444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global carbon steel tubing in oil and gas lift applications market is witnessing significant growth due to the increasing demand for energy resources, particularly in the oil and gas industry. Carbon steel tubing is widely used in the oil and gas lift applications sector for various purposes, including oil extraction, gas production, and well maintenance. This market report provides an in-depth analysis of the market, including its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

carbon steel tubing in oil and gas lift applications refers to the utilization of carbon steel pipes or tubes in the processes involved in extracting and lifting oil and gas resources from wells. These tubes are specifically designed to withstand the harsh conditions of the oil and gas industry, including high pressure, corrosive environments, and extreme temperatures. Carbon steel tubing offers durability, strength, and resistance to corrosion, making it a preferred choice in various oil and gas lift applications.

Executive Summary

The executive summary provides a concise overview of the global carbon steel tubing in oil and gas lift applications market. It includes key highlights of the market, such as market size, growth rate, major players, and market trends. This summary aims to provide a quick snapshot of the market’s current status and its potential for growth in the future.

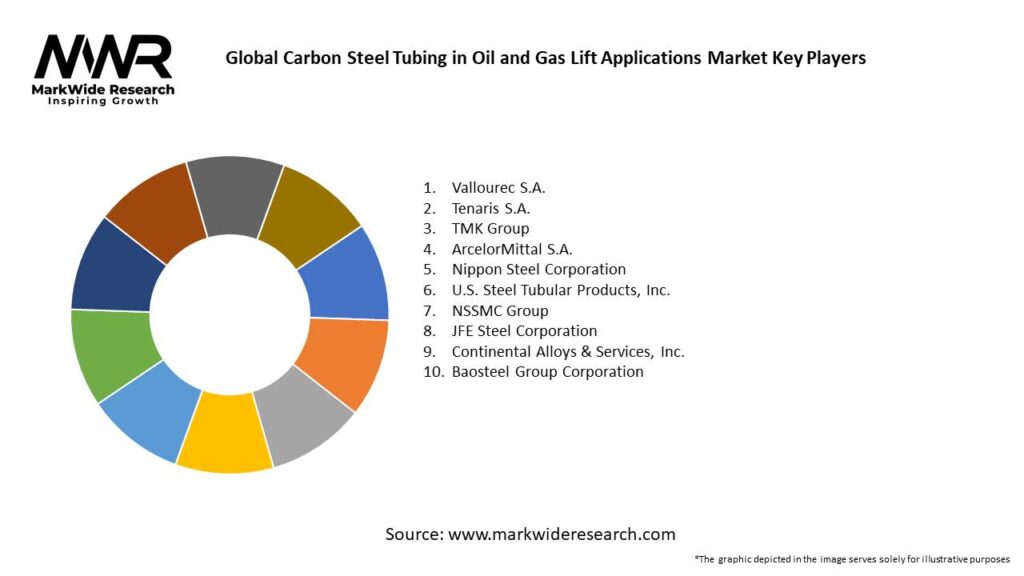

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Aging Infrastructure and Enhanced Recovery:

Many oil fields worldwide are at mature production stages, necessitating the deployment of artificial lift systems to sustain output. This drives continuous demand for durable and high-performance carbon steel tubing.

Technological Innovation:

Advances in manufacturing processes—such as improved heat treatment, seamless production, and enhanced coating technologies—have greatly increased the performance and longevity of carbon steel tubing.

Cost Considerations:

Carbon steel remains one of the most cost-effective materials available, offering a favorable balance of price and performance for large-scale oil extraction projects.

Corrosion and Environmental Challenges:

Ongoing improvements in corrosion inhibitors and protection systems are critical in ensuring that carbon steel tubing withstands corrosive well environments, extending asset longevity.

Global Market Diversification:

There is significant growth potential not only in traditional markets like North America, Europe, and the Middle East, but also in emerging regions such as Asia-Pacific and Latin America, where energy infrastructure is rapidly expanding.

Market Drivers

Maturing Oil Fields and Enhanced Oil Recovery:

As conventional pressure declines in mature reservoirs, artificial lift systems become essential to maintain production levels, driving a consistent need for reliable carbon steel tubing.

Technological Advances in Tubing Production:

Innovations in steel processing—including seamless manufacturing and advanced welding techniques—as well as improved corrosion protection solutions, have made carbon steel tubing more robust and cost-efficient.

Economic Considerations:

The cost advantage of carbon steel tubing over alternative materials (such as stainless steel or composite materials) is a decisive factor for operators, especially in budget-sensitive projects where cost efficiency is paramount.

