444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Amorphous Polyethylene Terephthalate (PET) market is experiencing robust expansion driven by growing demand for lightweight, high-clarity, and chemically resistant packaging solutions across food & beverage, pharmaceuticals, and consumer goods sectors. Unlike its crystalline counterpart, amorphous PET offers superior optical properties—exceptional transparency and gloss—making it ideal for applications such as blister packs, clamshell containers, and thermoformed trays. Sustainability trends are further accelerating its adoption, as amorphous PET is fully recyclable and increasingly incorporated into mono-material packaging designs to meet circular economy goals. Advances in resin formulations, barrier coatings, and recycled-content blends are broadening the material’s performance envelope and market appeal.

Meaning

Amorphous PET is a non-crystalline form of polyethylene terephthalate in which polymer chains are arranged randomly, preventing light scattering and delivering glass-like clarity. Produced by rapid quenching of molten PET, this amorphous structure differs from semi-crystalline PET by lacking distinct crystalline regions, resulting in a transparent, amorphous solid at room temperature. In packaging and thermoforming, amorphous PET offers advantages such as high-impact strength, excellent gas and moisture barrier properties (when coated or laminated), and compatibility with heat-seal layers, making it a versatile material for consumer-facing applications requiring both performance and aesthetic appeal.

Executive Summary

The global Amorphous PET market is poised for continued growth, driven by stringent food-safety regulations, rising demand for transparent pharmacy and medical packaging, and sustainability mandates favoring recyclable mono-material solutions. Technological innovations in nucleation control and co-polymerization are yielding amorphous PET grades with improved thermoformability and heat resistance. Major resin producers are expanding capacities in Asia-Pacific and North America to cater to packaging converters’ need for domestically sourced, eco-friendly resins. At the same time, OEMs are integrating barrier coatings—such as silicon oxide (SiOx) and aluminum oxide (AlOx)—to extend shelf life of oxygen-sensitive products, further enlarging market potential.

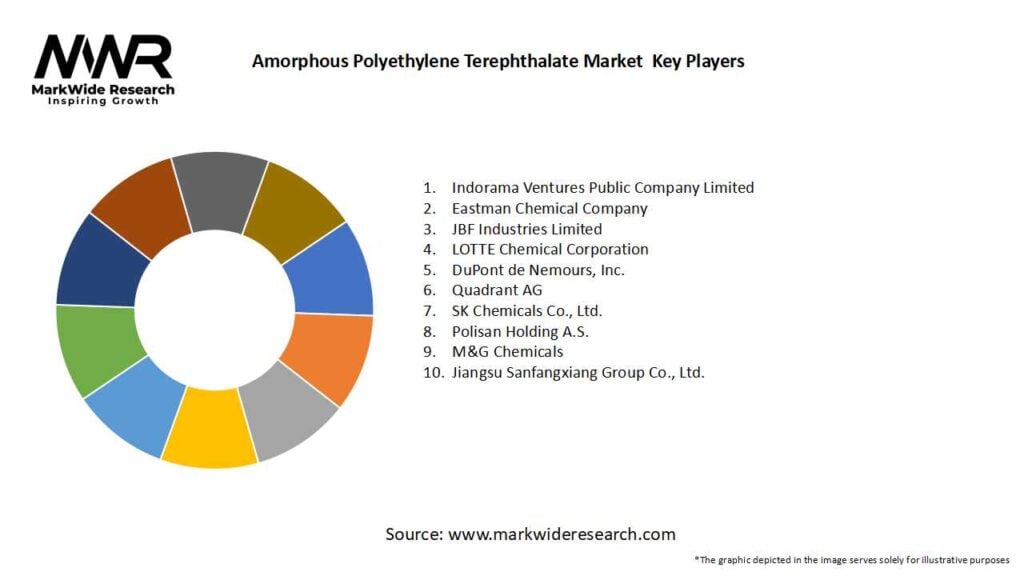

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Capacity Expansion: Over 1 million metric tons of new amorphous PET capacity is slated online by 2026 across China and the U.S., reflecting strong converter demand.

Recycled Content Blends: Amorphous PET with up to 50% post-consumer recyclate is gaining traction in food-grade applications under evolving regulatory support for recycled plastics.

Barrier Technology Integration: Multi-layer structures combining amorphous PET with barrier PET and oxygen scavengers are reducing oxygen transmission rates to below 5 cc/m²·day.

