Growth is driven by rising vehicle parc in emerging economies, international trade flows affecting crude and refined-product prices, and evolving retail models integrating non-fuel offerings. At the same time, environmental regulations, electrification trends, and fluctuating crude oil markets influence retail network strategies, product portfolios, and margin structures.

Meaning

Petroleum and diesel retail refers to the downstream segment of the oil value chain in which refined fuels are sold directly to motorists, fleet operators, and industrial users. Retail channels include company-owned stations, dealer-operated outlets, franchise networks, and hypermarket forecourts. Operators manage fuel procurement, storage, quality control, pricing, and ancillary services—food & beverage, auto-services, loyalty programs—to maximize site profitability. Retail margins depend on wholesale-to-retail price spreads, refined product crack spreads, local taxes, and non-fuel revenue streams.

Executive Summary

The Global Petroleum and Diesel Retail market is at a crossroads: traditional fuel volumes continue growing in Asia Pacific, Latin America, and Africa, while demand plateaus or declines in parts of Europe and North America due to energy-transition policies and EV adoption. Key players are investing in network optimization—closing underperforming sites, investing in high-margin convenience and EV charging, and deploying digital pricing tools. Consolidation among refiners, oil majors, and retail chains is reshaping competitive dynamics. Simultaneously, upstream price volatility and regulatory shifts on sulfur content, carbon pricing, and biofuel mandates are pressuring margins and reshaping product blends sold at retail pumps.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regional Volume Divergence: Asia Pacific accounts for over 40% of global diesel retail volumes, driven by commercial transport and off-road demand, while Western Europe sees flat to declining volumes.

Margin Pressures: Average retail margin per liter ranges from USD 0.05–0.15 globally, with non-fuel revenues (15–30% of site income) critical for overall profitability.

Network Rationalization: Up to 10% of global retail sites are forecast to close or convert to high-margin formats by 2028, as operators optimize for urban mobility trends.

Biofuel Integration: Mandates for B7–B10 diesel blends in North America and Europe, and up to B20 in Southeast Asia, require retail modifications—add-on pumps and labeling.

Digitalization & Loyalty: Mobile apps, dynamic pricing, and personalized loyalty schemes are boosting forecourt throughput by up to 5% in digitally matured markets.

Market Drivers

Vehicle Fleet Growth: Rising ownership rates in emerging markets stimulate retail fuel demand, especially for diesel in commercial transport and agriculture.

Economic Activity: Industrial output and freight movement intensity correlate directly with diesel retail volume growth.

Convenience Retailing: Combining fuel with high-margin convenience offerings drives footfall and revenue diversification.

Oil Price Trends: Lower crude prices can improve consumer demand but compress crack spreads, influencing retail pricing strategies.

Regulatory Mandates: Environmental regulations—sulfur limits, GHG reduction targets, biofuel blending—shape product offerings and station investments.

Market Restraints

Electrification: Growing EV penetration in Europe and China dampens gasoline and diesel volume growth over time.

Alternative Fuels: Hydrogen and CNG/ LNG refueling adoption in commercial fleets introduces competition in certain regions.

Taxation & Duties: High excise taxes on petroleum in some markets reduce consumer volumes and margin flexibility.

Site Overcapacity: Markets like the U.S. and Europe face fuel-retail over-saturation, leading to price wars and site closures.

Infrastructure Costs: Upgrading retail sites for biofuels, low-sulfur diesel, and renewable diesel blends requires significant CAPEX.

Market Opportunities

Renewable Diesel & SAF: Retail of hydrotreated vegetable oil (HVO) and sustainable aviation fuel (SAF) alongside diesel in transport hubs and airports.

EV Charging Integration: Forecourt electrification—fast chargers at high-traffic retail sites—to capture new mobility revenues.

Digital Ecosystems: Apps for pre-payment, remote fueling, and personalized offers can increase spend per visit.

Fleet Solutions: Dedicated B2B diesel card programs and on-site bunkering for large logistics operators.

Value-Added Services: Car wash, quick-service restaurants, and micro-fulfillment centers enhance site economics.

Market Dynamics

Consolidation: M&A among oil majors, refiners, and supermarket chains is concentrating market share in key regions.

Vertical Integration: E&P companies acquiring retail chains secure downstream outlets and hedge crack-spread volatility.

Franchising Growth: Franchise models reduce operator CAPEX and allow rapid network expansion with lower corporate risk.

Dynamic Pricing: Automated price adjustments based on wholesale indices and competitor moves optimize margins.

Sustainability Reporting: ESG commitments from major players drive investment in lower-emission fuels and site decarbonization.

Regional Analysis

Asia Pacific: Fastest-growing region; diesel remains preferred for heavy transport, with B20 mandates in Thailand and Indonesia.

North America: Mature market; C-store integration leads retail; EV-charging rollout accelerated in California and major metro areas.

Europe: Declining gasoline volumes; robust diesel demand in Eastern Europe; strong push for renewable diesel and EV infrastructure in Western Europe.

Latin America: Growing diesel volumes tied to freight and agriculture; high site density in Brazil and Mexico.

Middle East & Africa: High retail margins in GCC; retail expansion in Sub-Saharan Africa with foreign-investor chains entering underdeveloped networks.