Regulatory and Safety Standards:

Stricter industry standards and regulatory requirements for pipeline integrity and well safety require high-performance materials that offer both strength and reliability. Carbon steel tubing that meets these standards is essential for ensuring compliance and operational safety.

Global Infrastructure Investments:

Increased capital investments in oil and gas exploration and production infrastructure, particularly in emerging markets, drive demand for artificial lift solutions that rely on carbon steel tubing.

Market Restraints

Raw Material Price Volatility:

Fluctuations in the global steel market, driven by raw material costs and economic conditions, can impact the pricing and profitability of carbon steel tubing.

Competition from Alternative Materials:

Although carbon steel is cost-effective, advances in alternative materials such as stainless steel and composites—offering superior corrosion resistance—present competitive challenges in certain high-risk environments.

Environmental and Operational Challenges:

Extreme operating conditions, including high temperatures, corrosive chemicals, and abrasive environments in some wells, can affect the performance and lifespan of carbon steel tubing.

High Initial Capital Investment:

The setup costs for advanced manufacturing facilities, particularly for seamless tubing production with enhanced coatings, can be significant and may deter smaller players from entering the market.

Regulatory Barriers:

Variability in standards and certification requirements across regions can complicate market access and distribution, especially for international players.

Market Opportunities

Emerging Market Expansion:

Rapid industrialization and the growth of the energy sector in emerging regions such as Asia-Pacific and Latin America offer considerable potential for expanding the use of carbon steel tubing in artificial lift applications.

Innovation in Corrosion Protection:

Investment in research and development to produce advanced coatings and corrosion inhibitors can significantly enhance the performance and lifespan of carbon steel tubing, opening up new applications in harsh environments.

Digital Integration and Smart Monitoring:

Incorporating digital sensors and real-time monitoring systems with carbon steel tubing can offer integrated asset management solutions, enhancing predictive maintenance and operational reliability.

Diversification into New Applications:

Exploring the application of carbon steel tubing beyond traditional oil and gas lift—for instance, in geothermal energy systems and industrial fluid transport—can broaden revenue streams.

Public-Private Partnerships:

Collaborations between governments, industry players, and technology providers can facilitate large-scale infrastructure projects, driving increased demand for artificial lift components.

Market Dynamics

The market dynamics of carbon steel tubing in oil and gas lift applications are influenced by a combination of supply, demand, and economic factors:

Supply Side Factors:

• Technological Innovation: Continuous improvements in metallurgy, welding, and coating technologies have enhanced the performance of carbon steel tubing, making it more durable and cost-effective.

• Manufacturing Scale and Efficiency: Investments in large-scale production and automation have reduced production costs and improved supply consistency, even in the face of raw material price fluctuations.

Demand Side Factors:

• Infrastructure Renewal: Aging oil fields and the need for enhanced recovery techniques drive ongoing demand for reliable tubing solutions.

• Regional Growth: Expansion of oil and gas projects in emerging markets, driven by rising energy consumption and new exploration activities, contributes significantly to demand.

Economic Factors:

• Cost-Benefit Analysis: Operators evaluate the long-term economic benefits of using carbon steel tubing—such as reduced maintenance and higher durability—against the initial investment costs.

• Global Economic Conditions: Economic stability in key markets affects investments in upstream infrastructure projects and, consequently, the demand for artificial lift components.

Regional Analysis

North America:

The mature oil and gas market in the United States and Canada drives consistent demand for carbon steel tubing, supported by well-established supply chains and stringent safety regulations. Advanced R&D facilities and a robust maintenance culture ensure that high-performance products are continuously developed.

Europe:

Europe has a strong focus on operational safety, environmental compliance, and efficiency in oil and gas operations. The region’s demand is primarily driven by retrofitting aging infrastructure and enhancing the integrity of offshore and onshore wells.

Asia-Pacific:

Rapid industrialization, increased energy production, and significant investments in both upstream and midstream projects in countries such as China, India, and Southeast Asian nations have led to a rapidly expanding market for artificial lift components. Competitive manufacturing costs and growing infrastructure investments are key drivers in this region.

Latin America:

The Latin American market is experiencing growth driven by government initiatives and increasing investments in exploration and production. However, economic volatility and infrastructure challenges may moderate market expansion.

