444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global container weighing systems market is experiencing significant growth due to the increasing need for efficient and accurate weight measurements of containers in various industries. Container weighing systems play a crucial role in ensuring compliance with safety regulations and optimizing logistics operations. This comprehensive market analysis delves into the key aspects and trends shaping the industry.

Meaning

Container weighing systems refer to the equipment and technologies used to determine the weight of shipping containers accurately. They provide vital information for safe transportation, preventing accidents caused by overloading, and ensuring compliance with weight regulations imposed by shipping authorities.

Executive Summary

The executive summary of the global container weighing systems market provides a concise overview of the key findings and highlights of the market analysis. It presents a snapshot of the market size, growth rate, and major trends observed in the industry.

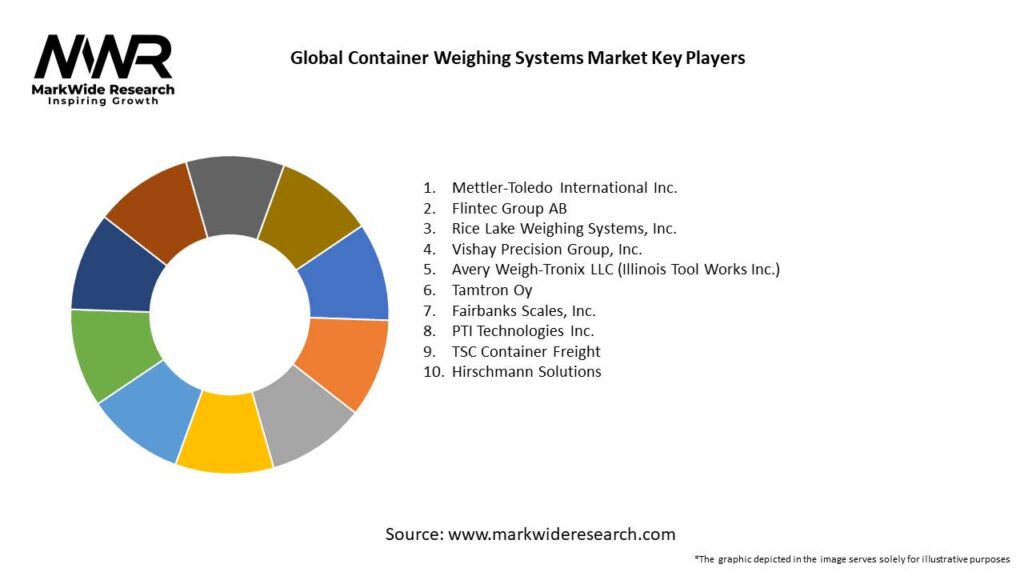

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Global Trade Expansion:

As international trade volumes continue to rise, the need for precise container weighing becomes increasingly critical to ensure safe shipping practices and compliance with regulatory standards.

Automated Digital Solutions:

Advances in sensor technology, data analytics, and cloud computing are enabling the development of integrated weighing systems that offer real-time monitoring and data accessibility.

Regulatory Mandates:

Strict international and national regulations require accurate weight measurement of containers, driving adoption across ports and logistics hubs worldwide.

Operational Efficiency and Safety:

Container weighing systems reduce manual handling, decrease turnaround times, and significantly minimize the risk of overloading-related accidents.

Sustainability and Cost Reduction:

Optimizing container loads leads to reduced fuel consumption and lower carbon emissions, aligning with global trends toward sustainable logistics.

Market Drivers

Growing Global Trade:

Rising containerized trade volumes demand efficient and accurate container weighing to facilitate smooth logistics and transportation operations.

Regulatory Enforcement:

International organizations and national governments are enforcing stringent weight regulations to enhance transportation safety, thereby fueling the need for high-precision weighing systems.

Technological Advancements:

Continuous innovations in sensor and data management technologies improve the accuracy, reliability, and integration of container weighing systems into digital logistics networks.

Operational Efficiency:

Automation of container weighing reduces manual labor, speeds up cargo throughput, and minimizes human error, contributing to lower operational costs.

Environmental and Cost Benefits:

Improved container weight management translates into better load distribution, reduced fuel consumption, and overall cost savings, aligning with sustainability goals.

Market Restraints

High Initial Capital Investment:

The cost of acquiring and installing advanced container weighing equipment can be significant, particularly for smaller ports and operators.

Integration Challenges:

Existing legacy systems may complicate the seamless integration of modern digital weighing solutions into established operational frameworks.

Maintenance and Calibration Costs:

Regular maintenance and calibration of sensitive weighing sensors are necessary to ensure accuracy, potentially increasing long-term operational costs.