Sustainability Mandates: EU Single-Use Plastics Directive and U.S. state-level recycled content laws are driving converters toward mono-PET trays and clamshells over mixed-material packaging.

Emerging Applications: Growth in ready-to-eat meals, salad kits, and medical diagnostic kits is fueling demand for high-clarity, steam-sterilizable amorphous PET packaging.

Market Drivers

Consumer Convenience Trends: The rise of on-the-go meals, meal kits, and single-serve packaging necessitates lightweight, clear containers that showcase product quality.

Regulatory Pressure: Mandatory recycled content targets and bans on PVC and multi-material films propel brands to adopt recyclable amorphous PET solutions.

Pharmaceutical & Medical Demand: Strict packaging integrity and clarity requirements in blister packs and device trays increase adoption of amorphous PET.

Technological Advancements: Improved resin grades with enhanced thermoformability, reduced cycle times, and better mechanical performance drive converter preference.

Sustainability Initiatives: Brand commitments to 100% recyclable packaging and closed-loop recycling systems bolster amorphous PET usage.

Market Restraints

Raw Material Price Volatility: Fluctuations in monoethylene glycol (MEG) and terephthalic acid (PTA) feedstock costs can compress converter margins.

Competition from PETG and PP: PETG’s easier formability at lower temperatures and polypropylene’s lower cost compete for similar packaging segments.

Barrier Limitations: Untreated amorphous PET has limited barrier against oxygen; coatings add complexity and cost.

Recycling Infrastructure Gaps: Inadequate collection systems in certain regions impede high-quality recycled PET availability.

Thermal Stability Constraints: Pure amorphous PET may soften at elevated temperatures, restricting applications requiring sterilization above 120 °C.

Market Opportunities

Next-Gen Recyclates: Chemical recycling to produce “virgin-equivalent” amorphous PET resin opens avenues for closed-loop, food-grade applications.

Functional Coatings: Development of thin, high-barrier coatings that cure at low temperatures can expand amorphous PET into fresh-cut produce trays.

Lightweighting: Resin formulations enabling thinner gauge structures without sacrificing rigidity will reduce material use and cost.

Emerging Geographies: Rapid urbanization in Southeast Asia, Latin America, and Africa presents new markets for transparent PET packaging.

Mono-Packaging Platforms: Integrating amorphous PET with PET lid films in single-material trays simplifies recycling and meets brand sustainability goals.

Market Dynamics

Converter–Resin Producer Collaboration: Joint development of customized amorphous PET grades accelerates time-to-market for new packaging designs.

M&A Activity: Consolidation among resin manufacturers and packaging converters is streamlining supply chains and fostering innovation investment.

Digital Printing Integration: On-package digital inkjet printing technologies require amorphous PET surfaces optimized for ink adhesion and high-resolution graphics.

Circular Economy Models: Brand- and industry-led recycling initiatives feed high-quality recycled amorphous PET back into food-grade packaging streams.

Cost vs. Performance Balance: Converters continuously evaluate trade-offs between high-clarity amorphous PET and lower-cost alternatives for emerging applications.

Regional Analysis

Asia-Pacific: Largest volume market, led by China and India’s booming fast-moving consumer goods (FMCG) and pharmaceutical sectors.

North America: Strong growth in meal-kit packaging and medical device trays, supported by established recycling infrastructure and high consumer awareness.

Europe: Driven by strict single-use plastics regulations, with Germany, France, and the UK leading adoption of recycled-content amorphous PET.

Latin America: Emerging demand in Brazil and Mexico for clear thermoformed packaging in foodservice and consumer electronics trays.

Middle East & Africa: Early-stage market expansion tied to supermarket growth and import substitution for packaged foods and pharmaceuticals.

Competitive Landscape:

Leading Companies in the Amorphous Polyethylene Terephthalate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