Competitive Landscape

Leading Companies in the Global Petroleum and Diesel Retail Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

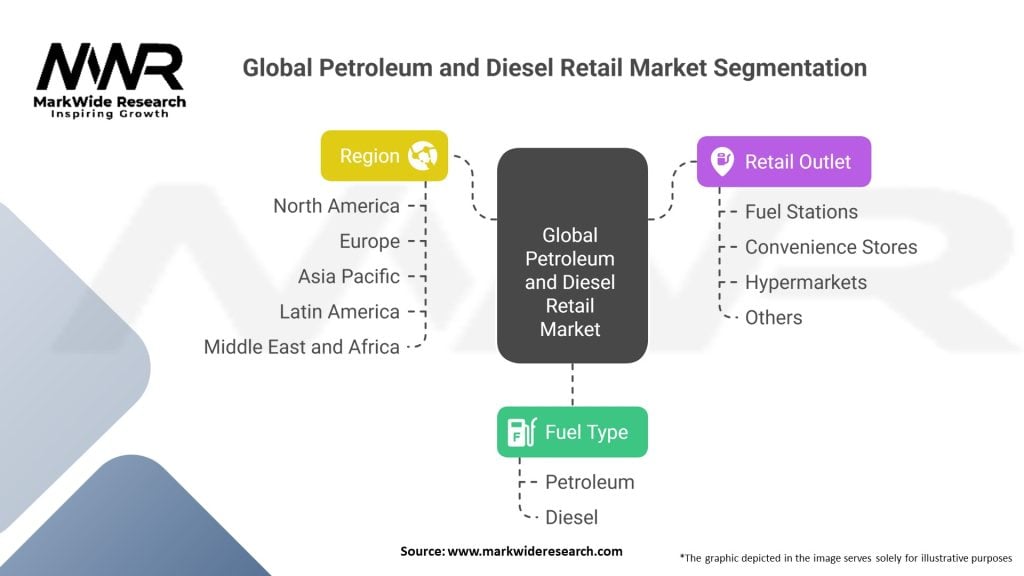

Segmentation

The global petroleum and diesel retail market can be segmented based on product type, distribution channel, and geography. By product type, the market includes gasoline, diesel, aviation fuel, and lubricants, among others. Distribution channels encompass gas stations, convenience stores, hypermarkets/supermarkets, and online retailing. Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the petroleum and diesel retail market can benefit from:

SWOT Analysis

Strengths:

Established global infrastructure and brand recognition.

Diversified revenue streams beyond fuel.

Ability to leverage upstream supply integration.

Weaknesses:

Thin fuel margin susceptible to price wars.

High fixed costs for network maintenance.

Legacy site footprints in declining-volume markets.

Opportunities:

EV charging and alternative-fuel station conversion.

Digital ecosystems and subscription models.

Expansion into under-served emerging markets.

Threats:

Accelerating EV adoption reducing core fuel volumes.

Regulatory headwinds: carbon taxes, methane emissions, ban on ICE vehicle sales.

Competition from new mobility solutions (shared micro-mobility, hydrogen).

Market Key Trends

Covid-19 Impact

The global petroleum and diesel retail market faced significant disruptions due to the COVID-19 pandemic. The imposition of lockdowns, travel restrictions, and reduced economic activity resulted in a decline in fuel consumption. However, as economies recover and travel restrictions ease, the market is expected to regain momentum, driven by pent-up demand and the resumption of economic activities.

Key Industry Developments

Analyst Suggestions

Based on the market analysis, industry analysts provide the following suggestions for market participants:

Future Outlook

The global petroleum and diesel retail market is expected to witness steady growth in the coming years. Factors such as population growth, urbanization, and increasing energy demands will drive market expansion. However, the market will also face challenges related to environmental concerns and the transition to alternative fuels. Adapting to changing market dynamics, embracing technological advancements, and focusing on sustainable practices will be key to future success.

Conclusion

The global petroleum and diesel retail market plays a vital role in meeting the energy needs of individuals and businesses worldwide. Market participants must navigate dynamic market conditions, address environmental concerns, and adapt to emerging trends. By understanding market drivers, leveraging opportunities, and embracing technological advancements, industry stakeholders can position themselves for success in this evolving market.

What is the Global Petroleum and Diesel Retail?

The Global Petroleum and Diesel Retail refers to the sector involved in the sale of petroleum products, including diesel fuel, to consumers and businesses. This market encompasses various distribution channels such as gas stations, convenience stores, and online platforms.

Who are the key players in the Global Petroleum and Diesel Retail Market?

Key players in the Global Petroleum and Diesel Retail Market include companies like ExxonMobil, BP, Shell, and Chevron, which dominate the industry through extensive distribution networks and brand recognition, among others.

What are the main drivers of growth in the Global Petroleum and Diesel Retail Market?

The main drivers of growth in the Global Petroleum and Diesel Retail Market include increasing global energy demand, the expansion of transportation networks, and rising industrial activities that require diesel fuel for operations.

What challenges does the Global Petroleum and Diesel Retail Market face?

The Global Petroleum and Diesel Retail Market faces challenges such as fluctuating crude oil prices, regulatory pressures regarding emissions, and the growing shift towards renewable energy sources that may reduce fossil fuel consumption.

What opportunities exist in the Global Petroleum and Diesel Retail Market?

Opportunities in the Global Petroleum and Diesel Retail Market include the development of alternative fuel options, advancements in fuel efficiency technologies, and the potential for expanding into emerging markets with increasing energy needs.

What trends are shaping the Global Petroleum and Diesel Retail Market?

Trends shaping the Global Petroleum and Diesel Retail Market include the integration of digital technologies for better customer engagement, the rise of electric vehicles influencing fuel demand, and a focus on sustainability practices within the industry.

Global Petroleum and Diesel Retail Market:

| Segmentation | Details |

|---|---|

| Fuel Type | Petroleum, Diesel |

| Retail Outlet | Fuel Stations, Convenience Stores, Hypermarkets, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Petroleum and Diesel Retail Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at