Middle East and Africa:

With significant oil reserves and ongoing energy projects, the Middle East remains a key market for advanced tubing solutions. In Africa, emerging markets are beginning to invest in improved pipeline infrastructure and artificial lift technologies to boost production efficiency.

Competitive Landscape

Leading companies in the Global Carbon Steel Tubing in Oil and Gas Lift Applications Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

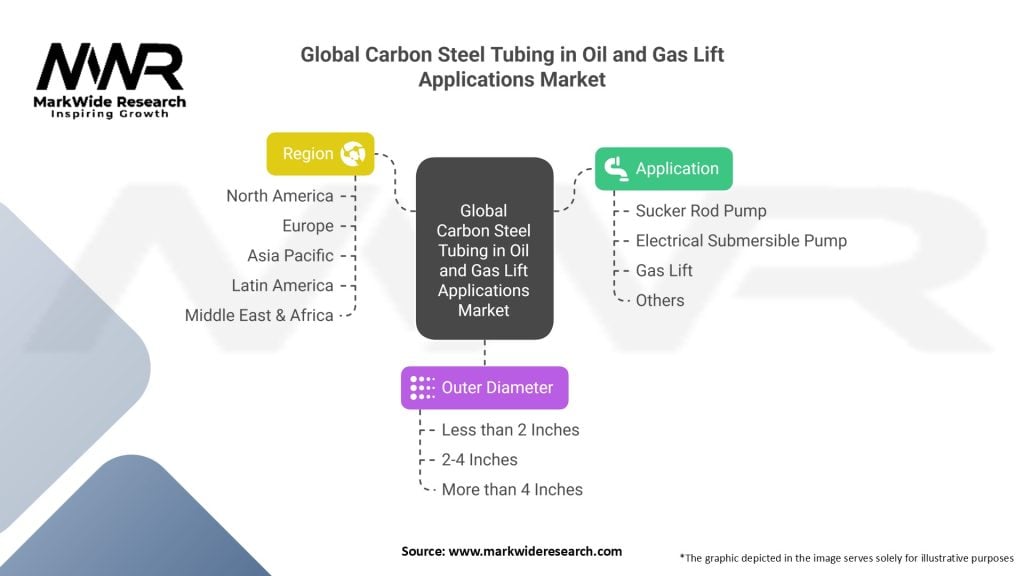

Segmentation

The market for carbon steel tubing in oil and gas lift applications can be segmented by:

By Product Type:

Seamless Tubing:

Known for superior strength and uniformity; typically used in high-pressure applications.

Welded Tubing:

Economical and widely used in less critical applications; offers adequate performance with lower cost.

By Coating/Finishing:

Bare Carbon Steel:

Basic form used when corrosion risk is minimal or when internal coatings are applied.

Coated Carbon Steel:

Tubing with anti-corrosion treatments and coatings to enhance durability and extend service life.

By Application:

Artificial Lift Systems:

Tubing used specifically in systems such as gas lift, sucker rod pumps, and electrical submersible pumps (ESP) to elevate hydrocarbons.

Pipeline Repair and Retrofitting:

Applications in replacing or reinforcing aging infrastructure.

Other Oilfield Applications:

Utilized in ancillary systems for monitoring, injection, or fluid transport.

By Distribution Channel:

Direct Sales:

Sales through manufacturer contracts and direct partnerships with oilfield service companies.

Distributors and Dealers:

Third-party networks extending market reach, especially in emerging economies.

OEM Supply:

Integration of tubing products as part of larger equipment offerings.

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Category-wise Insights

Seamless vs. Welded Tubing:

Seamless tubing offers high performance for extreme conditions, whereas welded tubing provides cost-effective solutions for standard applications.

Coated Solutions:

Enhanced with specialized coatings for improved corrosion resistance, these products are essential in corrosive environments and offshore operations.

Application-Specific Designs:

Customizations in tubing design—such as wall thickness, diameter, and material grade—are tailored to specific lift and pipeline repair applications, ensuring optimal performance in varied operational conditions.

Key Benefits for Industry Participants and Stakeholders

Enhanced Operational Efficiency:

Reliable, high-performance tubing reduces downtime and maintenance costs, leading to more efficient production operations.

Cost Savings:

The economic advantage of carbon steel, combined with improved manufacturing processes, provides a cost-effective solution for artificial lift systems.

Safety and Environmental Compliance:

High-integrity tubing improves well safety and meets stringent regulatory standards, reducing the risk of leaks and environmental hazards.

Scalability:

The availability of various grades and specifications allows for scalable solutions that can be customized to suit both mature fields and new projects.