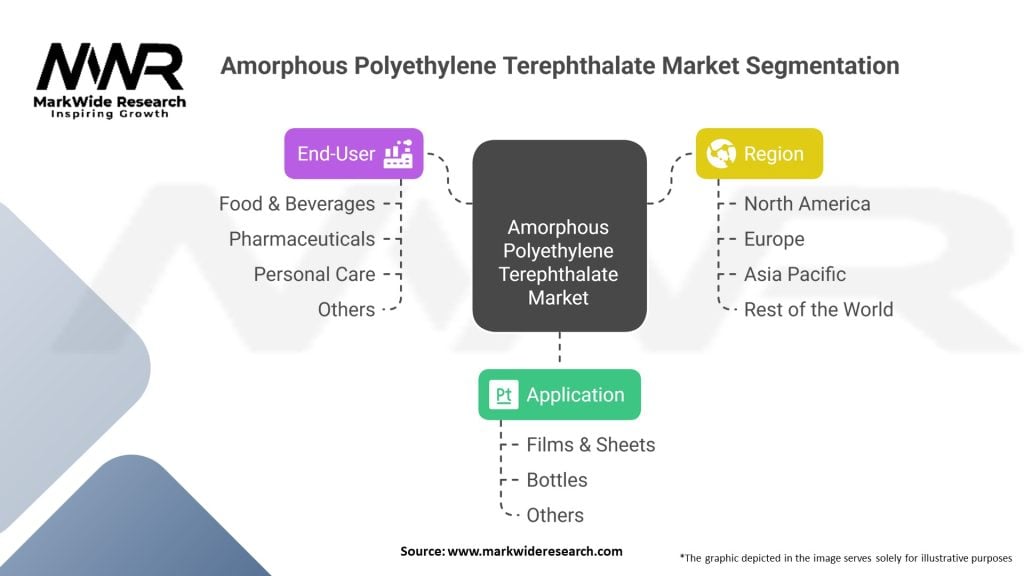

Segmentation

By Grade: Standard Amorphous PET, High-Viscosity Amorphous PET, Recycled-Content Amorphous PET

By Application: Food & Beverage Packaging, Pharmaceutical & Medical, Consumer Goods, Industrial & Electronics, Label Films

By Form: Resin Pellets, PET Sheets, PET Films

By Geography: Asia-Pacific, North America, Europe, Latin America, Middle East & Africa

Category-wise Insights

Food & Beverage: Clamshell containers, salad trays, bakery packaging—requiring high clarity and moderate barrier when laminated.

Pharmaceutical & Medical: Blister packs and device trays demanding sterilization compatibility and residue-free molding.

Consumer Goods: Transparent packaging for cosmetics and electronics, often combined with digital printing for brand differentiation.

Industrial & Electronics: Protective trays for semiconductors and precision components, where clarity aids inspection.

Label Films: High-gloss amorphous PET films used in pressure-sensitive labels, offering enhanced aesthetics and dimensional stability.

Key Benefits for Industry Participants and Stakeholders

Premium Shelf Appeal: Exceptional transparency and gloss enhance product visibility and perceived quality.

Recyclability: Full compatibility with existing PET recycling streams simplifies end-of-life management.

Dimensional Stability: Low shrinkage and good form-fill-seal performance reduce defects and material waste.

Barrier Enhancement: When coated or laminated, offers sufficient barrier for extended shelf life of oxygen- and moisture-sensitive products.

Process Efficiency: Rapid crystallization control and consistent melt properties lead to faster cycle times and reduced scrap rates.

SWOT Analysis

Strengths:

Superior optical clarity vs. crystalline PET.

Full recyclability and compatibility with rPET.

Broad application range across packaging and industrial segments.

Weaknesses:

Higher resin cost than standard PET.

Limited inherent barrier—coatings add cost and complexity.

Thermal stability constraints for high-heat applications.

Opportunities:

Growth of mono-material, high-recyclate packaging.

Expansion into emerging markets with rising packaged-food demand.

Innovations in low-temperature barrier coatings and chemical recycling.

Threats:

Competition from alternative polymers (PLA, PETG, PP).

Feedstock price volatility affecting resin costs.

Regional recycling inefficiencies limiting rPET supply quality.

Market Key Trends

Chemical Recycling Integration: Partnerships to convert mixed plastic waste into food-grade amorphous PET feedstock.

Advanced Nucleation: Nanoparticle-based nucleating agents enhancing gloss and shrinkage control in thermoformed parts.

Digital Decoration: Increased use of UV and water-based digital printing directly onto amorphous PET for rapid SKU changes.

Barrier Coating Innovation: Development of plasma-assisted and ALD (atomic layer deposition) coatings enabling ultra-thin barrier layers.

Sustainable Sourcing: Shift toward bio-based monomers to produce partially renewable PET while retaining amorphous properties.

