444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Magnesium Fluoride market is a vital segment of the chemical and materials industry, with applications in various fields, including optics, electronics, and metallurgy. Magnesium fluoride, with its unique optical and chemical properties, is a key material in industries that require high-performance coatings, optical components, and specialty ceramics. This report provides a comprehensive analysis of the executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding note on the Magnesium Fluoride Market.

Meaning

The Magnesium Fluoride Market is a sector within the chemical and materials industry that focuses on the production, distribution, and utilization of magnesium fluoride (MgF2). Magnesium fluoride is a chemical compound known for its unique optical properties, including transparency in the ultraviolet and infrared spectral ranges. It is used extensively in various applications, particularly as a coating material for optical lenses and windows due to its anti-reflective and protective qualities. This market addresses the global demand for high-purity magnesium fluoride in industries like optics, aerospace, and electronics, emphasizing its crucial role in enhancing optical performance and maintaining durability in diverse optical systems and components worldwide.

Executive Summary

The Magnesium Fluoride market is experiencing steady growth, driven by its versatile properties and applications across industries. Key findings and trends in the market include:

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Optical Applications Dominate: Over 65% of MgF₂ demand is for optical components—vacuum UV windows, IR laser optics, and UV lithography masks—due to its unparalleled transmission and durability.

Emerging High-Tech Uses: Adoption in VUV lithography for next-generation semiconductor nodes and solar-blind UV detectors for missile warning systems is accelerating.

Geographic Concentration: Asia-Pacific leads in production and consumption, driven by China’s dominant role in crystal growth and the region’s booming electronics and solar industries. Europe and North America remain key hubs for high-end, precision optical manufacturing.

Feedstock Constraints: High-purity MgF₂ feedstock (98–99.99% purity) is derived from natural minerals or synthetically produced, with supply tightness at the highest purity grades influencing market prices.

Technological Advancements: R&D in lower-temperature growth processes, co-doping strategies to reduce birefringence, and nano-structured coatings aims to extend MgF₂’s performance envelope.

Market Drivers

Semiconductor Lithography: The shift to 193 nm ArF and emerging 157 nm F₂ excimer lithography demands MgF₂ optics with exceptional UV transparency and resistance to laser damage.

High-Power Laser Systems: Industrial, medical, and defense lasers operating at CO₂ (10.6 μm), Nd:YAG (1.06 μm), and excimer wavelengths require robust MgF₂ windows and lenses.

Aerospace and Defense Sensors: IR and UV payloads on satellites, UAVs, and missile warning systems leverage MgF₂’s broadband transmission and environmental durability.

Growth in Photonics: Expanding markets for LiDAR, spectroscopy, and high-resolution imaging systems drive optical component consumption.

Ceramics and Metallurgy: Use as a flux in specialty aluminum smelting and in high-temperature ceramics benefits from MgF₂’s chemical inertness.

Market Restraints

High Production Costs: Energy-intensive crystal growth and stringent purity controls limit cost reductions.

Feedstock Volatility: Dependence on fluoride minerals and hydrofluoric acid production creates supply chain vulnerabilities.

Competitive Materials: Alternatives such as calcium fluoride (CaF₂) and barium fluoride (BaF₂) may compete in certain spectral regions, albeit with trade-offs in durability or refractive index.

Regulatory and Environmental Concerns: Use of fluoride compounds and associated emissions or waste handling can face stringent environmental regulations.

Market Opportunities

Next-Gen Lithography: If EUV (13.5 nm) optics move beyond reflective designs, novel fluoride-based materials may emerge—MgF₂ research could unlock niche roles.

Nanophotonics: Integration of MgF₂ nanolayers in meta-optics and plasmonics for beam shaping and anti-reflective coatings.

Biomedical Devices: UV-sterilizable windows and micro-optics for endoscopic or laser-therapy applications.

Solar Energy: MgF₂ anti-reflective coatings on photovoltaics to boost efficiency and durability.

Integrated Photonics: Fluoride waveguides for mid-IR on-chip spectroscopy in chemical sensing.

Market Dynamics

Supply Side: Technological improvements in crystal pulling rates, defect reduction, and process energy efficiency. Consolidation among specialty fluoride producers.

Demand Side: OEM partnerships in semiconductor and aerospace drive predictable off-take agreements. Increasing R&D collaborations for customized optical solutions.

Economic Factors: Cyclicality of semiconductor and aerospace capex influences MgF₂ demand. Diversification into adjacent markets (ceramics, solar) can buffer volatility.

Policy Influences: National security priorities bolster defense optics investments. Green manufacturing mandates spur innovations in waste reduction and recycling of fluoride byproducts.

Regional Analysis

Asia-Pacific: ~50% of global production; low-cost manufacturing in China; massive electronics and solar panel factories create local consumption hubs in China, South Korea, and Japan.

North America: Focus on high-value, precision optics for defense and semiconductor equipment; home to leading R&D centers and OEMs (e.g., optics houses in US).

Europe: Strong in precision glass and crystal optics, with major lens manufacturers in Germany and France; rigorous environmental regulations shape production practices.

Rest of World: Emerging markets in Middle East (solar projects) and Russia (defense optics) offer niche growth opportunities.