Competitive Differentiation:

Advanced coatings and the integration of digital monitoring systems position products at the forefront of innovation and reliability in the energy sector.

SWOT Analysis

Strengths:

Cost-Effective Material:

Carbon steel’s affordability makes it a preferred choice for large-scale applications in oil and gas.

High Strength and Durability:

Its mechanical properties and the ability to withstand high pressures make carbon steel tubing ideal for critical lift applications.

Established Production Processes:

Proven manufacturing techniques ensure consistent quality and supply reliability.

Weaknesses:

Susceptibility to Corrosion:

Without adequate protective coatings, carbon steel is prone to corrosion in harsh downhole environments.

Technological Limitations:

Conventional production methods may lag behind emerging materials in terms of corrosion resistance and lifespan.

Environmental Concerns:

The production of carbon steel and its subsequent processing have environmental impacts that are increasingly subject to regulatory scrutiny.

Opportunities:

Emerging Market Growth:

Rapid expansion in oil and gas activities in emerging economies creates a substantial opportunity for market penetration.

Technological Integration:

The adoption of digital monitoring and improved coating technologies can enhance product performance and extend service life.

New Application Development:

Diversifying into additional oilfield and infrastructural applications can open up new revenue streams.

Sustainability Initiatives:

Innovations in energy-efficient production and eco-friendly coatings can appeal to environmentally conscious operators and governments.

Threats:

Fluctuating Raw Material Prices:

Variations in the cost of steel and related raw materials can affect pricing strategies and profit margins.

Intense Global Competition:

Competitive pressure from manufacturers producing alternative materials and superior coating solutions may erode market share.

Regulatory and Environmental Challenges:

Stricter environmental regulations may increase production costs and compliance burdens.

Market Key Trends

Integration of Digital Technologies:

The use of IoT sensors and real-time monitoring in carbon steel tubing is increasingly enabling predictive maintenance and improved performance tracking.

Focus on Corrosion Protection:

Continuous improvements in coating technologies and cathodic protection systems are critical to extending the lifespan of tubing in corrosive environments.

Sustainability Initiatives:

The drive toward greener production methods and recycling initiatives is influencing production practices and product development.

Expansion of Artificial Lift Markets:

Growth in mature oil fields requiring artificial lift systems is contributing to higher demand for advanced tubing solutions.

Global Infrastructure Investment:

Increased government and private investments in energy infrastructure, particularly in emerging markets, are driving demand.

Covid-19 Impact

Temporary Disruptions:

The pandemic caused short-term delays in production and logistics, impacting supply chains and operational timelines.

Accelerated Digital Transformation:

COVID-19 accelerated the adoption of digital monitoring and automation in pipeline maintenance, indirectly benefiting the intelligent asset management systems associated with carbon steel tubing.

Economic Uncertainty:

Fluctuations in oil prices and investment hesitancy during the pandemic affected capital expenditures, though essential infrastructure investments helped sustain demand.

Renewed Focus on Maintenance:

Post-pandemic, there has been a greater emphasis on preventive maintenance and infrastructure reliability, boosting demand for high-quality tubing.

Resilience and Recovery:

Despite challenges, the essential nature of energy production ensured a recovery in demand, with operators increasingly investing in upgraded materials and technologies.

Key Industry Developments

Technological Innovations:

Advances in manufacturing and coating technologies have improved the corrosion resistance and durability of carbon steel tubing.

Capacity Expansion:

Investments in new production facilities and expansion of existing plants, particularly in Asia-Pacific and the Middle East, are boosting supply capabilities.

Strategic Collaborations:

Partnerships between steel manufacturers, coating technology developers, and oilfield service companies are driving integrated solutions for pipeline integrity.

Digital Integration:

Implementation of digital quality control systems and IoT-based monitoring is enhancing production efficiency and asset management.

Mergers and Acquisitions:

Consolidation in the market through mergers and acquisitions is streamlining operations and broadening global market presence.

Analyst Suggestions

Invest in R&D:

Prioritize research and development to improve coating technologies, enhance corrosion resistance, and integrate digital monitoring to extend tubing lifespan.

Enhance Supply Chain Resilience:

Diversify raw material sourcing and invest in modern production infrastructure to mitigate the impact of raw material price volatility and supply disruptions.

Expand into Emerging Markets:

Target emerging economies with expanding oil and gas sectors by offering cost-effective and reliable tubing solutions tailored to local conditions.