Economic Fluctuations:

Variability in global economic conditions and trade volumes may impact capital investment in new infrastructure, thereby affecting market growth.

Data Security Concerns:

As container weighing systems become increasingly integrated with digital platforms, the need to safeguard sensitive operational data against cyber threats becomes critical.

Market Opportunities

Emerging Markets:

Rapid industrialization and increasing trade volumes in emerging regions (e.g., Asia-Pacific, Latin America, and Africa) provide significant opportunities for market expansion.

Integration with IoT and Smart Port Systems:

Advancements in IoT, big data analytics, and cloud computing offer opportunities to create connected, automated ports, thereby enhancing efficiency and reducing downtime.

Expansion of Digital Monitoring Services:

Offering remote monitoring and predictive maintenance services as add-ons to container weighing systems can create new revenue streams.

Sustainable and Energy-Efficient Solutions:

Developing energy-efficient, eco-friendly weighing systems that reduce operational costs and environmental impact aligns with global sustainability trends.

Strategic Partnerships:

Collaborations between equipment manufacturers, software providers, and port operators can foster the development of integrated solutions, driving standardization and market penetration.

Market Dynamics

Supply Side Factors:

Technological Innovations:

Continuous improvements in sensor accuracy, wireless communications, and data processing technology are pivotal for advancing container weighing solutions.

Production Efficiency:

Investments in scalable, automated manufacturing processes have reduced the costs and enhanced the reliability of weighing systems.

Raw Material and Component Availability:

The availability of high-quality sensor components and robust digital platforms influences the overall performance and lifespan of the systems.

Demand Side Factors:

Infrastructure Modernization:

Aging port infrastructure is being upgraded worldwide, with an increasing emphasis on the adoption of modern, automated weighing technologies.

Operational Efficiency Needs:

The demand for reducing turnaround times, minimizing errors, and ensuring safety in container handling drives the need for accurate weighing systems.

Regulatory and Compliance Requirements:

Stricter enforcement of international transportation regulations ensures a steady demand for reliable container weighing solutions.

Economic Factors:

Global Trade Growth:

Economic stability and growth in global trade are central to increasing investments in logistics and transportation infrastructure.

Investment in Digital Transformation:

Increasing capital allocation for digitization and automation within the maritime and logistics sectors supports the adoption of advanced weighing systems.

Cost-Benefit Dynamics:

The long-term operational savings from improved accuracy and preventive maintenance justify the high initial capital investment.

Regional Analysis

North America:

Mature port infrastructure, strong regulatory environments, and high investments in digital transformation drive advanced weighing system adoption.

Europe:

Stringent environmental and safety standards, combined with a focus on sustainability, bolster the demand for precise container weighing solutions.

Asia-Pacific:

Rapid industrialization, massive growth in containerized trade, and increasing infrastructure investments make this region a significant growth driver.

Latin America:

Emerging economies with expanding transportation networks and modernization initiatives present considerable opportunities, albeit with some infrastructural challenges.

Middle East and Africa:

Ongoing infrastructure development and government-led initiatives aimed at enhancing port efficiency are gradually increasing market adoption.

Competitive Landscape

Leading companies in the Global Container Weighing Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

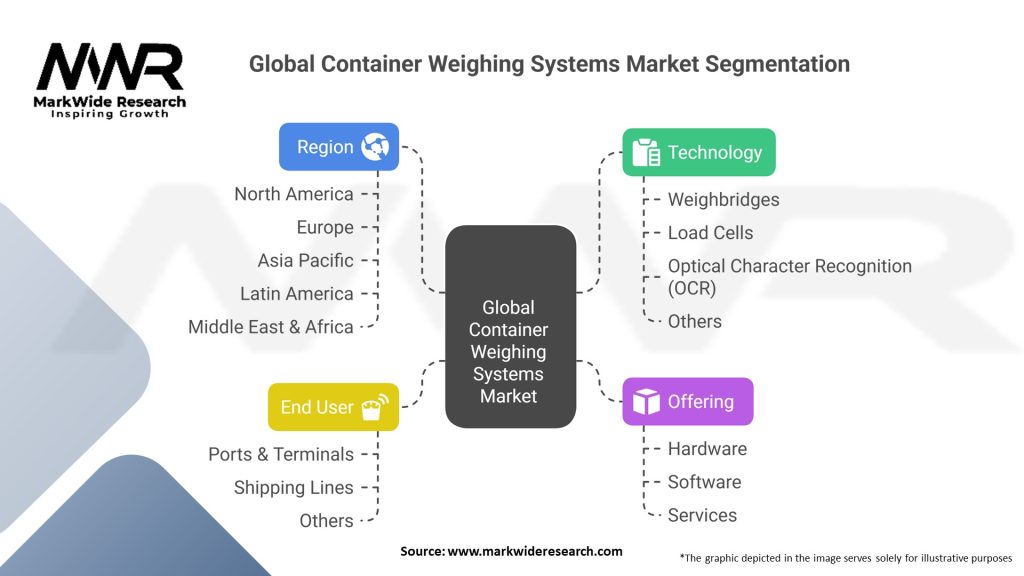

Segmentation

The market can be segmented based on various criteria, providing a detailed perspective:

By Technology:

Load Cell-Based Systems:

Predominantly used for their high accuracy and reliability in measuring heavy container loads.

Hydraulic and Pneumatic Systems:

Utilized for specialized applications requiring robust, high-pressure measurements.

Hybrid Systems:

Combining multiple sensor modalities to offer comprehensive, multi-dimensional weight data.

Digital and IoT-Enabled Systems:

Integrated with wireless communication and cloud data analytics for real-time monitoring and reporting.

By Application:

Port and Terminal Operations:

Used for container inspection, loading/unloading, and ensuring compliance with safety regulations.

Inland Transportation:

Employed in logistics hubs, rail yards, and trucking facilities to monitor cargo weight.

Industrial Weighing:

Applicable in warehousing, material handling, and quality control processes within manufacturing facilities.

Other Applications:

Custom installations and specialized deployments tailored to specific industry needs.

By Deployment Mode:

Fixed Systems:

Installed permanently at port terminals and logistics centers.

Mobile Systems:

Portable weighing solutions integrated on vehicles and mobile platforms, offering flexibility in diverse operational environments.

By End-User Industry:

Maritime and Port Operations

Rail and Trucking Industries

Manufacturing and Warehousing

Logistics and Distribution

Others

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

Category-wise Insights

Load Cell-Based Systems:

Offer the highest accuracy and reliability, making them the preferred choice for heavy-duty container weighing in high-traffic ports.

Digital and IoT-Enabled Systems:

Provide real-time data integration and remote monitoring capabilities, essential for streamlined operational management and predictive maintenance.

Fixed vs. Mobile Systems:

Fixed systems are crucial for permanent infrastructure, while mobile systems provide flexibility and adaptability in dynamic transportation environments.

Maritime Applications:

Remain the largest segment, as ports and terminals drive demand for compliance and operational efficiency.

Industrial and Inland Applications:

Support broader logistical operations and warehousing, offering additional revenue streams and system diversification.

Key Benefits for Industry Participants and Stakeholders

Operational Efficiency:

Automated weighing reduces human error, speeds up cargo processing, and minimizes downtime in port operations.

Cost Reduction:

Preventive maintenance and accurate weight data optimize logistics processes, resulting in significant cost savings.

Enhanced Safety and Compliance:

Accurate weight measurements are critical for adhering to international safety and transportation regulations, reducing the risk of overloading and accidents.

Data-Driven Decision Making:

Real-time data analytics enable better planning, scheduling, and maintenance of infrastructure, supporting strategic investments.

Sustainable Operations:

Improved efficiency and reduced fuel consumption through optimized load distribution contribute to environmental sustainability.

SWOT Analysis

Strengths:

High-Precision Technology:

Advanced sensors and digital data systems offer excellent accuracy in weight measurement.

Integration with Digital Platforms:

Seamless connectivity with IoT and cloud solutions enables real-time monitoring and predictive analytics.

Wide Application Range:

Versatility in use across maritime, rail, trucking, and industrial sectors ensures robust demand.

Weaknesses:

High Upfront Costs:

Significant capital investment is required for sophisticated digital weighing systems, which may deter smaller operators.

Complex Integration:

Ensuring compatibility with existing legacy systems and achieving smooth data integration can be challenging.

Maintenance Requirements:

Regular calibration and maintenance of sensors are necessary to sustain accuracy and performance, potentially increasing operational expenses.

Opportunities:

Emerging Market Growth:

Rapid industrial and infrastructure development in emerging regions presents major expansion opportunities.

Technological Advancements:

Continued innovation in sensor technology, automation, and digitalization will further enhance system performance.

Strategic Collaborations:

Partnerships with technology providers, software firms, and logistics operators can drive system integration and market standardization.

Data Monetization:

Leveraging the data generated from weighing systems for analytics and operational improvements creates additional revenue streams.

Threats:

Economic Instability:

Fluctuations in global economic conditions and trade volumes can impact investments in new infrastructure.

Regulatory Changes:

Shifts in safety and environmental regulations may require costly system upgrades.