Covid-19 Impact

The pandemic spurred demand for clear medical packaging—blister packs and device trays—boosting amorphous PET consumption in pharmaceutical applications. Concurrently, e-commerce packaging needs for ready-to-eat meals and consumer goods drove growth in transparent food containers. Supply chain disruptions led many converters to seek local resin production and stock higher inventories of amorphous PET, trends that are reshaping regional supply dynamics.

Key Industry Developments

Indorama’s rPET Expansion in Europe: Opened a chemical recycling pilot plant in Germany in 2023 to supply food-grade amorphous PET.

Eastman’s Molecular Recycling JV: Partnered with European converters to produce up to 150 ktpa of circular amorphous PET by 2025.

DuPont Teijin’s Coated Film Launch: Introduced a moisture-barrier amorphous PET film for medical blister applications in 2024.

Mitsubishi Chemical’s Nucleation Technology: Debuted an amorphous PET pellet grade in late 2023 enabling 20% faster cycle times in thermoforming.

Analyst Suggestions

Prioritize rPET Integration: Collaborate with recyclers and chemical recyclers to secure consistent recycled feedstock for food-grade amorphous PET.

Develop Proprietary Coatings: Invest in low-temperature barrier technologies that can be applied inline on packaging lines.

Expand Digital Print Compatibility: Work with ink and coating suppliers to optimize amorphous PET surfaces for direct printing without primers.

Focus on Lightweighting: Design resin grades enabling gauge reductions of 10–15% to decrease material usage and cost.

Target Emerging Regions: Establish distribution and technical support in Southeast Asia and Latin America to capture high-growth markets.

Future Outlook

The Amorphous PET market is projected to grow at a CAGR of 6–8% through 2030, fueled by continued expansion in foodservice packaging, pharmaceutical blister systems, and sustainable packaging initiatives. Innovations in chemical recycling and barrier coatings will broaden application scopes, while digital decoration and lightweighting trends will enhance product differentiation. As brand owners and regulators worldwide push for a circular plastics economy, amorphous PET—especially high-recyclate and bio-based variants—will remain a preferred material for clear, recyclable, high-performance packaging solutions.

Conclusion

In conclusion, amorphous PET occupies a strategic position at the intersection of performance, aesthetics, and sustainability. Stakeholders who invest in recycled-content integration, barrier technology partnerships, and lightweighting innovations will capture the emerging demand for mono-material circular packaging. By aligning resin development with evolving regulatory mandates and brand sustainability goals, the amorphous PET industry can deliver transparent, durable, and fully recyclable solutions that meet the needs of both converters and consumers in a rapidly changing market landscape.

What is Amorphous Polyethylene Terephthalate?

Amorphous Polyethylene Terephthalate, often abbreviated as APET, is a type of thermoplastic polymer known for its clarity, toughness, and chemical resistance. It is widely used in packaging, particularly for food and beverages, as well as in various industrial applications.

Which companies are leading in the Amorphous Polyethylene Terephthalate Market?

Leading companies in the Amorphous Polyethylene Terephthalate Market include Eastman Chemical Company, BASF SE, and DuPont, among others.

What are the growth factors driving the Amorphous Polyethylene Terephthalate Market?

The growth of the Amorphous Polyethylene Terephthalate Market is driven by increasing demand for lightweight and durable packaging solutions, particularly in the food and beverage sector. Additionally, the rise in e-commerce and sustainable packaging trends are contributing to market expansion.

What challenges does the Amorphous Polyethylene Terephthalate Market face?

The Amorphous Polyethylene Terephthalate Market faces challenges such as fluctuating raw material prices and environmental concerns regarding plastic waste. These factors can hinder production and affect market growth.

What opportunities exist in the Amorphous Polyethylene Terephthalate Market?

Opportunities in the Amorphous Polyethylene Terephthalate Market include the development of bio-based alternatives and innovations in recycling technologies. These advancements can enhance sustainability and open new markets for APET applications.

What trends are shaping the Amorphous Polyethylene Terephthalate Market?

Current trends in the Amorphous Polyethylene Terephthalate Market include a shift towards eco-friendly packaging solutions and the integration of smart packaging technologies. These trends are driven by consumer preferences for sustainability and convenience.

Amorphous Polyethylene Terephthalate Market

| Segmentation | Details |

|---|---|

| Application | Films & Sheets, Bottles, Others |

| End-User | Food & Beverages, Pharmaceuticals, Personal Care, Others |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Amorphous Polyethylene Terephthalate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at