Focus on Sustainability:

Develop energy-efficient production methods and eco-friendly coatings to appeal to environmentally conscious operators and comply with stricter regulations.

Leverage Digital Technologies:

Integrate IoT and data analytics to enable predictive maintenance and real-time quality monitoring, adding value for end-users and enhancing market competitiveness.

Future Outlook

The future of the Global Carbon Steel Tubing in Oil and Gas Lift Applications Market is promising, driven by continued investments in energy infrastructure and technological innovation. Key factors that are expected to shape the market include:

Technological Advancements:

Ongoing innovations in steel production, advanced coatings, and digital monitoring will further enhance the performance and cost-effectiveness of tubing solutions.

Market Expansion in Emerging Economies:

Growth in oilfield activities and infrastructure investments in regions such as Asia-Pacific, Latin America, and the Middle East will provide substantial new market opportunities.

Sustainability Pressures:

Increasing global focus on environmental sustainability will promote the use of recycled materials and energy-efficient production methods in the manufacturing of carbon steel tubing.

Preventive Maintenance Trends:

The demand for robust preventive maintenance and asset integrity management systems will drive the adoption of high-quality tubing solutions.

Global Economic Recovery:

As economic uncertainty stabilizes, increased capital investment in oil and gas infrastructure is likely to drive further growth.

Conclusion

The Global Carbon Steel Tubing in Oil and Gas Lift Applications Market is set to play a pivotal role in the ongoing modernization and maintenance of energy infrastructure. With its cost-effective nature, high strength, and durability, carbon steel tubing remains the backbone of artificial lift systems in oil fields worldwide. Despite challenges such as raw material volatility and environmental concerns, continuous technological advancements, digital integration, and strategic expansion into emerging markets are poised to drive robust growth.

In conclusion, the global carbon steel tubing in oil and gas lift applications market is poised for substantial growth due to increasing energy demand and the need for efficient oil and gas extraction processes. By understanding the market overview, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, and industry trends, stakeholders can make informed decisions and capitalize on the market’s potential. Despite challenges posed by the Covid-19 pandemic, the market is expected to recover and witness significant advancements in the future. With the right strategies and proactive measures, industry participants can thrive in this competitive landscape and contribute to the growth of the global carbon steel tubing in oil and gas lift applications market.

What is Global Carbon Steel Tubing in Oil and Gas Lift Applications?

Global Carbon Steel Tubing in Oil and Gas Lift Applications refers to the use of carbon steel tubing specifically designed for lifting fluids in oil and gas extraction processes. This tubing is essential for transporting oil, gas, and other fluids from underground reservoirs to the surface.

What are the key companies in the Global Carbon Steel Tubing in Oil and Gas Lift Applications market?

Key companies in the Global Carbon Steel Tubing in Oil and Gas Lift Applications market include Tenaris, Vallourec, and U.S. Steel, among others.

What are the growth factors driving the Global Carbon Steel Tubing in Oil and Gas Lift Applications market?

The growth of the Global Carbon Steel Tubing in Oil and Gas Lift Applications market is driven by increasing oil and gas exploration activities, rising energy demand, and advancements in drilling technologies. Additionally, the need for efficient fluid transport solutions contributes to market expansion.

What challenges does the Global Carbon Steel Tubing in Oil and Gas Lift Applications market face?

The Global Carbon Steel Tubing in Oil and Gas Lift Applications market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and competition from alternative materials. These factors can impact production costs and market dynamics.

What opportunities exist in the Global Carbon Steel Tubing in Oil and Gas Lift Applications market?

Opportunities in the Global Carbon Steel Tubing in Oil and Gas Lift Applications market include the development of innovative tubing solutions, expansion into emerging markets, and increasing investments in renewable energy projects. These trends can enhance market growth and diversification.

What trends are shaping the Global Carbon Steel Tubing in Oil and Gas Lift Applications market?

Trends shaping the Global Carbon Steel Tubing in Oil and Gas Lift Applications market include the adoption of advanced manufacturing techniques, the integration of smart technologies for monitoring, and a growing focus on sustainability. These trends are influencing product development and operational efficiency.

Global Carbon Steel Tubing in Oil and Gas Lift Applications Market

| Segmentation | Details |

|---|---|

| Application | Sucker Rod Pump, Electrical Submersible Pump, Gas Lift, Others |

| Outer Diameter | Less than 2 Inches, 2-4 Inches, More than 4 Inches |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Carbon Steel Tubing in Oil and Gas Lift Applications Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at