Intensifying Competition:

The presence of numerous established and emerging players could result in price pressures and reduced market share for some vendors.

Market Key Trends

Digital Transformation in Logistics:

The shift towards fully integrated, automated digital systems in port and logistics operations is driving demand for intelligent weighing solutions.

Adoption of IoT and Cloud Technologies:

Enhanced connectivity and real-time data analytics are becoming standard requirements in modern weighing systems.

Sustainability Initiatives:

Emphasis on reducing environmental impact through optimized load management and improved operational efficiency is gaining prominence.

Customizable and Scalable Solutions:

Growing demand for systems that can be tailored to specific port and industrial requirements offers significant market potential.

Focus on Predictive Maintenance:

The integration of predictive analytics into weighing systems to prevent failures and optimize maintenance schedules is a major trend.

Covid-19 Impact

Accelerated Remote Operations:

The pandemic spurred increased adoption of remote monitoring and digital management tools, leading to quicker integration of IoT-enabled weighing solutions.

Supply Chain Adjustments:

Temporary disruptions led to a reevaluation of supply chains, prompting investments in more resilient and efficient weighing technologies.

Increased Safety and Efficiency Demand:

The need to minimize on-site staffing and reduce turnaround times during the pandemic accelerated the deployment of automated weighing systems.

Budget Constraints and Optimizations:

Economic uncertainties led operators to focus on cost-saving technologies, increasing the appeal of precise, automated weighing systems.

Enhanced Data Utilization:

Greater emphasis on data-driven decision-making has further supported investments in advanced digital systems in port and industrial environments.

Key Industry Developments

Technological Innovation:

Recent breakthroughs in sensor design and digital integration have improved the accuracy and efficiency of container weighing systems.

Strategic Partnerships:

Collaborations between equipment manufacturers, software providers, and port operators are facilitating standardized, integrated solutions.

Market Expansion Initiatives:

Investments in new digital weighing platforms and automated systems are being ramped up, particularly in emerging markets.

R&D in Predictive Analytics:

Enhanced use of AI and machine learning for predictive maintenance and system optimization is setting new industry benchmarks.

Digital Transformation Programs:

Increased focus on digitalization within logistics and port operations is driving rapid adoption of next-generation weighing systems.

Analyst Suggestions

Invest in R&D:

Prioritize research to further innovate sensor technology, enhance digital integration, and develop scalable solutions.

Enhance System Integration:

Focus on streamlining compatibility with legacy systems and developing standardized protocols to ensure seamless data flow.

Expand into Emerging Markets:

Target rapidly developing regions with tailored, cost-effective solutions that meet local operational requirements.

Leverage IoT and Cloud Platforms:

Enhance digital connectivity and real-time data analytics to drive operational efficiencies and predictive maintenance.

Form Strategic Alliances:

Collaborate with technology providers, logistics operators, and industry consortia to foster innovation and expand market presence.

Future Outlook

The future of the Global Container Weighing Systems Market looks promising, with several trends set to drive long-term growth:

Continued Digital Transformation:

The ongoing drive towards automation and digital integration in port and logistics operations will sustain demand for advanced weighing systems.

Emerging Market Expansion:

As global trade increases in emerging regions, investment in modern, efficient infrastructure will bolster market growth.

Technological Advancements:

Continued improvements in sensor accuracy, IoT integration, and data analytics will further reduce operational costs and improve system reliability.

Sustainability Focus:

Enhanced efforts to reduce environmental impact and optimize energy use in logistics operations will support the adoption of intelligent weighing solutions.

Industry Consolidation:

Strategic mergers, acquisitions, and partnerships will streamline the competitive landscape and foster the widespread implementation of standardized systems.

Conclusion

The Global Container Weighing Systems Market is poised to revolutionize the logistics and port operations landscape by providing precise, automated, and digitally integrated weighing solutions. With a strong emphasis on safety, regulatory compliance, and operational efficiency, these systems are critical for optimizing containerized cargo management worldwide.

In conclusion, the global container weighing systems market is poised for substantial growth due to increased safety regulations, rising trade volumes, and the need for operational efficiency. By understanding the market dynamics, industry participants and stakeholders can make informed decisions and leverage the emerging opportunities in this rapidly evolving market. The integration of advanced technologies and a customer-centric approach will be crucial in shaping the future of container weighing systems.

Global Container Weighing Systems Market

| Segmentation | Details |

|---|---|

| Technology | Weighbridges, Load Cells, Optical Character Recognition (OCR), Others |

| Offering | Hardware, Software, Services |

| End User | Ports & Terminals, Shipping Lines, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Container Weighing Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at