Competitive Landscape

Leading Companies in the Magnesium Fluoride Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

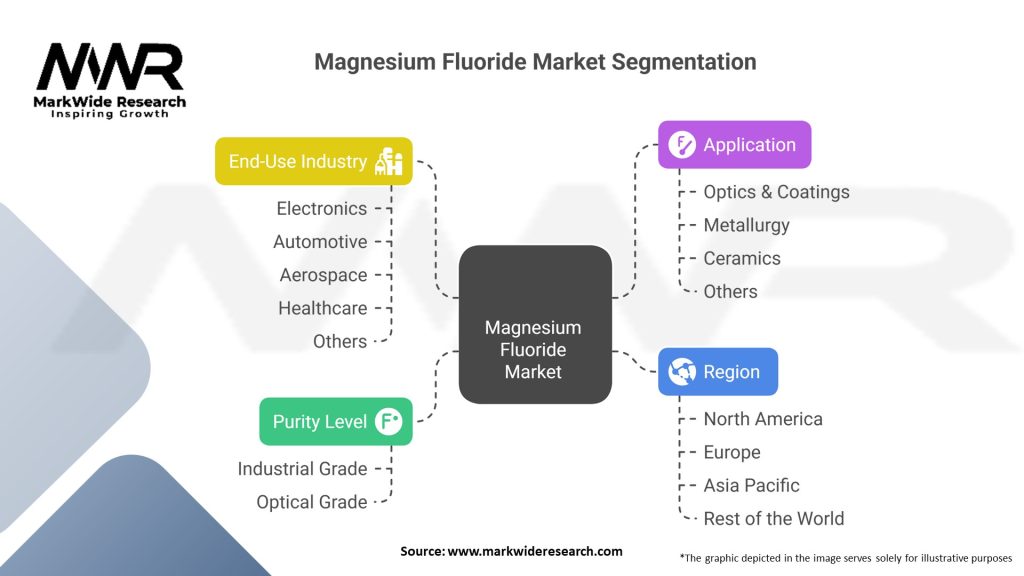

Segmentation

By Form:

Crystalline Powder (feedstock for coatings)

Bulk Crystals (windows, prisms)

Optical Components (lenses, prisms, windows)

By Grade:

Standard Purity (98–99%)

High Purity (99.9–99.99%)

Ultra-High Purity (>99.99%)

By Application:

Semiconductor Lithography

Laser Optics (industrial/medical)

Aerospace & Defense Sensors

Ceramics & Metallurgy

Photonics & Spectroscopy

Others (solar, biomedical)

By Region:

Asia-Pacific

North America

Europe

Rest of World

Category-wise Insights

Standard Purity MgF₂: Used in general optical coatings and low-cost flux applications.

High/Ultra-High Purity MgF₂: Mandatory for semiconductor excimer and VUV optics, precision laser windows, and scientific instrumentation.

Optical Components: Value-added segment commanding premium pricing for polished, coated parts with tight surface quality specifications.

Key Benefits for Industry Participants

Enhanced Optical Performance: MgF₂’s broadband transparency improves device functionality across UV–IR ranges.

Reduced System Complexity: Low refractive index reduces reflection losses, often eliminating the need for additional coatings.

Superior Durability: High abrasion and chemical resistance extend component lifetime, reducing maintenance.

Customization: Ability to grow large, defect-free crystals enables bespoke lens and window sizes.

Market Diversification: Suppliers can serve multiple high-value industries—semiconductor, defense, medical, photonics.

SWOT Analysis

A SWOT analysis highlights the strengths, weaknesses, opportunities, and threats in the Magnesium Fluoride market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Staying informed about key trends is essential for industry participants to capitalize on emerging opportunities:

Covid-19 Impact

The Covid-19 pandemic had several impacts on the Magnesium Fluoride market:

Key Industry Developments

Several key developments have shaped the Magnesium Fluoride market:

Analyst Suggestions

Based on current market trends and dynamics, analysts suggest the following strategies for industry participants:

Future Outlook

The future of the Magnesium Fluoride market looks promising:

Conclusion

The Magnesium Fluoride market is a pivotal segment of the chemical and materials industry, serving diverse applications across optics, electronics, and metallurgy. As demand for high-performance coatings, optical components, and specialty ceramics continues to grow, industry participants must focus on innovation, market diversification, and sustainability initiatives to meet the evolving needs of consumers and industries. With opportunities in advanced coatings, electronics growth, and ongoing materials research, the Magnesium Fluoride market offers a promising future in supporting technological advancements and materials science innovations.

What is Magnesium Fluoride?

Magnesium Fluoride is a chemical compound composed of magnesium and fluorine, commonly used in optics, ceramics, and as a flux in metallurgy. It is known for its low refractive index and high resistance to thermal shock.

What are the key players in the Magnesium Fluoride Market?

Key players in the Magnesium Fluoride Market include American Elements, Solvay, and Alfa Aesar, among others. These companies are involved in the production and supply of magnesium fluoride for various applications.

What are the growth factors driving the Magnesium Fluoride Market?

The growth of the Magnesium Fluoride Market is driven by increasing demand in the optical coatings industry, advancements in ceramic materials, and the rising use of magnesium fluoride in the electronics sector.

What challenges does the Magnesium Fluoride Market face?

Challenges in the Magnesium Fluoride Market include fluctuations in raw material prices, environmental regulations regarding fluoride compounds, and competition from alternative materials in various applications.

What opportunities exist in the Magnesium Fluoride Market?

Opportunities in the Magnesium Fluoride Market include the development of new applications in the renewable energy sector, such as solar panels, and the potential for innovations in high-performance optical devices.

What trends are shaping the Magnesium Fluoride Market?

Trends in the Magnesium Fluoride Market include a growing focus on sustainable production methods, increased research into its applications in nanotechnology, and the expansion of its use in advanced manufacturing processes.

Magnesium Fluoride Market

| Segmentation | Details |

|---|---|

| Purity Level | Industrial Grade, Optical Grade |

| Application | Optics & Coatings, Metallurgy, Ceramics, Others |

| End-Use Industry | Electronics, Automotive, Aerospace, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Magnesium Fluoride Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at